Cellulose Esters Market Size, Share & Industry Analysis, By Type (Cellulose Acetate, Cellulose Acetate Propionate, Cellulose Acetate Butyrate, Cellulose Nitrate, and Others), By End-Use Industry (Textiles, Food, Chemical Synthesis, Pharmaceuticals, Construction, Paper & Pulp, Paints & Coatings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

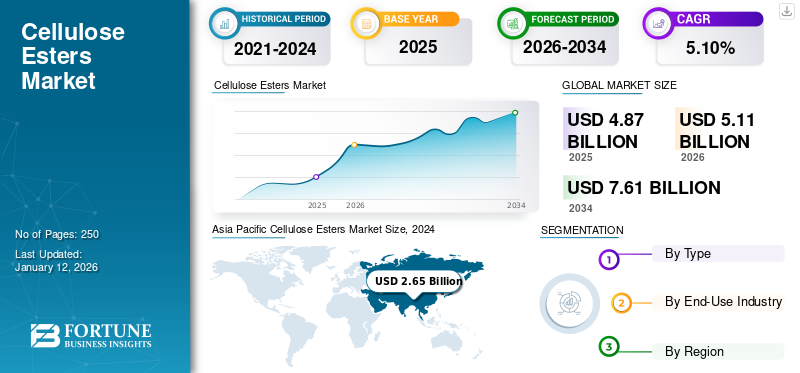

The global cellulose esters market size was valued at USD 4.63 billion in 2025 and is projected to grow from USD 4.87 billion in 2026 to USD 6.89 billion by 2034, exhibiting a CAGR of 5.10% during the forecast period. Asia Pacific dominated the cellulose esters market with a market share of 40% in 2025.

Cellulose esters are a class of organic compounds derived from cellulose, the primary structural component of plant cell walls. They are produced by reacting cellulose with organic acids or their anhydrides, which replace the hydroxyl groups on the cellulose chain with ester groups, thereby altering the material’s physical and chemical properties. Common types include cellulose acetate, cellulose nitrate, cellulose acetate butyrate, and cellulose acetate propionate. These materials are produced by chemically modifying cellulose with different acids, leading to various esters. They are primarily used in coatings, films, textiles, cigarette filters, and pharmaceuticals. The market is gaining momentum due to increasing demand for environmentally sustainable materials and regulatory trends favoring eco-friendly products.

As a significant and growing segment within the global specialty chemicals industry, the market benefits from the diverse application of cellulose-based derivatives across multiple sectors. They are produced through the reaction of cellulose with organic acids and offer a range of properties, such as excellent film-forming ability, high mechanical strength, biodegradability, and chemical resistance.

The market is driven by their widespread use in industries such as coatings, paints, textiles, photographic films, inks, and plastics. In coatings and paints, cellulose esters improve durability, adhesion, and aesthetic appeal. At the same time, in the textile industry, they are valued for their ability to enhance fabric strength and texture. The market is also witnessing growing demand for pharmaceuticals and personal care products, which are used as excipients in drug formulations and as film-formers in cosmetics.

Eastman Chemical Company, AkzoNobel, Borregaard AS, Daicel Corporation, and Celanese Corporation are key players operating in the market.

Global Cellulose Esters Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.87 billion

- 2026 Market Size: USD 5.11 billion

- 2034 Forecast Market Size: USD 7.61 billion

- CAGR: 5.10% from 2026–2034

Market Share:

- Asia Pacific dominated the cellulose esters market with a 40% share in 2025, driven by rapid industrialization, urbanization, and growing environmental awareness, particularly in countries like China, India, Japan, and South Korea.

- By type, Cellulose Acetate is expected to retain the largest market share in 2025, owing to its high transparency, toughness, and wide use in textiles, cigarette filters, packaging films, and photographic films.

Key Country Highlights:

- United States: Significant demand for cellulose esters in coatings, pharmaceuticals, and biodegradable plastics, supported by the country's advanced manufacturing sector and growing investments in sustainable materials.

- China: A major contributor to market volume, with strong growth in the construction, automotive, and pharmaceutical sectors driving demand for coatings, drug delivery systems, and films.

- Japan: Key player in high-performance applications such as electronics and healthcare, with a focus on innovation and biocompatible materials like cellulose esters.

- Germany & France (Europe): Market expansion driven by EU-wide sustainability regulations encouraging bio-based alternatives, especially in packaging, automotive, and pharma sectors.

CELLULOSE ESTERS MARKET TRENDS

Sustainability Profile of Products to Boost Market Growth

Derived from cellulose, a natural, renewable polymer found in plant fibers, cellulose esters offer an eco-friendly alternative to traditional synthetic polymers such as polyethylene and polystyrene, which are derived from non-renewable petroleum resources and pose serious environmental threats due to their non-biodegradability. This sustainable profile aligns with the global shift toward environmentally responsible production and consumption patterns, thus fostering rapid growth in the market. In sectors such as packaging, where there is a strong movement away from single-use plastics, cellulose esters present an excellent solution.

