Flat Steel Market Size, Share & Industry Analysis, By Type (Hot Rolled Coil (HRC), Cold Rolled Coil (CRC), Sheets, and Others), By Application (Construction, Automotive & Transportation, Mechanical Equipment, Energy, Packaging, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

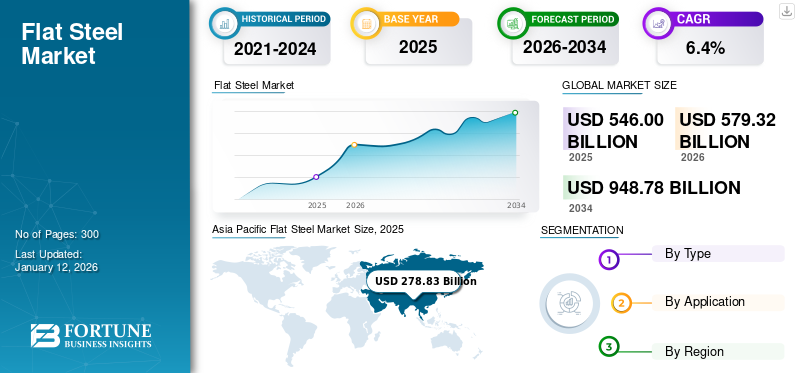

The global flat steel market size was valued at USD 546 billion in 2025. The market is projected to grow from USD 579.32 billion in 2026 to USD 948.78 billion by 2034, exhibiting a CAGR of 6.4% during the forecast period. Asia Pacific dominated the flat steel market with a market share of 51% in 2025.

Flat steel is a type of steel primarily produced from scrap steel, iron ore, and coal. It enhances the reliability, consistency, toughness, and quality of end products while reducing waste. Additionally, it improves the performance of products for end users and facilitates hassle-free processing, enhancing yield and extending product shelf life. These factors drive demand in the automotive and construction industries.

Moreover, the increasing use of steel in various applications for better quality products and cost reduction will further boost the adoption of flat steel. Technological advancements aimed at making the product more reliable and lightweight, along with the rapid development of infrastructure in emerging countries such as India and China, are expected to propel the growth of the market during the forecast period.

ArcelorMittal, POSCO, ThyssenKrupp Steel Europe, Tata Steel, and Nippon Steel Corporation are the key players operating in the market.

The COVID-19 pandemic disrupted supply chains, led to containment measures, and caused a halt in consumption activities. This resulted in shortages of raw materials, machinery closures, and a significant lack of skilled labor. As factories shut down, steel production declined. Automotive manufacturers such as Tata Industries, Tesla, and Maruti Suzuki experienced reduced production activity due to the suspension of operations during the pandemic. This closure affected the adoption of steel. However, demand for products rebounded more quickly in emerging nations compared to developed ones, primarily due to the increased use of steel in the mechanical industry.

Global Flat Steel Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 546 billion

- 2026 Market Size: USD 579.32 billion

- 2034 Forecast Market Size: USD 948.78 billion

- CAGR: 6.4% from 2026–2034

Market Share:

- Asia Pacific dominated the flat steel market with a 51% share in 2025, driven by rapid industrialization, infrastructure development, and increasing automotive production in China, India, and Southeast Asia.

- By type, Hot Rolled Coil (HRC) is expected to retain the largest market share in 2025, supported by its high strength, durability, and rising demand from construction, machinery, and pipe-making applications.

Key Country Highlights:

- China: Leads the market due to high steel production capacity, rapid urban infrastructure growth, and strong R&D activities supporting advanced steel product development.

- India: Expected to witness the fastest growth, fueled by infrastructure expansion, automotive industry demand, and supportive government policies like the PLI Scheme to boost domestic manufacturing.

- United States: Market growth supported by infrastructure redevelopment and domestic manufacturing protection measures, including tariffs favoring U.S. steel producers.

- Europe: Demand is strengthened by innovation in the automotive sector, adoption of electric arc furnaces, and compliance with stringent environmental regulations under the European Green Deal.

