Femtech Market Size, Share & Industry Analysis, By Type (Products {Wearables, Fertility & Hormone Monitoring Kits, & Sexual Wellness Devices}, Software {Reproductive & Fertility Apps, Pregnancy & postnatal Apps, Sexual & Hormonal Health Apps, and General Wellness & Lifestyle Apps}, and Services {Telehealth & Teleconsultations, Subscription-based Wellness Programs}), By Application (Menstruation Care & Fertility Tracking, Pregnancy & Nursing Care, Menopausal Health, & General Health & Wellness), By End-User (Individual Users, Hospitals, & Fertility Clinics) and Regional Forecast, 2026-2034

Femtech Market Size

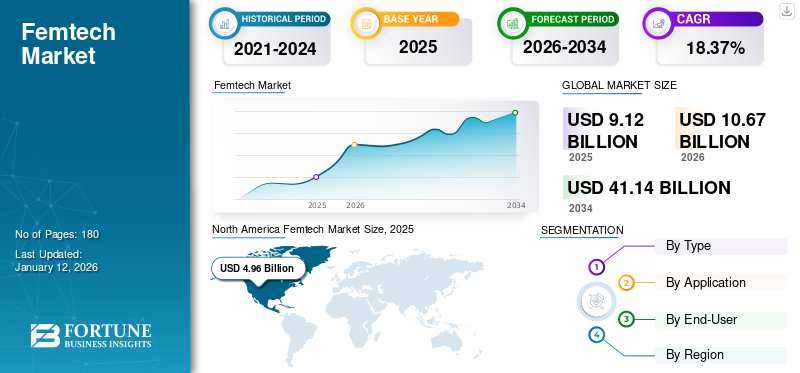

The global femtech market size was valued at USD 9.12 billion in 2025. The market is projected to grow from USD 10.67 billion in 2026 to USD 41.14 billion by 2034, exhibiting a CAGR of 18.37% during the forecast period. North America dominated the femtech market with a market share of 54.40% in 2025.

Femtech refers to female technology products, software, and services that enable the use of digital health to manage women’s health issues. The primary aim of female technology is to develop products, software, and tech-enabled solutions in order to cater to the unmet rising need for women’s health. The products and solutions are aimed at managing health disorders that specifically affect women’s health. The increasing prevalence of health disorders such as menopausal health, reproductive health, general health, and others among the female population, along with growing awareness about these disorders, are some of the factors expected to support the market growth.

Different key players such as Flo Health Inc., Joylux, Inc., and Natural Cycles USA Corp, among others, are focusing on the development and introduction of innovative products and mobile applications that support their growing share in the market.

- For instance, according to the 2023 article published by the National Center for Biotechnology Information (NCBI), the prevalence of menstrual cycle irregularities ranges from 5% to 35.6% among women globally.

Additionally, a growing focus on investment and funding coupled with the increasing number of new startups with advanced solutions to support health demands among women is also expected to contribute to market growth.

Global Femtech Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 9.12 billion

- 2026 Market Size: USD 10.67 billion

- 2034 Forecast Market Size: USD 41.14 billion

- CAGR: 18.37% from 2026–2034

Market Share:

- North America dominated the femtech market with a 54.40% share in 2025, driven by increasing healthcare expenditure, technological advancements in digital platforms, and a growing number of startups focusing on women’s health solutions.

- By type, products held the largest market share in 2024, supported by rising awareness of women’s health, technological innovations in wearable devices, and a surge in product launches addressing reproductive health, pregnancy, and general wellness.

Key Country Highlights:

- United States: Growth is driven by rising investments in femtech startups, increasing funding for R&D, and a surge in adoption of mobile apps and wearables for personal health management.

- Europe: Market growth is fueled by strong regulatory frameworks for data protection, increasing awareness campaigns on women’s health, and heightened funding activities for femtech innovations across key countries like the U.K., Germany, and France.

