Cell and Gene Therapy Market Size, Share & Industry Analysis by Type (Cell Therapy {Therapy Type [CAR-T Cell Therapy, TCR-T Cell Therapy, Natural Killer (NK) Cells, and Others], Product Type [Kymriah, Yescarta, Tecartus, Breyanzi, Abecma, Carvykti, and Others], Indication [Oncology and Others]} and Gene Therapy {Product Type [Zolgensma, Luxturna, Roctavian, and Others], Vector Type [Viral Vectors and Non-Viral Vectors], Indication [Genetic Disorders, Ophthalmology, Hematology, and Others]}), By End User (Hospitals & Clinics, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

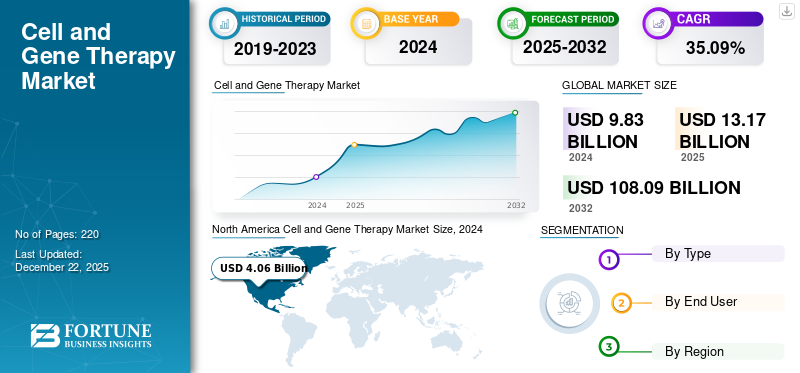

The global cell and gene therapy market size was valued at USD 13.17 billion in 2025. The market is projected to grow from USD 17.54 billion in 2026 to USD 200.54 billion by 2034, exhibiting a CAGR of 35.60% during the forecast period. North america dominated the cell and gene therapy market with a market share of 40.10% in 2025.

The market is expected to witness a significant growth trajectory during the forecast period. This is due to the increasing demand for targeted treatment and personalized medicine approach for non-drug treatable diseases such as cancer, rare genetic diseases, neurological disorders, and others.

Cell and gene therapy aims to offer innovative therapies that involve modification or replacing defective cells and genes to treat or potentially cure various genetic disorders, cancers, and other serious diseases. Thus, the advancements in biotechnology, genomics, and molecular biology is contributing toward the development of these therapies to offer personalized treatment options with the potential for long-term benefits. Furthermore, increasing collaborations between key players to expand the development of cell and gene therapy products are anticipated to propel the market growth.

- For instance, in September 2024, Evotec SE collaborated with Novo Nordisk A/s to develop off-the-shelf cell therapy products. Under the collaboration, Novo Nordisk provided funding for technology development activities at Evotec’s R&D site in Germany.

Furthermore, the market encompasses several major players, with Bayer AG and GSK plc at the forefront. Key players in the industry depict a focus on investment in R&D activities.

MARKET DYNAMICS

MARKET DRIVERS

Surging Prevalence of Cancer and Genetic Disorders to Drive Market Growth

The rising prevalence of cancer and rare genetic disorders is increasing the demand for more curated treatment options, driving the market growth. Cell and gene therapy correct the genetic mutations or restore cell functions for those patients who have limited treatment options available. Additionally, advancements in genomic research and personalized medicine have boosted the development of targeted therapies tailored to individual genetic profiles. Thus, the global demand for targeted treatments to fulfil the unmet medical needs and increase patient satisfaction propels market growth.

- For instance, in August 2025, as per the World Health Organization Report, globally around 7.74 million people were recorded to be living with sickle cell diseases in 2021. Such a large number of people suffering from non-curable diseases increases the demand for targeted therapies and is expected to propel the global cell and gene therapy market growth.

MARKET RESTRAINTS

High Manufacturing Complexities and Costs to Hamper Adoption and Market Growth

High manufacturing complexity and costs significantly restricts the adoption of cell and gene therapies and market growth. The high cost is associated with the manufacturing complexities and clinical and non-clinical studies.

Additionally, the personalized nature of cell and gene therapies makes it difficult to scale up, thus limiting the manufacturing capacity and causing delays in delivery and increasing overall costs, hindering widespread adoption.

- For instance, as per data published by various sources including the American Academy of Ophthalmology, the cost of treatment for Luxturna is approximately USD 425,000 per eye. Luxturna is a gene therapy for the treatment of vision loss due to a gene mutation.

