Clinical Perinatal Software Market Size, Share & Industry Analysis, By Type (Integrated and Standalone), By Deployment (On-premise and Cloud-based), By Application (Fetal Monitoring, Maternal Health Management, Neonatal/Infant Care, and Others), By End User (Hospitals & Clinics, Specialty Clinics and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

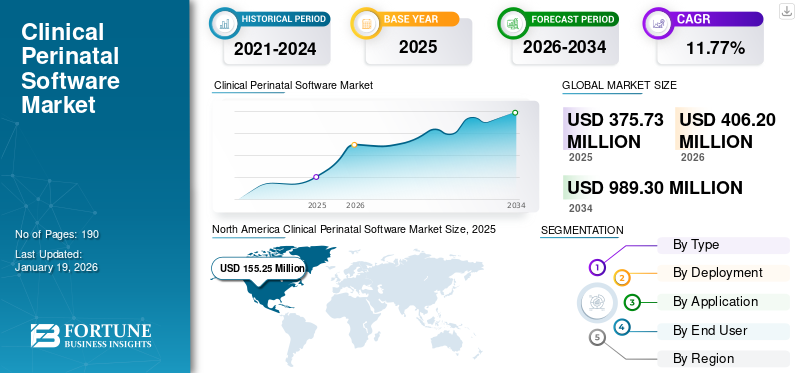

The global clinical perinatal software market size was valued at USD 375.73 million in 2025. The market is projected to grow from USD 406.2 million in 2026 to USD 989.3 million by 2034, exhibiting a CAGR of 11.77% during the forecast period. North America dominated the clinical perinatal software market with a market share of 41.32% in 2025.

Clinical perinatal software refers to specialized digital platforms and tools used in maternal-fetal and neonatal care settings. These solutions are designed to support healthcare systems in managing pregnancy, labor & delivery, and newborn care by integrating clinical data, monitoring maternal and fetal conditions, and improving decision-making during perinatal care. The global clinical perinatal software market is growing steadily, supported by rising demand for maternal and neonatal care solutions, the digitalization of hospitals, and increased focus on reducing birth-related risks. Additionally, the growth is further being fueled by the adoption of electronic health records (EHR), real-time monitoring tools, and clinical decision support systems for obstetrics.

Furthermore, the market encompasses several major players with General Electric Company, Koninklijke Philips N.V., PeriGen, Inc., and Clinical Computer Systems, Inc. at the forefront. Broad portfolio with innovative product launches, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Burden of Maternal & Neonatal Health to Propel Market Growth

The increasing burden of maternal and neonatal health is considered to be the most prominent driver for the market. The leading cause of maternal deaths include preeclampsia/eclampsia, hemorrhage, intrapartum hypoxia, obstructed labor, and prematurity complications. All these conditions can be avoided through early detection and monitoring. Clinical prenatal software helps in preventing stillbirth or birth asphyxia, real-time monitoring of premature/low-birthweight infants, enabling timely interventions, and others, in turn reducing mortality. Thus, the adoption of these software is rapidly increasing, especially in high income-countries.

- For instance, according to WHO report published in April 2025, around 260,000 women died from pregnancy and childbirth-related causes in 2023. Low-and –middle-income countries were responsible for around 90% of these deaths.

MARKET RESTRAINTS

Limited Adoption in Emerging Economies to Restrict Market Expansion

Limited adoption in emerging economies restrains the growth of the overall market. Infrastructure gaps and cost concerns in low-and-middle income countries slow down deployment outside developed healthcare systems. Additionally, lack of trained staff also hampers the implementation of advanced perinatal software solutions. Moreover, majority of the programs are donor-funded, thus lack of sufficient funding for such programs results in slower adoption of these products.

- For example, Zambia Electronic Perinatal Record System (ZEPRS) was implemented with the support of organizations such as the Bill and Melinda Gates Foundation and the U.S. National Institutes of Health (NIH).

MARKET OPPORTUNITIES

Integration with Telehealth & Remote Monitoring to Create Lucrative Growth Opportunities

With the rapidly evolving landscape for digital health across the globe, hybrid prenatal care that includes digital as well as occasional in-person visits to healthcare professional is now becoming standard practice in many health systems. The COVID-19 pandemic demonstrated the need and potential of remote monitoring using telehealth. This can be done through connected healthcare devices, mobile apps, SaaS portals, and teleconsultations. The confluence of all these factors is expected to increase access to care, expand user base, and offer recurring revenues through subscription or per-patient models. This is expected to provide a lucrative growth opportunity.

- For instance, a research study was published in the National Center for Biotechnology Information (NCBI), in June 2023, which stated that in November 2020, around 17.3% of the study participants had a telehealth prenatal visit. This number was around 1% from 2018 through January 2020.

