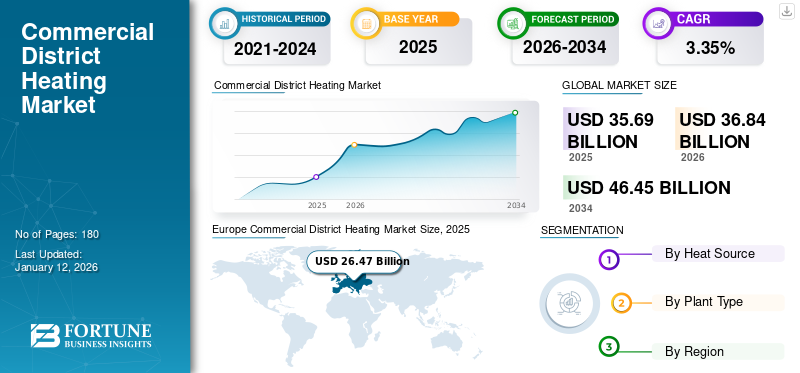

Commercial District Heating Market Size, Share & Industry Analysis By Heat Source (Coal, Natural Gas, Renewable, Oil & Petroleum Products, and Others) By Plant Type (Boiler, CHP, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global commercial district heating market size was valued at USD 35.69 billion in 2025 and is projected to grow from USD 36.84 billion in 2026 to USD 46.45 billion by 2034, exhibiting a CAGR of 3.35% during the forecast period. Europe dominated the commercial district heating market with a share of 74.16% in 2025.

District heating systems offer efficient and centralized heating for commercial applications, distributing heat from a central plant through a network of insulated pipes. This approach can be more efficient and cost-effective than individual heating systems, especially in large commercial buildings. District heating systems can provide consistent and reliable heating, enhancing comfort in commercial buildings.

Statkraft is one of the leading companies holding considerable global market share. Statkraft offers district heating solutions for commercial applications, using a network of insulated pipes to transport hot water for heating and cooling. It utilizes various energy sources, including waste heat, renewable fuels, and surplus energy from industries, to heat the water. Statkraft also provides district heating for building sites, snow melting, and sidewalk heating.

MARKET DYNAMICS

COMMERCIAL DISTRICT HEATING MARKET TRENDS

Integration of Renewable Energy and Waste Heat Sources to Support Market Growth

The integration of renewable and waste heat sources is on rise in advancing global commercial district heating systems. In this technique the energy is utilized from sources such as biomass, solar thermal, geothermal, and industrial waste heat, these systems significantly reduce reliance on fossil fuels and lower greenhouse gas emissions. Commercial buildings, which often have high and consistent heating demands, benefit from the stable and efficient supply these sources provide. Additionally, tapping into local renewable and excess heat improves energy security and minimizes transmission losses. This approach supports sustainability goals while also offering cost savings and long-term energy resilience for commercial infrastructure.

MARKET DRIVERS

Rising Energy Efficiency and Sustainability Need to Support Market Growth

The market is experiencing substantial growth, driven by the increasing need for energy efficiency, sustainability, and growing urbanization of commercial areas. District heating systems offer a centralized, efficient heating solution that can be combined with renewable energy sources, reducing carbon emissions and improving overall energy performance. District heating systems enable commercial establishments such as office complexes, hotels, medical facilities, and schools to take advantage of centralized heat generation and distribution. This unified method minimizes energy waste that typically occurs with separate heating systems, resulting in decreased operational expenses, enhanced energy efficiency, and emission reduction.

MARKET RESTRAINTS

Rising in High Initial Capital Costs to Restrain Market Expansion

A significant obstacle for the market is the substantial initial investment needed for infrastructure development, encompassing the building of heat generation facilities, distribution systems, and connections to individual buildings. This upfront expense discourages possible investors and restricts the growth of the market. Updating older buildings and their heating systems to link them to district heating networks is both technically difficult and costly. This process often involves significant renovations and disturbances to current structures, which can deter property developers.

MARKET OPPORTUNITIES

Government Initiatives are Supporting the Market Growth

Commercial district heating is increasingly supported by government initiatives aimed at promoting energy efficiency, renewable energy, and reducing carbon emissions. These initiatives often include subsidies, regulations, and partnerships to encourage the development and expansion of district heating networks, particularly those utilizing renewable energy sources. For instance, in July 2022, the U.S. Department of Energy (DOE) made an investment of USD 10 million for six initiatives aimed at promoting the use of clean energy technologies. As part of this initiative, three projects were selected for developing and showcasing cutting-edge district energy systems. These systems are capable of utilizing low-carbon fuels or renewable energy sources alongside adaptable combined heat and power and energy storage systems.

