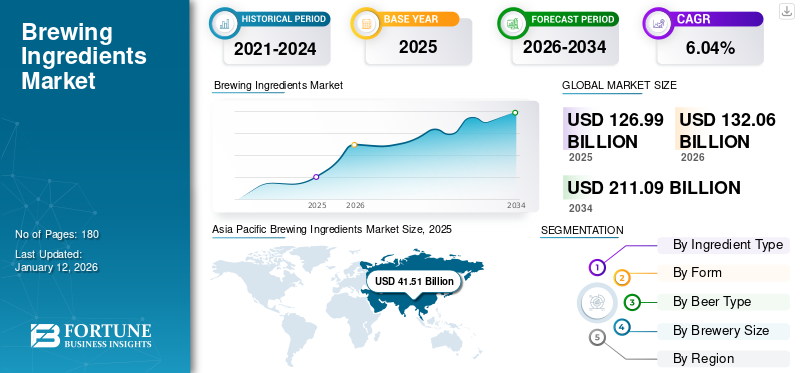

Brewing Ingredients Market Size, Share & Industry Analysis By Ingredient Type (Yeast, Hops, Malt, Adjuncts, and Enzymes), By Form (Dry and Liquid), By Beer Type (Lager, Ale, Stout, and Others), By Brewery Size (Craft Breweries, Microbreweries, and Industrial Breweries), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global brewing ingredients market size was valued at USD 126.99 billion in 2025. The market is projected to grow from USD 132.06 billion in 2026 to USD 211.09 billion by 2034, exhibiting a CAGR of 6.04% during the forecast period of 2026-2034. Asia Pacific dominated the brewing ingredients market with a market share of 32.68% in 2025.

Some of the prominent manufacturers in the industry are Kerry Group plc, Angel Yeast Co., Ltd., Cargill Incorporated, RahrBSG, and Lesaffre.

The ingredients or components used in the production of beer or in the brewing process are called brewing ingredients. Key ingredients include malt or malt extract, hops, yeast, adjuncts, enzymes, and additives. The global market growth is primarily driven by growing beer production, rising number of macro & craft breweries, and high beer consumption rate in emerging nations. Additionally, growing urbanization, youth population, disposable income among younger consumer groups, growth in women's employment, and rising party culture in Asian countries are other significant factors influencing the expansion of the global brewing ingredients market share in the future.

Brewing Ingredients Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 126.99 billion

- 2026 Market Size: USD 132.06 billion

- 2034 Forecast Market Size: USD 211.09 billion

- CAGR: 6.04% from 2026–2034

Market Share:

- Asia Pacific dominated the brewing ingredients market with a 32.68% share in 2025, driven by rapid urbanization, growing disposable income, increasing party culture, rising female employment, and high beer consumption in countries like China, India, and South Korea.

- By ingredient type, malt is expected to retain the largest market share in 2025, supported by its essential role in fermentation, flavor, and texture enhancement.

- By form, dry ingredients hold the leading share due to their affordability and longer shelf-life.

- By beer type, lager leads due to its milder flavor profile and wider consumer acceptance.

- By brewery size, industrial breweries dominate in volume, while craft breweries are projected to grow at the fastest CAGR, driven by rising demand for premium and innovative beer flavors.

Key Country Highlights:

- China: Leads Asia Pacific in beer production and consumption; growth driven by rising interest in craft beer and variety of flavors. In 2020, China brewed 34.1 billion liters of beer.

- United States: Nearly 9,761 craft breweries were operating by 2023, contributing significantly to the growing demand for artisanal and flavored beer.

- Germany: Europe’s top beer producer with 87.83 million hectoliters in 2022; demand for craft and fruit beers is rising rapidly.

- South Africa: Use of locally grown sorghum as a key adjunct in brewing is expanding, with 70% of brewers using sorghum in Nigeria and increasing investment in local processing facilities to reduce reliance on imports.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Artisanal Beers to Strengthen Market’s Potential

Artisanal beers have become popular in recent years, with craft beer-making techniques and microbreweries attaining high popularity and attention. These beers are counted among premium quality beverages as craft breweries tend to utilize superior quality ingredients, such as locally and freshly sourced barley and hops compared to mass-produced beers. Such beers align well with the rising trend of health-consciousness, where consumers seek premium beverages. Along with the quality of the brewing process and ingredients, artisanal beers also hold a reputation for providing innovative flavors through the various ingredients used while producing them. As majority of the consumers globally are looking for a vast range of flavors, breweries are trying to experiment with several ingredients. For instance, in October 2024, Bira 91, an India-based beer maker, announced the opening of its latest taproom in Mumbai, which features a line of craft beer brewed with premium-quality ingredients. As a result, this high demand for artisanal beers will trigger the adoption of brewing ingredients.