FLAT STEEL MARKET TRENDS

Rapid Inclusion of Steel in the Automotive Industry Attributable to Its Characteristics to Propel Market Progress

The automotive industry is undergoing significant redesigns driven by various factors aimed at improving profit margins. As part of this transformation, steel is increasingly being replaced with composite materials and aluminum. However, a substantial portion of vehicle bodies, including components such as guards and frames, is still made from steel. This reliance makes the automotive sector one of the largest consumers of flat steel products, accounting for over 10% of all steel manufactured globally. Moreover, the demand for cold-rolled steel is rising, particularly for interior components and exterior body applications, due to its dent resistance and high formability. Additionally, auto parts that require impact resistance and superior surface finishing are witnessing strong sales. These trends lead to a higher demand for flat steel, creating lucrative opportunities for the market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Robust Demand for Flat Steel from the Construction Industry to Drive Market Growth

The accelerating trend of nuclearization among the population, coupled with increasing urbanization, is a key factor driving the growth of the construction industry. This sector utilizes flat steel for construction frames and structural support in staircases, roofing, welded structures, and shed applications. The growing affluence of the middle class, the rising trend of owning multiple homes, and the renovation or redevelopment of existing houses further boost the construction industry, thereby enhancing market demand. Additionally, construction projects such as infrastructure developments, skyscrapers, and steel bridges require significant amounts of steel plates. At the same time, the infrastructure sector's demand for highways, roads, and rail projects is expected to grow during the review period.

Flat steel is widely used in structural components such as beams, columns, and braces to provide support and stability. Its high tensile strength makes it ideal for carrying heavy loads and withstanding external forces such as wind and earthquakes. Additionally, steel sheets are commonly used for roofing and cladding in both residential and commercial buildings, offering weather resistance, durability, and aesthetic appeal. These roofing sheets come in various profiles and coatings to accommodate different architectural styles and climate conditions.

Moreover, steel panels are utilized in facades and curtain walls to create visually appealing exteriors for buildings while meeting specific architectural design requirements. The lightweight nature of steel enables innovative designs while ensuring structural integrity. Overall, the construction industry's dependence on flat steel highlights its significance as a fundamental material for creating safe, durable, and aesthetically pleasing structures and infrastructure. Consequently, the ongoing innovations in the steel industry and the rapid expansion of construction projects are expected to drive the flat steel market growth.

Market Restraints

Fluctuation in Steel Prices is Likely to Hamper the Market Proliferation

Fluctuations in the prices of steel and raw materials such as coal, iron, and scrap steel are frequently observed. These raw material prices are highly unstable due to the laws of supply and demand. Additionally, manufacturing costs influence storage capacity and pricing. Consequently, fluctuations in steel prices directly affect the cost of steel production. Moreover, the prices of other products are closely tied to steel prices, meaning that any changes in steel prices will impact the final prices of these products. Furthermore, steel prices have witnessed significant increases due to notable changes in demand and geopolitical events, which may hinder market expansion in the forecast period.

Market Opportunities

Technological Advancements in the Steel Industry to Create Significant Opportunity

The development of advanced high-strength steel (AHSS) for the automotive industry is a key trend. These materials provide better performance while being lighter, improving fuel efficiency and reducing carbon emissions from vehicles. These innovations improve product performance and contribute to sustainability goals through weight reduction and material efficiency, driving increased demand for flat products globally. The growth of Electric Vehicles (EVs) is also contributing to the demand for such steel.

Market Challenges

Stringent Environmental Regulations Pose Significant Challenges to the Steel Industry

The market faces significant challenges due to increasingly stringent environmental regulations. Compliance with policies aimed at reducing carbon emissions, minimizing waste, and curbing energy consumption requires substantial investments in cleaner production technologies and sustainable practices. Stricter environmental regulations, especially in the European Union, are forcing steel manufacturers to adopt cleaner technologies. The costs associated with implementing sustainable practices and reducing emissions can be significant, particularly for older production plants.

