Ride Sharing Market Size, Share & Industry Analysis, By Type (E-Hailing and Station Based), By Commute Type (Long Distance, Corporate, and Inter City), By Application Type (iOS, Android, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

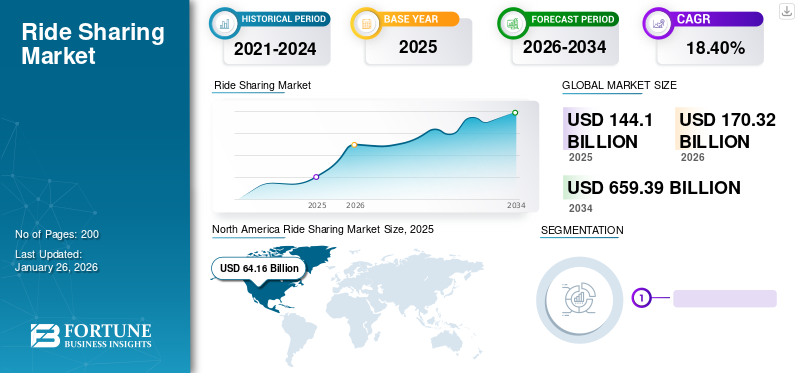

The global ride sharing market size was valued at USD 144.10 billion in 2025 and is projected to grow from USD 170.32 billion in 2026 to USD 659.39 billion by 2034, exhibiting a CAGR of 18.40% during the forecast period. North America dominated the ride sharing market with a market share of 44.52% in 2025.

The global ride-sharing market has experienced significant growth in recent years, driven by the increasing popularity of convenient and cost-effective transportation solutions. Ride-sharing services, facilitated by mobile apps, allow users to book rides from nearby drivers, often at lower costs compared to traditional taxi services. The market has witnessed a surge in adoption due to factors, such as urbanization, rising traffic congestion, and the growing preference for sustainable transportation options.

Download Free sample to learn more about this report.

Global Ride-Sharing Market Overview

Market Size:

- 2025 Value:USD 144.10 billion

- 2026 Value:USD 170.32 billion

- 2034 Forecast Value:USD 659.39 billion, with a CAGR of 18.40% from 2026–2034

Market Share:

- Regional Leader:North America held approximately 44.52% market share in 2025, driven by early adoption, mature platform ecosystems (Uber, Lyft), and high smartphone penetration

- Fastest‑Growing Region:Asia Pacific is poised to be the fastest-growing region due to rapid urbanization, rising middle-class incomes, and proliferation of mobility apps and digital platforms

Industry Trends:

- Certified Mobility Platforms Expansion:Major players (Uber, Lyft, Ola, Grab) expanding services into intercity, pooling, and subscription-based models

- Digital & Mobile Integration:High smartphone penetration and data connectivity fueling app-based booking, dynamic pricing, and real-time tracking

- Fleet Electrification & Green Mobility:Ride-share fleets shifting toward electric vehicles to meet sustainability goals and regulatory mandates

Driving Factors:

- Urbanization & Traffic Congestion:Increasing demand for shared mobility solutions to ease parking pressure and road congestion

- Rising Costs of Car Ownership:Economic constraints, fuel prices, and maintenance costs push users toward shared transport solutions

- Convenience & Affordability:On-demand access, pooled rides, and app-based models offer lower-cost mobility alternatives

- Smartphone & Internet Penetration:Greater access to mobile apps and seamless payment systems accelerates adoption in emerging markets

- Regulatory Support & Investment:Governments promoting ride-sharing as a part of public transit infrastructure and smart city initiatives

Major players in the ride-sharing industry, such as Uber, Lyft, and DiDi Chuxing, have expanded their operations worldwide, offering a variety of ride options, including carpooling, shared rides, and premium services. Additionally, advancements in technology, such as GPS navigation and real-time tracking, have enhanced the user experience and contributed to the market's growth. However, regulatory challenges and concerns over safety and security continue to be significant factors influencing the market dynamics.

