Calcium Hypochlorite Market Size, Share & Industry Analysis, By Process (Sodium Process and Calcium Process), By Form (Granular & Powder and Tablet), By Application (Water Treatment, Swimming Pool Sanitation, Industrial Disinfection, Food & Beverage, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

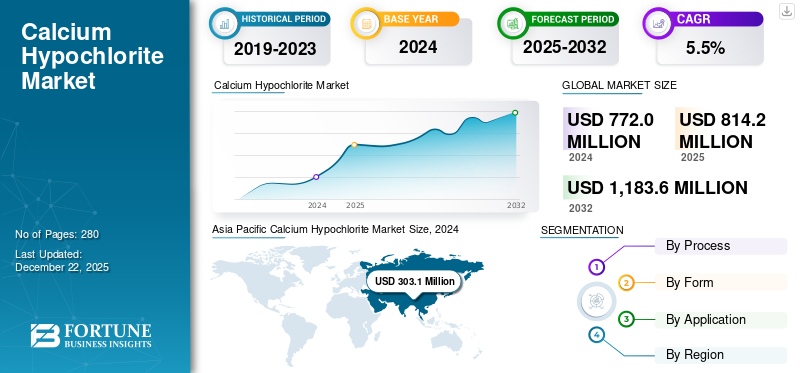

The global calcium hypochlorite market size was valued at USD 814.2 million in 2025 and is projected to grow from USD 858.9 million in 2026 to USD 1317.3

million by 2034, exhibiting a CAGR of 5.50% during the forecast period. Asia Pacific dominated the calcium hypochlorite market with a market share of 39.00% in 2025.

Calcium hypochlorite is an inorganic chemical compound commonly known as bleaching powder or calcium oxychloride. Its chemical formula is Ca(ClO)2. It is a versatile compound with numerous uses, primarily as a disinfectant and oxidizing agent. It's widely used in water treatment, swimming pools, and as a bleaching agent. In addition, it's used in organic chemistry, specifically for oxidation reactions. A huge quantity of the compound is utilized specifically in water treatment plants for purifying drinking water and treating wastewater. It's also used in swimming pool sanitization and disinfection of various water bodies and equipment. Therefore, increasing uncertainties about waterborne diseases and strict regulations related to water quality standards are anticipated to boost product demand in the coming years.

Sinopec Jianghan Salt Chemical Hubei Co., Ltd., Grasim Industries Limited, Tianjin Kaifeng Chemical Co., Ltd., Huanghua Kaifeng Chemical Co., Ltd., and Tianjin Yufeng Chemical Co., Ltd. are a few major players in the market. These companies are driving the market through in-line organic and inorganic investments, capitalizing aggressively to leverage the market's maximum potential.

MARKET DYNAMICS

MARKET DRIVERS

Increased Water Safety Regulations to Boost Market Growth

The expansion of municipal water treatment, commercial water treatment, and industrial water treatment plants largely drives the product demand. There is also an increase in the number of water treatment facilities to meet the growing demand for freshwater globally, which is also emphasizing the focus on disinfecting chemicals such as calcium hypochlorite. Also, governments and global health agencies are enforcing stricter norms on drinking water and sanitation as these chemicals are crucial for removing contaminants, water disinfection, and managing water quality in various sectors, including municipal, industrial, and agricultural. Hence, the regulatory push and crucial nature of these cleaning chemicals are boosting demand for the product, especially in developing nations with emerging urban populations. Therefore, efficacy to ensure safety and increased water safety regulations are set to drive the global calcium hypochlorite market growth during the forecast period.

MARKET RESTRAINTS

Stringent Chemical Regulations and Presence of Substitutes May Hamper Market Growth

Though calcium hypochlorite is a widely adopted disinfectant and bleaching agent, it is a regulated chemical due to its reactivity and potential for dangerous reactions, especially with other chemicals or when exposed to heat, moisture, or sunlight. It is unstable and decomposes slowly at normal temperatures, releasing heat. At higher temperatures, the decomposition rate increases, potentially leading to fire or explosion. These hazards increase logistical and compliance costs for end users. To control this compound wisely, environmental agencies in North America, Europe, and parts of Asia have introduced strict regulations on the storage, handling, and transportation of chlorine-based compounds, including calcium hypochlorite. In addition, alternative disinfectants, including sodium hypochlorite, chlorine dioxide, and ultraviolet sterilization systems, are hindering market share, particularly in advanced municipal treatment setups. Therefore, stringent chemical regulations and the presence of substitutes may hamper market growth.