Segmentation Analysis

By Type

Hot Rolled Coil (HRC) Segment to Dominate Market Owing to High Demand from Equipment and Machinery Applications

Based on type, the market is classified into Hot Rolled Coil (HRC), Cold Rolled Coil (CRC), sheets, and others.

The Hot Rolled Coil (HRC) segment is expected to maintain its dominance throughout the forecast period due to the rising demand for agricultural equipment, construction, machinery, and pipe-making applications. This product offers high strength, durability, temperature resistance, and excellent formability. Additionally, its growing preference for applications that do not require significant force or shape alterations, along with advancements in HRC technology, will further support the segment's growth. The segment dominated the market with 5.24% of the market share in 2026.

The Cold Rolled Coil (CRC) segment is expected to grow significantly during the forecast period. CRCs are increasingly gaining popularity in applications where enhanced surface finish and formability are required, such as the automotive sector, where components with complex shapes are manufactured.

By Application

To know how our report can help streamline your business, Speak to Analyst

Construction Segment to Dominate Owing to Increasing Applications of Flat Steel

Based on application, the market is segmented into construction, automotive & transportation, mechanical equipment, energy, packaging, and others.

The construction segment held the largest flat steel market share in 2024. The product is primarily used for roofing, sheds, welded structures, and staircases in the construction industry due to its cost-effectiveness, safety, and lightweight properties. Furthermore, the growing preference for modern techniques, such as monolithic construction, which allows for faster project implementation, is expected to further increase the demand for this product in the construction sector. The segment is anticipated to attain 54.20% of the market share in 2026.

The increasing adoption of electric vehicles in China, Germany, and the U.S. is expected to drive growth in the automotive industry, leading to higher consumption of products such as Cold-Rolled Coil (CRC) and Hot-Rolled Coil (HRC). The formability and high strength of these materials will enhance their use in mechanical equipment, such as industrial and agricultural tractors. Additionally, the rising demand for corrosion-resistant materials from various equipment manufacturers will further boost the need for these products in the mechanical equipment sector.

The others segment encompasses metal products, domestic appliances, consumer goods, defense items, packaging, and electronics. Product consumption is significant in these applications due to their exceptional shear and tensile strength. Furthermore, the increasing use of electronic accessories, along with rising consumer disposable income, is contributing to a higher demand for metals in manufacturing industries. Consequently, these factors are expected to promote market growth during the forecast period.

The automotive and transportation segment is poised to grow with a considerable CAGR of 6.31% during the forecast period (2025-2032).

Flat Steel Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Flat Steel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market's size stood at USD 262.55 billion in 2024 and USD 278.83 billion in 2025. The region held a dominant market share. Industrialization and advancements in steel technology are expected to drive market expansion in the region. China holds a significant share of the market and is foreseen to gain USD 127.95 billion in 2026, due to its increasing steel production and the rapid growth of the construction industry. Additionally, rising research and development activities are likely to boost the demand for steel products in China. The Indian market is expected to witness the fastest growth, driven by increasing demand for steel in the infrastructure and automotive sectors. The country’s steel production is bolstered by policies such as the PLI Scheme, designed to enhance domestic manufacturing capabilities and increase exports. India is poised to reach USD 46.32 billion in 2026, while Japan is set to be valued at USD 31.14 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is the third largest market projected to reach a market value of USD 109.3 billion in 2026. The market in North America is recovering with a resurgence in infrastructure development and growth in the automotive sector. The U.S. has also implemented tariffs to protect its domestic steel industry, boosting the growth of companies such as Steel Dynamics. The U.S. market is anticipated to gain USD 87.98 billion in 2026.

Europe

Europe is the second largest market set to be valued at USD 130.16 billion in 2026, exhibiting a CAGR of 5.81% during the forecast period (2026-2034). In Europe, rapid technological innovation in the automotive sector is expected to drive strong demand for flat steel, particularly steel sheets and Hot Rolled Coils (HRC). The U.K. market is set to grow with a valuation of USD 30.33 billion in 2026.Europe faces challenges related to trade barriers and competition from countries such as China. However, the region is focusing on innovation, sustainability, and increasing the use of electric arc furnaces to stay competitive. The European Union’s focus on reducing carbon emissions and adhering to stricter environmental regulations is also shaping the market dynamics. Germany is estimated to hit USD 50.59 billion in 2026, while France is likely to gain USD 22.18 billion in 2025.