MARKET CHALLENGES

High Implementation Cost to Hamper Market Growth

High implementation costs poses one of the significant clinical perinatal software challenges to the overall clinical perinatal software market growth. The integration of these software requires significant upfront investment in IT infrastructure, as well as in the requirement of skilled professionals. Thus, high capital and operational costs result in slower adoption of these software among smaller hospitals, specialty clinics, and low- and middle-income countries.

- For instance, according to an article published in 2024, since 2021, the Department of Health and Social Care and NHS England have invested an additional USD 225 (£165) million a year to improve maternity and neonatal care.

CLINICAL PERINATAL SOFTWARE MARKET TRENDS

Shift towards Cloud and SaaS Model is One Significant Clinical Perinatal Software Market Trends

In recent years, the marketspace is witnessing a shift towards cloud and SaaS model. Key factors responsible for this shift include cost efficiency of cloud-based software, scalability across multiple sites, remote accessibility allowing efficient maternal care, and faster technological advancements. Over the past few years, hospitals across the globe, especially in high income countries are migrating towards cloud-based model owing to above-mentioned advantages.

- For instance, according to an article published by Doctors App in March 2025, cloud-based solutions offer lower costs, flexibility, and remote access.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Integrated Software Contributed to Growth of the Segment

On the basis of the type, the market is classified into integrated and standalone.

To know how our report can help streamline your business, Speak to Analyst

The integrated segment accounted for the leading clinical perinatal software market share in 69.18% 2026. The growing demand for integrated solutions by hospitals and health systems coupled with increasing adoption due to their advantages have primarily driven the segment growth. These software ensure seamless data flow, enhance workflow efficiency, reduce the risk of data breach, and support decision making.

- For instance, GE Healthcare is one of the prominent players that offers integrated software in this market.

By Deployment

High Usage of Machine Learning Contributed to Segmental Growth

On the basis of deployment, the market is classified into on-premise and cloud-based.

The on-premise segment accounted for the significant share of the market in 73.25% 2026. Historically, large hospitals and health systems have majorly relied on the on-premise software. Additionally, many healthcare providers prefer on-premise deployments in order to maintain patient data security and comply with the strict regulatory requirements. Owing to these factors, this segment held the dominating share in the global market.

- For instance, Epic Systems is of the major players in the market that offer on-premise solutions for perinatal usage.

The cloud-based perinatal software segment is expected to grow at a CAGR of 13.93% over the study period.

By Application

Increasing Focus on Fetal Monitoring to Reduce Neonatal Mortality Fuels Growth of Fetal Monitoring Segment

In terms of application, the market is categorized into fetal monitoring, maternal health management, neonatal / infant care, and others.

The fetal monitoring segment captured the largest clinical perinatal software market share in 36.74% 2026. In 2025, the segment is anticipated to dominate with 37.4% share. Fetal monitoring software has a clinical importance in nearly all institutional births, making it the most widely adopted application. The solutions for fetal monitoring play an important role in detecting abnormal heart rate patterns along with preventing complications such as preterm distress, intrapartum hypoxia, and others. Such higher adoption of these solutions to reduce neonatal mortality and technological advancements in these software result in the dominance of the segment.

- For instance, a study was published by the Hudson Institute of Medical Research in February 2025, which demonstrated the new AI-driven approach for fetal brain health monitoring.

The maternal health management segment is expected to witness 12.52% growth over the forecast period.

By End User

Active Involvement in Artificial Intelligence Implementation by Pharmaceutical Companies Propelled Segment Growth

Based on end-user, the market is segmented into hospitals & clinics, specialty clinics, and others.

In terms of end-user, in 2026, hospitals & clinics dominated the global market with largest market share 69.49%. Hospitals & clinics are the primary settings where are largely implemented. These settings handle majority of high-risk pregnancies, and neonatal intensive, resulting in higher adoption of these solutions. Additionally, higher rate of admission in ICUs for maternal care also supported the market growth. Furthermore, the segment is set to hold 69.7% share in 2025.

- For instance, according to the data published by the CDC/National Center for Health Statistics in December 2023, during 2020-2022, the admission rate of mothers to an intensive care unit (ICU) during hospitalization for delivery was 1.8 per 1,000 live births.

In addition, specialty clinics segment is projected to grow at a CAGR of 12.44% during the forecast period.

Clinical Perinatal Software Market Regional Outlook

By geography, the market is divided into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America Clinical Perinatal Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America dominated the global market in 2025 valuing at USD 155.25 million and also took the leading share in 2026 with USD 168.17 million. Key factors fostering the regional dominance include strong shift towards digital health adoption, supportive regulatory framework, and high maternal mortality rates resulting in growing demand, and increasing strategic partnerships in the region. In 2026, U.S. market is estimated to reach USD 154.42 million. The increasing implementation of these solutions by hospitals and maternity clinics in the country supported the growing demand for digital solutions in the region.

