Cellulose Acetate Market Size, Share & Industry Analysis, By Type (Fiber and Plastic), By Application (Plastics, Paints & Coatings, Pulp & Paper, and Others), By Application (Cigarette Filters, Textiles & Apparel, Photographic Films, Tapes & Labels, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

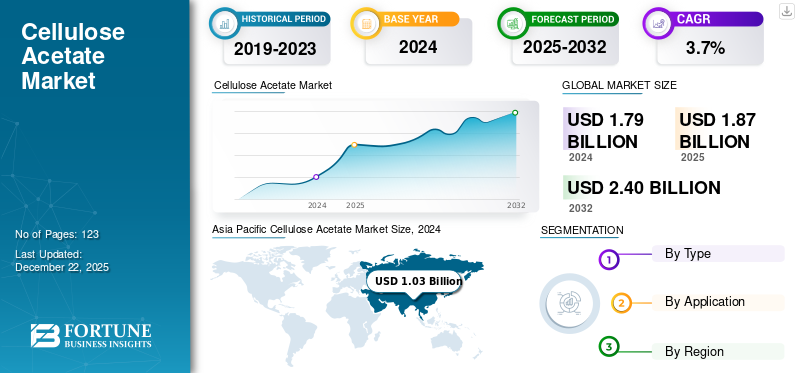

The global cellulose acetate market size was valued at USD 1.85 billion in 2025 and is projected to grow from USD 1.92 billion in 2026 to USD 2.58 billion by 2034 at a CAGR of 3.70% during the forecast period of 2026-2034. Asia Pacific dominated the cellulose acetate market with a market share of 58% in 2025.

Cellulose acetate is a semi-synthetic polymer derived from cellulose, the natural structural component found in the cell walls of plants, particularly wood pulp and cotton linters. It is produced through the acetylation of cellulose, where hydroxyl groups in the cellulose molecule are replaced by acetyl groups using acetic anhydride and acetic acid, resulting in a thermoplastic material with versatile properties. With properties such as high transparency, toughness, resistance to impact, and dimensional stability, it has found widespread industrial and commercial applications. It has been used in the production of textile fibers, where it serves as a substitute for silk due to its smooth texture, luster, and dyeability. It is extensively used in the manufacture of cigarette filters, which represent one of its largest global applications. It is also applied in photographic films, membranes for water purification, coatings, and packaging films due to its chemical resistance and ability to form clear, durable products. In the eyewear industry, cellulose acetate sheets are preferred for making high-quality spectacle and sunglass frames owing to their light weight, strength, and the ability to incorporate a wide variety of colors and patterns.

The market is prominent in the production of cigarette tow filters, which account for the largest share of consumption, followed by applications in textile fibers, molded plastics, packaging films, and photographic films. The growth of the market is driven by the increasing need for eco-friendly alternatives to petroleum-based plastics, regulatory shifts favoring biodegradable materials, and rising awareness of environmental sustainability. In addition, the expanding textiles industry

Celanese Corporation, Cerdia International GmbH, Eastman Chemical Company, Daicel Corporation, and Vizag Chemical are the key players operating in the market.

In 2020, global lockdowns, restrictions on cross-border trade, and factory shutdowns led to a significant contraction in production and distribution, which is heavily used in cigarette filters, textile fibers, films, and coatings, and faced mixed demand shocks across sectors. The tobacco industry, which represents the largest consumption share, experienced temporary declines in consumption in some regions due to supply chain interruptions, labor shortages, and reduced retail activity. By late 2021, as economies reopened and supply chains stabilized, demand gradually recovered, though the pace varied by region and application.

