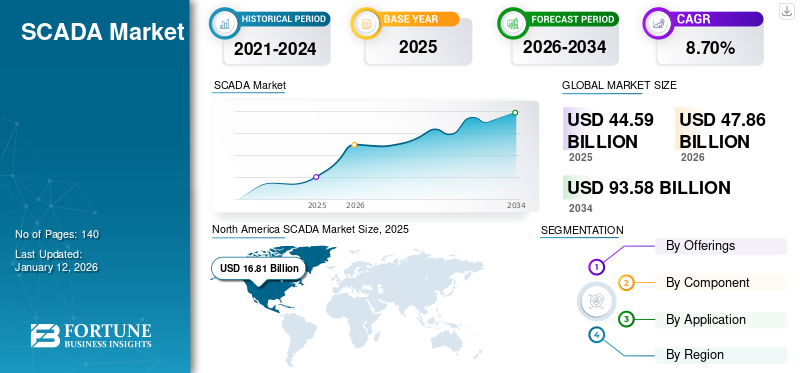

SCADA Market Size, Share & Industry Analysis, By Component (Hardware, Software and Services), By Deployment (Cloud, On Premise and Hybrid), By Application (Process Monitoring & Visualization, Alarm Management, Energy & Power Management, Historian/Time-Series Data and Others), By End User (Utilities & Energy, Water & Wastewater, Process Industries, Discrete Manufacturing, Buildings & Critical Facilities and Others), and Regional Forecast, 2026 – 2034

SCADA Market Size and Future Outlook

The global SCADA market size was valued at USD 12.90 billion in 2025. The market is projected to grow from USD 13.87 billion in 2026 to USD 26.59 billion by 2034, exhibiting a CAGR of 8.5% during the forecast period.

Supervisory Control and Data Acquisition (SCADA) is a combination of software and hardware components that are primarily used in industries to gather real-time data, monitor and control processes, equipment and plants remotely or on-site, to improve efficiency and safety.

The market is evolving from a primarily on premise industrial monitoring layer into a broader, cyber-resilient, hybrid operations platform. This growth is being supported by industrial modernization budgets, grid and utility infrastructure upgrades, and rising operational reliability expectations across distributed assets.

End users are increasingly prioritizing scalable architectures, rapid deployment and interoperability with heterogeneous field devices and protocols, while vendors are responding with more modular licensing, web and mobile access as well has platform independence for large, complex deployments. Siemens positions SIMATIC WinCC Open Architecture for large-scale, high-complexity projects with web and mobile access, reflecting the move toward wider, secure accessibility.

Furthermore, leading SCADA vendors such as Siemens, Schneider Electric, ABB, Rockwell Automation, Emerson, Honeywell and Yokogawa are sharpening their positioning around hybrid operations, power and utility modernization, and secure remote access. Schneider Electric markets Geo SCADA Expert as a platform that can be deployed on-premises or in cloud environments, aligning with buyer demand for flexible deployment and lifecycle modernization.

SCADA MARKET TRENDS

Rising Shift from On-premise to Hybrid Architectures is a Prominent Trend in Market

The market is increasingly moving away from purely on premise deployments toward hybrid architectures as industries needs the reliability of local control combined with the scalability of cloud services. In critical environments such as utilities and manufacturing, real-time control and safety functions are still kept close to the site to minimize latency and operational risk. Another reason for the shift is improved interoperability, where hybrid models make it easier to integrate SCADA data with enterprise systems for performance management and compliance. Cybersecurity is also shaping this trend, as hybrid architectures allow segmented designs where sensitive control layers remain isolated while higher-level monitoring can be securely accessed. Vendors increasingly position their SCADA platforms to support both on premise and cloud environments, reflecting customer demand for flexibility. For instance,

- In April 2025, As per Utility of the Future Survey 103 utility professionals, highlighted that utilities are actively modernizing grid operations and adopting more digital operating models to improve reliability and visibility across distributed assets. This modernization direction aligns strongly with hybrid SCADA architectures.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Modernization of Aging Industrial and Utility Infrastructure Propels Market Growth

Many utilities, water networks, and industrial plants still rely on older SCADA and control platforms that lack real-time visibility, advanced alarming and flexible integration with newer field devices. Upgrades are often triggered by the need to improve reliability, reduce unplanned downtime and extend asset life through better monitoring and preventive maintenance. Modern SCADA platforms also enable smoother expansion as facilities add new substations, pump stations, production lines, or remote sites that must be supervised centrally.