Surging Demand for Low-Sugar and Low-Alcohol Beers to Promote Market Growth

The world of beverages is rapidly changing and has shifted toward low-sugar and low-alcoholic beers, specifically due to the trending wellness culture. Beers with low alcohol and sugar content are primarily popular among consumers who are concerned about their health & wellness and seeking alternatives to alcohol-based beers. However, currently, low-sugar and low-alcohol beers are no longer considered inferior to traditional beers, and their growth is rapid. Specifically, Gen Z consumers are responsible for fueling the demand for low-sugar and alcohol-infused beers as this generation believes in moderate drinking and is aware of the health concerns associated with heavy drinking. As a result, this demand for low-alcohol and low-sugar beers is increasing the chances for innovations in the industry, with the majority of producers providing both alcoholic and non-alcoholic beer versions to their customers. For instance, in November 2024, a renowned beer brand in the U.K. rolled out its first-ever non-alcoholic beer, “AF Pilsner,” comprising 0.5% ABV.

MARKET RESTRAINTS

Price Volatility of Raw Ingredients and Quality Control Challenges to Obstruct Market’s Potential

Price fluctuations of raw materials used in the production of beer is one of the crucial challenges faced by the breweries worldwide. Volatility in the cost price of raw ingredients (hops, malt, and yeast) caused by some unprecedented challenges, such as geopolitical tensions, adverse climatic conditions, and sudden changes in agricultural output, directly hinders the overall cost structure of beer producers. Thus, such volatility affects the operational planning and profit margins, leading to high pricing pressures and manufacturing costs of end products. Quality control is another prime challenge that beer makers experience. Inconsistency in ingredient quality can lead to uneven taste and customer dissatisfaction. Such discrepancies can impede brand reputation and result in poor growth. Moreover, this factor can negatively hamper the brand’s position in the global brewing industry.

MARKET CHALLENGE

Lack of Exotic Ingredients and Stringent Regulations Are Big Challenges

The restricted availability of exotic ingredients (specialty malt/hop varieties) in the beer industry is limiting the market’s growth. Breweries utilize these specialty ingredients to innovate and differentiate their products. Thus, a shortage of exotic ingredients limits breweries from crafting new flavor profiles for consumers globally.

Rigorous regulations in the beer market are also a tough challenge, restricting the industry’s growing momentum. The global alcohol sector is subject to several state, federal, and local regulations covering safety standards, licensing, taxation, and labeling. Thus, such strict regulations can limit the consumption and sales of beer in various countries, leading to the slow brewing ingredients market growth.

MARKET OPPORTUNITIES

Technological Advancements in Brewing Technology to Pave Market Growth Opportunities

The beer market has undergone considerable transformation through the usage of high-end technologies. These advancements have enabled the beer industry to innovate in terms of quality, customer experience, and production. One of the most popular trends is the utilization of biotechnology to create new yeast strains. With the help of such genetically modified yeasts, the brewers can introduce alcohols with unique flavor and enhance the fermentation efficiency. Other than this, automated fermentation systems are also used in the brewing industry as they allow precise control over fermentation and temperature conditions. Apart from improving the finished product’s consistency, these systems also assist in minimizing waste and strengthening energy efficiency. Moreover, with time, the application of the Internet of Things (IoT) and Artificial Intelligence (AI) is becoming prominent in this industry. Using both these techniques can aid in the creation of new recipes and allow easy monitoring at every stage.

