Chassis Sensors Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUVs, LCV, and HCV), By Sensor Type (Speed Sensors, Pressure Sensors, Position Sensors, Temperature Sensors, and Acceleration Sensors), By Application (Suspension Systems, Braking Systems, Steering Systems, and ADAS Integration), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

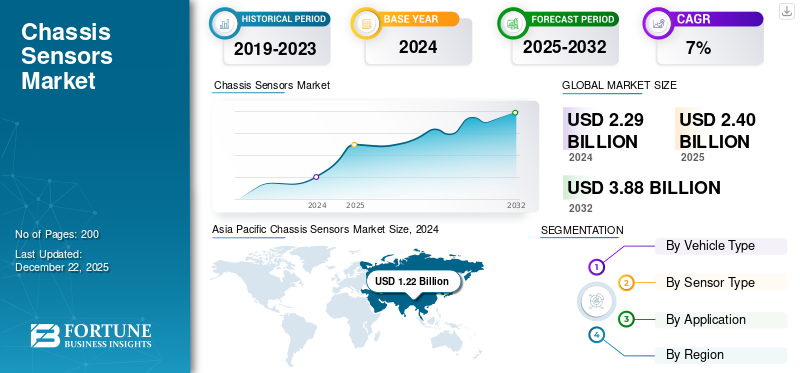

The global chassis sensors market size was valued at USD 2.29 billion in 2024. The market is projected to grow from USD 2.40 billion in 2025 to USD 3.88 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period. Asia Pacific dominated the global market with a share of 53.28% in 2024.

Automotive chassis sensors are critical components in modern vehicles, responsible for monitoring various parameters related to the vehicle's chassis, such as ride height, suspension travel, and steering angle. These sensors provide essential data for systems such as electronic stability control, adaptive suspension, and headlight leveling, enhancing vehicle stability, comfort, and safety.

The increasing demand for advanced safety features and comfort in vehicles drives the global market growth. As passenger cars and commercial vehicles become more sophisticated, the need for precise monitoring of chassis dynamics continues to grow. This trend is further supported by regulatory mandates focusing on enhanced safety and efficiency, encouraging widespread adoption of chassis sensors across various vehicle types. The market benefits from technological advancements in sensor technologies, such as MEMS and Hall effect sensors, which offer improved accuracy and reliability.

The COVID-19 pandemic initially impacted the chassis sensors market by disrupted global supply chains and halting manufacturing operations. However, as economies recovered, the market rebounded due to increased demand for vehicles with advanced safety features. The pandemic accelerated the adoption of digital technologies, enhancing capabilities such as remote monitoring and predictive maintenance in the automotive sector. This shift further supported the growth of the market by emphasizing the importance of reliable and efficient vehicle systems. Robert Bosch, Continental are among the major market players. Technology development with strategic partnerships with automotive manufacturers are focused by these key players.

Download Free sample to learn more about this report.

Chassis Sensors Market Trends

Increasing Focus On Miniaturization and Energy Efficient Chassis Sensors is Key Market Trend

The focus on miniaturized and energy efficient chassis sensors is driven by the need for lighter, more fuel-efficient vehicles and the integration of sensors into electric and hybrid vehicles. Companies such as Infineon Technologies and STMicroelectronics are developing smaller, energy-efficient sensors that provide high accuracy without compromising performance. Technological developments, such as the use of MEMS (Micro-Electro-Mechanical Systems) technology, have allowed the development of miniaturized sensors with improved reliability and reduced power consumption.

Additionally, advancements in sensor fusion algorithms enable these compact sensors to provide comprehensive data on vehicle dynamics, enhancing overall vehicle stability and safety. Government regulations, such as those mandating electronic stability control (ESC) and anti-lock braking systems (ABS), further drive the demand for these advanced sensors. The integration of IoT and cloud connectivity supports real-time data analysis and predictive maintenance, further boosting sensor adoption in modern vehicles and enhancing chassis sensors market growth.