- China: The rapid rise in healthcare digitization, government initiatives to promote tech-enabled fertility care, and a growing ecosystem of femtech startups are major drivers supporting market expansion.

- Japan: The focus on integrating femtech solutions into corporate healthcare benefits, along with rising consumer demand for personalized health applications, is propelling market growth in the country.

Market Dynamics

Market Drivers

Increasing Investment in R&D Activities and Technologies among Organizations Boost Demand for Femtech

The integration of technology such as artificial intelligence and machine learning in female technology medical devices and apps by the key players is resulting in the growing adoption and demand for technology-enabled women’s health solutions and products among the female population.

The growing awareness about the benefits of these products in emerging countries is another crucial factor supporting the increasing demand for these products in the market. This demand is driving the focus of prominent players toward R&D activities to develop and introduce novel digital products and platforms.

Additionally, there is a growing emphasis on R&D investment and funding among government organizations, and other players for the development of women’s health products integrated with technology such as mobile applications, wearable devices, and others.

- According to the 2024 data published by Guardian News & Media Limited, it was reported that female technology companies exclusively founded by women receive 28% of venture capital funding in the U.K.

The ongoing efforts of start-ups to gain approval for their products and receive funding from various investors are crucial factors expected to spur the global femtech market growth. This, along with large corporations, is also focusing on providing female technology-powered reproductive health & fertility treatments as employee benefits, which is further expected to boost the adoption rate for these products in the market.

- For instance, in 2019, Renovia Inc., received the U.S. FDA approval for its Leva Digital Therapeutic pelvic floor exercise tool. The company raised USD 17 million in Series C funding in 2021, following Series B funding of USD 42.3 million in 2018.

Hence, with the increasing demand for these digital products and solutions, along with the rising accessibility of smartphones in developed and developing countries, the market is expected to grow during the forecast period.

Other Prominent Drivers

- Growing Focus on Women’s Health - Increased recognition of gender-specific health issues affecting women is creating demand for targeted solutions.

- Corporate Support & Inclusivity Initiatives - More companies are investing in female technology solutions as part of their diversity and inclusivity efforts.

Market Restraints

Limited Access to High-tech Products and Services in Emerging Markets Limits Market Growth

There is an increasing adoption and demand for digital and other technology-enabled solutions in emerging countries. However, the limited access to technologically advanced products in emerging countries such as Poland, India, China, and others is one of the crucial factors limiting the adoption rate of these products in the market.

The limited availability, high cost associated with advanced devices, products, and software, and reduced awareness among the female population are some of the additional factors expected to hamper the demand for these products. Along with this, the societal and cultural differences in the developed and emerging nations regarding the understanding of fertility, menstruation, and other women’s health disorders, especially in rural areas, also limit the adoption rate for these products in the market.

Additionally, the lower investment in women’s health and digital health compared to other healthcare sectors is another crucial factor anticipated to limit the market growth.

- According to a 2023 article published by PitchBook, women make up around 50% of the global population, but the healthcare R&D targeted toward women’s health specifically is just around 4%, which demonstrates a huge gap between the demand and supply of products and services targeting women’s health.

All these factors, including the limited awareness programs regarding women’s health issues in developing countries, are expected to hamper global market growth in the future.

Market Opportunities

Underserved and Underpenetrated Areas Present a Lucrative Opportunity for Market Growth

There is a growing demand for female technology products and mobile applications, especially in emerging countries such as Poland, China, and India. Increasing awareness of women’s health, rising healthcare expenditure and advancements in healthcare infrastructure, and growing investment in digital health technologies, among others, are some of the factors contributing to the growing adoption rate for these products in developing regions.

- For instance, according to 2023 statistics published by the International Trade Administration (ITA), it was reported that the healthcare expenditure was USD 161.0 billion in Brazil.

Additionally, the growing number of investments in research and development for female technology among government organizations, the growing number of users for these products, and mobile applications, are some of the additional factors presenting beneficial opportunities for the manufacturers in the market.

