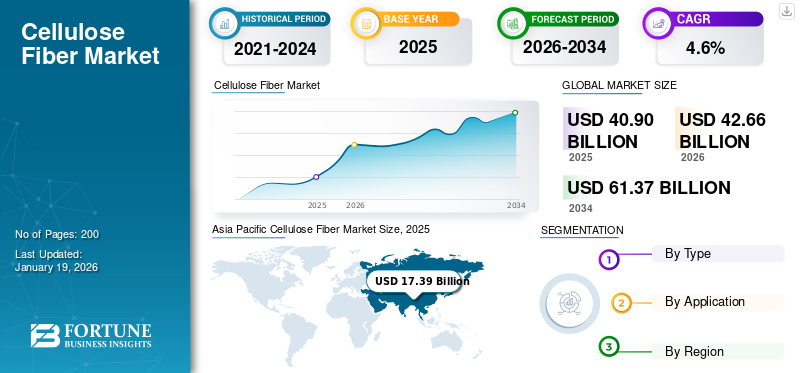

Cellulose Fiber Market Size, Share & Industry Analysis by Type (Natural and Synthetic), By Application (Textile, Hygiene, Industrial Applications, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cellulose fiber market size was valued at USD 40.9 billion in 2025. The market is projected to grow from USD 42.66 billion in 2026 to USD 61.37 billion by 2034, exhibiting a CAGR of 4.6% during the forecast period. Asia Pacific dominated the cellulose fiber market with a market share of 43% in 2025.

Cellulose fiber is a natural or man-made fiber derived primarily from plant-based cellulose, the main structural component of plant cell walls. It is composed of long chains of glucose molecules linked together, which provide strength, flexibility, and biodegradability. They are widely valued in the textile, hygiene, and industrial sectors due to their softness, breathability, moisture absorption, and eco-friendly profile. They are biodegradable and renewable, making them increasingly important in sustainable material solutions compared to synthetic fibers derived from petrochemicals. The growing demand for sustainable, biodegradable, and eco-friendly materials across various sectors, including textiles, apparel, hygiene products, industrial applications, and nonwovens, drives market expansion. Moreover, rising population growth, urbanization, and increasing consumer preference for comfortable, natural-feel fabrics are further boosting the product demand.

Furthermore, the market encompasses several major players with Aditya Birla Group, Lenzing AG, Celotech Chemical Co., Ltd., RYAM (Rayonier Advanced Materials), and Daicel Corporation. Broad portfolio with innovative product launch and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Growth of the Textile and Apparel Industry to Propel the Market Growth

Rising urbanization, increasing disposable income, and the expansion of middle-class populations in developing economies such as India, China, and Brazil are boosting the demand for affordable yet high-quality clothing.

- For example, in May 2025, Birla Cellulose, which comes under the Aditya Birla Group in India, scaled up its viscose production capacities to meet the growing demand in apparel and home textiles.

In developed markets such as Europe and North America, the consumer demand has shifted toward premium and sustainable clothing, boosting the demand for regenerated fibers such as lyocell, which provides a silky feel with high durability.

- Brands such as Levi’s, H&M, and Patagonia are increasingly incorporating TENCEL™ (lyocell) fibers from Lenzing AG into their clothing lines as part of their sustainability initiatives.

Such developments are likely to drive cellulose fiber market growth over the coming years.

MARKET RESTRAINTS

Fluctuating Raw Material Availability and Price Volatility to Restrict Market Expansion

Cotton, the most widely used, is heavily dependent on favorable climatic conditions and agricultural productivity. Extreme weather events such as droughts, floods, or pest infestations can drastically reduce cotton yields, leading to supply shortages and price spikes.

- For instance, the global cotton production has been affected in recent years by climate variability in key producing countries such as India and the U.S. These disruptions directly impact the cost and supply chain of textile manufacturers reliant on cotton.

Wood pulp, the raw material for viscose, modal, and lyocell fibers, also faces challenges. Pulp prices are highly volatile due to fluctuations in demand from competing industries, such as paper and packaging, and constraints in forestry operations. Moreover, the sustainable sourcing of wood pulp is limited by deforestation concerns, land-use regulations, and the availability of certified forests.

- For example, Canopy, a non-profit environmental organization, has frequently criticized viscose producers for sourcing pulp linked to deforestation in endangered forest regions. This restricts sourcing options and also raises costs for companies striving to comply with sustainability certifications such as FSC (Forest Stewardship Council).

MARKET OPPORTUNITIES

Technological Advancements in Fiber Processing to Create Lucrative Growth Opportunities

Innovations in processing technologies are significantly boosting the growth of the market, and traditionally, manufacturing regenerated fibers such as viscose involved chemical-intensive processes that posed environmental risks. However, recent advancements have focused on sustainable, closed-loop production methods that minimize chemical waste and water usage.

- For instance, the lyocell process, pioneered by Lenzing AG, uses a non-toxic organic solvent (NMMO) in a closed-loop system where more than 99% of the solvent is recovered and reused, making it one of the most eco-friendly textile fibers available.