The COVID-19 pandemic profoundly impacted the global ride-sharing market, leading to a significant decline in demand as lockdowns and travel restrictions were imposed worldwide. Concerns over virus transmission and a shift towards remote work also contributed to reduced ride-sharing usage. However, as economies gradually reopen and vaccination rates increase, the ride sharing market is expected to recover, albeit with continued focus on safety measures and hygiene protocols.

Ride Sharing Market Trends

Rising Demand for Micro mobility to Drive the Market Growth

Micro-mobility can be termed as the ability to movement for short distances using vehicles that can accommodate only one or two people. These vehicles consist of light vehicles such as mopeds, bikes, scooters, and longboards. Shared micro-mobility is a smart option for commuters seeking a quick ride in the city without any hustle of mass transit. The idea of micro-mobility makes a huge impact on how to make use of scooters and bikes and earn from them. The rising congestions, especially in metro cities, are there is a vast scope for micro-mobility as it can over these problems. For instance, the Volkswagen Group is promoting micro-mobility as a part of its electric mobility plan. The company has introduced Cityskater and Streetmate electric scooters in Geneva. Daimler and BMW together are offering scooters on rent in more than 6 cities in Europe.

Ride Sharing Market Growth Factors

Urbanization and Increasing Congestion in Major Cities to Drive Market Growth

Rapid urbanization has led to overcrowded roads, longer commuting times, and greater difficulty in finding parking, driving the demand for alternative transportation solutions, such as ride-sharing. According to the latest data from the United Nations, the global urban population is expected to reach 68% by 2050, up from 55% in 2018. As cities become more densely populated, traditional modes of transportation, such as private car ownership and public transit, are becoming less viable options for many residents. Ride-sharing services offer a convenient and flexible alternative, allowing users to book rides on-demand and share vehicles with others, reducing the number of cars on the road and easing traffic congestion.

The rise of smartphone technology has played a crucial role in driving the adoption of ride-sharing services. With the proliferation of smartphones and the widespread availability of ride-sharing apps, booking a ride has become more accessible and seamless than ever before. This convenience has led to increased usage among consumers, particularly in urban areas where ride-sharing is often more cost-effective and efficient than owning a car.

Environmental concerns and a growing emphasis on sustainability are driving more consumers to choose ride sharing over traditional modes of transportation. By reducing the number of vehicles on the road and promoting carpooling and shared rides, ride-sharing services contribute to lower greenhouse gas emissions and support efforts to combat climate change. In conclusion, the increasing urbanization, coupled with the convenience of smartphone technology and a growing focus on sustainability, are key drivers fueling the growth of the global ride sharing market. As cities continue to expand and traffic congestion worsens, ride-sharing is expected to play an increasingly vital role in providing efficient and environmentally friendly transportation options for urban dwellers worldwide.

Increasing Penetration of Internet and Smartphones to Boost the Market Growth

The rapid adoption of smart devices such as smartphones, smart wearables, and the increasing use of internet data have created high opportunities for ride-sharing services across the world, amplifying the global ride sharing market growth. Internet connectivity is the primary requirement for availing ride transport services. The users must download ride-providing applications on their smartphones using the internet to access the information and navigation of the ride. Internet connectivity is necessary for the efficient functioning of V2V communication, navigation, and telematics. Moreover, the smartphone apps provide various security features such as name, number, and photograph of the driver, vehicle number, route tracing details, and records of past rides.

Restraining Factors

Resistance from the Traditional Transport Services as well as High Risk of Cyber Threat to Hamper the Market Growth

The growing penetration of ride-sharing services across the globe is creating conflicts and disagreements between the traditional three-wheeler and taxi drivers. The ride services providers offer more advantages such as affordable doorstep pick-up and drop, complete details of the ride, and higher convenience compared to the traditional transport service providers. Therefore, taxi drivers in countries like Japan and India are opposing the ride service providers. However, the advanced features may cause a threat to the passengers. The ride service apps consist of detailed user information and the payment apps linked to these apps. Also, the real-time data of the ride is available, which creates a high risk of cybersecurity threats.

