Button-activated Safety Lancet Market Size, Share & Industry Analysis, By Product Type (Push/Top Button and Side Button), By Incision Type (Blade and Needle), By Age Group (Adult and Pediatric), By Application (Blood Glucose Monitoring, Hemoglobin Testing, Cholesterol Testing, and Others), By Gauge Size (22G and Below, 23G-28G, and Above 28G), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies/E-commerce Platforms), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

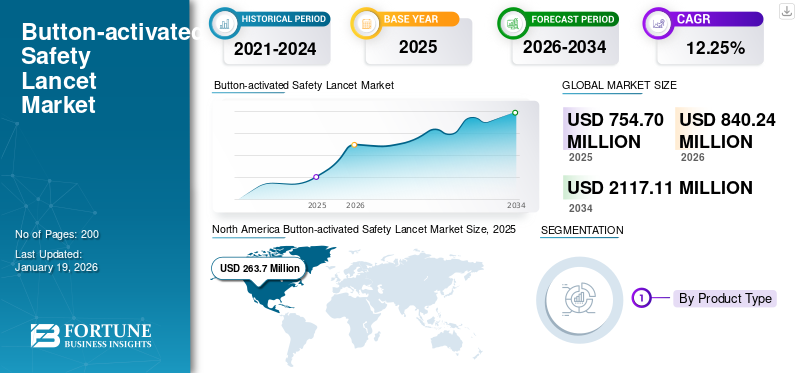

The global button-activated safety lancet market size was valued at USD 754.7 million in 2025. The market is projected to grow from USD 840.24 million in 2026 to USD 2,117.11 million by 2034, exhibiting a CAGR of 12.25% during the forecast period. North America dominated the button-activated safety lancet market with a market share of 57.70% in 2025.

Button-activated safety lancets are single-use lancets specifically used to obtain capillary blood samples through a quick skin puncture. These lancets incorporate an activation button technology, either a push button or side positioned button. Post activation, the device triggers the blade or needle to make an incision. Button-activated devices are primarily used for blood glucose monitoring, hemoglobin testing, and other diagnostic procedures. The growth of the market is attributed to an increasing global prevalence of chronic diseases such as diabetes and anemia, growing preference for minimally invasive and safe blood sampling methods, and technological advancements in products.

The market is highly fragmented, with several key players such as BD, Cardinal Health, HTL-STREFA (MTD Medical Technology and Devices), SARSTEDT AG & Co. KG, and others, increasingly implemented various growth strategies such as acquisitions, new product launches, and geographical expansions to gain a significant market share.

MARKET DYNAMICS

Market Drivers

Increasing Prevalence of Diabetes and Rising Emphasis on Point-of-Care Diagnostics Accelerate Market Expansion

The soaring diabetic population worldwide, requiring frequent blood glucose monitoring, is one of the prominent drivers positively impacting the global button-activated safety lancet market growth. As per healthcare authorities such as the World Health Organization, the burden of diabetes is substantially increasing in low- and middle-income countries. This has led to the increased demand for user-friendly lancets such as button-activated variants, particularly those that reduce the risk of needlestick injuries and cross-contamination.

- For instance, according to data published by the International Diabetes Federation, the prevalence of diabetes is estimated to reach 60 million in Africa by 2050. This increase is around 142% as compared to the diabetes prevalence in the region in 2024.

Moreover, the rising adoption of point-of-care (POC) diagnostic devices is projected to boost market growth. Button-activated safety lancets are widely used in conjunction with portable blood analyzers and glucometers. The growing emphasis on early detection and monitoring of diseases, supported by expanding healthcare access in rural and remote areas, is propelling the use of such lancets.

Market Restraints

Emergence of Alternative Blood Sampling Devices to Deter Product Adoption

The availability and growing adoption of alternative blood sampling technologies, such as continuous glucose monitoring (CGM) devices and minimally invasive sampling techniques, are expected to hamper the demand for button-activated safety lancets in the near future.

In addition, CGM systems provide real-time blood glucose levels without frequent finger pricks, significantly reducing the need for traditional lancets. Particularly in developed markets, the increasing adoption of these advanced monitoring solutions poses a substantial threat to the demand for conventional blood sampling devices, including safety lancets.

- For instance, in November 2021, Intuity Medical Inc., announced the introduction of its new Pogo Automatic Blood Glucose Monitoring System in the U.S. The newly introduced product allows seamless glucose monitoring without the help of any strips or lancets.