MARKET OPPORTUNITIES

Development of New Therapies for Untreatable Neurodegenerative Disorders to Bolster Market Growth

Current treatment methods have significant gaps to address the underlying cause of the neurodegenerative diseases, such as Alzheimer's, Parkinson's, and ALS. However, these gaps can be filled with the emergence of genetic editing techniques. Thus, the development of effective treatments for these challenging disorders with the help of cell and gene editing techniques can accelerate market expansion and act as a transformative step in healthcare solutions. Furthermore, market players are focusing on the development of cell-based therapies for the untreatable neurodegenerative diseases.

- For instance, in January 2025, Bayer AG and BlueRock Therapeutics LP announced an initiation plan for the bemdaneprocel Phase III clinical trial. It is an investigational cell therapy for Parkinson’s disease. It is a cornerstone for allogeneic cell-based therapies for neurodegenerative disorders.

CELL AND GENE THERAPY MARKET TRENDS

Increasing Focus on CRISPR-based Precision Medicine is a Prominent Market Trend

The rising focus of researchers and pharmaceutical companies to adopt CRISPR technologies for developing personalized cell and gene therapy is a prominent market trend. CRISPR enables the precise editing of genes, improving the development of targeted treatments for genetic disorders—the CRISPR-based therapies aimed to enhance the effectiveness and safety profiles of cell and gene therapies. Furthermore, CRISPR enables precise gene editing and improves the development of targeted treatments for genetic disorders.

- For instance, in May 2024, NIH-supported researchers at the Children’s Hospital of Philadelphia and the University of Pennsylvania developed a customized therapy using the gene-editing platform CRISPR. The therapy has been developed for the treatment of newborns with the rare, incurable genetic disorder carbamoyl phosphate synthetase 1 (CPS1) deficiency. The platform used can be adapted to target different disorders, highlighting its potential to revolutionize genetic medicine. Such advancements are likely to contribute to market growth during the forecast period.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Shortage of Skilled Professionals to Challenge Market Growth

Cell and gene therapy manufacturing and development require various technical skills. The specialized nature of these therapies requires highly trained scientists, clinicians, and technical staff, who are in limited supply. Further, the current CGT workforce may not be ready to meet this increasing demand.

- For instance, in September 2025, as per data published by the International Society for Cell & Gene Therapy (ISCT) Laboratory Practices Committee, the majority of laboratories in the U.S. and EU exhibit an inability to hire experienced technical and production staff with only 35.0% of staff in 2023. Such a limited number of professionals hampers the production and challenges the market growth.

Segmentation Analysis

By Type

Regulatory Approval and New Product Development to Propel Cell Therapy Segmental Growth

On the basis of segmentation by type, the market is classified into cell therapy and gene therapy.

The cell therapy segment accounted for the dominant global cell and gene therapy market share of 70.35% in 2026. The cell therapy segment is further divided into product type, therapy type, and indication. The increasing demand for targeted treatment and personalized therapy especially for the hard-to-treat cancers, is supporting the segmental growth. Additionally, a higher number of clinical studies associated with it and increasing regulatory approvals for new cell therapies are expected to boost the segment’s growth.

- For instance, in August 2024, Adaptimmune Therapeutics announced the U.S. FDA approval for Tecelra, a T-cell receptor (TCR) therapy for the treatment of metastatic synovial sarcoma, a type of soft tissue sarcoma.

Furthermore, the gene therapy segment accounted for the second leading share of the market in 2024. The segment is divided into product type, vector type, and indication.

To know how our report can help streamline your business, Speak to Analyst

By End User

Strong Focus on Partnerships to Develop New Products to Propel Hospital & Clinics’ Segmental Expansion

Based on end user, the market is segmented into hospitals & clinics, specialty clinics, and others.

In 2026, the hospitals & clinics segment recorded a leading share of 55.59% in the market. Cell and gene therapy are specialized therapies and are often administered by skilled professionals in hospital settings. Furthermore, increasing focus of hospitals and clinics to collaborate with key companies and develop new therapies is set to propel the segment’s growth.

- For instance, in June 2025, MarkHerz Inc. signed a Memorandum of Understanding (MOU) with the Technical University of Munich (TUM) hospital, Germany, to develop new development of cardiovascular and diabetes-targeted AAV gene therapie. Such collaborations are poised to propel the segment’s growth.

In addition, the specialty clinics segment as an end user is projected to grow at a staggering CAGR of 36.99% during the study period.