Cellulose Acetate Market Trends

Growing Demand for Biodegradable Alternatives to Plastics to Boost Market Growth

Governments globally implement stricter regulations on single-use plastics, and brands face mounting pressure from environmentally conscious consumers. It is increasingly recognized as a viable and eco-friendly material. Derived from renewable resources such as wood pulp and cotton linters, it is inherently biodegradable under appropriate conditions, offering a sustainable substitute for petroleum-based polymers that persist in the environment for centuries. In sustainable packaging, it is finding strong traction in films, wraps, and coatings that require durability, transparency, and resistance to grease, while also being compostable. In the packaging sector, rising restrictions on single-use plastics across regions such as the European Union, North America, and parts of Asia are driving demand for films and coatings, which can replace petroleum-based plastics in food packaging, labels, and consumer goods applications without compromising functionality.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Demand from Textile and Apparel Industry Drives Market Growth

The demand for lightweight, comfortable, and sustainable fabrics drives the cellulose acetate market growth. As consumer lifestyles shift toward fashion that blends comfort with style, the demand has steadily increased. In addition to aesthetics, the fibers offer practical advantages such as resistance to shrinking, low moisture absorption, and quick-drying capabilities, making them suitable for diverse climates and daily wear. Moreover, sustainability at the forefront of the global fashion industry provides a renewable and biodegradable alternative to petroleum-derived fibers such as polyester and nylon. Leading fashion brands are incorporating eco-friendly materials into their supply chains, and their ability to meet both performance and sustainability criteria makes them an attractive choice.

Market Restraints

Environmental Concerns over Production and End-of-Life Management Constraints Limit Market Growth

The biodegradability depends on the degree of substitution and environmental conditions; in some cases, products such as cigarette filters made from cellulose acetate degrade very slowly, contributing significantly to urban litter and marine pollution. This discrepancy between its marketed sustainability and actual degradation performance under real-world conditions has led to increasing criticism from environmental groups, policymakers, and consumers. Moreover, the manufacturing process often involves the use of chemical solvents and plasticizers, including acetic anhydride, which raise environmental and occupational safety concerns if not properly managed.

Market Opportunities

Expanding Use in Cigarette Filters and Consumer Products will Create Significant Growth Opportunities

Cellulose acetate tow is the primary raw material for filter rods, valued for its ability to reduce tar and nicotine intake while maintaining airflow and filtration efficiency. Despite rising anti-smoking campaigns and regulatory measures in developed countries, global cigarette consumption remains high, particularly in emerging economies across Asia Pacific, the Middle East and Africa, where growing populations and increasing disposable incomes continue to sustain demand. This consistent consumption pattern ensures a stable base demand for cellulose acetate. Furthermore, innovation in filter technologies, including biodegradable cigarette filters, is creating new opportunities as manufacturers respond to concerns over plastic waste from discarded butts, which are a major source of pollution.

Market Challenges

Volatility in Raw Material Prices and Supply Constraints Could Lead to Several Market Challenges

Climate-related disruptions such as droughts, deforestation restrictions, and pests can limit the availability of cotton linters and sustainable wood pulp, leading to supply shortages and cost escalation for manufacturers. Additionally, competition from other industries such as paper, textiles, and biofuels increases the strain on raw material supply, further intensifying price instability. Fluctuating acetic acid and acetic anhydride prices, essential chemicals in the esterification process, also contribute to production cost uncertainty. With rising demand for eco-friendly alternatives, the cellulose acetate industry is pressured to scale up capacity, but sourcing sustainable feedstock consistently at competitive prices remains challenging.

Trade Protectionism and Geopolitical Impact

It is derived from wood pulp and acetic anhydride, and is heavily dependent on steady cross-border trade flows of feedstock and finished products. Rising protectionist measures such as tariffs, import restrictions, and localization mandates in major consuming regions such as the North America, Europe, and Asia Pacific can increase input costs for manufacturers, limit export opportunities, and drive market fragmentation. For example, restrictions on wood pulp exports from key producing countries or heightened trade barriers on chemicals such as acetic acid disrupt supply security, leading to price volatility. Geopolitical tensions further complicate this scenario by affecting energy markets, logistics, and investment flows. Instability in Eastern Europe, shifting U.S.-China trade relations, and sanctions on major chemical-exporting nations could hinder the smooth trade of cellulose acetate and its raw materials. Moreover, geopolitical competition is prompting countries to prioritize self-sufficiency in chemical value chains, spurring regional investments but reducing global integration.