- For instance, cellulose acetate films are increasingly used for food packaging as they are biodegradable and offer good transparency and mechanical strength, crucial for maintaining food quality and product visibility.

- Similarly, in the coatings industry, cellulose esters enhance paints' durability and aesthetic appeal while offering lower toxicity and reduced volatile organic compound (VOC) emissions compared to synthetic alternatives. Automotive coatings, in particular, are adopting cellulose-based solutions to meet stricter environmental regulations without compromising performance.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Applications in Pharmaceuticals & Healthcare to Support Market Growth

Cellulose esters and ethers are increasingly utilized in drug delivery systems, wound healing, and as excipients in pharmaceutical formulations due to their non-toxic and biocompatible properties.

- Approximately 40% of market opportunities are driven by their use in drug delivery systems and controlled-release drug formulations. Notably, hydroxypropyl methylcellulose (HPMC) has witnessed a 50% increase in demand due to its superior drug-binding capacity and ability to control drug release effectively.

- Additionally, over 75% of drug manufacturers are integrating HPMC and ethylcellulose into oral tablets, capsules, and ophthalmic solutions.

The rise in demand for advanced drug delivery technologies, coupled with the global expansion of the pharmaceutical market, is driving the adoption of cellulose-based products, further boosting demand for cellulose ethers and esters.

MARKET RESTRAINTS

Raw Material Price Volatility and Regulatory Hurdles May Hamper Market Growth

The cellulose esters market growth faces notable challenges from raw material price volatility and regulatory hurdles. As these esters are derived primarily from natural sources such as wood pulp and cotton, production costs of wood pulp and cotton are heavily influenced by fluctuations in agricultural and forestry markets.

- For instance, disruptions such as poor cotton harvests in major producing countries such as India or drought-induced decline in North America's timber supply can sharply increase raw material costs.

This volatility directly impacts the production cost of cellulose esters, making it difficult for producers to maintain consistent pricing. When raw material prices surge, manufacturers are often forced to pass these increases on to consumers, potentially weakening demand, particularly in price-sensitive markets such as packaging and textiles.

In addition to supply chain challenges, regulatory frameworks present another significant obstacle to market expansion. Although cellulose esters are generally considered more environmentally friendly compared to synthetic alternatives, the chemical processes involved in their production are subject to strict safety, environmental, and waste management regulations.

- For example, the European Union’s REACH regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals) imposes detailed reporting and compliance requirements, which can increase operational costs and delay time-to-market for new products.

MARKET OPPORTUNITIES

Technological Advancements in Production and Formulation to Create Lucrative Market Opportunities

Traditionally valued for their biodegradability and film-forming capabilities, cellulose acetate and cellulose nitrate are now being engineered to deliver enhanced performance attributes such as improved solubility, greater thermal stability, and increased mechanical strength. These advancements have expanded their application beyond conventional sectors such as coatings and plastics, enabling their integration into high-performance areas, including electronics, pharmaceuticals, and textiles.

- For instance, in the electronics industry, cellulose esters are being used to develop flexible display screens and eco-friendly electronic substrates. Their inherent transparency, flexibility, and environmental benefits offer a significant advantage over synthetic polymers. Researchers have modified cellulose acetate to improve its dielectric properties, making it a viable material for electronic applications requiring both sustainability and technical performance.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Cellulose Acetate Segment Dominated Due to its High Transparency & Toughness

Based on type, the market is segmented into cellulose acetate, cellulose acetate propionate, cellulose acetate butyrate, cellulose nitrate, and others.

The cellulose acetate segment held the major global cellulose esters market share in 2024, driven by rising demand for sustainable and biodegradable materials across diverse industries. As a derivative of natural cellulose, cellulose acetate appeals strongly to manufacturers seeking alternatives to petroleum-based plastics, particularly in textiles, cigarette filters, and photographic films. The fashion industry’s growing emphasis on eco-friendly fibers is boosting its application in apparel production. Additionally, increasing regulatory restrictions on single-use plastics encourage the use of cellulose acetate in bioplastics, packaging films, and eyewear frames. The material’s high transparency, toughness, and ease of processing make it attractive for various consumer goods.

The cellulose acetate propionate segment is set to witness significant growth during the forecast period due to its unique combination of transparency, toughness, and chemical resistance. It is ideal for applications requiring durable, lightweight, and aesthetically appealing materials. The segment is experiencing increasing demand from the automotive, consumer electronics, and eyewear industries.

The cellulose acetate butyrate segment growth is attributed to the rising demand for high-performance finishes from various industries, such as aerospace, automotive, and industrial equipment. Known for its superior weatherability, UV resistance, and flexibility, it is widely used for coatings, inks, and automotive applications. CAB’s ability to improve film-forming properties, durability, and adhesion in coatings makes it indispensable in demanding industrial settings.

By End-Use Industry

Paper & Pulp Segment Led Market Due to Rising Demand for Premium Packaging Solutions

Based on end-use industry, the market is segmented into textiles, food, chemical synthesis, pharmaceuticals, construction, paper & pulp, paints & coatings, and others.