Market Dynamics

Market Drivers

Implementation of Stringent Emissions Norms and Safety Regulations to Drive Market Growth

Governments globally are enforcing stricter standards to reduce emissions and enhance vehicle safety, driving the need for advanced sensors to monitor and control various vehicle systems. For instance, the European Union's Euro 6d emissions standards require vehicles to be equipped with sensors that monitor emissions in real time, ensuring compliance. Companies such as Continental AG and Bosch are developing advanced sensor technologies to meet these requirements, such as pressure sensors for fuel injection systems and temperature sensors for exhaust gas management.

Technological developments include the integration of MEMS (Micro-Electro-Mechanical Systems) enhance sensor precision and miniaturization, leading to more efficient sensor deployment. Additionally, IoT integration in sensors enables real-time data processing, improving vehicle performance and safety. Regulations such as the U.S. National Highway Traffic Safety Administration's (NHTSA) safety standards further drive the demand for chassis sensors by mandating features such as electronic stability control, which relies on advanced sensor systems.

Market Restraints

Reliability and Accuracy Issues Associated with New Technologies to Restrain Market Growth

Automotive sensors, including chassis sensors, must operate reliably across a wide range of temperatures, humidity levels, and physical stress. However, their performance can be compromised under extreme weather conditions such as heavy rain or snow, which can impede signal accuracy and sensor reliability. This challenge is particularly significant for advanced driver assistance system (ADAS) and autonomous vehicles, where sensor accuracy is critical for safety.

To address these challenges, sensor manufacturers such as Robert Bosch GmbH and Continental AG are investing in research and development to enhance sensor robustness and accuracy. Governments and regulatory bodies, such as the European Union, have implemented stringent safety standards that require vehicles to perform consistently under diverse environmental conditions, reinforcing the need for reliable sensor technologies. Technological advancements, including the integration of MEMS (Micro-Electro-Mechanical Systems), are further improving sensor precision and durability.

Market Opportunities

Critical Role of Automotive Chassis Sensors in Enabling ADAS and Autonomous Driving Technologies

Chassis sensors, including accelerometers, gyroscopes, and suspension position sensors, provide real-time data for vehicle stability, traction control, and adaptive suspension systems. With ADAS adoption, demand for high-precision chassis sensors is surging. For instance, Bosch’s 2024 LiDAR sensors enhance obstacle detection, while Continental’s smart chassis sensors optimize electric vehicle (EV) battery efficiency by adjusting suspension dynamics. Euro 7 norms (effective 2025) mandate stricter safety and emission controls, requiring advanced chassis sensors for real-time monitoring. The U.S. NHTSA mandates electronic stability control (ESC) in all vehicles, reliant on chassis sensor data to prevent rollovers.

Segmentation Analysis

By Vehicle Type

SUVs Segment Leads owing to Global Popularity

By vehicle type, the market is divided into hatchback/sedan, SUVs, LCV (Light Commercial Vehicles), and HCV (Heavy Commercial Vehicles).

The SUV segment dominates the market due to its popularity and increasing demand globally. SUVs require advanced chassis sensors for stability and safety features, which are crucial for their higher center of gravity compared to other vehicle types.

The fastest-growing segment is expected to be LCVs, driven by the rise of e-commerce and logistics, which has increased the demand for efficient and safe commercial vehicles. Technological developments such as advanced driver-assistance systems (ADAS) are also driving growth in this segment. Governments have implemented regulations to enhance vehicle safety, such as the European Union's Euro NCAP standards, which encourage the use of advanced safety features in all vehicle types.

By Sensor Type

Technological Advancements Boosts Acceleration Sensors’ Segment Growth

By sensor type, the market is segmented into speed sensors, pressure sensors, position sensors, temperature sensors, and acceleration sensors.

Acceleration sensors is expected to be fastest-growing segment, driven by their critical role in ADAS and autonomous vehicles. Technological advancements such as MEMS (Micro-Electro-Mechanical Systems) are enhancing sensor accuracy and reliability. Additionally, regulations such the U.S. National Highway Traffic Safety Administration (NHTSA)'s requirements for electronic stability control systems have increased the demand for these sensors. Additionally, innovations in sensor miniaturization and integration with IoT further support segment growth.

