Calcium Hydroxide Market Size, Share & Industry Analysis, By Application (Water Treatment, Construction, Environmental Gas Treatment, Food & Beverages, Pulp & Paper, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

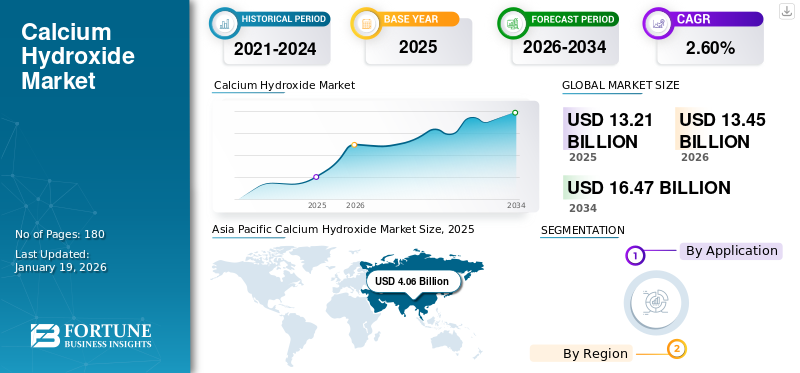

The global calcium hydroxide market size was valued at USD 13.21 billion in 2025. The market is projected to grow from USD 13.45 billion in 2026 to USD 16.47 billion by 2034, exhibiting a CAGR of 2.60% during the forecast period. Asia Pacific dominated the calcium hydroxide market with a market share of 31% in 2025.

The global market is witnessing significant growth opportunities, driven by various applications such as water treatment, construction, chemicals, metallurgy, and the compound’s excellent neutralizing and binding properties. Calcium hydroxide, or hydrated lime, is produced through the controlled hydration of quicklime and is widely available as a fine white powder. In the mining and metallurgy sectors, it assists in removing impurities and improving ore yield. Construction companies rely on it for soil stabilization and masonry applications. Regulatory emphasis on eco-friendly and low-toxicity materials further boosts its appeal across sectors. Rising demand from infrastructure development and water scarcity concerns, particularly in emerging economies, will significantly drive market growth.

Key players working in the market include Carmeuse, Lhoist Group, Graymont Limited, United States Lime & Minerals, Inc., and Sigma Minerals Ltd.

GLOBAL CALCIUM HYDROXIDE MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 13.21 billion

- 2026 Market Size: USD 13.45 billion

- 2034 Forecast Market Size: USD 16.47 billion

- CAGR: 2.60% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 31% share, rising from USD 4.06 billion in 2025 to USD 4.14 billion in 2026.

- By application: Water treatment dominated due to its pH-adjusting and contaminant-neutralizing properties.

- By end use: Construction sector grew steadily, driven by soil stabilization and infrastructure expansion.

Key Country Highlights:

- China: Major consumer driven by construction and water treatment projects.

- India: Strong demand from road and infrastructure development initiatives.

- U.S.: Steady use in metallurgy, construction, and municipal water treatment.

- Germany & U.K.: Focus on sustainable industrial and environmental applications.

- Brazil: Rising consumption in mining, construction, and wastewater management.

CALCIUM HYDROXIDE MARKET TRENDS

Growing Use of Waste Management Processes is a Key Market Trend

The global focus on sustainable waste management drives the adoption of calcium hydroxide in treating industrial, municipal, and hazardous waste. Lime’s chemical properties make it highly effective for stabilizing sludge, neutralizing acids, and reducing heavy metal solubility in contaminated materials. Governments are mandating stricter disposal norms, particularly in mining, chemicals, and water and wastewater treatment sectors, making lime-based solutions essential. Advanced processes now integrate the product into multi-stage treatment systems, offering safer and eco-friendlier outcomes.

MARKET DYNAMICS

MARKET DRIVERS

Industrial Growth and Metallurgical Processing are Fueling the Market Growth

Calcium hydroxide is essential in metallurgical processes, where it is used to remove impurities in non-ferrous and ferrous metal refining. Its ability to act as a fluxing agent and pH control during ore processing has made it indispensable in the steel, copper, and aluminum industries. As global demand for metals rises across the construction, automotive, and electronics sectors, lime consumption in metallurgy continues to grow. Furthermore, its use in treating acidic mine drainage and neutralizing waste streams makes it environmentally indispensable. As the mining and metallurgical industries scale operations to meet global material needs, these industries are becoming key drivers of growth in the market.