BREWING INGREDIENTS MARKET TRENDS

Emerging Trend of Creating Beers with Organic Ingredients

The emerging organic products phenomenon is reshaping the alcohol industry and driven by growing environmental concerns and improved sustainable beverage options. Organic beer is composed of organic ingredients (yeast, hops, and barley) and cultivated with minimal preservatives and additives. This manufacturing process aligns with the rising consumer need for cleaner substitutes to traditional beers. As today’s individuals are more concerned about their overall health & wellness, this trend has strengthened the usage of organic ingredients in beer production. Moreover, crafting organic beer minimizes the risk of carbon footprint on the environment, thereby contributing to the demand for organic-ingredient-based beers. Moreover, compared to conventional beer, organic beer production promotes responsible farming practices and supports local brewers. As a result, this trend has influenced the macro and microbreweries to introduce beers created by utilizing organic raw ingredients.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic considerably affected the beer industry. As a result, the product demand shrank during the pandemic period. During this crisis, market players faced numerous hurdles and challenges in managing sustainable business operations. Due to lockdowns and restrictions on large public gatherings, companies reduced employee headcount in production plants. Trade restrictions also impacted the raw material supply. To overcome these challenges, producers needed to restructure their strategies to achieve business sustainability. According to the Brewers of Europe’s report on the impact of COVID-19 on the brewing industry, the pandemic was responsible for a decline of nearly 42% in beer volume sales from the hospitality sector. The net volume sales of beer fell by 9% (34 million hectoliters) in Europe in 2020. The production volume of this beverage in North America and the European region declined at a double-digit rate. It had an adverse effect on the demand for brewing ingredients during the pandemic. According to the Brewers Association, beer production in the U.S. in 2020 declined by nearly 13% from 2019. As a result, the global brewing ingredients market share contracted during the COVID-19 era.

SEGMENTATION ANALYSIS

By Ingredient Type

Better Mouthfeel and Taste Factor of Malt Led to Its Market Dominance

By ingredient type, the market is segmented into malt, hops, yeast, adjuncts, and enzymes.

The malt segment dominated the global market by holding the most prominent share. Malt is a key ingredient for fermenting beer. It offers sugar to facilitate beer’s fermentation process. Malt and malt extract are made from brewing-grade malted barley and are available in both dry and liquid forms. It is available in various types, including pale, wheat, and amber. Additionally, malt and malt extract are basic ingredients that offer color, flavor, mouthfeel, and foaming properties to the beer.

Additionally, malt grains contain polyphenols, minerals, and vitamins, including vitamin B and silica. Thus, malt offers health benefits to beer. Various research and studies claim that to produce a good-quality 1-liter beer, nearly 200 grams of malt or malt extract are required. Therefore, the segment holds the largest market share.

The adjuncts segment is anticipated to expand with the highest growth rate during the forecast period. Increasing concern among breweries about economically producing beer is driving the demand for adjuncts in the market. Beer adjunct is an ingredient widely used in beer production to enhance the product’s characteristics and reduce the overall production time & cost. Furthermore, a growing number of beer consumers around the world are seeking new products with different exotic flavors. However, many other factors are influencing their product choices including affordability, availability, and lifestyles that have promoted the popularity of beer consumption. The huge demand for flavored beer products among consumers has forced companies to develop new products with different flavors. This factor will drive the adjuncts’ demand during the forecast period.

The hops segment dominated the market with a market share of 5% in 2024.

To know how our report can help streamline your business, Speak to Analyst

By Form

Longer Shelf-Life Propels Dry Ingredients’ Demand in Breweries

By form, the market has been segmented into dry and liquid.

The dry segment holds the largest market share. Dry ingredients, such as malt, adjuncts, hops, and yeast, including barley, flaked corn, rice, wheat, or sorghum, are widely used in the preparation of beers across the globe. Dry ingredients are more affordable as compared to liquid products and have a longer shelf life than liquid ingredients. In addition, dry ingredients play a critical role in refining the texture, color, and mouth feel of beer, which, in turn, draws the attention of beer manufacturers.

The liquid ingredients segment is projected to record the highest CAGR during the forecast period. Liquid ingredients, such as malt extract, liquid yeast, liquid syrups, maize, rice, or wheat syrups, and sugar syrup are tremendously used in breweries owing to their premium quality, easy usage, decreased labor, and transportation cost. Additionally, the usage of these ingredients makes the brewing process simpler and easier.

By Beer Type

Wider Taste Acceptance Helps Lager Hold Leading Market Share

Based on beer type, the global market is segmented into lager, ale, stout, and others.

The lager segment holds the largest global market share of64.43% in 2026. Lager is a popular beer type due to its distinct taste, refreshing appeal, and its smooth finish. It attracts consumers who are looking for milder alternatives to other beer types. It is brewed at a lesser temperature, between 7 and 13°C, and contains 5-11% ABV, which enhances the mouthfeel and overall drinking experience for consumers. As a result, lager is produced on a large scale in the industry.

