Car Rental & Leasing Market Size, Share & Industry Analysis, By Type (Rental and Leasing), By Use (Personal and Commercial), By Propulsion (ICE and Electric), By Mode (Online and Offline), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

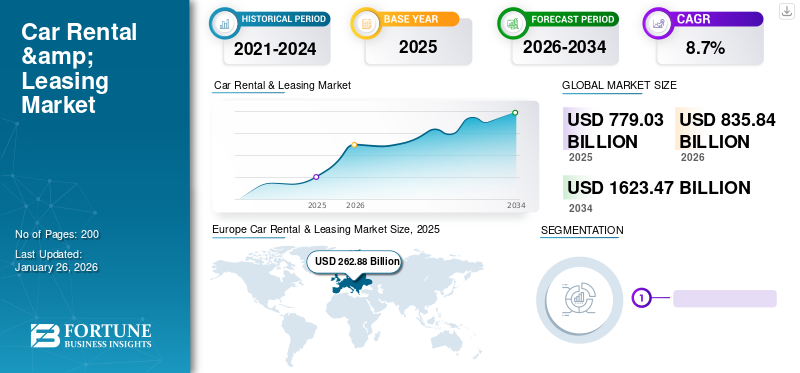

The car rental & leasing market size was valued at USD 779.03 billion in 2025 and is projected to grow from USD 835.84 billion in 2026 to USD 1623.47 billion by 2034, exhibiting a CAGR of 8.7% during the forecast period. Europe dominated the global market with a share of 33.7% in 2025.

Car rental & leasing is an industry that provides vehicles to customers for short-term rentals or long-term leases. A lease is typically tenured for two to four years, while rentals vary anywhere from a day up to several months. Car rental services are commonly used by people who need a vehicle for a temporary period, such as when travelling for business or vacation. On the other hand, car leasing is used by people who want to drive a new car but don’t want to pay a high up-front cost for purchasing a vehicle.

The primary factor that drives the car rental & leasing market growth is the increasing popularity of car-sharing services and ride-hailing applications, which have made it easy for people to access transportation without owning a vehicle. Additionally, the rise of the sharing economy has led to an increased demand for car rental & leasing options as more people seek flexible and cost-effective ways to access vehicles.

The COVID-19 pandemic severely impacted the leisure travel segment of the market as many people postponed or cancelled their travel plans. As a result, many car rental companies experienced a significant decline in the demand for long-term leasing services and a shift toward short-term rental options.

Download Free sample to learn more about this report.

Car Rental & Leasing Market Trends

Shift Toward Electric & Hybrid Vehicles and Use of Predictive Maintenance Services Will Drive Industry Growth

The trend of eco-friendly transportation options is growing at a notable pace. Vehicle rental companies are expanding their fleets with electric vehicles to meet the increasing demand for sustainable transportation. Many companies are implementing eco-friendly practices, such as adopting energy-efficient technologies, recycling programs, and carbon offset initiatives to align with the broader global focus on sustainability.

Car rental & leasing services are increasingly utilizing digital platforms and mobile apps for seamless booking, vehicle selection, and payment processes. This aims to enhance the overall customer experience and streamline operations. The use of data analytics for predictive maintenance is gaining traction. Rental companies are leveraging technology to monitor vehicle health in real time, enabling proactive maintenance to minimize downtime and improve overall fleet efficiency.

Car Rental & Leasing Market Growth Factors

Rising Importance of Convenience Will Drive Car Rental & Leasing Market Progress

Convenience plays a pivotal role in the success of the car rental & leasing industry. The ease of access, streamlined booking processes, and flexible pickup/drop-off options contribute to the industry’s appeal. The ability to book a car online from anywhere at any time improves convenience. Mobile apps and user-friendly websites make the reservation process quick and efficient. Car rental & leasing companies often provide flexibility in choosing pickup and drop-off locations, allowing customers to tailor their specific needs, such as airport or local office pickups.

These companies provide a diverse fleet of vehicles catering to different preferences and needs. Whether it is a compact car for city travel or a spacious SUV for a family trip, having options enhances convenience for customers. Clear and transparent pricing models without hidden fees, contribute to customer satisfaction and ease of decision-making. Streamlined processes for vehicle pickup and return save customers time and effort, and offer a positive driving experience.

RESTRAINING FACTORS

Evolving Mobility Trends and High Insurance Costs May Hinder Market Growth

Changing trends in mobility, such as increased interest in car sharing or subscription services can divert demand away from traditional car rental & leasing models. Ride-sharing services, such as Lyft and Uber provide alternative transportation options, potentially reducing the demand for conventional car rental services, especially for shorter distances.