The position sensors dominates the segment due to their widespread use in vehicle systems such as suspension and steering.

By Application

Suspension Systems Dominate Due to their Dependence on Precise Sensors Data

By application, the market is segmented into suspension systems, braking systems, steering systems, and ADAS integration.

The suspension systems segment dominate the market as they rely on precise sensor data to ensure vehicle stability and comfort.

ADAS integration is the fastest-growing segment, driven by the increasing adoption of autonomous and semi-autonomous vehicles. Technological developments such as sensor fusion and advanced algorithms are enhancing ADAS capabilities. Governments have implemented regulations such the EU's General Safety Regulation, which mandates the inclusion of ADAS features in new vehicles. Furthermore, advancements in sensor technologies are enabling more efficient and safer vehicle operations across all applications.

Chassis Sensors Market Regional Outlook

Based on geography, the market is studied across Asia Pacific, North America, Europe, and Rest of the World.

Asia Pacific

Asia Pacific Chassis Sensors Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region is currently dominating and fastest-growing due to its large manufacturing base and government support. Countries such as China and India are experiencing rapid growth due to government initiatives and increasing demand for vehicles. Technological advancements such as MEMS (Micro-Electro-Mechanical Systems) are enhancing sensor reliability and accuracy. New product launches and collaborations among automotive component manufacturers also support the region's growth.

- For instance, in March 2025, IN-SPACe proposed the formation of a technology consortium aimed at integrating ISRO's advanced sensor technologies into the automotive sector. This initiative seeks to leverage ISRO's high-end sensor technology, currently at Technology Readiness Level (TRL-9), to enhance the automotive industry's sensor capabilities, which are currently at TRL-3.

North America

In North America, the growth for chassis sensors is characterized by a strong presence of automotive manufacturers and a well-established supply chain. The region benefits from advanced technological infrastructure and stringent safety regulations, such as those enforced by the U.S. National Highway Traffic Safety Administration (NHTSA). These regulations drive the demand for sophisticated chassis sensors in vehicles. Companies such as General Motors and Ford are investing in electric vehicle and autonomous technologies, boosting the demand for advanced sensors. Technological developments such as sensor fusion and AI integration are also enhancing vehicle safety and performance in this region.

U.S. automotive chassis sensors market is characterized by rapid technological advancement and a strong focus on vehicle safety and performance. Chassis sensors, such as accelerometers, linear displacement sensors, and potentiometric sensors, are integral to modern vehicles, enabling advanced driver-assistance systems (ADAS), adaptive suspension, and stability control. Recent innovations include wireless and digital sensors, which offer improved accuracy and easier integration. Regulatory pressures, including new safety mandates, are accelerating adoption, while the growing popularity of electric and autonomous vehicles is further driving demand for sophisticated chassis sensor solutions.

Europe

Regulatory pressures and economic uncertainties influence Europe's market. The European Union's Euro NCAP standards mandate advanced safety features, increasing the demand for chassis sensors. However, economic challenges have slowed market growth compared to other regions. Despite this, European manufacturers such as Volkswagen and BMW are focusing on electric and autonomous vehicle technologies, which require advanced sensor systems. Regulations such as the EU's General Safety Regulation are also driving innovation in sensor technologies.

Rest of the World

Rest of the World, including the Middle East & Africa, and Latin America, presents emerging opportunities for chassis sensors. Markets in these regions are driven by government initiatives to promote automotive growth and investments in infrastructure. While they currently contribute less to the global market share, they significant offer potential for future expansion. Technological developments and partnerships with global manufacturers are expected to drive growth in these regions.

Competitive Landscape

Key Market Players

Key Players Focus on Innovations to Enhance Vehicle Stability

Robert Bosch GmbH has maximum contribution in the global automotive chassis sensors market share. Its dominance is attributed to its extensive portfolio of advanced technologies. Bosch offers a wide range of chassis sensors, including speed, position, and acceleration sensors, which are crucial for advanced driver-assistance systems (ADAS) and vehicle stability control. The company's strong research and development capabilities enable it to continuously enhance sensor accuracy and reliability, ensuring compliance with stringent safety and performance standards.