Similarly, utilities are investing in digital grid programs that require improved telemetry, event handling, and operator decision support for faster fault detection and restoration. For instance,

- In August 2025, TD World reported that Southern California Edison accelerated fault detection using its AWARE system, which uses waveform signatures to detect and classify grid faults to mitigate outages and speed restoration. This directly supports the need for improved telemetry and operator decision support for faster detection and restoration.

This creates sustained demand for SCADA software upgrades, services for migration and integration, and new architectures that support both legacy assets and modern digital operations.

MARKET RESTRAINTS

Cybersecurity Risks and Fear of Increased Attack Surface Restricts Market Growth

Cybersecurity risks and the fear of expanding the attack surface are major restraints on SCADA market growth, especially as operational networks become more connected and accessible. Many utilities and industrial operators remain cautious about modernizing legacy SCADA environments as integrating remote access, web clients, or cloud-linked monitoring can introduce new entry points for attackers.

In critical infrastructure, a short disruption can have severe consequences, hence organizations often delay upgrades until security controls and governance are fully validated. The cost and complexity of implementing strong segmentation, identity controls, continuous monitoring, and secure communications can also increase project timelines and budgets. As a result, some organizations prefer incremental upgrades rather than full modernization, limiting short-term market expansion even though security concerns ultimately push long-term investment.

MARKET OPPORTUNITIES

Rising Industrial Digital Transformation and Smart Manufacturing to Offer Market Growth Opportunities

Industrial digital transformation and smart manufacturing are creating strong growth opportunities for SCADA as factories seek better real-time visibility, control, and performance monitoring across production lines. Manufacturers are increasingly connecting equipment, sensors, and control systems to capture operational data that can improve throughput, quality, and uptime. SCADA platforms support this shift by enabling centralized dashboards, advanced alarming and historical data capture that helps identify bottlenecks and recurring faults. Smart manufacturing initiatives also require easier integration between plant-floor operations and higher-level systems for reporting and performance management.

As multi-site manufacturing expands, SCADA becomes more valuable for standardizing monitoring and control across facilities and enabling remote supervision. This drives demand not only for software upgrades but also for integration, cybersecurity, and modernization services as companies move toward connected and data-driven operations.

Segmentation Analysis

By Component

Rising Demand for Advanced Visualization by SCADA Software to Propel Segmental Growth

Based on the component, the market is divided into hardware (Programmable Logic Controller (PLC), Remote Terminal Unit (RTU), Human-Machine Interface (HMI) and Others), software (Plant /Factory SCADA, Infrastructure/Utility SCADA, Machine SCADA/Line SCADA, Power SCADA (Electrical distribution focused), and services.

Software accounted for the largest market share and anticipated to rise with a CAGR of 10.3% over the forecast period as industries are modernizing legacy control environments with more scalable SCADA platforms that support multi-site operations. Demand is rising for advanced visualization, alarm/event management, and historian capabilities that improve uptime and decision-making in utilities and industrial plants.

The shift toward hybrid deployment also increases software spending as organizations adopt web clients, centralized monitoring and cloud-enabled analytics while keeping control functions local. In parallel, utilities are investing in grid modernization and distributed asset management, which relies heavily on SCADA software for telemetry, event handling, and faster fault detection.

By Deployment

Rising Need for Ultra Reliable Real Time Control to Propel on Premise Deployment Growth

Based on the deployment, the market is divided on-premise, cloud, and hybrid.

On premise accounted for the largest SCADA market share mainly due to need for ultra-reliable real time control in critical operations such as utilities, oil and gas and manufacturing. Many operators prefer keeping control servers and core functions on site to minimize latency and ensure continuity even during network disruptions. On premise deployments also align with strict safety, regulatory, and data governance requirements, especially where sensitive operational data must remain within the facility. For instance,

- In June 2025, Le Sueur Municipal Utilities presented a council action item to replace and upgrade its electric utility SCADA system, explicitly budgeting for a primary server, backup server, on-premise operator PCs with multiple monitors, enhanced alarming, real-time notifications, and robust backup capabilities.

Cloud is anticipated to rise with a CAGR of 15.3% over the forecast period driven by demand for centralized monitoring across distributed assets and easier scaling across multiple sites.

By Application

Increasing Use of Process Monitoring & Visualization to Propel Segmental Growth

Based on the application, the market is divided into process monitoring & visualization, alarm management, energy & power management, historian/time-series data and others.

Process monitoring & visualization accounted for the largest market share mainly due to its role as the core operational layer for real time supervision of industrial and utility processes. Most SCADA deployments start with operator dashboards, trends and graphical views that help teams track equipment status, process parameters and production conditions continuously. These capabilities improve uptime by enabling faster detection of abnormal behavior and reducing reliance on manual inspections across complex plants and distributed assets. Visualization also supports safer operations by giving operators clear, centralized awareness of alarms, process deviations and equipment health in one interface.