Cell and Gene Therapy Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Cell and Gene Therapy Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held a dominant share in 2025, valued at USD 5.27 billion, and also bagged the leading share in 2026 with USD 7 billion. North America’s dominance in the market is driven by factors such as the presence of key players with advanced research facilities and innovation centers, adequate reimbursement policies, and healthcare facilities to maintain the region’s dominance in the market. In 2026, the U.S. market is estimated to have reached USD 6.52 billion. The U.S. dominated the North America market, with advanced healthcare facilities and investment in research and development set to propel the market growth in the country.

- For instance, in April 2025, Thermo Fischer Scientific Inc. launched a new facility, the U.S. Advanced Therapies Collaboration Center (ATxCC) in California, to accelerate cell therapy development from research to commercialization.

Europe and Asia Pacific

Other regions, such as Europe and the Asia Pacific, are anticipated to witness notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 27.0%, which is the second highest amongst all the regions, and touch the valuation of USD 6.15 billion in 2026. The increasing prevalence of genetic, autoimmune disorders and presence of advanced facilities primarily drive the regional expansion. Backed by these factors, the U.K. is expected to have recorded a valuation of USD 1 billion, Germany, USD 1.5 billion in 2026 and France, USD 0.79 billion, in 2025. After Europe, the market in the Asia Pacific is estimated to have reached USD 2.67 billion in 2026 and secure the position of the third-largest region in the market. In the region, India and China markets are both estimated to have reached USD 0.22 billion and USD 0.96 billion in 2026.

Latin America and the Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness moderate growth in this market. The Latin America market, in 2026, is set to have recorded a value of USD 1.12 billion. The region has slower market growth due to limited facilities for specialized therapies and the presence of lower-income population decreases the adoption of the therapies. In the Middle East & Africa, the GCC is set to have touched an estimated value of USD 0.26 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Diverse Product Portfolio and Strong R&D Activities to Allow Novartis AG and Gilead Sciences, Inc. to Hold Dominant Market Share

The global cell and gene therapy market shows a consolidated structure with a small number of large-sized companies actively operating across the globe. These players offer prominent cell and gene therapy products for various disease indications ranging from cancers to rare diseases. Novartis AG and Gilead Sciences, Inc. are some of the dominating players in the market. Their strong range of cell and gene therapy products, with strategic activities to expand their offerings for different disorders, is set to boost their position in the market.

Apart from this, the other prominent players in the market includes Rocket Pharmaceuticals, Bristol-Myers Squibb Company, and Krystal Biotech Inc., among others. These key players are focusing on the research and development of new therapies focusing on personalized medicine to enhance their market presence.

LIST OF KEY CELL AND GENE THERAPY COMPANIES PROFILED

- Vertex Pharmaceuticals Incorporated (U.S.)

- Krystal Biotech, Inc. (U.S.)

- Rocket Pharmaceuticals (U.S.)

- CRISPR Therapeutics (Switzerland)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- Hoffmann-La Roche Ltd (Spark Therapeutics) (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Adaptimmune (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Rocket Pharmaceuticals received the U.S. FDA RMAT (Regenerative Medicine Advanced Therapy) designation for RP-A601 gene therapy for the treatment of patients with PKP2-arrhythmogenic cardiomyopathy.

- July 2025: Australia’s Viral Vector Manufacturing Facility (VVMF) and Cell Therapies signed a Memorandum of Understanding (MoU) to strengthen the onshore development and manufacturing of advanced therapy medicinal products (ATMPs).

- January 2024: AbbVie Inc. collaborated with Umoja Biopharma to develop multiple in-situ generated, CAR T-cell therapy candidates in oncology using the company's VivoVecTM platform.

- December 2023: Vertex Pharmaceuticals Incorporated, in collaboration with CRISPR Therapeutics, received the U.S. FDA approval for CASGEVY, a CRISPR/Cas9 genome-edited cell therapy, for the treatment of SCD (sickle cell disease) in patients in the age group of 12 years and above with recurrent VOCs (vaso-occlusive crises).

- May 2023: Krystal Biotech, Inc. received the U.S. FDA approval for VYJUVEK for the treatment of patients six months of age or older with dystrophic epidermolysis bullosa (DEB).

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 35.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By End User

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 17.54 billion in 2026 and is projected to reach USD 200.54 billion by 2034.

In 2025, the market value stood at USD 5.27 billion.

The market is expected to exhibit a CAGR of 35.60% during the forecast period of 2026-2034.

In 2025, the cell therapy segment led the market by type.

The key factors driving the market are the rising prevalence of cancer, increasing government initiatives, and others.

Novartis AG and Gilead Sciences are some of the prominent players in the market.

North america dominated the cell and gene therapy market with a market share of 40.10% in 2025.

The increasing demand for personalized medicine is a major factor that is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us