Bosch's global presence and partnerships with major automotive manufacturers further solidify its position as a market leader. Bosch's offerings in automotive chassis sensors include advanced MEMS (Micro-Electro-Mechanical Systems) technology, which enhances sensor precision and miniaturization. This technology is integral to modern vehicles, supporting features like electronic stability control and anti-lock braking systems.

Continental AG is also a major key player in the market. Continental offers a diverse range of chassis sensors, including pressure and temperature sensors, which are essential for monitoring vehicle systems such as suspension and braking. The company's focus on innovation and integration with advanced technologies such as IoT and Artificial Intelligence (AI) strengthening its strong market presence. Continental's sensors are designed to enhance vehicle safety and efficiency, aligning with global regulatory demands for improved safety features and reduced emissions. Continental's comprehensive product line and strategic partnerships with automotive manufacturers contribute to its market share.

LIST OF KEY CHASSIS SENSORS COMPANIES PROFILED

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- DENSO Corporation (Japan)

- Infineon Technologies AG (Germany)

- NXP Semiconductors NV (Netherlands)

- Sensata Technologies Holding Inc. (U.S.)

- STMicroelectronics NV (Switzerland)

- TE Connectivity Ltd. (Switzerland)

- Amphenol Corporation (U.S.)

- BorgWarner Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2025- TDK introduces the new high-performance, cost-effective stray-field robust Micronas HAL/HAR 35xy* 2D Hall-effect position sensor family for automotive applications. New sensors include a single-die version (HAL 3550) and a dual-die version (HAR 3550) with analog (linear, ratiometric) and digital (PWM, SENT & Switch) output interfaces, based on the flagship Micronas HAL/HAR 39xy family, offering a more cost-effective option without sacrificing performance or functional safety performance. Main target applications are steering wheel angles, brake and accelerator pedal positions, valve positions, and chassis position detection.

- January 2025- Continental automotive introduced Xelve, a performance-scalable and cost-optimized ADAS and automated driving solution portfolio. This portfolio includes advanced chassis sensors designed to improve vehicle safety and performance.

- November 2024- Murata Manufacturing Co., Ltd. introduced the SCH1633-D01, a micro-electromechanical system (MEMS) based sensor designed for automotive applications such as autonomous driving (AD), advanced driver-assistance systems (ADAS), inertial navigation, vehicle stability control, and camera or headlight alignment. The SCH1633-D01 is optimized for zonal architecture, allowing subsystems such as GNSS integration, chassis control, and vehicle attitude sensing to utilize its measurements. Packaged in a 24-pin SOIC housing, it features a SafeSPI 2.0 interface with up to a 20-bit data frame, system-level time synchronization, and extensive self-diagnostics. It is AEC-Q100 grade 1 qualified and ISO26262 compliant with ASIL-B+ rating. Mass production is planned for early 2025.

- September 2024- Continental launched a major product range expansion initiative for the aftermarket, introducing new product groups, including sensors for driver assistance system adas, chassis and steering components, and high-pressure fuel pumps.

- January 2022- Qualcomm and Renault Group extended their collaboration to bring the latest digital advancements to next-generation vehicles with the Snapdragon Digital Chassis. Renault Group would work with Qualcomm Technologies to leverage the Snapdragon Digital Chassis to equip upcoming Renault vehicles with the latest connected and intelligent solutions for its next-generation vehicles.

REPORT COVERAGE

The global chassis sensors market analysis report provides detailed market analysis and focuses on key aspects such as leading companies, vehicle types, design, and technology advances. Besides this, the report offers insights into the latest market trends and highlights key automotive industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Type

By Sensor Type

By Application

By Geography

|

Frequently Asked Questions

Fortune Business Insights says the market was valued at USD 2.29 billion in 2024 and is projected to reach USD 3.88 billion by 2032.

The market is expected to register a CAGR of 7.1% during the forecast period.

Increasing emphasis on stringent emissions norms and safety regulations are key factors likely to drive market growth.

Asia Pacific lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us