The paper & pulp segment held the largest global market share in 2024, driven by the increasing demand for high-quality and durable specialty papers. Cellulose esters, such as cellulose acetate and cellulose nitrate, enhance paper properties, including strength, smoothness, printability, and chemical resistance. Rising demand for premium packaging solutions, especially for food, cosmetics, and pharmaceuticals, is boosting the production of specialty papers that rely heavily on cellulose esters. Moreover, the shift toward sustainable and biodegradable materials further boosts segment growth.

The textiles segment is expected to grow significantly during the forecast period, owing to the rising consumer preference for eco-friendly and biodegradable fabrics.

The construction segment is set to witness significant growth during the forecast period due to the product's film-forming, binding, and thickening properties. They are widely used in paints, coatings, adhesives, and construction composites, enhancing material performance with improved flexibility, durability, and moisture resistance. Growing emphasis on sustainable construction practices encourages using biodegradable and low-VOC (volatile organic compound) materials, positioning cellulose esters as an attractive option.

Cellulose Esters Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Cellulose Esters Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.80 billion in 2025 and USD 2.95 billion in 2026. Market growth is driven by rapid industrialization, urbanization, and growing environmental awareness. Countries such as China, India, Japan, and South Korea are major contributors. Rising disposable incomes and expanding construction, automotive, and pharmaceutical industries fuel the product demand in coatings, plastics, and drug delivery systems.

North America

North America is expected to grow significantly during the forecast period, driven by strong demand for coatings, textiles, and pharmaceuticals. The U.S., with its mature industrial base and growing focus on sustainable materials, leads regional consumption. Growing investment in eco-friendly and bio-based products in the packaging and automotive sectors further bolsters market expansion. The pharmaceutical industry’s need for cellulose esters as excipients and controlled-release agents also fuels steady demand. Innovation and collaboration between manufacturers and research institutions enhance product development, promoting the use of cellulose esters in newer applications such as biodegradable plastics.

Europe

Europe is projected to be the second-largest global market, driven by strict environmental regulations and a high preference for sustainable products. The European Union’s aggressive climate policies encourage industries to replace synthetic polymers with bio-based alternatives such as cellulose esters. Key countries, including Germany, France, Italy, and the U.K., drive demand for automotive coatings, packaging films, and textile applications. The pharmaceutical sector is also a major consumer, with cellulose esters used extensively in drug formulations and medical packaging. Moreover, innovation in sustainable packaging and expanding the bioeconomy strategy across the EU present new growth opportunities.

Latin America

The market in Latin America is expected to grow moderately. Rising industrial activities and an increasing focus on sustainable and biodegradable materials drive the region's growth.

Middle East & Africa

The Middle East & Africa region is witnessing steady, driven by ongoing industrial development in countries such as UAE, Saudi Arabia, and South Africa. Opportunities are emerging in the automotive, construction, and pharmaceutical sectors, fueled by growing urbanization, infrastructural projects, and healthcare investments, which fuels the need for coatings, films, and pharmaceutical excipients. Increasing environmental awareness and regulatory reforms to reduce plastic waste enhances the appeal of bio-based and biodegradable products.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Offer Tailored Solutions to Gain a Competitive Edge

The major players operating in the market are Eastman Chemical Company, AkzoNobel, Borregaard AS, Daicel Corporation, and Celanese Corporation. Eastman Chemical Company is a leading producer of specialty chemicals and materials, offering custom-made solutions in various industries, including pharmaceuticals, paints & coatings, electronics, and food. The company is recognized for developing specific categories of cellulose ester derivatives. Similarly, numerous key players in this market focus on developing a strong regional presence, reliable distribution channels, and novel product offerings.

LIST OF KEY CELLULOSE ESTER COMPANIES PROFILED

- Eastman Chemical Company (U.S.)

- AkzoNobel (Netherlands)

- Borregaard AS (Norway)

- Daicel Corporation (Japan)

- Sichuan Push Acetati Co., Ltd. (China)

- Celanese Corporation (U.S.)

- Alpha Chemika (India)

- Mitsubishi Chemical Group Corporation (Japan)

- RYAM (U.S.)

- Georgia-Pacific (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2022: Eastman Chemical Company expanded its bio-based cellulose acetate production capabilities. The investment focuses on sustainable manufacturing processes to meet the growing demand for cellulose esters in packaging and coatings.

- January 2022: Solvay launched a new cellulose acetate film designed for food packaging applications, offering superior barrier properties to extend the shelf life of perishable goods. This innovation supports the growing trend toward sustainable and biodegradable packaging solutions.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, types, and end-use industries. Additionally, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2034 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 5.10% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 5.11 billion in 2026 and is projected to reach USD 7.61 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.80 billion.

The market is expected to exhibit a CAGR of 5.10% during the forecast period of 2026-2034.

The paper & pulp segment led the market by end-use industry.

Cellulose esters offer an eco-friendly alternative to traditional synthetic polymers, which are key factors driving the markets growth.

Eastman Chemical Company, AkzoNobel, Borregaard AS, Daicel Corporation, and Celanese Corporation are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us