MARKET OPPORTUNITIES

Growing Demand from Swimming Pools & Public Facilities to Create Lucrative Opportunities

The growing demand for swimming pools and public facilities, particularly in the residential and tourism sectors, presents significant lucrative opportunities. This growth is driven by factors such as rising disposable incomes, increased leisure time, and the desire for amenities that enhance living and vacation experiences. Urban infrastructure growth and rising income levels have fueled the construction of commercial and residential swimming pools, driving demand for pool sanitization chemicals. The global swimming pool market is projected to experience substantial growth in the coming years, fueled by the demand for luxury lifestyles and the increasing popularity of recreational activities. Also, swimming pools and recreational facilities are highly sought after by travelers, leading hotels and resorts to invest heavily in these amenities. These trends create opportunities for businesses involved in pool construction, maintenance, equipment, and related services. The above-mentioned facts and scenarios are likely to drive the market growth further, creating lucrative opportunities in the market.

GLOBAL CALCIUM HYPOCHLORITE MARKET TRENDS

Growing Adoption of Household Cleaners and Disinfectants to Drive Market Growth

Calcium hypochlorite is highly effective in killing germs, viruses, and bacteria. This effectiveness makes it a preferred ingredient in household cleaning products, especially during periods of increased hygiene awareness. As a result, it is used in various household cleaning products, including bathroom cleaners, laundry detergents, and floor cleaners. Its ability to eliminate bacteria and odors makes it a popular choice for maintaining a hygienic living environment. Consumers are increasingly aware of the importance of hygiene and sanitation, which fuels the demand for effective cleaning and disinfecting products. In addition, the COVID-19 pandemic heightened this awareness in households and enhanced the focus on public health initiatives, leading to investments in sanitation and hygiene. The chemical compound is a critical ingredient in many cleaners and disinfectant formulations, and the growing adoption of household cleaners and disinfectants will drive the market growth.

Download Free sample to learn more about this report.

IMPACT of COVID-19

The COVID-19 pandemic negatively impacted business operations in several ways, such as the temporary suspension of production, which resulted in disruptions in the supply chain. Lockdown measures and reduced consumer spending and decreased the usage of public swimming pools, which is among the prominent applications of the product. However, application areas such as water treatment and the food industry were still operating, which experienced heightened demand for the product, averaging out the reduced demand in other industrial application areas.

TRADE PROTECTIONISM & GEOPOLITICAL IMPACT

Geopolitical tensions and tariffs can disrupt the market through various channels, leading to price fluctuations, supply chain disruptions, and reduced market access. Imposing tariffs on the product or its raw materials can increase production costs and make it more expensive to import or export. Also, disruptions in the product’s supply chain can impact water treatment facilities and public health, along with the textile industry, which utilizes the chemical compound as a bleaching agent. These factors can negatively impact both producers and consumers, affecting demand, pricing, and overall market growth.

Segmentation Analysis

By Process

Sodium Process Dominated Market Owing to Its Efficiency and Cost-Effectiveness

On the basis of process, the market is segmented into sodium process and calcium process.

The sodium process held a dominant share of the global calcium hypochlorite market in 2026, accounting for 77.65% of the market with a size of USD 666.9 million. The sodium process is more widely adopted and dominant due to its cost-effectiveness and efficiency compared to traditional methods. The sodium process utilizes sodium hydroxide and chlorine gas, making it a more commercially viable option, especially for large-scale water treatment applications. The sodium process is generally cheaper to operate, leading to lower production costs for manufacturers. It has also benefited from technological advancements in automated dosing systems and packaging technologies, which will maintain this production process dominance in the market.