Similarly, innovations in enzyme-based treatments and nanocellulose technologies are enhancing fiber properties such as strength, softness, and durability, expanding their usability in technical textiles and composite materials.

- For example, Sateri Holdings Limited in China has been investing in cleaner production technologies to produce viscose and modal fibers with reduced environmental footprints.

CELLULOSE FIBER MARKET TRENDS

Rising Demand for Sustainable and Eco-Friendly Materials is one of the Significant Market Trends

The increasing consumer and industrial preference for sustainable, renewable, and biodegradable materials drives the growth of the market. Cellulose fibers, whether natural such as cotton and jute or man-made such as lyocell and modal, are derived from renewable resources and are fully biodegradable, aligning with global sustainability goals.

- For example, in August 2024, Lenzing AG heavily invested in producing lyocell fibers under its TENCEL™ brand, emphasizing their low environmental footprint through closed-loop production processes.

The fashion industry, which accounts for a large share of the textile demand, is also under pressure from consumers demanding sustainable clothing options. Brands such as H&M and Zara have announced sustainability roadmaps that include increased sourcing of cellulose fibers.

MARKET CHALLENGES

Competition from Synthetic Fibers to Hamper Market Growth

Polyester and other synthetics offer several advantages such as lower cost, higher durability, and superior wrinkle resistance that cellulose fibers struggle to match. Synthetic fibers are less dependent on natural resources, making them more resilient to raw material shortages and price fluctuations.

- For instance, polyester is derived from petrochemicals, which, despite their environmental drawbacks, are available in abundant supply and benefit from a well-established global manufacturing infrastructure.

Additionally, technological improvements in synthetic fibers have expanded their applications, making them more versatile. Innovations in microfiber and moisture-wicking polyester fabrics have increased their attractiveness in sportswear, outdoor gear, and industrial textiles.

- For example, companies such as Toray Industries (Japan) and Reliance Industries (India) have invested heavily in advanced polyester technologies, further widening the performance gap between synthetic and cellulose fibers.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Adoption and Comfort Contributed to the Growth of the Natural Segment

On the basis of segmentation by type, the market is classified into natural and synthetic.

The natural segment held the largest cellulose fiber market share 60.57% in 2026 and is expected to experience substantial growth, driven by its widespread acceptance, comfort, and biodegradability. Cotton, being the most widely used natural fiber, remains in high demand due to its softness, breathability, and versatility across apparel, home textiles, and industrial applications. Increasing consumer preference for eco-friendly and natural fabrics is boosting the adoption of organic cotton.

The growth of the synthetic segment is driven by its versatility, consistent quality, and technological innovations. Unlike natural fibers, they are less dependent on agricultural cycles, making their supply relatively more stable. Viscose remains a popular choice due to its silk-like texture and affordability, widely used in mass-market apparel. Technological advancements, such as closed-loop production processes pioneered by Lenzing AG, have reduced environmental concerns and boosted confidence in regenerated fibers.

By Application

Textile Segment to Grow at the Fastest CAGR with Surging Demand for Sustainable Fabrics

Based on application, the market is segmented into textile, hygiene, industrial applications, and others.

To know how our report can help streamline your business, Speak to Analyst

The textile segment dominates the market, driven by the rising demand for natural-feel, breathable, and sustainable fabrics. Increasing disposable incomes and urbanization in the Asia Pacific are fueling the demand for affordable apparel, while developed markets in Europe and North America emphasize premium, eco-friendly textiles. The segment held a share of 53.80% in 2026.

The hygiene segment is projected to grow at a CAGR of 4.1% during the study period. The growth of the segment is due to the rising demand for absorbent, soft, and skin-friendly materials in products such as diapers, wipes, sanitary napkins, and adult incontinence items. Growing population, rising health awareness, and increased hygiene spending in emerging markets such as India and China are boosting the demand for cellulose fibers.

Cellulose Fiber Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Cellulose Fiber Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held a dominant share in 2025, valued at USD 17.39 billion, and also bagged the leading share in 2026 with a value of USD 18.24 billion. The factors fostering the dominance of the region include rising urbanization, population growth, and increasing disposable incomes, which are driving the consumption of apparel, hygiene products, and home textiles. The growth of the market is driven by a massive textile and apparel manufacturing base in the region. China and India dominate viscose and cotton production, with companies such as Birla Cellulose (India) and Sateri (China) serving the global product demand.

In 2026, the China market is estimated to have reached a valuation of USD 6.52 billion. The country is the largest producer and consumer of viscose fibers globally, with companies such as Sateri, Tangshan Sanyou, and Yibin Grace dominating global supply. A robust textile and apparel manufacturing base makes China the backbone of the global fast fashion supply chain, boosting cellulose fiber demand.

To know how our report can help streamline your business, Speak to Analyst

Europe

The Europe market is anticipated to witness notable growth over the coming years. During the forecast period, the regional market is projected to record a growth rate of 4.8%, which is the second highest amongst all the regions, and touch the valuation of USD 10.52 billion in 2025. The stringent environmental regulations, circular economy initiatives, and a strong culture of sustainability are driving market growth. Countries such as Germany, France, and Italy are major hubs for high-quality textiles and home furnishings, where the demand for eco-friendly fibers is high. The U.K. is anticipated to record a valuation of USD 1.00 billion; Germany, USD 3.04 billion; and France, USD 1.22 billion, in 2026.

North America

After Europe, the market in North America is estimated to have reached USD 8.86 billion in 2025, securing the position of the third-largest region in the market. The growth of the market is driven by a strong demand for sustainable and premium textiles, alongside growth in hygiene and specialty applications. Consumers in the U.S. and Canada are increasingly conscious of eco-friendly products, encouraging brands to shift toward regenerated fibers such as lyocell and modal. In 2026, the U.S. market is estimated to have reached a value of USD 7.48 billion.

Latin America and the Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness moderate growth in this market. In 2025, the Latin America market is estimated to have recorded a valuation of USD 2.60 billion. The growth of the market is driven by increasing hygiene product consumption, coupled with growing awareness of sustainable materials.

In the Middle East & Africa, Saudi Arabia is anticipated to have touched a value of USD 1.54 billion in 2025. The market’s growth is attributed to the increasing demand for textiles, hygiene products, and home furnishings. Rising population, rapid urbanization, and improving living standards in countries such as South Africa, Egypt, and GCC nations are fueling product demand.

COMPETITIVE LANDSCAPE

Key Industry Players

Product Innovation and Partnerships Emerge as Key Strategies Adopted by Companies for Maintaining Market Position

Product innovation and collaborations with end-user industry players are important strategies that companies are deploying to maintain their position in the market. Some of the key market players include the Aditya Birla Group, Lenzing AG, Celotech Chemical Co., Ltd., RYAM (Rayonier Advanced Materials), and Daicel Corporation. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their manufacturing capacities and sales and distribution networks across the globe.

LIST OF KEY CELLULOSE FIBER COMPANIES PROFILED

- Aditya Birla Group (India)

- Lenzing AG (Austria)

- Celotech Chemical Co., Ltd. (China)

- RYAM (Rayonier Advanced Materials) (U.S.)

- Spinnova Plc (Finland)

- Borregaard AS (Norway)

- Daicel Corporation (Japan)

- Fibrezone India (India)

- LVJIAN (China)

- ISOCELL GmbH & Co KG (Austria)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Lenzing announced a collaboration with Italian partners (including Marchi & Fildi S.p.A. and selected manufacturing partners) to develop premium-quality fabric blends that combine TENCE Lyocell with recycled natural fibers (recycled cotton, silk, and wool). The deal would accelerate circularity-ready textile solutions for premium apparel and help brands scale recycled blends.

- April 2025: Asia Pacific Rayon (APR) showcased Lyocell and viscose innovations and strengthened partner collaborations across value-chain partners at key trade shows (e.g., DTG/Indo-Intertex). The move highlights APR’s product development and go-to-market efforts to expand lyocell applications across apparel and technical textiles.

- January 2025: Kelheim Fibres published its 2024 Sustainability Report and revalidated EMAS performance (January 2025) and completed a corporate restructuring agreement (July 2024) to stabilize financing moves that support Kelheim’s specialty-viscose product roadmap and position the company to invest in product development and sustainability improvements.

- January 2025: Lenzing expanded its LENZING Lyocell Fill portfolio by introducing finer cut-length variants and new fiber options tailored for home-textile and filling applications. The move would broaden product applications and enable the development of new products in comfort and nonwoven filling markets.

- November 2023: Sateri commissioned commercial Lyocell production at its Nantong facility (adding ~100,000 tpa) as part of its multi-site capacity build-out to grow Lyocell output toward planned targets, supporting product diversification into Lyocell and strengthening Sateri’s downstream supply for apparel & nonwovens.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.6% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type · Natural · Synthetic |

|

By Application · Textile · Hygiene · Industrial Applications · Others |

|

|

By Geography · North America (By Type, Application, Formulation, Application, and Country) o U.S. o Canada · Europe (By Type, Application, Formulation, Application, and Country/Sub-region) o Germany o Italy o France o U.K. o Rest of Europe · Asia Pacific (By Type, Application, Formulation, Application, and Country/Sub-region) o China o India o Japan o South Korea o Rest of Asia Pacific · Latin America (By Type, Application, Formulation, Application, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, Application, Formulation, Application, and Country/Sub-region) o Saudi Arabia o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

The global cellulose fiber market size is projected to grow from $42.66 billion in 2026 to $61.37 billion by 2034, exhibiting a CAGR of 4.60%

In 2025, the market value stood at USD 17.39 billion.

The market is expected to exhibit a CAGR of 4.6% during the forecast period of 2026-2034.

In 2025, the natural segment led the market by type.

The key factors driving the market are the rising demand for sustainable, biodegradable textiles, growth in the apparel and hygiene sectors, and technological advancements in eco-friendly fiber processing.

Aditya Birla Group, Lenzing AG, Celotech Chemical Co., Ltd., RYAM (Rayonier Advanced Materials), and Daicel Corporation are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Government regulations promoting green materials, corporate sustainability commitments, and increasing consumer preference for natural, comfortable fabrics are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us