Moreover, ongoing advancements and decreasing prices of CGM and other minimally invasive diagnostics are further expected to deter the adoption of lancets.

Market Opportunities

Growing Emphasis on Home-based Diagnostics to Accelerate Market Growth

The rising demand for home-based diagnostic solutions, driven by the growth of telemedicine and remote monitoring, is estimated to offer favorable opportunities for market growth. Post-COVID-19, there is a shift in preference to manage chronic conditions such as diabetes from home-care settings. Button-activated safety lancets are ideally positioned to serve this demand due to their ergonomic and hygienic design.

- For instance, according to a study published on NCBI in August 2022, the daily rate of glucose diagnostics testing at home amongst the population over age 80 years increased to an estimated 80% compared to 70% in 2013. This study was conducted in Ontario, Canada, to understand the preference for home-based diagnostics.

Market Challenges

Limited Product Awareness Coupled with Improper Usage Create Obstacles for Market Growth

One of the major challenges for button-activated safety lancet market share expansion is limited product awareness and improper usage, particularly among home users and caregivers in non-clinical settings. While the design of these lancets ensures enhanced safety and sterility, improper handling, such as incorrect activation, reuse attempts, or improper disposal, probably leads to injury or infection, defeating their safety purpose.

Moreover, a lack of standardization across brands results in varied activation pressures, gauge sizes, and ergonomic designs, creating confusion among users and caregivers. Regulatory authorities are yet to fully harmonize product usage guidelines, particularly in low- and middle-income countries.

Button-Activated Safety Lancet Market Trends

Rising Preference for Ultra-Fine Gauge Sizes for Painless Procedures

The market is witnessing increasing preference for ultra-fine gauge sizes to reduce pain during sampling, especially in pediatric and geriatric patients. The availability of 28G and finer variants caters to this demand by ensuring a virtually painless blood draw, enhancing user compliance, and overall experience. Simultaneously, manufacturers are focusing on developing ergonomically designed lancets with improved grip, intuitive activation, and color-coded gauges to enhance usability across various patient demographics.

In addition, companies are also investing in advanced packaging solutions that ensure sterility, compactness, and ease of disposal. As healthcare delivery models shift toward outpatient care and remote patient monitoring, these user-centric and eco-conscious innovations are poised to gain more traction.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

Supply Chain Disruptions and Drop in Monitoring Tests Negatively Affected Industry Expansion

The market witnessed a considerable decline in 2020 due to the COVID-19 pandemic. The negative growth of the market was attributed to supply chain disruptions for safety lancets and reduced demand in that period. Further, the significant decline in monitoring tests for diabetes, hemoglobin, and others, due to a strong focus on COVID-19 management, also led to negative market growth.

- For instance, according to data published by NCBI in February 2021, HBA1C testing significantly reduced to around 66.0% in the first 8 weeks of March and April 2020.

In 2022, the button-activated safety lancet market started to recover due to the increasing volume of glucose self-monitoring and rising patient visits to diagnostic laboratories, as well as hospitals.

Segmentation Analysis

By Product Type

Availability of Products and Ease of Use for Push/Top Button-activated Segment is Likely to Dominate

Based on product type, the market is subdivided into push/top button and side button.

The push/top button-activated segment dominated the market in 2024. The dominance is due to their ease of use and wide compatibility with blood glucose monitoring devices. Their straightforward, single-handed operation makes them suitable for both healthcare professionals and patients in home settings. This product type is commonly used in hospitals, diagnostic labs, and by chronic care patients, especially those managing diabetes.

The side button segment is estimated to exhibit considerable CAGR during the forecast period. The side button mechanism allows better control of hand pressure, making it easier to manage puncture depth. These lancets are designed to improve user comfort and reduce hand strain during frequent use.

By Incision Type

Needle Segment to Dominate the Market Due to Superior Safety Features and Lesser Pain

Based on incision type, the market is divided into blade and needle.

The needle segment dominated the market in 2024 due to its low penetration force and reduced pain. This type of lancet is widely used for blood glucose monitoring, especially among diabetic patients who require frequent testing. Moreover, newer needle-based lancets offer color-coded gauges and adjustable depths, improving both safety and comfort during self-administration.

- According to a study published by NCBI in April 2020, the pain caused by the needle version was less compared to the blade version while obtaining blood samples for testing.