High insurance costs associated with renting or leasing a vehicle can act as a deterrent for potential customers, thereby affecting the market, especially for long–term leasing. Car rental & leasing companies often pass on the high insurance costs to customers, leading to higher rental and lease prices. This can make these services less attractive and competitive compared to alternative transportation options. These companies may experience a reduction in their profit margins due to the elevated insurance expenses. This can impact their overall financial health, potentially limiting investment in vehicle fleets or technology upgrades.

Car Rental & Leasing Market Segmentation Analysis

By Type Analysis

Improved Financial Flexibility and Lower Monthly Payments Will Increase the Demand for Leasing Services

Based on type, the market is segmented into rental and leasing.

Leasing will dominate the market growth during the forecast time period. Leasing incurs lower upfront costs compared to purchasing a vehicle. This applies to individuals who prefer a more budget-friendly option with lower initial payments. Leasing payments are typically lower than monthly loan payments when buying a car. This affordability makes leasing an attractive option for those looking for a cost-effective means of accessing a car. Leasing often covers routine maintenance and repairs, reducing the financial burden on lessees. This reduction in costs can be appealing to individuals seeking a hassle-free driving experience.

- The leasing segment will account for 93.31% market share in 2026.

Rental segment is likely to exhibit steady growth by the end of 2032. Rise in urbanization, coupled with growing environmental concerns, has led to an increase in consumer preference toward more sustainable and flexible transportation solutions. Car rental offers the convenience of on-demand access. The rise of the sharing economy and advancements in technology have also played a major role in the growth of car rental services, making it easier for people to book and use vehicles when needed. Furthermore, travel trends, both for business and leisure, are contributing to the increased demand for rental cars as individuals seek efficient and personalized transportation options.

To know how our report can help streamline your business, Speak to Analyst

By Use Analysis

Reduction in Operation Costs Propelled Demand for Vehicles for Commercial Use

Based on use, the market is categorized into personal and commercial.

The commercial segment dominated the car rental & leasing market share of 85.07% in 2026. Leasing can provide tax benefits to businesses, such as tax deductions for lease payments or writing off the cost of the vehicle as a business expense. This helps firms reduce their operating cost and, thus, will propel the segment’s growth during the forecast period.

Personal segment will grow at a lower pace than commercial segment within the forecast period. Personal car leasing can be more cost-effective than buying a car for individuals who don't want to make a large upfront payment or cannot afford to pay the total cost of a vehicle. Moreover, personal car leasing allows for more frequent upgrades to new car models, which can be appealing to individuals who want to stay up-to-date with the latest technology and safety features. All these factors will drive the segment’s growth over the forecast period.

By Propulsion Analysis

Lower Upfront Costs Coupled With Presence of Large Infrastructure will Drive Adoption of ICE Propulsion Systems

The market is divided into electric and ICE based on propulsion.

ICE segment is expected to maintain largest market share of 73.1% in 2026. Despite the growing interest in electric vehicles, there is a substantial demand for Internal Combustion Engine (ICE) cars due to factors, such as affordability, established infrastructure, and high consumer preference for traditional automotive technology. Affordability remains a significant consideration for many consumers as electric vehicles often come with a higher upfront cost. Additionally, the existing infrastructure for gasoline and diesel vehicles, including an extensive network of fueling stations, also contributes to the appeal of ICE cars.

The positive image associated with electric cars, including their association with cutting-edge technology and innovation, has contributed to a major shift in consumer perception. Electric cars are being increasingly seen as desirable and modern transportation options. Many major companies operating in the market are heavily investing in electric vehicle technology. This commitment to sustainable mobility is reflected in the development of new electric models, creating a broader range of choices for consumers.

By Mode Analysis

Superior Efficiency and Convenience Offered by Online Mode to Accelerate Its Demand

Based on mode, the market is spilt into online and offline.

Online segment will grow at a rapid CAGR within the forecast period. The online segment will account for 69.44% market share in 2026. Customers appreciate the ease of browsing available vehicles, comparing prices, and completing the entire rental or leasing process online. This convenience aligns with the broader shift toward digital transactions. Online platforms provide clear information about the rental or leasing terms, costs, and available vehicles. Online operations streamline processes, reducing the time required for paperwork and manual transactions. Customers can complete reservations, payments, and documentation efficiently, improving their overall experience. The use of smartphones enables customers to access car rental & leasing services from anywhere, making it more convenient for those on the go. Incorporating advanced technologies, such as GPS, mobile apps, and digital solutions can enhance the overall rental experience and contribute to the appeal of online operations.

Some customers prefer or require in-person assistance, especially when dealing with complex rental or leasing situations. Having physical locations allows companies to provide face-to-face support and guidance. Customers may feel more comfortable inspecting the vehicle in person before renting or leasing. Offline operations facilitate on-site inspections, addressing concerns about the vehicle’s condition and features.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, and the rest of the world.