Process monitoring & visualization is anticipated to rise with a CAGR of 14.2% over the forecast period driven by increasing adoption of multi-site operations, remote monitoring needs and modernization of legacy control rooms into web and mobile enabled interfaces.

By End User

To know how our report can help streamline your business, Speak to Analyst

Rising Large Ticket and Long Tenor Financing by Construction and Real Estate to Boost Utilities and Energy Segment Growth

Based on end user, the market is segmented into utilities & energy, water & wastewater, process industries, discrete manufacturing, buildings & critical facilities, and others.

In 2025, the utilities and energy dominated the global market as this sector operates large-scale, mission-critical and geographically distributed assets such as transmission and distribution networks, substations, renewable plants, pipelines, and storage facilities that require continuous monitoring and remote control. Utilities also run 24/7 operations where real-time telemetry, event handling, and alarm management are essential to maintain reliability and restore service quickly during faults. In addition, grid modernization programs, renewables integration and electrification initiatives are increasing the volume of connected assets and operational data, which directly expands demand for SCADA upgrades and new deployments across energy infrastructure.

Discrete manufacturing is projected to grow at a CAGR of 10.3% over the forecast period due to rising adoption of smart manufacturing and Industry 4.0 programs that require better line visibility, faster fault diagnosis and higher equipment utilization.

SCADA Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

North America

North America SCADA Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2024, valuing at USD 4.39 billion, and also maintained the leading share in 2025, with USD 4.64 billion. The North America market growth is driven by a combination of infrastructure modernization and new operational requirements across utilities and industrial sectors. A large installed base of aging grid, water and industrial control systems is pushing utilities and plants to upgrade SCADA platforms for higher reliability, better alarm and event handling and improved operator decision support in North America countries.

U.S SCADA Market

Based on North America’s strong contribution, the U.S. market was valued at USD 3.56 billion in 2025, accounting for roughly 28.0% of global SCADA sales.

Europe

Europe is projected to record a growth rate of 6.7% in the coming years, which is the second highest among all regions, and reached a valuation of USD 3.49 billion by 2025. The Europe market growth is driven by rising adoption of digital operations in water and wastewater networks, where remote pumping stations and treatment plants require continuous supervision. Cybersecurity and regulatory pressure are encouraging upgrades to more secure SCADA architectures with stronger access control, segmentation, and auditing capabilities. In addition, growth in critical facilities such as data centers and large transport infrastructure is increasing the need for power monitoring and electrical distribution-focused SCADA deployments across Europe.

U.K SCADA Market

The U.K. market in 2025 reached USD 0.59 billion, representing roughly 5.0% of global SCADA revenues.

Germany SCADA Market

Germany’s market reached USD 0.72 billion in 2025, equivalent to around 6.0% of global SCADA sales.

Asia Pacific

Asia Pacific was valued at USD 3.42 billion in 2025 and secure the position of the third-largest region in the market. The market is expanding robustly due to increasing industrial automation and infrastructure modernization driving demand for real-time monitoring and control systems across sectors such as energy, manufacturing and water management. Further, China, India, and Japan are among the leading adopters in the region as industries leverage SCADA solutions to optimize processes and support digital transformation initiatives.

Japan SCADA Market

The Japan market in 2025 was at USD 0.50 billion, accounting for roughly 4.0% of global SCADA revenues. Japan’s market growth is attributed to ongoing modernization of aging industrial plants and utility infrastructure, where operators are upgrading control and monitoring systems to improve reliability and reduce downtime. The product demand is also supported by increased investment in power grid resilience and integration of renewables, which requires stronger telemetry, event handling and centralized supervision of distributed assets.

China SCADA Market

China’s market is projected to be one of the largest worldwide, with 2025 revenue valued at around USD 1.09 billion, representing roughly 8% of global SCADA sales.

India SCADA Market

The India market in 2025 was valued at USD 0.60 billion, accounting for roughly 5% of global SCADA revenues.