The calcium process produces a dry, more stable form of calcium hypochlorite, making it easier to handle and store. This dry form is also less affected by moisture, which is crucial in regions with varying climates. The product produced from this process is widely used in industrial and municipal water treatment, swimming pool sanitization, and other applications where a stable and efficient disinfectant is needed. As a result, the calcium process will experience the fastest growth over the forecast period.

By Form

Granular & Powder Segment Held a Dominant Share Due to Wide Adoption in Water Treatment & Industrial Applications

Based on form, the market is bifurcated into granular & powder and tablet.

The granular & powder segment accounted for a major share of the market in 2026, representing 57.56% of the market with a size of USD 494.4 million. Granular & powder form is preferred for disinfection and water treatment due to its ease of handling, stability, and cost-effectiveness compared to tablets. Granular forms are often more concentrated, requiring less material for the same disinfection dosage. Calcium hypochlorite is often supplied in lined drums for granules and in bags or buckets for powder, allowing for efficient storage and handling. In addition, the powdered and granular form offers a fast release of chlorine, offering rapid functionality to users and making it an ideal choice among water treatment and industrial applications.

The tablet segment is anticipated to have a significant growth rate due to its increasing use in specialty applications. Tablets are more convenient for dosing, require less storage space, and offer better shelf life. Swimming pool owners mostly prefer tablets due to their slow release and convenience. In addition, they are highly adapted for household or portable applications where ease of handling, safety, and portability are primary requirements.

By Application

To know how our report can help streamline your business, Speak to Analyst

Water Treatment Segment to Dominate Market Owing to Strong Disinfecting Properties

Based on application, the market is segmented into water treatment, swimming pool sanitation, industrial disinfection, food & beverage, and others.

The water treatment segment dominated the market in 2026, accounting for 34.61% of the market with a size of USD 297.3 million. The product is one of the most consumed water treatment chemicals, mainly due to its strong disinfecting properties and ease of use. It releases chlorine when dissolved in water, which effectively kills bacteria, viruses, and other microorganisms that can contaminate water sources. Its ability to disinfect drinking water, wastewater, and even swimming pools makes it a versatile and cost-effective solution. Further, it releases hypochlorous acid when it reacts with water, which is a powerful antimicrobial agent. This makes it effective against a wide range of pathogens, including bacteria, viruses, and protozoa, making water treatment the largest consumer in the market.

The swimming pool sanitation segment is anticipated to showcase significant growth, owing to the product’s high utilization to maintain clear, clean water. It is frequently used for swimming pool sanitation due to its strong oxidizing power, making it highly effective at killing a wide range of microorganisms. It also offers advantages in terms of stability and ease of use compared to other chlorine-based sanitizers.

Another important application area is food & beverage, where it is utilized for sanitation and disinfection due to its effectiveness in killing microorganisms and its relative stability compared to other chlorine compounds. It is used to sanitize equipment and surfaces and even to wash fruits and vegetables, helping to reduce microbial contamination and prevent foodborne illnesses, driving its demand moderately until 2032.

CALCIUM HYPOCHLORITE MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Calcium Hypochlorite Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market size stood at USD 320.7 million in 2025 and led the global market. China is the major producer and consumer of this product. The market growth in China is due to the growing usage of the product in water treatment and the expanding swimming pool industry. Furthermore, China is the hub of many industries, including pulp and paper, textiles, and others, in which the product is highly utilized for sanitation purposes, boosting its demand in the region. The Japan market is projected to reach USD 52.2 million by 2026, the China market is projected to reach USD 151.4 million by 2026, and the India market is projected to reach USD 17.6 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

Market growth in North America is attributed to increasing water treatment needs and stricter regulations. The region is a major consumer, with the U.S. being a leading country due to the presence of pool sanitization and municipal water treatment. The U.S. is identified as the largest market, with a projected market size of USD 187.7 million by 2026.

Europe

Europe is another prominent region in the market, where the increased focus on sustainable water management and stringent environmental regulations drives growth. The industry is characterized by a mix of major players and specialized companies offering a range of products and services. Key trends include the development of eco-friendly products, the integration of digital solutions, and collaboration with municipalities and industries. The UK market is projected to reach USD 24.3 million by 2026, while the Germany market is projected to reach USD 43.4 million by 2026.