Ride Sharing Market Segmentation Analysis

By Type Analysis

E-Hailing Expected to Dominate the Market Due to Increasing Government Initiatives to Increase Awareness among People Regarding Air Pollution

The E-hailing segment is projected to dominate the market with a share of 82.63% in 2026. Based on type, the market is segmented into E-hailing and station-based types. The e-hailing segment will hold a major share in the global market in 2023. E-hailing ride services provide transportation to passengers by hiring a personal driver through a contract or employment basis. Besides, the rising demand for e-hailing services owing to increasing government initiatives to raise awareness among people regarding air pollution, passenger comfort, increasing traffic congestion, and ease of booking are propelling the demand for ride-sharing, predominantly e-hailing.

In e-hailing ride services, the rides are booked in advance and paid for through the smartphone application of the transportation network company. Uber, Ola, Lyft, and Gett are prominent players in the e-hailing ride business. For instance, Didi Chuxing, a leading ride sharing company, takes over the shares of 99, Brazil’s leading ride-hail app. The company invests in smart transportation services and AI capabilities through operations and partnerships. For instance, BMW has launched the car-sharing service ReachNow with BMW 370 series cars for short- and long-term rental and delivery services.

By Commute Type Analysis

Inter City Segment to Hold the Largest Market Share Due to the Rising Congestion in Public Transports

Based on the commute type, the market is segmented into corporate, long-distance, and intercity. The intercity segment holds the largest share 50.26% in 2026 of the global market. The intercity rides are between two cities. The commute comprises of a single-way tour from one city to another. Intercity rides are widely availed by the daily commuters that commute from one city to another for work purposes. With the rising congestion in public transports and fatigue occurring while driving, private vehicles create high opportunities for intercity commute rides as they offer enhanced comfort and convenience at affordable fare rates.

By Application Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Android Segment Expected to Hold the Largest Market Share

The Android segment is expected to lead the market, contributing 45.46% globally in 2026. ased on the application type, the market is segmented into Android, iOS, and others. In 2020, the android segment held the largest share of the global market. The ride-sharing apps are developed using cloud computing in mobiles. The majority of the population owns an android based smartphone owing to its user-friendly nature. Therefore, several prominent ride sharing companies develop apps that are supported by the android operating system. For example, android is the leading operating system in India, with over 75% of the market share. Samsung, Xiaomi, Oppo, and Vivo are a few of the many top mobile sector players operating on the Android system.

REGIONAL INSIGHTS:

North America Ride Sharing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 64.16 billion in 2025. The region holds dominance in the global market due to the rapid development of electric cars in countries such as Canada, the U.S., and Mexico, and the rapid adoption of technologically advanced features by ride-service providers. The United States market is projected to reach USD 60.47 billion by 2026, driven by expanding services and electrification initiatives. Uber has been rapidly expanding its business in Canada. For instance, last year, Lyft became the first company to announce the launch of green mode, providing electric car rideshare to its customers. The ride-sharing market in the U.S. is projected to grow significantly, reaching an estimated value of USD 167.2 billion by 2032. Moreover, the company introduced this development with the intention of the ‘Green City Initiative,’ which works on reducing the use of fossil fuels. These developments are thereby accelerating the market in this region.

Europe holds the third-largest share in the global market owing to rising partnerships between service providers and governments to promote ride-sharing services across the region. The United Kingdom market is projected to reach USD 6.86 billion by 2026, while the Germany market is projected to reach USD 1.72 billion by 2026, reflecting steady expansion supported by regulatory alignment and increasing adoption of shared mobility platforms.