South America and Middle East & Africa

The South America and Middle East & Africa regions are expected to witness moderate growth in the market during the forecast period. The South America market reached a valuation of USD 0.83 billion in 2025. South America and Middle East & Africa market growth is owing to expanding investments in power, water, and oil and gas infrastructure that require reliable remote monitoring and control across geographically dispersed assets. Utilities in these regions are upgrading grid and substation automation to improve service reliability and support new generation capacity, including renewables. Industrial development and new project buildouts, often led by EPC-led deployments, are also increasing adoption of SCADA for operational visibility and safety. In the Middle East & Africa, the GCC reached a value of USD 0.23 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Are Expanding Hybrid-Capable SCADA Platforms that Helping to Propel Market Progress

Market players are expanding hybrid-capable SCADA platforms to help customers modernize operations without compromising the reliability of on-site control. This approach allows critical real-time functions to remain local while enabling centralized monitoring, reporting, and analytics through cloud-connected layers. Hybrid capability also supports faster multi-site rollout, since new assets can be integrated and supervised across locations with less infrastructure buildout.

Vendors are strengthening web and mobile access, making it easier for operators and maintenance teams to respond to alarms and performance issues remotely. In addition, hybrid-ready platforms improve interoperability by connecting SCADA data with enterprise systems for performance management and compliance. This strategy is accelerating adoption as it offers flexibility to upgrade legacy environments in stages while preparing operations for future digital expansion.

LIST OF KEY SCADA COMPANIES PROFILED

- Siemens (Germany)

- Schneider Electric (France)

- ABB Group (Switzerland)

- Rockwell Automation (U.S.)

- Honeywell (U.S.)

- Emerson (U.S.)

- Yokogawa Electric (Japan)

- Mitsubishi Electric (Japan)

- AVEVA (U.K.)

- Inductive Automation (U.S.)

- ICONICS (U.S.)

- GE Digital (U.S.)

- Hitachi Energy (Switzerland)

- OSlsoft (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2025: Tatsoft launched FrameworX 10.1, modern SCADA platform. This platform unifies SCADA depth, UNS architecture, and AI-ready foundation into one seamless solution and digital transformation.

- September 2025: Inductive Automation launched Ignition 8.3, a comprehensive update to its industrial application platform, Ignition by Inductive Automation. Ignition provides tools for building solutions in SCADA, IIoT, MES, HMI, and more.

- May 2025: Relatech S.p.A. announced the acquisition of the product suite of ConneXSoft GmbH, specializes in SCADA extension software for building and energy management. The acquisition will help to serve the local market and provide dedicated support to customers and the Eco channel.

- April 2025: Emerson launched DeltaV SaaS SCADA with Edge Connect, a flexible, preconfigured edge solution engineered to deliver more seamless operational technology (OT) data mobility out of the box. It is designed to connect existing field devices to the cloud-hosted DeltaV SaaS SCADA system in minutes.

- March 2025: Quorum Software acquired zdSCADA, an in cloud-based supervisory control and data acquisition (SCADA) technology provider. This acquisition enhances Quorum’s comprehensive Upstream On Demand suite, integrating best-in-class SCADA to provide real-time well data for production management.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.5% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, By Deployment, By Application, By End User, and Region |

|

By Component |

· Hardware o Programmable Logic Controller (PLC) o Remote Terminal Unit (RTU) o Human-Machine Interface (HMI) o Others · Software o Plant / Factory SCADA o Infrastructure / Utility SCADA o Machine SCADA / Line SCADA o Power SCADA (Electrical distribution focused) · Services |

|

By Deployment |

· Cloud · On Premise · Hybrid |

|

By Application |

· Process monitoring & visualization · Alarm management · Energy & power management · Historian / time-series data · Others |

|

By End User |

· Utilities & Energy · Water & Wastewater · Process Industries · Discrete Manufacturing · Buildings & Critical Facilities · Others |

|

By End User |

· North America (By Component, By Deployment, By Application, By End User and Country) o U.S. o Canada o Mexico · Europe (By Component, By Deployment, By Application, By End User and Country) o Germany o U.K. o France o Spain o Italy o Russia o Benelux o Nordics o Rest of Europe · Asia Pacific (By Component, By Deployment, By Application, By End User and Country) o China o Japan o India o South Korea o ASEAN o Oceania o Rest of Asia Pacific · South America (By Component, By Deployment, By Application, By End User and Country) o Brazil o Argentina o Rest of Latin America · Middle East & Africa (By Component, By Deployment, By Application, By End User and Country) o Turkey o Israel o GCC o South Africa o North Africa o Rest of Middle East & Africa |

Frequently Asked Questions

According to Fortune Business Insights, the global market value stood at USD 12.90 billion in 2025 and is projected to reach USD 26.59 billion by 2034.

In 2025 the market value stood at USD 4.64 billion.

The market is expected to exhibit a CAGR of 8.5% during the forecast period of 2026-2032.

By end user, the utilities & energy is expected to lead the market.

Rising modernization of aging industrial and utility infrastructure propels market growth.

Siemens, ABB, Rockwell, Honeywell are the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us