Ale is one of the fastest-growing beer types, the segment is projected to exhibit the highest CAGR of 6.25% during the forecast period (2025-2032). Increasing macro and craft brewery establishments in countries, such as the U.S., the U.K., Germany, and others is likely to drive the ingredients’ demand. Additionally, ale can be produced in less space in small fermenters. As a result, new players with a smaller brewery size are focusing on producing ale type of beer. Therefore, the segment is anticipated to record a higher CAGR.

By Brewery Size

Increasing Popularity of Premium Beer Among Adults Drives Craft Breweries' Growth

By brewery size, the global market is segmented into craft breweries, microbreweries, and industrial breweries.

The craft breweries segment is anticipated to record the highest CAGR during the forecast period and market share of 11% in 2025. The increasing number of craft breweries in developing and Western countries will drive the demand for brewing ingredients from this segment. Additionally, the demand for craft beer will grow exponentially in the future with rising consumer preference toward new flavors, varieties, and tastes. Furthermore, the emerging trend of premium beer and willingness to experience innovative products are significantly contributing to the craft beer demand growth. As a result, craft beer production is growing annually, which is why the demand for brewing ingredients from this segment is anticipated to register the highest growth trajectory. According to the Brewers Association, nearly 23,359,870 BBLS of craft beer were sold in the U.S. in 2023. Craft beer production volume accounted for nearly 13.3% of the country’s total beer production volume in 2023.

The industrial breweries segment holds the largest market share. Key players, such as Anheuser-Busch InBev, Heineken, Carlsberg Group, Asahi Breweries, and Molson Coors have established large-scale beer production plants across the world. They manufacture a larger volume of beer to meet its growing demand globally. Thus, brewing ingredients have exhibited the highest demand from this segment. These players are also collaborating with various regional contractual breweries to enhance their production capacity. It will additionally drive the segment in the future.

The microbeweries segment is anticipated to grow at a CAGR of 6.08% during the forecast period (2025-2032).

BREWING INGREDIENTS MARKET REGIONAL OUTLOOK

The market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific holds the largest proportion of the market and accounted for USD 39.90 billion in 2024.

Asia Pacific

Asia Pacific Brewing Ingredients Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest market share with a valuation of USD 41.51 billion in 2025 and USD 43.37 billion in 2026. Alcoholic beverage, especially beer, consumption across Asian countries, including China and South Korea, has been increasing rapidly in recent years as it is considered a social drink. Rapid urbanization and the growing earning capacity of urban consumers push the demand for these products. Furthermore, the increasing party culture and nightlife trend among youths additionally impact beer consumption across the region. The growing beer consumption will, thus, impact the sales of brewing ingredients in the coming years. China is one of the leading markets for beer in terms of both production and consumption. Craft beer has shown a strong surge in its demand in recent years in China.

According to the U.S. Department of Agriculture report published in January 2022, China brewed nearly 34.1 billion liters of beer in 2020. The U.S. was the second-largest beer producer in that year. The key factor for growth in the demand for craft beer is consumers’ willingness to try a variety of flavors. The same trend is also represented in the South Korean market. Thus, the consumption of craft beer and number of microbrewers have increased in recent years. According to the Korean Craft Brewers Associations, in 2020, 156 microbrewers were operating across the South Korean market. Since 2015, nearly 100 new microbrewers have entered the market. China is anticipated to capture a share of USD 26.29 billion in 2026.

Local breweries have dominated the global beer market in terms of production and sales across China, India, and South Korea. These breweries are involved in innovation and research & development activities to introduce new products, which assists the local brewers in staying competitive in the marketplace. The growing beer industry in Asian countries is directly influencing the demand for brewing ingredients to produce beer. Thus, the industry is anticipated to register the highest CAGR during the forecast period. India is projected to be valued at USD 4.82 billion, while Japan is poised to be valued at USD 4.24 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third leading region for beer ingredients with a valuation of USD 26 billion in 2026. The beer market is gaining prominence in countries across the region as beer is recognized as a special drink that acts as a mediator in social gatherings. The global advancements have made customers shift to novel beer variants, such as craft beer or premium quality beer, from the traditional lager beer. In addition, the brewing companies are largely incorporating premium-quality ingredients, such as malt, hops, barley, yeast, corn, malt, barley, rice, and sorghum, which captivate the consumer’s attention due to the enhanced texture, mouth-feel, or flavor of the brewed beers. Factors, such as flourishing economies, rising purchasing power, midnight-party culture, and increased westernization have influenced the population to consume beer on a daily basis.