Europe Car Rental & Leasing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe dominated the market with the largest share in 2025. The region is one of the most popular tourist destinations in the world, with millions of people travelling to the continent every year. Car rental and leasing services are in high demand among tourists who want to explore the region's diverse cities and landscapes. This factor is boosting the market’s growth across the region. Europe dominated the market with a valuation of USD 262.88 billion in 2025 and USD 280.67 billion in 2026.The UK market is projected to reach USD 68.43 billion by 2026, while the Germany market is projected to reach USD 56.74 billion by 2026.

North America

North America held a significant market share in 2025. North America is a popular destination for both business and leisure travel, and car rental & leasing services are in high demand to meet the transportation needs of travellers. Moreover, a strong economy with low unemployment rate drives the demand for these services as consumers have more disposable income to spend on travel and transportation. The U.S. market is projected to reach USD 242.43 billion by 2026.

Asia Pacific

Asia Pacific is expected to witness significant growth in the market over the forecast period. Urbanization is driving the demand for car rental & leasing services in the region as more people are living in cities where car ownership can be impractical or expensive. Moreover, the growth of international business and trade in the region has increased the demand for personal transportation options, such as car rental and leasing. The Japan market is projected to reach USD 50.24 billion by 2026, the China market is projected to reach USD 169.9 billion by 2026, and the India market is projected to reach USD 6.91 billion by 2026.

Rest Of The World

Many countries in the rest of the world, comprising regions, such as the Middle East & Africa and Latin America, are experiencing economic growth, leading to increased consumer spending on and demand for personal transportation services, such as vehicle rental and leasing. Moreover, cities, such as Dubai are witnessing increased tourism, which is also driving the market’s growth in the region.

List of Key Companies in Car Rental & Leasing Market

Strategic Partnerships and Collaborations to Expand Business Operations of Industry Players

The car rental & leasing market has a high degree of competition, with several key players having a solid foothold in the market. These car rental companies are offering loyalty programs, entering long-term agreements with other players, expanding their global footprint by opening new branches, and diversifying their service portfolios to gain competitive advantage in the market.

For instance, in September 2022, Hertz and General Motors Co. signed an agreement in which Hertz will be buying up to 175,000 electric vehicles, including Chevrolet, Buick, GMC, Cadillac, and Bright Drop EVs over the next five years. Hertz and GM’s plan is the largest and broadest expansion of EVs among fleet customers due to its wide range of price points and vehicle categories, from compact and midsize SUVs to pickups and luxury vehicles. The agreement will help the companies commence the electric vehicle deliveries through 2027 as Hertz increases the EV component of its fleet and GM accelerates its EV production.

List of Key Companies Profiled:

- Enterprise Holdings (U.S.)

- Hertz Global Holdings (U.S.)

- AVIS Budget Group (U.S.)

- Europcar Mobility Group (France)

- Sixt SE (Germany)

- ALD Automotive (France)

- LeasePlan Corporation (Netherlands)

- Budget Rent a Car (U.S.)

- National Car Rental (U.S.)

- Dollar Rent a Car (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – Enterprise Holdings, Inc. opened new branches in Chile, the Cayman Islands, and the U.S. Virgin Islands as a part of its global car rental expansion program. This expansion in the Caribbean and Latin America will offer more vehicle rental and mobility options for both leisure and business travellers across these regions.

- November 2023 – Enterprise Holdings, Inc. introduced the Plus Your Points promotion to enable its registered members to earn double points on qualifying rentals. This promotion will be available to members in the U.S., the U.K., Canada, Ireland, France, Spain, Puerto Rico, and Germany.

- October 2023 – Enterprise Holdings, Inc., the National Hockey League Players’ Association (NHLPA), and the National Hockey League (NHL) declared a multiyear extension of their partnership. Enterprise Holdings will remain the official rental car partner for the NHL and NHLPA.

- November 2023 – Hertz and EVgo Inc. announced a joint promotion to offer one year of special charging rates to drivers renting any EV model at a Hertz location across the U.S.

- March 2021 – Europcar Mobility Group announced the extension of its strategic alliance with ECO Rent a Car in India and Shouqi Car Rental in China.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as leading companies, product/service types, and top product applications. Besides, it offers significant insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

REPORT SCOPE & SEGEMENTATION

|

ATRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Use

|

|

|

By Propulsion

|

|

|

By Mode

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 779.03 billion in 2025.

The market is to be expected to record a CAGR of 8.7% over the forecast period of 2026-2034.

By type, the leasing segment will lead the market.

The market size in North America stood at USD 248.44 billion in 2025.

Increasing demand for flexible and cost-effective transportation options will drive the market.

The increasing popularity of ride-sharing services will hinder the market’s progress.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us