Research and Development (R&D) Trends

Research and development (R&D) in the market is increasingly focused on sustainability, performance enhancement, and diversification of applications. Traditionally dominated by cigarette filters and textile fibers, the industry is now witnessing innovation driven by environmental regulations, consumer demand for eco-friendly materials, and technological progress in bio-based polymers. A major trend is the development of biodegradable and compostable products, particularly for packaging films, straws, and single-use items, as regulators globally tighten restrictions on petroleum-based plastics. Companies are investing in advanced plasticization and modification techniques to improve mechanical strength, thermal stability, and moisture resistance, enabling them to compete more effectively with synthetic polymers.

Segmentation Analysis

By Type

Fiber Segment Dominated Market Owing to Increasing Use in Cigarette Filters Industry

Based on type, the market is classified into fiber and plastic.

The fiber segment held the largest cellulose acetate market with a share of 60.94% in 2026 and is expected to experience substantial growth, driven by the increasing demand in the production of cigarette tows, textiles, and specialty fabrics. In addition, the tobacco industry significantly drives consumption, as cellulose acetate tow remains the standard material for cigarette filters due to its filtration efficiency and ease of manufacturing. Urbanization and rising disposable incomes in Asia, especially China and India, have increased demand for clothing and cigarettes, further fueling the growth in the segment.

The plastic segment is projected to experience significant growth in the coming years, driven by its application in consumer goods, automotive components, electronics, and medical devices. It offers excellent dimensional stability, toughness, and resistance to impact, making it a suitable alternative to petroleum-based plastics. Industries such as eyewear, tool handles, films, and coatings rely on cellulose acetate plastics for their clarity, aesthetics, and workability, which strengthens their adoption in high-value consumer products. Additionally, technological innovation in bioplastics and the shift toward greener polymers are enhancing appeal in packaging and electronics casings.

By Application

To know how our report can help streamline your business, Speak to Analyst

Cigarette Filters Segment to Dominate Market Owing to Its Extensive Applications

In terms of application, the market is segmented into cigarette filters, textiles & apparel, photographic films, tapes & labels, and others.

The cigarette filters application accounts for the largest market with a share of 80.21% in 2026, driven by both consumption patterns and regulatory landscapes. Cellulose acetate tow is the preferred material due to its biodegradability compared to synthetic alternatives, which aligns with tightening environmental policies aimed at reducing plastic waste. However, the demand trajectory is influenced by declining smoking rates in developed markets including Europe and North America, where stricter anti-smoking laws and public health campaigns are prevalent. Conversely, rising smoking prevalence in emerging economies in the Asia Pacific sustains demand growth.

The textiles & apparel segment is also experiencing favorable growth over the projected period. The growth of the segment is associated with the growing consumer preference for sustainable, lightweight, and breathable fabrics. Its natural luster, silk-like appearance, and dye affinity make it an attractive alternative to petroleum-based fibers in fashion and home textiles.

Cellulose Acetate Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Cellulose Acetate Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the market with a size of USD 1.07 billion in 2026 and is projected to register the highest CAGR over the forecast period, driven by cigarette filter demand in China, India, and ASEAN countries. Rising smoking prevalence, coupled with large-scale tobacco production, sustains high consumption levels despite regulatory pressures. The region is also the largest hub for textile and apparel manufacturing, where acetate fibers are increasingly used to cater to both domestic consumers and international fashion brands. Rapid urbanization, growing middle-class populations, and rising disposable incomes further boost demand for premium fabrics and packaged goods. The Japan market is projected to reach USD 0.22 billion by 2026, the China market is projected to reach USD 0.51 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

China Cellulose Acetate Market Share, By Application, 2024

To get more information on the regional analysis of this market, Download Free sample

North America

The North American market is witnessing steady growth due to mature consumption patterns and sustainability-driven innovation. Cigarette filter demand is declining due to strict anti-smoking laws and health campaigns. The region is witnessing new opportunities in eco-friendly packaging, biodegradable films, and specialty coatings. Rising consumer preference for sustainable materials in the U.S. and Canada supports acetate adoption in tapes, labels, and premium packaging. The growth of the market in the U.S. is driven less by volume expansion and more by innovation, sustainability, and niche applications. Cigarette filters, historically the largest segment, are witnessing a steady decline due to strict anti-smoking laws, high taxation, and public health awareness campaigns. However, opportunities are emerging in reduced-risk products (RRPs) such as heated tobacco, where acetate-based filters are being adapted to new product formats. The U.S. market is projected to reach USD 0.21 billion by 2026.

