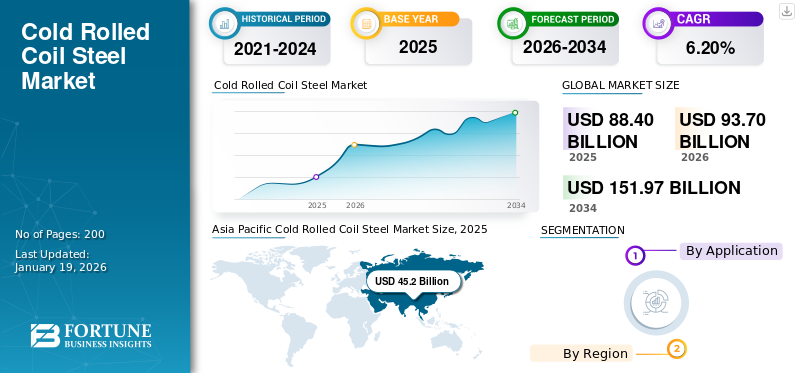

Cold Rolled Coil Steel Market Size, Share & Industry Analysis, By Application (Automotive, Construction, Mechanical Equipment, Consumer Appliances, Packaging, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cold rolled coil steel market size was valued at USD 83.51 billion in 2025 and is projected to grow from USD 88.35 billion in 2026 to USD 134.71 billion by 2034, exhibiting a CAGR of 6.2% during the forecast period. Asia Pacific dominated the cold rolled coil steel market with a market share of 51% in 2025.

Cold Rolled Coil (CRC) Steel is a type of steel processed at room temperature after hot rolling, improving its surface finish, dimensional accuracy, and mechanical strength. It is widely used in the automotive, appliance, furniture, and construction industries due to its high strength, good formability, and aesthetic appeal. The market is growing, driven by increasing demand for low-density and strong materials in the electronics and automotive industries. Increasing construction activities in emerging economies are further boosting product adoption. Additionally, growing investments in renewable energy and electric vehicles are anticipated to push the market during the forecast period. The major manufacturers operating in the market include Tata Steel, ArcelorMittal, POSCO, JFE Steel Corporation, and NIPPON STEEL CORPORATION.

MARKET DYNAMICS

MARKET DRIVERS

Rising Industrialization and Urban Expansion to Drive Product Demand

The increasing pace of industrial growth and urban infrastructure development, especially in developing economies, drives the demand for cold rolled coil (CRC) steel. The material offers high strength, smooth surface finish, and excellent formability. This makes this steel ideal for use in automotive components, appliances, and construction materials. Increasing investments in urban housing, transportation, and manufacturing facilities support its adoption. The growing demand for lightweight and durable materials in modern industries also contributes to market growth. Technological advancements in steel processing are enhancing product quality and efficiency. The rising focus on sustainable and energy-efficient materials is further boosting the cold rolled coil steel market growth.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices to Hinder Market Growth

The market faces challenges due to frequent changes in the costs of essential raw materials like iron ore, coal, and scrap steel. These variations increase production costs and put pressure on manufacturers’ profit margins. Sudden price increases can make products less affordable, while unexpected declines may disrupt supply chain operations. To manage this, companies must adopt cost-effective measures and explore alternative sources. However, such unpredictability in raw material costs creates a barrier to consistent pricing and long-term planning and is expected to limit the market growth over the forecast period.

MARKET OPPORTUNITIES

Growing Electric Vehicle Production and Shift Toward Green Manufacturing to Create Growth Opportunities

The increasing focus on electric vehicle (EV) production creates significant opportunities for the market. CRC steel is widely used in EV components due to its lightweight, high strength, and excellent formability, which helps enhance energy efficiency and performance. As EV production expands globally, the demand for such steel is expected to rise. Additionally, the shift toward green manufacturing, including the use of electric arc furnaces and recycled materials, is gaining attention. These sustainable practices help reduce carbon emissions and align with global environmental goals. These factors are likely to support market growth in the coming years.

- According to the World’s Top Exports, the global rise in electric vehicle demand, valued at USD 141.5 billion in 2024, is expected to boost cold rolled coil steel usage due to its key role in EV manufacturing for strength and efficiency.

MARKET CHALLENGE

Strict Environmental Regulations and Alternative Materials to Challenge Market Growth

The production of CRC steel is highly energy-intensive and contributes to carbon emissions, making it a key focus of environmental regulations. With increasing pressure to reduce industrial emissions, producers must invest in cleaner technologies and more sustainable production methods. These upgrades often involve high costs and complex implementation. Additionally, the growing use of alternative materials such as aluminum and composites poses a challenge to CRC steel. These substitutes offer similar strength with lower weight and environmental impact. As a result, both regulatory constraints and rising material alternatives are expected to challenge market growth in the coming years.

COLD ROLLED COIL STEEL MARKET TREND

Rising Adoption of Recycling and Sustainable Production in the CRC Steel Industry

The market is witnessing a growing trend toward recycling and circular economy approaches. As environmental concerns and sustainability goals become more prominent, manufacturers are turning to recycled scrap steel to reduce dependence on raw materials and minimize carbon emissions. This trend is gaining pace, especially in regions with strict environmental regulations. Adopting electric arc furnaces and closed-loop production systems is helping companies lower energy use, reduce waste, and improve resource efficiency. These efforts are expected to enhance supply stability, lower production costs, and support long-term environmental objectives in the CRC steel market.