Further, developing and developed countries such as India, China, Indonesia, and Japan are anticipated to experience substantial growth in Asia Pacific, predominantly in urban transportation. The Japan market is projected to reach USD 11.63 billion by 2026, the China market is projected to reach USD 38.60 billion by 2026, and the India market is projected to reach USD 23.30 billion by 2026. Additionally, factors such as an augmented need to save fuel by offering a ride to colleagues and commuters heading along the same route and increasing daily commute to workplaces in urban areas are expected to drive the Asia Pacific market.

List of Key Companies in Ride Sharing Market

Didi Chuxing Market Presence Makes it as a Top Player in the Market

The market is highly competitive and fragmented in nature, with the presence of key market players such as Uber Technologies Inc., Lyft, Inc., Didi Chuxing Technology Co., Bolt Technology OÜ, Gett, and GrabTaxi Holdings Pte. Ltd. These market players adopted new product launches and expansion to gain traction in the market.

DiDi Chuxing is a global leader in the mobile transportation platform. The company excels in offering app-based transportation services to more than 550 million users in Asia, Australia, and Latin America. They offer a full range of transportation services, including bus, Luxe, Taxi, designated driving, bike, and e-bike sharing and enterprise solutions. The company also collaborates with several policymakers, automotive and taxi industries by communicating and solving environmental and transportation challenges by innovating smart solutions using its AI capabilities. DiDi is continuously improving user experience and building safe and sustainable mobile transportation for a better future. Further, DiDi Chuxing comes up with the new in-app Health Guard program AI solution to verify daily vehicle disinfection, mask-wearing, and driver temperature.

LIST OF KEY COMPANIES PROFILED:

- Uber Technologies Inc. (California, U.S.)

- DiDi Global Inc. (Beijing, China)

- Gett (London, U.K.)

- Grab (Singapore)

- Bolt Technology OÜ (Tallinn, Estonia)

- Careem (Dubai, UAE)

- Cabify España S.L.U. (Madrid, Spain)

- Lyft, Inc. (California, U.S.)

- Zimride (California, U.S.)

- car2go Group GmbH (Berlin, Germany)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Nissan Motor Co., Ltd. announced the launch of an autonomous vehicle ride-share service within Japan in the coming three years. Nissan aspires to fulfill the transportation needs of urban residents by integrating autonomous vehicles into the ride-sharing market.

- February 2024: Uber commenced electric auto rickshaw service in Ayodhya under ride-sharing Uber Auto. It also plans to launch Uber Go and Uber Intercity for growth in shared mobility needs in the area.

- January 2024: Uber Japan announced the launch of ride-sharing services by April, as the Japanese government decided to lift a ban on ride-sharing services partially. Uber Japan’s new services will only be available in certain areas and at certain times when taxis are deemed in short supply. The central government will decide the parameters in the near future. The company aims to expand such services across Japan.

- January 2024: Motul Bangladesh, a renowned lubricant company, announced its partnership with Pathao Limited, a leading ride-sharing service. This partnership is set to deliver exclusive benefits for Pathao riders who opt for Motul lubricants for their bikes and cars, enhancing the experience for riders associated with Pathao.

- August 2021: Revel Transit Inc. launched a ride-sharing service in New York, the U.S. All cars in the fleet are Tesla, and all the drivers are the company’s employees.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types, commute types, and leading applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market over recent years.

An Infographic Representation of Ride Sharing Market

To get information on various segments, share your queries with us

Ride Sharing Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.40% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Commute Type

|

|

|

By Application Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 144.10 billion in 2025 and is projected to reach USD 659.39 billion by 2034.

In 2025, the North American market size stood at USD 64.16 billion.

The market is projected to grow at a CAGR of 18.40% and will exhibit steady growth over the forecast period (2026-2034).

E-hailing is expected to be the leading segment in this market during the forecast period.

Increasing penetration of the internet and smartphones to boost the market growth

Didi Chuxing is the leading player in the global market.

North America dominated the market share in 2025.

Stringent emission reduction norms are expected to drive market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic