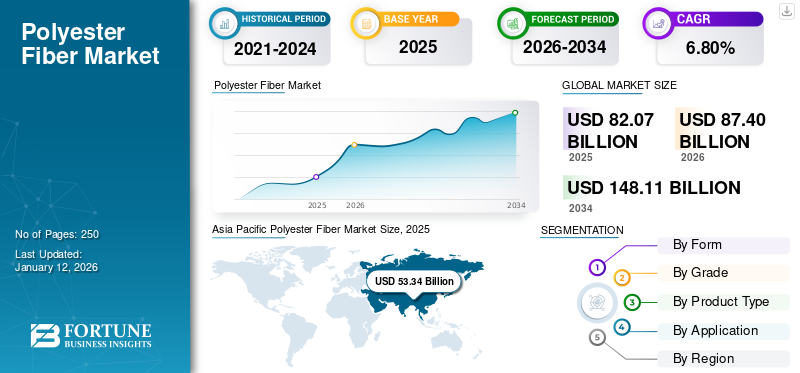

Polyester Fiber Market Size, Share & Industry Analysis, By Form (Solid and Hollow), By Grade (PET and PCDT), By Product Type (Filament Yarn and Staple), By Application (Textile & Apparel, Home & Furnishing, Automotive & Transportation, Industrial, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global polyester fiber market size was valued at USD 82.07 billion in 2025. The market is projected to grow from USD 87.4 billion in 2026 to USD 148.11 billion by 2034, exhibiting a CAGR of 6.80% during the forecast period. Asia Pacific dominated the polyester fiber market with a market share of 65% in 2025.

Polyester fiber is a synthetic material made from petroleum-based chemicals through a process called polymerization. It's composed of long chains of polymers containing ester functional groups. Known for its durability, wrinkle resistance, and ability to retain shape, they are manufactured in various forms, including filament, staple, and tow. Reliance Industries Limited., Indorama Ventures Public Company Limited., and Toray Industries, Inc. are key companies operating in the market.

The applications of polyester are widespread across industries. In textiles, it's used for clothing, upholstery, and bedding due to its strength and moisture-wicking properties. Beyond fashion, these fibers are incorporated into industrial materials like tire cords, conveyor belts, and safety belts. They're also found in home goods such as curtains, carpets, and stuffing for furniture. Additionally, polyester is utilized in medical applications, filtration systems, and as reinforcement in composite materials.

- According to GreenMatch UK, In a world where every third piece of clothing is likely made of polyester, this synthetic fibre has woven its way into the fabric of our lives.

GLOBAL POLYESTER FIBER MARKET LANDSCAPE OVERVIEW

Market Size:

- 2025 Value: USD 82.07 billion

- 2026 Value: USD 87.4 billion

- 2034 Forecast Value: USD 148.11 billion

- CAGR: 6.80% from 2026–2034

Market Share:

- Asia Pacific held the largest share of 65% in 2025, valued at USD 50.34 billion

- By form, the solid segment dominated in 2024 due to superior strength and durability

- By product type, filament yarn led the market with high demand from performance textiles

- By application, textile & apparel accounted for the largest market share in 2024

Key Country Highlights:

- China: Leads polyester fiber exports; filament and staple exports grew over 20% YoY in 2023

- India: Second-largest market in Asia, driven by apparel and industrial uses

- U.S.: Stable demand led by automotive, industrial, and medical textile sectors using rPET

- Germany & Italy: Focus on recycled fiber innovation and premium applications

- Brazil & Mexico: Key LATAM hubs with growing facility modernization

- Middle East: Building integrated petrochemical capacity; Africa sees demand rise in Egypt and Ethiopia

POLYESTER FIBER MARKET TRENDS

Recycling Advances Due to Consumer Preferences and Corporate Policies to Boost Polyester’s Appeal

The market continues to expand robustly, primarily driven by the textile and apparel industry’s growing demand for durable, wrinkle-resistant fabrics. Recycled polyester (rPET) has gained significant market share as sustainability concerns influence consumer preferences and corporate policies. Technical innovations are improving fiber performance characteristics, including moisture-wicking properties and antimicrobial treatments. Digital textile printing advancements have further boosted polyester’s popularity due to its excellent color retention and printing compatibility. Asia Pacific witnessed a polyester fiber market growth from USD 47.41 Billion in 2023 to USD 50.34 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Textile and Apparel Industry to Drive Market Growth

The market is experiencing robust growth driven primarily by the expanding textile and apparel industry, particularly in developing economies. Rising disposable incomes and changing fashion trends are fueling consumption. The automotive sector's demand for durable, lightweight materials is another significant factor. Additionally, polyester's sustainability advantages through recycling innovations are attracting environmentally conscious consumers and manufacturers. The material's versatility across applications—from clothing to home furnishings to industrial uses—continues to broaden its market reach, while its cost-effectiveness compared to natural fibers maintains its competitive edge in price-sensitive markets.

MARKET RESTRAINTS

Environmental Concerns to Hamper Market Growth

Environmental concerns are severely limiting polyester fiber market growth because the material's non-biodegradable nature contributes to microplastic pollution in oceans and landfills. This has caused increased regulatory scrutiny and consumer backlash against synthetic fibers. Additionally, volatile crude oil prices directly impact production costs since polyester is petroleum-derived, resulting in unpredictable profit margins for manufacturers. The growing preference for natural and sustainable fibers has consequently shifted market demand patterns, as consumers increasingly favor organic cotton, hemp, and other eco-friendly alternatives that offer comparable performance without environmental drawbacks.

- According to EarthDay Org, it is estimated that 342 million barrels of oil are used to produce plastic-based fibers each year. At its core, polyester is a material derived from fossil fuels, making it incredibly unsustainable and harmful.

MARKET OPPORTUNITIES

Recycled Polyester Production to Create Market Growth Opportunities

Technological breakthroughs in recycled polyester production have created substantial market opportunities because they address environmental concerns while maintaining performance qualities. This has resulted in partnerships between major players and recycling innovators developing closed-loop systems. Simultaneously, the growing demand for polyester fibers in technical textiles for healthcare, construction, and agriculture presents lucrative new applications beyond traditional uses. The integration of performance-enhancing additives has consequently opened premium market segments for the fibers. The polyester fibers can outperform natural fibers in moisture management, UV protection, and antimicrobial properties. This allows manufacturers to capture higher-margin markets while meeting evolving consumer expectations for multifunctional textiles.

- According to Textile Exchange, the % of RPET increased from 11% in 2010 to 15% in 2020 (8.4 million tons).

MARKET CHALLENGES

Microfiber Concerns During Washing and Non-Biodegradability Issues Threaten Market Growth

The market faces increasing scrutiny regarding environmental impact, particularly concerning microfiber shedding during washing and non-biodegradability issues. Rising competition from natural and cellulosic fibers, driven by consumer preferences for sustainable and comfortable materials, threatens market. Energy-intensive manufacturing processes contribute to high carbon footprints, challenging industry sustainability claims. Price fluctuations in raw materials, primarily purified terephthalic acid (PTA) and monoethylene glycol (MEG), affect production costs.

Segmentation Analysis

By Form

Solid Segment Holds Dominant Share Due to their Superior Tensile Strength and Durability

Based on form, the market is segmented into solid and hollow.

The solid segment held the largest global polyester fiber market share in 2024 due to their superior tensile strength and durability, making them ideal for apparel and industrial applications where structural integrity is critical. Their consistent performance and cost-effective production processes have established them as industry standards.

By Grade

PET Segment held the Largest Share Due to its Versatility and Cost-Effectiveness

Based on grade, the market is fragmented into PET (Polyethylene Terephthalate) and PCDT (Poly-1,4-Cyclohexylene-Dimethylene Terephthalate).

The Polyethylene Terephthalate (PET) segment held the largest market share in 2024 and is expected to remain the largest during the forecast period. PET grade dominates the market with its versatility and cost-effectiveness. Characterized by excellent tensile strength and chemical resistance, PET fibers are extensively utilized in everyday textiles, packaging materials, and industrial applications. Their relatively simple manufacturing process and recyclability have established PET as the industry standard.

By Product Type

Filament Segment to Lead the Demand Due to its preference for Performance Fabrics and Technical Textiles

Based on product type, the market is bifurcated into filament yarn and staple.

The filament segment held the largest market share in 2024. Filament yarn leads the market as continuous, smooth fibers that deliver superior strength and uniformity. These properties make filament yarn the preferred choice for performance fabrics, technical textiles, and high-quality apparel where consistency and durability are essential. Its excellent processability has established dominance in automated textile manufacturing, particularly in regions with advanced manufacturing capabilities.

By Application

Textile & Apparel Segment Led the Demand Due to Superior Product Properties

Based on application, the market is segmented into textile & apparel, home & furnishing, automotive & transportation, industrial, and others.

The textile & apparel segment held the highest market share in 2024. This dominance is due to polyester's wrinkle resistance, durability, and cost-effectiveness. This segment continues to expand with fast fashion trends and growing middle-class populations in developing regions demanding affordable, low-maintenance clothing options.

Home & furnishing represents a substantial market share with polyester's application in carpets, curtains, upholstery, and bedding. The product’s stain resistance, color retention, and flame-retardant properties make it ideal for household textiles where durability and easy maintenance are essential considerations.

Polyester Fiber Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Polyester Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest global market size in 2025, generating market revenue worth USD 53.34 billion. Asia Pacific dominates global polyester production, with China leading the way through extensive manufacturing infrastructure and integrated supply chains. India follows as the second-largest market with rapid growth. Vietnam, Bangladesh, and Indonesia are emerging players due to lower labor costs. The region maintains a competitive advantage through technological advancements and cost-effective manufacturing at scale.

- According to China Customs data, the exports of chemical fiber in 2023 totaled 6.5 million tons, indicating a growth of 15.08% compared to the previous year. Exports of chemical fiber made up 9.47% of the total, which was a 0.76 percentage point increase from 2022.