The blade segment is projected to hold the second-largest market share as they are often preferred in hospital laboratories and diagnostic centers. While they can cause slightly more discomfort than needle-based variants, their high accuracy and sufficient sample yield make them suitable for adult patients. Blade lancets also incorporate safety lock mechanisms and retractable designs, making them compliant with occupational safety norms.

By Age Group

Adult Segment Dominates the Market Due to Higher Demand for Various Applications

On the basis of age group, the market is categorized into adult and pediatric.

The adult segment held a dominating market share in 2024. The growth of the segment can be attributed to the large population of individuals with chronic conditions such as diabetes, cardiovascular diseases, and anemia. Adults as well as the elderly population are undergoing regular hemoglobin and blood glucose testing. Button-activated safety lancets are preferred by this age group for their reliability, hygienic sampling, and minimal training requirements.

The pediatric segment is estimated to register a considerable CAGR during the forecast period. Manufacturers are innovating in this space by designing colorful, distraction-friendly, and ergonomically shaped lancets for pediatric use. Growing rates of juvenile diabetes and school-based screening initiatives are further boosting demand.

By Application

Increasing Prevalence of Diabetes to Drive the Blood Glucose Monitoring Segment

On the basis of application, the market is subdivided into blood glucose monitoring, hemoglobin testing, cholesterol testing, and others.

The blood glucose monitoring segment held the largest market share in 2024. Certain factors, such as substantial incidence of diabetes, preference for home-based diagnostics, and new product launches, are responsible for the maximum market share. Furthermore, button-activated safety lancets offer a safe, convenient, and quick method for capillary blood sampling without professional supervision. The integration of these lancets into glucometer kits is further projected to boost segment growth.

- For instance, as of 2025, the projections from the International Diabetes Federation (IDF) reported that 1 in 8 adults, approximately 783 million, will be living with diabetes by 2045.

The considerable growth of the hemoglobin testing segment is driven by increasing awareness and diagnostic screening for anemia, especially among pregnant women and the geriatric population. Button-activated lancets are used in point-of-care hemoglobin testing kits across hospitals, community health centers, and blood donation camps.

By Gauge Size

Growing Preference for Ultra-Fine Lancets to Boost Above 28G Segment Growth

On the basis of gauge size, the market is divided into 22G and below, 23G-28G, and above 28G.

Lancets with gauge sizes above 28G dominate the market and are highly preferred for applications requiring minimal pain and smaller blood samples such as glucose monitoring. Their ultra-thin needle reduces skin trauma and speeds up healing, making them ideal for daily use in chronic disease management. The increasing focus on patient comfort, particularly in home care and pediatric applications, is expected to further drive the demand for finer gauge lancets.

Lancets with 22-gauge needles held the second-largest market share in 2024. They are commonly deployed in clinical laboratories and are suitable for adult patients. These lancets are favored in diagnostic facilities for their sample yield and reliability, especially when blood flow is harder to obtain.

By Distribution Channel

Hospitals & Clinics to Dominate Due to Higher Number of Patient Visits to Hospital Settings

Based on distribution channel, the market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies/e-commerce platforms.

The hospital pharmacies segment accounted for a major market share in 2024 due to their direct association with patient treatment and diagnostic services. These channels enable quick access to lancets prescribed by healthcare professionals. Hospitals also procure lancets in bulk for use in wards, ICUs, and outpatient departments.

The online pharmacies/e-commerce platforms segment is estimated to register the highest CAGR during the forecast period. Online channels are witnessing rapid growth due to increasing e-commerce penetration and the convenience of home delivery. Online trial platforms and medical stores offer a wide range of button-activated lancets with detailed specifications, customer reviews, and competitive pricing. The growing trend of home-based diagnostics and remote patient monitoring is boosting the demand for direct-to-consumer lancet availability, especially among chronic patients and caregivers.

BUTTON-ACTIVATED SAFETY LANCET MARKET REGIONAL OUTLOOK

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Dominates the Global Market Owing to Robust Infrastructure and Product Awareness

North America Button-activated Safety Lancet Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 263.7 million in 2025 and USD 291.97 million in 2026. The region holds a dominant share of the market, driven by a high prevalence of diabetes and widespread adoption of point-of-care testing.

In the U.S., the growth is primarily attributed to advanced healthcare infrastructure, strong reimbursement frameworks, and increasing emphasis on self-monitoring. Additionally, the rise in home-based diagnostics post-pandemic and favorable FDA approvals for advanced safety lancets propel market expansion.