The U.S. holds a prominent share valued at USD 15.43 billion in 2026. Increasing beer production, along with emerging macro, craft, and brewpubs, is driving the industry growth. Over the last five years, the brewing industry has experienced substantial growth in the number of regional micro and craft breweries. According to the Brewers Association, nearly 9,761 craft breweries were operating in the U.S. by the end of 2023.

Download Free sample to learn more about this report.

Europe

Europe is the second-leading region in the global market with a valuation of USD 37.52 billion in 2026, exhibiting a CAGR of 5.24% during the forecast period (2025-2032) . European countries, such as Germany, the U.K., Poland, France, and Spain contribute to the rising momentum of the industry, which is attributed to the increased entrants in the beer industry. The U.K. market continues to grow, projected to reach a market value of USD 3.57 billion in 2026. Poland is recognized as the third-largest beer producer in the European market. Thus, it invests more in the manufacturing of innovative brewed products by keeping customers in mind. France, one of the other leading consumers of alcoholic beverages, has been emphasizing more on the beer movement over the last few years. The French locals are highly demanding novel alcoholic beverages, especially beers, as they extensively focus on the taste and flavor of the beers. However, fruit beers have gained the utmost attention from citizens in recent years due to the appealing fusion of fruity highlights with traditional beer elements. In addition, the demand for freshly brewed beer is increasing at a higher pace, which, in turn, is boosting the growth of craft beers across the region. The growing demand for beer and rising beer production in European countries is likely to drive the ingredients demand in the future. According to the Brewers of Europe, Germany is the leading beer producer in the region, which produced nearly 87.83 million hectoliters of beer in 2022. Additionally, the European Union’s total beer production, including the U.K., reached nearly 401.95 million hectoliters in 2022, which increased by approximately 5.6% from 2020. Germany is estimated to reach a value of USD 8.13 billion in 2026, while France is expected to be valued at USD 2.00 billion in the same year.

South America

South America is the fourth largest market with a share of USD 17.24 billion in 2025. Over the past decade, the region has witnessed a steady increase in the number of microbreweries in countries, such as Brazil. These microbrewers are developing novel products to stay competitive in the regional market space. Furthermore, the increasing research on developing new products using different ingredients will take the industry to the next level.

Since the consumption of beer is increasing across the region, global players are investing in expansion activities. For instance, in May 2022, Compañía Cervecerías Unidas (CCU)., a beverages manufacturing company owned by Heineken, invested USD 23 million in its beer production plant in Luján, Argentina. The company made this investment to increase its production and logistics capacity across the national and international markets. As a result, the industry in South American countries is gradually expanding and will exhibit a promising growth trajectory during the forecast period.

Middle East & Africa

The Middle East & Africa is one of the attractive markets in the global market space. South Africa and Nigeria are key beer-producing countries in the region. Key players, including South African Breweries and Heineken South Africa, continuously invest in new product launches, logistics, marketing, and promotional activities, which is a key factor contributing to the steady increase in per-capita beer consumption in South Africa. Additionally, the back-to-authenticity trend is driving the demand for craft beer in the country. Thus, the number of craft beer manufacturers is increasing in South Africa.

Sorghum is one of the key ingredients used as adjunct in beer processing methods across South Africa and Nigeria. South Africa is expected to reach a market value of USD 3.42 billion in 2025. The sorghum malting industry in Nigeria has a combined malting capacity of over 160,000 metric tons (MT) per annum. To increase the sorghum production capacity, regional governments and agriculture research institutes are providing hybrid sorghum seeds to the farmers. As a result, the product is available at a lower price to the brewers. According to Adamu Bature, secretary of the Sorghum, Millet Farmers Association of Nigeria, nearly 70% of regional brewers use sorghum as a by-product for brewing beer and malt in the country. Therefore, the growing focus on adopting locally produced ingredients in the brewing industry helps save billions of dollars spent on the imports of barley. Thus, companies are also developing new plants to produce ingredients using locally sourced grains and adjuncts. For instance, in July 2021, Société Anonyme des Brasseries du Cameroun, a brewing company in Cameroon, invested funds to develop a corn processing plant to supply corn grits to the beer producers. The company has intended to produce 30,000 tons of corn grits yearly for beer production.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focusing On Mergers and Acquisitions to Expand Their Geographical Presence

The global market share exhibits a highly fragmented structure with the presence of international and regional players. The leading players in the global market, such as Kerry Group plc, Angel Yeast Co., Ltd., Cargill Incorporated, RahrBSG, and Lesaffre are actively focusing on mergers and acquisitions to strengthen their market presence. These players account for nearly 19% of the global market. Furthermore, they are focusing on broadening their business line by expanding their product portfolio, followed by base expansion, joint ventures, and other promotional activities. It will significantly shape the industry’s growth during the forecast period.