Market Challenges

Cybersecurity Threats Associated With the Product to Hinder Market Growth

The growing use of data in the female technology industry has certain benefits, such as improved user experience, enhanced efficiency, and others. However, the technology holds challenges, including data leaks of information that involve sensitive personal data such as biometrics and the medical and health status of the individual.

The security, privacy, and safety issues around these technologies and data may lead to differential harm among individuals. Various factors, such as the non-compliant practices of the industry, inadequate regulations, and limited research and guidelines for privacy-preserving, cyber-secure, and safe products enable these complex risks and harms.

- For instance, according to 2021 statistics published by VARIndia, the number of cybercrime incidents has increased by 18.4% since 2019 in India.

Other Prominent Challenges

- Regulatory & Compliance Barriers - Many female technology innovations lack clear regulatory pathways (e.g., FDA classification of fertility apps). Stricter policies regarding data sharing and biometric data collection may slow market expansion.

- Market Fragmentation & Lack of Standardization - The industry remains highly fragmented, with numerous small startups operating independently. Standardized guidelines for these product classifications are still missing, thus hampering the overall market growth.

Femtech Market Trends

Increasing Technological Advancements and Adoption of Artificial Intelligence has Emerged as a Profitable Trend

The growing prevalence of health disorders among the female population is resulting in a growing focus of key players, particularly emerging startups, on supporting the increasing demand for health solutions.

The growing penetration of mobile applications and digital wearables, such as fertility trackers, coupled with increasing competition among the key players, is resulting in the shift toward the adoption of advanced technology, including machine learning and artificial intelligence, to develop novel and personalized products among the general population.

The growing focus of start-ups on developing technologically advanced products is an increasing trend, boosting the adoption and demand for these products among the general female population. This, along with health insurers, emphasizes the integration of femtech solutions into policies for maternal care, fertility, and hormone health, which is also expected to boost the adoption rate for these products in the market.

- In December 2024, Asan launched the Asan Period Tracker, an app that tracks all aspects of users’ menstrual cycles, moods, and symptoms and offers free insights with an aim to strengthen its product portfolio.

The market has become a fascinating industry that thrives to meet specific women’s healthcare needs.

Other Prominent Trends

- Expansion of Menopause-Focused Solutions: Previously overlooked, menopause-related innovations are now gaining traction, with companies including Elekta and Embr Wave providing digital and wearable solutions for symptom management.

- Personalized Medicine for Women: Most companies are developing DNA and hormone-based diagnostics that provide tailored healthcare plans for women.

- Increase in Digital Therapeutics & Chronic Care: Apps such as Clue and Flo offer cycle tracking, mental health support, and sexual health education. AI-powered chatbots and virtual assistants are improving access to mental health support for women.

- Blockchain for Secure Data Management: Blockchain-based health data platforms will improve privacy & security for female technology apps. Users will control & monetize their health data through decentralized health platforms.

Download Free sample to learn more about this report.

Impact of COVID-19

Increased Adoption of Digital Health Applications and Products During Pandemic Fueled Market Growth

The COVID-19 pandemic positively impacted the growth of the market. The temporary shutdown of the healthcare facilities for general health & wellness owing to the shifted focus on COVID-19 management was one of the crucial reasons that resulted in the increased adoption of mobile health products and applications.

Additionally, the increased fear of health issues among the general population led to increased downloads of mobile applications related to various health conditions and the use of wearables and devices that enabled remote monitoring of the parameters.

The increased investment, adoption, and use of these digital solutions resulted in a rising number of R&D activities to develop and introduce various health apps is another factor that resulted in the market growth during the pandemic.

- According to a 2021 article published by The Open COVID Journal, the general public's adoption of digital health solutions during the COVID-19 pandemic increased, resulting in a 25% increase in the number of health downloads and around 50% increase in the number of downloads in fitness applications.