Latin America

Mexico and Brazil are the leading countries in Latin America. The increasing adoption of products in the consumer goods, metal products, and mechanical equipment industries will drive market growth.

Middle East & Africa

The Middle East & Africa is anticipated to hold USD 27.31 billion in 2026. The growth of the construction sector in the Middle East & Africa is expected to drive market expansion in the coming years. This is largely due to an increasing number of companies developing industrial facilities and enhancing manufacturing capacities, which will support the overall growth of construction activities in the region. Saudi Arabia is likely to stand at USD 18.87 billion in 2025.

Competitive Landscape

Key Industry Players

Business Expansion in the Construction Industry to Retain More Customers is the Key Strategic Initiative Implemented by Companies

Key players such as ArcelorMittal, POSCO, ThyssenKrupp Steel Europe, Tata Steel, and Nippon Steel Corporation focus on product innovation, capacity expansion, collaborations, and acquisitions. Nippon Steel Corporation is a steel producer that utilizes both hot and cold-rolled processes to manufacture steel-based products for its customers. Additionally, the company is actively involved in research and development, acquisitions, and innovation to meet consumer demands. Mergers and acquisitions among major steel producers are driving efficiencies, expanding production capacities, and enabling these companies to adapt better to the rapidly changing market conditions.

List of Top Flat Steel Companies

- ArcelorMittal (Luxembourg)

- NIPPON STEEL CORPORATION (Japan)

- Ezz Steel (Egypt)

- Tata Steel (India)

- HBIS Group (China)

- Voestalpine Group (Austria)

- ThyssenKrupp Steel Europe (Germany)

- Metals USA (U.S.)

- POSCO (South Korea)

- Yieh Corp. (Taiwan)

KEY INDUSTRY DEVELOPMENTS

- June 2022: Nippon Steel Corporation announced the offering of a 30-year service life warranty program for ZEXEED, the company's high corrosion-resistant coated steel in relation to perforation caused by corrosion in products that satisfy certain requirements. This development will help the company serve its customers efficiently.

- April 2021: Nippon Steel Corporation (Nippon Steel) announced the launch of its new product, ZAM-EX, highly corrosion-resistant coated steel sheets for the global market. This product development will allow the company to gain competence in the market.

- March 2021: ArcelorMittal launched XCarb, an initiative to reduce CO2 emissions during steel manufacturing while focusing on achieving demonstrable progress toward carbon-neutral steel. The company invested in several initiatives to reduce carbon emissions from the blast furnace.

- October 2020: ArcelorMittal Europe announced a CO2 technology strategy to produce the first green steel solutions for customers. With this initiative, the company aims to deliver its 30% CO2 emissions target by 2030 and achieve net zero by 2050. Also, the company is implementing projects in almost all flat product sites to use gases from different sources for blast furnace injection to reduce CO2 emissions.

REPORT COVERAGE

The flat steel market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, types, applications, and products. Also, it provides quantitative data in terms of volume and value, market analysis, research methodology for market data, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, it encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.4% between 2026 and 2034 |

|

Unit |

Value (USD Billion), Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 579.32 billion in 2026 and is projected to record a valuation of USD 948.78 billion by 2034.

Registering a CAGR of 6.4%, the market will exhibit considerable growth during the forecast period.

The Hot Rolled Coil (HRC) segment was the leading type in the market in 2026.

Robust demand for the product from the construction industry is the key factor driving the market.

China held the highest share of the market in 2026.

ThyssenKrupp Steel Europe, Nippon Steel Corporation, ArcelorMittal, and Tata Steel are the top players in the market.

The rapid growth of the construction and automotive industries is anticipated to boost the consumption of the product.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us