MARKET RESTRAINTS

Complex Logistics and Storage Requirements could limit Market Growth

The handling and storage of the product involve several logistical complexities that pose logistical challenges for suppliers and end users. The product must be kept dry and stored in moisture-free environments to prevent degradation, caking, or reduced reactivity. Bulk transport also requires specialized containers or silo systems to avoid contamination and ensure safety compliance. These factors increase supply chain costs, particularly in regions with high humidity, limited infrastructure, or remote project sites. Small-scale consumers, especially in developing countries, often lack the infrastructure to store lime properly, which reduces usability and leads to product waste.

MARKET OPPORTUNITIES

Infrastructure Development in Emerging Economies Poses a Strong Opportunity for Market Players

Emerging economies are witnessing robust calcium hydroxide market growth in infrastructure development, creating strong demand for materials such as calcium hydroxide used in road construction, soil stabilization, and civil engineering. In road projects, it enhances base layer strength and durability, especially in moisture-prone regions. Its affordability and performance benefits make it a go-to material in countries with budget-sensitive projects. Additionally, investments in ports, bridges, and railways require large volumes of materials, where lime contributes to soil modification and improved load-bearing capacity. As developing regions continue to urbanize and expand essential infrastructure, the role of lime in supporting these projects will grow.

- According to the India Brand Equity Foundation (IBEF), the Indian road infrastructure witnessed a robust growth in 2024. India has the second-largest road network in the world, spanning 6.7 million km. National highway construction in India increased at a 9.3% CAGR between FY16 and FY24. This growth presents major opportunities for the calcium hydroxide market, particularly in road development.

MARKET CHALLENGE

Health and Safety Risks Associated with Lime Could Limit Market Growth

The handling and storage of the product pose notable health and safety challenges, which may decrease its adoption in certain industries or smaller operations. Exposure to lime dust can cause respiratory issues, skin irritation, and eye damage, requiring strict protective equipment and handling protocols. These occupational hazards increase manufacturers' operational complexity and compliance requirements, especially under strict workplace safety regulations in developed markets. As a result, smaller businesses or organizations without robust safety infrastructure may avoid lime-based products altogether, preferring less hazardous materials.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

To know how our report can help streamline your business, Speak to Analyst

Water Treatment Segment Dominated due to Its Ability to Adjust pH

Based on application, the market is classified into water treatment, construction, environmental gas treatment, food & beverages, pulp & paper, and others.

The water treatment segment accounted for the largest calcium hydroxide market share of 36.21% in 2026 and is expected to remain dominant throughout the forecast period. Calcium hydroxide is a key material in water treatment applications due to its ability to adjust pH, precipitate heavy metals, and neutralize acidic contaminants. It is widely used in municipal water treatment plants to soften water by removing hardness-causing calcium and magnesium ions. It also helps control biological growth in distribution systems and minimizes pipeline corrosion by stabilizing pH levels. It removes phosphates, fluorides, and heavy metals in industrial wastewater treatment, ensuring environmental safety.

The construction sector is projected to experience significant growth in the upcoming forecast period. In the construction sector, calcium hydroxide is extensively used to improve building materials' durability, plasticity, and workability. It is commonly added to mortars, plasters, and stuccos to enhance bonding and water retention properties. Lime-based mortars are favored for their flexibility and resistance to cracking, particularly in restoration projects and historical buildings. Calcium hydroxide reacts with clay soils in soil stabilization to reduce moisture content and increase load-bearing capacity, which is critical for road construction and foundation work. Additionally, its antimicrobial properties help prevent mold growth in building interiors. The Construction segment is expected to hold a 32.75% share in 2024.

Calcium Hydroxide Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East and Africa.

Asia Pacific

Asia Pacific Calcium Hydroxide Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific witnessed a Calcium Hydroxide Market growth from USD 4.06 billion in 2025 to USD 4.14 billion in 2026. led by rapid urbanization, industrialization, and infrastructure development across emerging economies. Countries such as China, India, Indonesia, and Vietnam are showing an increasing demand for calcium hydroxide in construction, mining, and wastewater treatment. In countries such as China and India, lime is essential for road building, soil stabilization, and brick production. The Japanese market is projected to reach USD 0.05 billion by 2026, the Chinese market is projected to reach USD 3.67 billion by 2026, and the Indian market is projected to reach USD 0.28 billion by 2026. The growing need for clean water and stricter pollution control norms is expanding lime usage in municipal and industrial water treatment plants. Rising demand for calcium hydroxide in water treatment is expected to drive the market in the region.