Furthermore, an increasing number of startups focusing on developing and introducing health products and applications, particularly for women’s health conditions, and growing investments in advancements of these products are some of the factors expected to support global market growth in the future.

Trade Protectionism

The female technology products such as fertility trackers and artificial intelligence-driven diagnostics require regulatory approval, which varies according to the region. The female technology products are regulated by the Food and Drug Administration in the U.S. and the European Union in Europe. However, strict data-sharing policies make it difficult for international companies to operate in these regions. Furthermore, countries including India, Brazil, and the UAE are developing new digital health frameworks, impacting market expansion.

Segmentation Analysis

By Type

Technological Advancements Coupled with Rising Number of Product Approvals to Boost Growth of Product Segment

By type, the market is segmented into product, software, and services.

The products segment dominated the global femtech market share of 56.56% in 2026. The rising awareness regarding the products and their technological advancements to monitor and improve women’s health is one of the major reasons contributing to the increasing penetration of these products globally. In addition, the growing number of product approvals and launches by emerging players to cater to the rising demand for the treatment of women’s health conditions is another crucial factor supporting the segment's growth.

On the other hand, the software segment is expected to grow at a considerable CAGR during the forecast period. This growth is due to the growing focus of start-ups and other prominent players toward research activities, and increasing funding by governments, investors, and other agencies for technological advancements of the products in the market. Furthermore, the growing number of launches of mobile applications for menstruation, period tracking, and several others services is supporting the increasing adoption rate for these applications in the market.

- According to a 2023 article published by the National Center for Biotechnology Information (NCBI), about 50 million women use apps to track their menstruation in the U.S.

By Application

Pregnancy & Nursing Care Segment Leads Owing to Increasing Number of Users

Amongst application, the market is sub-segmented into menstruation care & fertility tracking, pregnancy & nursing care, menopausal health, and general health & wellness.

The pregnancy & nursing care segment dominated the market share 44.82% globally in 2026. This dominance is attributed to growing awareness about wearable devices and remote monitoring of maternal health among the population, resulting in increasing demand for these products in the market.

Additionally, the increasing demand for wearable devices among the population is resulting in the growing research and development activities by key players toward the development and introduction of new products to support the unmet need of female health disorders.

- In 2022, Samueli School of Engineering University of California developed an algorithm-based abdominal patch, Lullaby, for monitoring fetal heart rate. The device will allow remote monitoring of fetal heart rate with the use of a smartphone and aims to improve prenatal care.

The menstruation care & fertility tracking segment is expected to grow with the highest CAGR during the forecast period. The growth is due to the increasing awareness about the benefits of mobile applications for menstruation tracking and other applications, especially in emerging countries, resulting in the growing adoption and demand for these products in the market.

Also, the expanding applications and benefits of these apps for various women’s health issues are contributing to the rising penetration of these apps.

- In October 2023, Flo Health, Inc., launched a new feature, “Flo for Partners,” in its period tracking app Flo, which includes tips, advice, and polls on the menstrual cycle, with an aim to support men with insights into their female partner’s menstrual cycle and reproductive health.

Furthermore, the menopausal health segment is expected to grow with a considerable CAGR during the forecast period. The growth is owing to the increasing number of women experiencing the side effects of menopause and growing awareness regarding the products and devices for these concerns. Along with this, growing funding by women’s health startups in regional innovation is anticipated to support the growth in the region.

- According to a 2021 article published by the Lancet Journal, there will be more than 1.2 billion menopausal and post-menopausal women globally by 2030.

On the other hand, the rising concern regarding health and wellness among women is leading to the increasing use of women’s health products to monitor their health regularly. During the COVID-19 pandemic, the number of health app users globally increased owing to significant health concerns and fitness tracking.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Individual Users Segment to Dominate Due to Increasing Adoption of Mobile Apps and Wearable Devices for Personal Use

Based on the end-user, the market is segmented into individual users, hospitals, fertility clinics, and others.