Major Players in the Brewing Ingredients Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF KEY BREWING INGREDIENTS COMPANIES PROFILED:

- American International Foods, Inc. (U.S.)

- (U.S.)

- Kerry Group plc. (Ireland)

- AngelYeast Co., Ltd. (China)

- Cargill, Incorporated (U.S.)

- Boortmalt N.V. (Belgium)

- Lesaffre (France)

- Viking Malt (Finland)

- Maltexco S.A. (Chile)

- Lallemand Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: AB Biotek, a subsidiary of AB Mauri, expanded its product portfolio by launching a dry yeast range under its premium brand, Pinnacle. The company launched this product for industrial and craft brewers.

- March 2024: Far Yeast Brewing Co., Ltd., one of the key brewing products manufacturing companies, renewed its standard brands “Far Yeast Tokyo Series” and “Far Yeast Genryu Series” and relaunched its “Far Yeast Series.” These yeast products are developed for brewing applications.

- November 2023: Malteries Soufflet, one of the leading players in the malt industry, acquired a 100% share of United Malt Group Limited (United Malt), another key malt manufacturing company, for approximately USD 994.46 million. The acquisition assisted Malteries to strengthen its presence in the global craft brewery sector.

- June 2022: Delta Breweries, a Zimbabwean brewing company, launched a new product under its brand “Chibuku.” This product is brewed from sorghum infused with banana flavor and is available across Zimbabwe and South African markets.

- March 2022: Drifters Breweries, an Indian brewing company, launched a new product on the occasion of Indian Premier League (IPL) 2022. Bajra (Pearl Millet) and Rice were used as an adjunct to produce this product. This product was available across India through online and offline stores.

INNOVATION ANALYSIS AND OPPORTUNITIES:

The global brewing industry has grown tremendously over the years, with rising consumer demand for innovative flavors and low-sugar, low-alcoholic, and other specialty category beers. As a result, companies are investing a substantial amount in research and development and adopting locally sourced adjuncts in the brewing process to develop novel and distinct product ranges for the market. This has significantly shaped the industry landscape over time. The rising health consciousness among consumers led to the demand for beer products tagged with health claims, such as organic and non-GMO. Thus, companies are inclined toward developing new products using organically cultivated adjuncts and other raw materials. Furthermore, this trend will encourage companies to introduce new products with lower alcoholic content to cater to the consumers' requirements.

Several government associations and universities are engaging in the research and development of new formulas by adding locally grown raw materials. Since beer consumption is increasing rapidly across the world, manufacturers are facing challenges in raw material procurement, especially barley. Thus, industrial researchers are conducting numerous research activities to develop new formulas using varieties of beer ingredients, such as rye, rice, corn, sorghum, and cassava. The research assists microbrewers and craft brewers in running the business sustainably and competing with global players. This factor is further supporting the market growth. For instance, in September 2020, multiple universities in China, including the School of Bioengineering, Qilu University of Technology, Jinan, China, and the College of Tropical Crops, Hainan University, Haikou, China, conducted research on brewing 2-phenyl ethanol beer from cassava and published a report for the industry.

REPORT COVERAGE

The report offers quantitative and qualitative insights into the market using different research methodologies. This global market growth forecast also offers a detailed regional analysis, market analysis, market trends, market dynamics, regional market forecast, and the market’s growth rate for all possible segments. This report provides various key insights on the market, an overview of related markets, the competitive landscape, forecast period, recent industry developments, such as mergers & acquisitions, regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.04% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Ingredient Type

By Form

By Beer Type

By Brewery Size

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 126.99 billion in 2025.

The market will record a CAGR of 6.04%, exhibiting promising growth during the forecast period.

The malt segment is the leading segment in the market.

Increasing number of craft breweries and macro breweries, paired with the growing consumption of beer, is driving the market’s growth.

Kerry Group plc, Angel Yeast Co., Ltd., Cargill Incorporated, RahrBSG, and Lesaffre are a few of the market's leading players.

Asia Pacific dominated the global market in terms of share in 2025.

Increasing merger and acquisition activities is turning into an emerging trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us