- For instance, according to an article published by Winrock International in June 2025, the U.S. has a far higher maternal mortality rates than any other high-income country. According to 2022 data from the National Center for Health Statistics, this rate was 22.3 deaths per 100,000 live births.

Europe and Asia Pacific

On the other hand, markets in the Europe and Asia Pacific regions are projected to grow at a notable rate in the near future. During the forecast period, European region is anticipated to grow at a CAGR of 9.96%, which is the second largest region amongst all the regions and touch the valuation of USD 92.8 million in 2025. Key factors responsible for this include increasing demand for effective clinical perinatal software solutions due to the rapid rise in birth rates, along with advancements in technology. Backed by these factors, countries including the U.K. anticipates to record the valuation of USD 21.03 million, Germany to record USD 23.94 million in 2026 and France to record USD 17.6 million in 2025. After Europe, the market in Asia Pacific is valued to reach USD 85.0 million in 2025 and secure the position of third-largest region in the market. In the region, India and China both are estimated to reach USD 18.38 million and USD 23.76 million respectively in 2026.

Furthermore, Latin America and Middle East & Africa regions are anticipated to grow at a moderate rate over the study period. Latin America market in 2025 is set to record USD 24.4 million as its valuation. Government policies to increase adoption of digital health further drive usage in these regions. In Middle East & Africa, GCC is set to attain the value of USD 7.6 million in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range of Product Offerings coupled with Strong Presence of Leading Companies in Hospitals & Large Health Systems Supported their Dominating Position

The global clinical perinatal software market showcases a fragmented structure with presence of few dominant players along with an increasing number of mid-sized emerging companies and specialized startups. General Electric Company and Koninklijke Philips N.V. are some of the prominent players in the market. These companies have global footprint, specialized products, and wide adoption across the globe, which supports their market dominance.

The other notable players include PeriGen Inc., Clinical Computer Systems, Inc., Epic Systems, and others are focusing specifically on fetal monitoring, decision support, and neonatal/maternal care. These companies undertake various strategic initiatives to strengthen their market presence.

- For instance, in August 2025, Clinical Computer Systems, Inc. participated in the MEDITECH Alliance Program as Collaborator. This is aimed to accelerate the integration of the OBIX Perinatal Data System with MEDITECH Expanse.

LIST OF KEY CLINICAL PERINATAL SOFTWARE COMPANIES PROFILED

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (The Netherlands)

- PeriGen, Inc. (U.S.)

- Clinical Computer Systems, Inc. (U.S.)

- Epic Systems (U.S.)

- Oracle (U.S.)

- System C (UK)

- Trium Analysis Online GmbH (Germany)

- K2 Medical Systems Ltd. (U.S.)

- Huntleigh Healthcare Limited (UK)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Clinical Computer Systems, Inc. (OBIX) partnered with Dubai Health to enhance newborn and maternity care.

- November 2024: BrightHeart received the U.S. FDA 510(k) clearance for its first AI software designed for prenatal fetal heart ultrasound.

- January 2024: Clinical Computer Systems, Inc. (OBIX) and Nordic Digital Platforms signed MOU to transform maternity care services in the GCC and the UAE.

- August 2023: PeriGen Inc. introduced LaborWatch, with successful integration across a major U.S. health system.

- June 2020: Koninklijke Philips N.V. introduced the Avalon CL Fetal and Maternal Pod and Patch in the U.S. to reduce unnecessary physical interactions between clinicians and patients.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.77% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type · Integrated · Standalone |

|

By Deployment · On-premise · Cloud-based |

|

|

By Application · Fetal Monitoring · Maternal Health Management · Neonatal / Infant Care · Others |

|

|

By End User · Hospitals & Clinics · Specialty Clinics · Others |

|

|

By Geography · North America (By Type, Deployment, Application, End User, and Country) o U.S. o Canada · Europe (By Type, Deployment, Application, End User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Type, Deployment, Application, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Type, Deployment, Application, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, Deployment, Application, End User, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 375.73 million in 2025 and is projected to reach USD 989.3 million by 2034.

In 2024, the market value stood at USD 155.25 million.

The market is expected to exhibit a CAGR of 11.77% during the forecast period of 2026-2034.

The fetal monitoring segment led the market by application.

The key factors driving the market are the, and high global maternal & neonatal health burden, rising institutional deliveries & NICU admissions, and supportive government policies for digital health adoption.

GE HealthCare, Koninklijke Philips N.V., PeriGen, Inc., and Clinical Computer Systems, Inc. are some of the prominent players in the market.

North America dominated the market in 2025.

Shift towards telehealth & remote monitoring, and adoption of AI in perinatal care & advanced analytics in fetal monitoring are some of the factors that are expected to favor the product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us