Individual users dominated the market in 2024. Certain factors, such as widespread availability and adoption of mobile apps coupled with wearable devices targeting women’s health, are prominently boosting the segment's growth. Moreover, the direct-to-consumer (D2C) model, freemium pricing strategies, and smartphone accessibility are further projected to have a positive impact on the market. In addition, increasing investments by market players to launch functionally advanced apps to encourage individual users for their usage, which is further estimated to boost segment growth during the forecast period.

- For instance, in July 2023, Flo Health raised USD 200 million through rounds of series funding. The funding will be utilized for attracting more users, along with leveraging of functionality with the help of advanced computing technologies.

Fertility clinics held the second-largest market share in 2024. These clinics utilize specialized software and diagnostic platforms for advanced reproductive care, such as hormone tracking, embryo monitoring, and cycle synchronization for IVF. In addition, rising focus of fertility clinics to offer personalized patient experience along with streamlining the patient engagement is also estimated to offer a favorable opportunity for segment growth.

Femtech Market Regional Outlook

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Femtech Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated and generated USD 4.19 billion in 2024. The increasing healthcare expenditure, research and development funding, and growing number of players operating in the industry, are some of the factors supporting the growth of the market. Moreover, growing technological advancements in products and digital platforms results in increasing adoption of advanced and novel solutions in the region’s key countries. The U.S. market is projected to reach USD 5.46 billion by 2026.

- For instance, according to 2024 data published by the Centers for Medicare & Medicaid Information (CMS), the per capita healthcare expenditure is USD 14,750.0 in the U.S.

U.S.

The increasing funding by investors and other organizations, and the growing number of startups focused on the development of products, among others, are some of the factors supporting the country’s market growth in the region.

Europe

Europe is expected to grow at a considerable CAGR during the forecast period. The growth is due to the increasing focus on initiatives regarding awareness about women’s health and the benefits offered by digital products and applications. Moreover, the rising funding in the femtech sector, the growing focus of the companies toward the expansion of its facilities to develop and introduce novel products, especially in the U.K., Germany, and France, and strict regulations regarding data protection, among others, are some of the additional factors supporting the market growth in the region. The UK market is projected to reach USD 0.42 billion by 2026, while the Germany market is projected to reach USD 0.63 billion by 2026.

- In January 2022, Wellster, a Munich-based startup, raised USD 60.0 million to launch a female technology platform in Europe.

Asia Pacific

Asia Pacific is expected to register the highest CAGR during the forecast period. The growth is owing to the rising healthcare expenditure coupled with initiatives to raise funding to establish tech-enabled healthcare facilities, especially in China, Japan, and India, in the market. This, along with the growing penetration of advanced products and applications is resulting in the rising R&D initiatives to introduce novel products in the market. The Japan market is projected to reach USD 0.53 billion by 2026, the China market is projected to reach USD 0.39 billion by 2026, and the India market is projected to reach USD 0.18 billion by 2026.

- For instance, in March 2025, Arva Health raised USD 1.0 million to build a tech-enabled next-gen fertility clinic in India.

Rest of the World

The rest of the world is expected to grow at a considerable growth rate during the forecast period. The growth is owing to the increasing accessibility of technology-based products and applications, including menstrual health products and others, as well as the penetration of smartphone users among the population in the UAE, Saudi Arabia, and other countries.

Also, the rising number of initiatives by startups and other government authorities to support the market's growth in regions such as the Middle East, Africa, and others via funding and investment are expected to spur the rest of the world's market share globally during the forecast period.

In February 2022, Nabta Health, the Middle East’s only hybrid healthcare platform dedicated to elective, preventive women’s healthcare, raised USD 1.5 million in an angel investment round, which will be used to expand the company’s product portfolio and its market share within the UAE.