Europe

Europe accounts for a substantial CAGR over the analysis period due to a robust healthcare infrastructure and the presence of market players. These players are also targeting the region with ergonomic, CE-marked lancet products to meet the specific needs of both adults and pediatric patients. Additionally, growing investments in elderly care and digital health services are expanding the demand for painless, user-friendly devices.

- For instance, in October 2020, NHS Somerset published that around USD 13.42 million was spent on safety lancets across England and Wales.

Asia Pacific

Asia Pacific is expected to showcase the highest CAGR over the forecast period due to the rising diabetic population in China and India. Further, expanding access to healthcare services, growing health awareness, and increased government screening initiatives are boosting the demand for button-activated safety lancets.

- As of 2025, according to data published by the World Health Organization (WHO), around 77.0 million above the age of 18 years are suffering from type 2 diabetes in India.

Latin America and the Middle East & Africa

The Latin America market is expected to grow at a significant CAGR during the forecast period due to the increasing healthcare expenditure and rising demand for home diabetes monitoring influenced by the significant disease burden in the region. The Middle East & Africa market is anticipated to register stagnant growth during the forecast period. The regional market growth is primarily driven by rising chronic disease burden and improvements in healthcare accessibility.

- For instance, as per an article published by the South African Medical Research Council in November 2024, the South African government implemented various policies aimed at addressing non-communicable diseases (NCDs), with a particular focus on diabetes.

COMPETITIVE LANDSCAPE

Key Market Players

Strong Distribution Network and Focus on New Product Launches Assist Companies in Maintaining their Market Share

The market is fragmented, with established players dominating the market, such as HTL-STREFA, BD, and Abbott. Major players have recently introduced lancet variants with enhanced safety lock features, color-coded depth indicators, and wider gauge size options. Strategic partnerships between diagnostic companies and online pharmacies are expanding product availability.

- In January 2025, BD announced expanded investments in its U.S. manufacturing network to increase production capacity for essential medical devices, such as syringes, needles, and IV catheters, to address the ongoing demand from the nation's healthcare system.

LIST OF KEY BUTTON-ACTIVATED SAFETY LANCET COMPANIES PROFILED:

- Biosense Technologies Private Limited (India)

- Cardinal Health (U.S.)

- Niche Healthcare (Australia)

- Medivena (U.S.)

- ICU Medical (U.S.)

- BD (U.S.)

- HTL-STREFA S.A. (Poland)

- Greiner Bio-One International GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- November 2024– Sterilance Medical (Suzhou) Inc. participated in MEDICA 2024 in Germany to showcase its innovative product range.

- September 2022 – Tasso, Inc. received FDA approval for its Tasso+ safety lancet. The lancet has received approval under class II medical devices

- May 2021– Owen Mumford introduced the Unistik Touch family of safety lancets to achieve up to 500 μl of blood.

- June 2021– Sterilance Medical (Suzhou) Inc.’s SteriHeel Plus, a disposable safety heel incision lancet, won the China Patent Excellence Award.

- March 2021 – Owen Mumford introduced 16G safety lancets for high capillary volume sampling. The newly launched device has one touch activation technology.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, competitive landscape, product type, incision type, age group, applications, gauge size, and distribution channel. Additionally, it offers market dynamics and insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.25% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, and Region |

|

By Product Type |

· Push/Top Button · Side Button |

|

By Incision Type |

· Needle · Blade |

|

By Age Group |

· Adult · Pediatric |

|

By Application |

· Blood Glucose Monitoring · Hemoglobin Testing · Cholesterol Testing · Others |

|

By Gauge Size |

· 22G and Below · 23G-28G · Above 28G |

|

By Distribution Channel |

· Hospital Pharmacies · Retail Pharmacies · Online Pharmacies/E-commerce Platforms |

|

By Region |

· North America (By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, and Country) o U.S. o Canada · Europe (By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product Type, Incision Type, Age Group, Application, Gauge Size, Distribution Channel, Country/Sub-Region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 754.7 million in 2025 and is projected to record a valuation of USD 2,117.11 million by 2034.

The market will exhibit a steady CAGR of 12.25% during the forecast period of 2026-2034.

By product type, the push/top button-activated segment led the market during the forecast period.

The rising prevalence of diabetes and emphasis on point-of-care diagnostics are key factors driving the market.

HTL-STREFA, BD, and Cardinal Health are major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us