Download Free sample to learn more about this report.

Segmentation Analysis

By Application

Automotive Segment to Dominate Driven by Demand for Lightweight and High-Strength Materials

Based on the application, the market is segmented into automotive, construction, mechanical equipment, consumer appliances, packaging, and others.

The automotive segment held a dominant global cold rolled coil steel market share in 2024, fueled by the increasing demand for lightweight and high-strength materials that enhance fuel efficiency and vehicle safety. Due to its excellent formability and surface finish, CRC steel is widely used in body panels, doors, chassis components, and structural reinforcements. The surge in electric vehicle production and stricter emission standards further boost its usage, especially in developed and emerging automotive markets.

In the construction segment, CRC steel is used extensively in structural frameworks, roofing, wall systems, and interior components due to its strength, uniform thickness, and ease of fabrication. Rapid urbanization, smart city development, and residential and commercial infrastructure growth significantly contribute to CRC steel demand in this sector. Its corrosion resistance and aesthetic finish also makes it suitable for architectural applications.

The consumer appliances segment is also witnessing steady growth, with CRC steel being the preferred material for products such as refrigerators, washing machines, ovens, and air conditioners. Its smooth surface, resistance to wear, and excellent paintability make it ideal for internal and external appliance parts. Rising consumer demand for energy-efficient and durable home appliances drives steady growth in this segment.

Cold Rolled Coil Steel Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Cold Rolled Coil Steel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominates the global market with a size of USD 45.2 billion in 2025, driven by rapid industrialization, urbanization, and expanding manufacturing bases in countries like China, India, South Korea, and Japan. Strong automotive, construction, and consumer appliance demand continues to fuel market growth. Government support for infrastructure development, electric vehicle adoption, and smart manufacturing further accelerates steel consumption. Additionally, rising foreign investments and increased export activities strengthen the region’s position as a major hub for CRC steel production and usage.

North America

The CRC steel market in North America is witnessing steady growth fueled by industrial advancements, infrastructure upgrades, and a strong automotive sector. Government investments in EV production and energy-efficient construction are key factors supporting demand. The U.S. and Canada are seeing rising adoption of high-performance steel in automotive components, home appliances, and structural applications. Additionally, the increasing focus on sustainable production aligns with the region’s well-established manufacturing base, and investments in advanced steel technologies continue to drive CRC steel consumption.

Europe

In Europe, the market is shaped by strict environmental regulations and advanced manufacturing practices. The region is witnessing increased use of CRC steel in automotive lightweight, energy-efficient appliances, and green building construction. Countries like Germany, France, and U.K. are investing heavily in EV production, smart infrastructure, and sustainable manufacturing, driving demand for CRC steel. With its well-developed industrial base and a strong focus on circular economy, the region continues to be a major consumer.

Latin America

In Latin America, the market is expanding due to growing automotive production, infrastructure projects, and rising demand for consumer appliances. Increased construction, transportation, and manufacturing investments drive steel usage in countries like Brazil and Mexico. In addition, the shift toward EVs and modern production techniques further supports market growth in the region.

Middle East & Africa

In the Middle East and Africa, the market is growing due to rising infrastructure projects, industrial expansion, and increasing automotive production. Countries like the UAE, Saudi Arabia, and South Africa lead in the demand for this steel through construction and transport development. The push for EV adoption and local manufacturing also supports the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Investments in R&D to Introduce New Products by Key Companies to Maintain Their Dominating Positions

Key global companies include Tata Steel, ArcelorMittal, POSCO, JFE Steel Corporation, and NIPPON STEEL CORPORATION. These companies compete based on purity levels, cost-effective processing techniques, supply chain integration, and regional dominance while investing in sustainable extraction technologies to address environmental concerns. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY COLD ROLLED COIL STEEL COMPANIES

- Tata Steel (India)

- ArcelorMittal (Luxembourg)

- POSCO (South Korea)

- HYUNDAI STEEL (South Korea)

- JSW Steel (India)

- United States Steel Corporation (U.S.)

- NIPPON STEEL CORPORATION (Japan)

- thyssenkrupp Steel Europe (Germany)

- JFE Steel Corporation (Japan)

- Olympic Steel (U.S.)

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.2% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Application · Automotive · Construction · Mechanical Equipment · Consumer Appliances · Packaging · Others |

|

By Region · North America (By Application and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Application and By Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe (By Application) · Asia Pacific (By Application and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Application and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Application and By Country) o South Arabia (By Application) o South Africa (By Application) o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

The global cold rolled coil steel market is projected to grow from USD 93.7 billion in 2026 to USD 151.97 billion by 2034, exhibiting a CAGR of 6.2% during the forecast period.

In 2025, the market value stood at USD 45.2 billion.

The market is expected to exhibit a CAGR of 6.2% during the forecast period.

The key factors driving the market are the growing demand from the construction industry for infrastructure projects and urban expansion.

Tata Steel, ArcelorMittal, POSCO, JFE Steel Corporation, and NIPPON STEEL CORPORATION are the top players in the market.

Asia Pacific dominated the market in 2025.

Rising demand for lightweight and high-strength materials, growth in the automotive and construction industries, and increasing focus on energy-efficient manufacturing are key factors expected to favor the adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us