Competitive Landscape

Key Industry Players

Femtech Startups to Hold a Significant Proportion with Strong Product Portfolio

The market is highly fragmented with many players operating in the market. The key players are constantly focusing on the development and introduction of innovative products and applications to address women’s health issues. Along with this, the shifting focus from established players in women’s health toward digital health applications, products, and solutions is anticipated to increase their share in the global market.

Flo Health Inc., Natural Cycles USA Corp., and Glow, Inc., are some of the major players operating in the market focused on catering to the unmet demand for women’s health issues. The rising efforts of these players to increase their funding to develop innovative products and applications, among others, is one of the vital reasons supporting the growth of these players.

- For instance, in May 2024, Natural Cycles USA Corp., a women’s health company, secured USD 55.0 million in funding with an aim to strengthen its presence in the market.

Chiaro Technology Limited., Joylux, Inc., and Coroflo, Ltd. are some other prominent players in the market focused on developing and introducing products that aim to improve women’s health issues. The increasing number of product approvals and launches in the market by these players is one of the important factors responsible for the growing share of these players.

- In October 2020, Elvie, a subsidiary of Chiaro Technology Limited, launched Elvie Curve, a non-electric breast pump. This launch aims to broaden the company’s product portfolio in the market.

List of Key Femtech Companies Profiled

- Flo Health Inc. (U.K.)

- Chiaro Technology Limited (U.K.)

- Natural Cycles USA Corp (U.S.)

- BioWink GmbH (Germany)

- FemTec Health (U.S.)

- Glow, Inc. (U.S.)

- HeraMed (Israel)

- Joylux, Inc. (U.S.)

- Coroflo Ltd. (Ireland)

Key Industry Developments

- May 2025 – Comma, a female-founded, integrated period care company, launched its secure period tracking app, Sara, alongside a USD 2.0 million seed funding round. This helped the company to increase its brand presence.

- October 2024 – Elvie launched a wearable breast pump, Elvie Stride 2, which offers hospital-grade suction combined with the comfort of lightweight ultra-soft silicone cups with an aim to strengthen its product portfolio.

- January 2024 – Natural Cycles received Health Canada’s approval to commercialize its Natural Cycles app as a form of birth control.

- September 2023 – Natural Cycles USA Corp, received the 510(k) clearance from the U.S. FDA for using wrist temperature data from Apple Watch. The integration allows the Natural Cycles application to use overnight wrist temperature data from Apple Watch for users with their consent.

- June 2023 – Flo Health Inc., launched its open-sourcing technology with its Anonymous Mode feature to focus more on privacy in the industry.

Investment Analysis and Opportunities

For Investors

- Prioritization of startups focusing on underserved health areas, including menopause, chronic disease, and others.

- Emphasis toward companies leveraging artificial intelligence & predictive analytics for personalized women’s health solutions.

- Supporting startups entering emerging markets such as Asia Pacific, Middle East & Africa due to high unmet demand.

For Start-ups:

- Emphasis on regulatory compliance for product approvals to avoid delays in scaling globally.

- Adopt a hybrid revenue model that includes subscription, e-commerce, and partnerships to sustain long-term growth.

- Focus on product-market fit by conducting extensive user research before launching.

- Seek non-traditional funding sources such as government grants and women-led VC firms to bypass investment biases.

- Partner with insurers & corporates to integrate solutions into mainstream healthcare plans.

REPORT COVERAGE

The global femtech market report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, type, application, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.37% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 10.67 billion in 2026 and is projected to reach USD 41.14 billion by 2034.

The market will exhibit steady growth at a CAGR of 18.37% during the forecast period (2026-2034).

By type, the product segment will lead the market.

The rising prevalence of women’s health disorders, increasing adoption of digital health among women population, increasing research and development activities by market players, and rising number of approvals and launches of female technology products are the key drivers of the market.

Femtec Health, Flo Health Inc., Chiaro Technology Limited, and Natural Cycles USA Corp are the major players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us