Europe

Europe is also a positive contributor to the market, driven by strict environmental and health regulations, making sustainability the biggest growth catalyst. The European Union ban on certain single-use plastics has positioned cellulose acetate as a strong substitute in tapes, labels, and packaging. The region’s luxury fashion and textiles industry also drives acetate demand due to its silk-like quality and renewable origin. The UK market is projected to reach USD 0.03 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

Latin America

In Latin America, growth is driven by steady smoking rates in countries such as Brazil and Mexico, sustaining demand for cigarette filters. Expanding consumer goods, retail, and e-commerce sectors fuel demand for tapes, labels, and packaging solutions. The textiles and apparel industry also benefits from cellulose acetate’s affordability and silk-like qualities for domestic use and regional exports.

Middle East & Africa

The forecast period is expected to see a positive pace of growth in the Middle East & Africa market , driven by high smoking prevalence in Turkey, Egypt, and parts of the Gulf, sustaining the cigarette filter market. Additionally, textile industries in Turkey and North Africa contribute to demand, supported by exports to European markets. Growing urbanization, a youthful population, and rising consumer markets are expanding opportunities in packaging, tapes, and labels.

Competitive Landscape

Key Market Players

Key Players Adopted an Expansion Growth Strategy to Maintain their Dominance in Market

The major producers are present in the Asia Pacific, resulting in a semi-fragmented market. Some of the key market players include Celanese Corporation, Cerdia International GmbH, Eastman Chemical Company, Daicel Corporation, and Vizag Chemical.

These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their manufacturing capacity and sales and distribution network across the globe.

List of Top Cellulose Acetate Companies

- Celanese Corporation (U.S.)

- Cerdia International GmbH (Switzerland)

- Eastman Chemical Company (U.S.)

- Daicel Corporation (Japan)

- TIANJIN NAT TECHNOLOGY CO., LTD. (China)

- Fresco Printpack Pvt. Ltd. (India)

- Interplex India (India)

- RX Chemicals (India)

- Vizag Chemical (India)

- SimSon Pharma Limited (India)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Eastman announced a strategic partnership with Huafon Chemical to establish a local cellulose acetate filament yarn (Naia) manufacturing facility in China, aimed at localized production and product innovation for Eastman Naia yarns. This expands Eastman’s downstream footprint in the world’s largest textiles market and shortens supply chains for apparel filament yarn customers.

- September 2024: MCG signed a definitive agreement to transfer its triacetate fiber business to GSI Creos Corporation. This is a portfolio reshaping move (triacetate is a cellulose-based specialty fiber), indicating MCG’s strategic refocus and a buyer (GSI Creos) taking on that specialty cellulose stream.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, types, compositions used to produce these product types, and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 3.70% from 2026 to 2034 |

|

Segmentation |

By Type · Fiber · Plastic |

|

By Application · Cigarette Filters · Textiles & Apparel · Photographic Films · Tapes & Labels · Others |

|

|

By Region · North America (By Type, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, By Application, and By Country) o Germany (By Application) o France (By Application) o U.K. (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Type, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Type, By Application, and By Country) o Saudi Arabia (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1.92 billion in 2026 and is projected to record a valuation of USD 2.58 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 1.07 billion.

Recording a CAGR of 3.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2026, the cigarette filters is the leading segment in the market by application.

Growing demand from the cigarette filters industry is a key factor driving the growth of the market.

Asia Pacific is poised to capture the highest market share during the forecast period.

Celanese Corporation, Cerdia International GmbH, Eastman Chemical Company, Daicel Corporation, and Vizag Chemical are the key players in the market and have adopted strategies, such as acquisition and capacity expansion, for their growth in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us