- Among these, the export growth of polyester filament and polyester staple fiber has increased by more than 20% year-on-year. For instance, the monthly average exports of polyester staple fiber have reached 100,000 tons, significantly exceeding the levels of previous years.

North America

North America presents a mature market with stable but modest growth, shifting from commodity to specialty and technical polyester fibers. Sustainability initiatives drive increased demand for recycled polyester in the region. Major players in U.S. are emphasizing on innovation and sustainable practices for high-performance polyester applications for the automotive, industrial, and medical sectors. All these factors are contributing to the market growth.

Europe

European manufacturers focus on premium segments and sustainable production. The region leads in recycled polyester innovation and circular economy initiatives. Germany, Italy, and Turkey maintain strong positions despite higher production costs. Advanced technology, product differentiation, and proximity to design-driven industries help maintain market relevance against Asian competition.

- According to the European Environment Agency, Between 60% and 70% of textiles are made of plastic (mostly polyester), which is made of oil and gas. The remainder is made of biobased textiles, including cotton and wool.

Latin America

Brazil and Mexico represent the primary production hubs in LATAM, serving domestic and regional textile industries. The region faces competition from Asian imports of basic polyester products. Infrastructure challenges and economic volatility impact consistent growth, though recent investments in modernizing facilities indicate a potential for increased regional production.

Middle East & Africa

Middle Eastern countries leverage petroleum resources to develop significant polyester production capacity through integrated petrochemical complexes. African nations represent emerging consumer markets with limited domestic production. Investment in textile manufacturing is increasing across Egypt, Morocco, and Ethiopia, suggesting future growth potential for polyester consumption.

COMPETITIVE LANDSCAPE

Key Industry Players

Novel Product Development to Become a Key Strategy in the Market

The global polyester fiber market is concentrated with companies such as Reliance Industries Limited., Indorama Ventures Public Company Limited., Toray Industries, Inc., Sinopec Yizheng Chemical Fibre Limited Liability Company, and Zhejiang Hengyi Group Co., Ltd, accounting for a significant market share. The leading polyester fiber companies are focusing on capacity expansion in Asia, investing in recycled polyester technology and developing specialty and technical fibers for higher margins. In addition, they are implementing sustainability initiatives to meet regulatory requirements, and strategically acquiring regional competitors to strengthen global market presence.

LIST OF KEY POLYESTER FIBER COMPANIES PROFILED

- Reliance Industries Limited. (India)

- Indorama Ventures Public Company Limited. (Thailand)

- Toray Industries, Inc. (Japan)

- Sinopec Yizheng Chemical Fibre Limited Liability Company (China)

- Zhejiang Hengyi Group Co., Ltd (China)

- Tongkun Holding Group (China)

- Sanfame Group (China)

- Far Eastern New Century Corporation (Taiwan)

- Alpek Polyester. (Mexico)

- ADVANSA (Turkey)

KEY INDUSTRY DEVELOPMENTS

- March 2025 - ADVANSA’s ADVAtex is a 100% recycled polyester fiber made from pre-consumer textile waste. It reduces reliance on virgin materials while maintaining quality. The process transforms textile waste into durable fibers for furniture and mattresses, addressing global textile waste challenges. Certified by GRS and Oeko-Tex.

- July 2024 - Indorama Ventures has joined a consortium of seven companies across five countries to establish a sustainable polyester fiber supply chain. This initiative utilizes CO₂-derived, renewable, and bio-based materials, replacing traditional fossil resources. The resulting polyester fiber is planned for use in THE NORTH FACE products in Japan.

- July 2023 - ADVANSA and Asahi Kasei Advance have collaborated to introduce Ocean-Friendly Fiber, a sustainable textile solution derived from recycled marine waste. This innovative fiber aims to reduce ocean pollution by repurposing discarded fishing nets and other marine debris into high-quality textile materials. The initiative not only addresses environmental concerns but also offers a durable and eco-friendly alternative for the textile industry.

- April 2023 - Toray Industries is promoting the use of recycled polyester fibers to enhance sustainability. They are expanding the collection of raw materials beyond PET bottles to include various sources, aiming to contribute to a circular economy and reduce environmental impact.

- May 2022 - Alpek, S.A.B. de C.V., finalized its acquisition of OCTAL Holding SAOC for USD 620 million, effective June 1, 2022. This strategic move integrates high-value PET sheet products into Alpek's portfolio, enhancing its position in the polyester industry.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, forms, grades, product types, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) & Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.80% during 2026-2034 |

|

Segmentation |

By Form, By Grade, By Product Type, By Application, and By Region |

|

By Form

|

|

|

By Grade

|

|

|

By Product Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 87.4 billion in 2026 and is projected to reach USD 148.11 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 53.34 billion.

The market is expected to exhibit a CAGR of 6.80% during the forecast period.

The textile & apparel application led the market.

Expansion of the textile industry to drive market growth.

Reliance Industries Limited., Indorama Ventures Public Company Limited., TORAY INDUSTRIES, INC., SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY, and Zhejiang Hengyi Group Co., Ltd are the top players in the market.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us