Latin America

The Brazil market dominates the Latin America region. The demand in Brazil is steadily growing, primarily driven by increasing requirements for water treatment, sanitation, and agricultural applications. The Brazilian market also benefits from the rising agricultural sector, where the product is used as a disinfectant and bleaching agent.

Middle East & Africa

The Middle East region's industry is primarily driven by the growing tourism sector and rising demand for clean water. GCC countries are implementing various strategies to expand their economies, including expanding tourism places and residential and commercial hubs. Such projects will increase the number of swimming pools, thus driving market growth. South Africa's market is experiencing growth due to a combination of factors, including a thriving textile industry and expanding pulp and paper industrial applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Expansion in Capacity to be a Strategic Strategy of Dominating Companies

Expansion in capacity is an important strategy adopted by notable market leaders, including Gujarat Alkalies and Chemicals, Grasim, and Primo Chemicals, to sustain their position in the market. Key players are employing strategies, including sustainable practices, strategic alliances, and product diversification, to sustain their dominance and cater to evolving market demands. Especially, notable players are investing in the calcium hypochlorite industry to expand their production capacities in high-growth nations, including India and China. Such robust strategic initiatives will keep fueling the market growth during the projected period.

LIST OF KEY CALCIUM HYPOCHLORITE COMPANIES PROFILED

- Dodhia Chem-Tex Pvt. Ltd. (India)

- Grasim Industries Limited (India)

- Huanghua Kaifeng Chemical Co., Ltd. (China)

- Innovative Water Care, LLC (UK)

- LCI Co., Ltd. (South Korea)

- Nankai Chemical Co., Ltd. (Japan)

- Organic Industries Pvt. Ltd. (India)

- Sinopec Jianghan Salt Chemical Hubei Co., Ltd. (China)

- Tianjin Kaifeng Chemical Co., Ltd. (China)

- Westlake Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Hangzhou ASIA Chemical Engineering Co., Ltd launched a new Bleaching Powder Production Line that produces high-efficiency calcium hypochlorite, also known as concentrated bleaching powder or high-efficiency chlorinated lime, with an effective chlorine content exceeding 70%. This new line is designed to improve production efficiency, reduce costs, and enhance product quality, setting a new standard for the industry.

- January 2023: Primo Chemicals launched its SBP (Stable Bleaching Powder), which will be manufactured at a plant in Naya Nangal, Punjab, with a production capacity of 33 kilotons. The company’s ongoing progressive expansion plan will meet the increasing domestic and global demand.

- March 2022: Grasim Company planned to expand its production capacity of caustic soda, an essential raw material in the production of calcium hypochlorite. Under this strategic expansion plan, the company will increase its caustic soda capacity from 1,264 to 1,530 kilotons per annum.

- July 2021: Sinopec Jianghan Salt Chemical Hubei Co., Ltd. (the "Company"), a subsidiary of China Petroleum & Chemical Corporation, successfully conducted a trial operation of its new batch feeder for concentrated bleaching powder that has a capacity of 12 kilotons per year.

- February 2020: Gujarat Alkalies and Chemicals commenced commercial production of Stable Bleaching Powder (SBP) at Dahej, Gujarat, India. With the company’s latest capacity expansion, its total production capacity will increase to 30 kilotons per annum.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, processes, forms, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.50% from 2026-2034 |

|

Unit |

Volume (Kilotons), Value (USD Million) |

|

Segmentation |

By Process

|

|

By Form

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 814.2 million in 2025 and is projected to reach USD 1317.3 million by 2034.

Growing at a significant CAGR of 5.50%, the market will exhibit considerable growth over the forecast period (2026-2034).

Based on application, the water treatment segment is expected to lead over the forecast period.

Increased water safety regulations are the key factor driving the market.

Sinopec Jianghan Salt Chemical Hubei Co., Ltd., Grasim Industries Limited, Tianjin Kaifeng Chemical Co., Ltd., and Huanghua Kaifeng Chemical Co., Ltd. are the leading players in the market.

China held the largest share of the global market in 2025.

Increasing product demand from water treatment and expansion in the swimming pool industry are anticipated to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us