- In China, the Construction segment is estimated to hold a 33.4% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

North America

North America holds a significant share of the market for calcium hydroxide, driven by consistent demand from the construction, water treatment, and metallurgy sectors. The U.S. leads regional consumption, supported by aging infrastructure requiring restoration, soil stabilization in highway projects, and ongoing urban expansion. The U.S. market is projected to reach USD 2.72 billion by 2026. Additionally, steel and non-ferrous metal producers rely on lime for refining and impurity removal, ensuring sustained demand from the metallurgical sector.

Europe

Europe is a key player in the market due to its advanced environmental regulations, mature industrial base, and focus on sustainable practices. Countries such as Germany, France, and the U.K. utilize lime extensively in construction and environmental management. European water treatment utilities apply the product for pH control, wastewater purification, and sludge stabilization, in line with EU directives. The metallurgy industry also contributes significantly, with steel production heavily depending on lime for impurity removal. The UK market is projected to reach USD 0.23 billion by 2026, while the German market is projected to reach USD 0.67 billion by 2026.

Latin America

In Latin America, the market is primarily driven by its applications in mining and construction, particularly in countries such as Brazil. Mining operations utilize this type of lime for ore flotation, pH control, and mine wastewater treatment. The construction industry benefits from lime’s role in mortar, plaster, and soil stabilization, especially in rural infrastructure development. Additionally, lime is increasingly used in environmental applications and drinking water treatment systems in urban areas.

Middle East & Africa

The Middle East and Africa region is witnessing growing demand for the product due to infrastructure expansion, mining activities, and increased investment in water treatment systems. In Gulf countries, calcium hydroxide is used in road construction and as a key additive in cement and mortar formulations. The ongoing construction boom in East and West Africa, supported by urban development projects, further stimulates lime consumption.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Players Focus On Capacity Expansion to Reinforce their Market Presence

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Carmeuse, Lhoist Group, Graymont Limited, United States Lime & Minerals, Inc., and Sigma Minerals Ltd. These companies compete based on product innovation, cost-efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY COMPANIES PROFILED

- Carmeuse (Belgium)

- Cheney Lime & Cement Company (U.S.)

- Lhoist Group (Belgium)

- Graymont Limited (Canada)

- Mississippi Lime Company d/b/a MLC. (U.S.)

- United States Lime & Minerals, Inc. (U.S.)

- Pete Lien & Sons, Inc. (U.S.)

- Sigma Minerals Ltd. (India)

- Greer Lime Company (U.S.)

- Shaurya Minerals (India)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Graymont has announced that they are making an investment to expand their lime production in in Victoria, Australia to meet the needs of its growing customer base. The company has acquired a land for the expansion and also built Logistics Terminal in Melbourne to expand its supply network.

- May 2024: The Lhoist Group has announced that they are aiming to produce the first low-carbon dolime at its Dolomies de Marche-les-Dames site. The project is called GLOBE it is a part pf Lhoist's commitment to an ambitious policy of decarbonizing its activities.

- January 2024: Mississippi Lime Company (MLC), a leading global supplier of lime products and technical solutions, announced an investment in constructing a state-of-the-art, sustainable kiln at its newly acquired lime operation in Bonne Terre, Mo. Construction began in early 2024, and commissioning will be completed by 2026.

- September 2023: Graymont Limited announced plans to expand its business in Southeast Asia. For this, the company acquired Compact Energy, a major lime processing facility in Malaysia. Through this move, the company planned to produce 600,000 tons of quicklime and 170,000 tons of Calcium Hydroxide annually.

- April 2021: Carmeuse acquired the SOCHA lime plant in Tunisia, with financial support from UGFS North Africa. This acquisition would help the company to strengthen the Carmeuse Overseas export capacity, due to its strategic location in El Hamma.

REPORT COVERAGE

The global market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information about the key regions/countries, key industry growth, new product launches, details on partnerships, mergers & acquisitions, and a number of manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 2.60% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Application

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 13.21 billion in 2025 and is projected to reach USD 16.47 billion by 2034.

In 2025, the market value stood at USD 4.06 billion.

The market is expected to exhibit a CAGR of 2.60% during the forecast period.

The water treatment segment led the market in 2025.

The growth of the construction industry is set to be the key factor in driving the market.

Carmeuse, Lhoist Group, Graymont Limited, United States Lime & Minerals, Inc., and Sigma Minerals Ltd are some of the leading players in the market.

Asia Pacific dominated the market in 2025.

The booming sustainable construction industry is likely to drive the adoption of the product in the forthcoming years.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us