Download Free sample to learn more about this report.

Segmentation Analysis

By Heat Source

Rising Global Focus towards Clean Energy to Lead the Growth of Renewables in the Market

Based on heat source, the market is classified into coal, natural gas, renewable, oil & petroleum products, and others.

Renewable is anticipated to grow fastest owing to recent progress in insulation technology and digital innovations which has increased the availability of low-temperature renewable energy options, such as low-temperature geothermal energy, solar thermal energy, and waste heat resources. In numerous regions, these energy sources are easily accessible.

Natural gas is anticipated to hold a considerable share in the global market. Natural gas power plants are significantly more cost-effective than fossil fuel plants and have a lower impact on the environment. There is a plentiful supply of natural gas available. Several facilities are being set up in numerous locations globally. This trend is anticipated to promote the growth of natural gas in the market.

By Plant Type

Combined Heat & Power (CHP) Plant Anticipated to Grow Fastest Owing to its High Efficiency

On the basis of plant type, the market is segmented into boiler, CHP, and others.

CHP holds the most significant share in the market as commercial district heating system powered by a CHP plant offers significant benefits, including increased efficiency, reduced emissions, lower operating costs, and improved energy security. CHP plants generate both electricity and usable heat from a single fuel source, making them highly efficient. This approach also reduces reliance on the traditional electricity grid, enhancing resilience.

The need for boiler plants is influenced by their adaptability and economic efficiency in addressing different heating demand patterns. These plants can operate on multiple fuel types, such as natural gas, biomass, coal, and oil, offering operational flexibility and protection against changes in fuel prices. This adaptability enables district heating providers to respond to the availability of local fuels and comply with regulatory standards.

Commercial District Heating Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

Europe Commercial District Heating Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In North America, the commercial sector is a significant user of district heating, driven by cost-effectiveness, efficiency, and environmental goals. District heating systems offer centralized heat production and distribution, reducing energy waste and lowering operational costs compared to individual heating systems. The commercial sector, encompassing buildings including office spaces.

Europe

Commercial district heating is largely adopted in Europe owing to supportive policies and regulations aimed at reducing greenhouse gas emissions. The European Union's Renewable Energy Directive and other policies mandate increased renewable energy use, pushing member states to integrate renewable and waste heat sources into district heating systems. Europe dominated the market with a valuation of USD 26.47 billion in 2025 and USD 27.31 billion in 2026.

For instance, in April 2024, Poland’s Ministry of Climate and Environment launched the Renewable Heat Source for Heating program, whereby USD 500 million is made available in the form of grants and loans. The funding will support renewable heating technologies such as heat pumps, solar collectors, and geoenergy thermal systems, as well as heating network connections and heat storage facilities.

Asia Pacific

The swift urbanization and modernization taking place in the Asia Pacific region are fueling the expansion of the district heating market. Nations such as China, South Korea, and Japan are enhancing their district heating systems to satisfy the increasing need for heating in urban centers undergoing population growth and economic advancement.

Rest of the World

The market in the rest of the world region is experiencing strong growth, driven by increasing urbanization, rising disposable incomes, and environmental concerns. Key factors propelling this growth include government initiatives supporting cleaner heating technologies and sustainable urban development, advancements in technology for enhanced efficiency, and a growing emphasis on energy efficiency and renewable energy sources.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Acquisition to Seize Growing Opportunities in the Growing Commercial District Heating Market

Various strategic measures such as mergers and acquisitions play crucial roles in helping market players to expand their business presence. For instance, in November 2024, Adven – a district heating provider, acquired Sweden-based district heating firm Österlens Kraft Fjärrvärme AB. Adven will be managing the operations and leveraging their expertise in district heating.

LIST OF KEY COMMERCIAL DISTRICT HEATING COMPANIES PROFILED

- ALFA LAVAL (Sweden)

- Xylem (U.S.)

- Ramboll (Denmark)

- EnBW (Germany)

- Statkraft (Norway)

- ON (U.K.)

- Engie (France)

- Vicinity Energy (U.S.)

- ARANER (U.S.)

- Cordia (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: In the U.K., the Green Heat Network Fund (GHNF) awarded around $36 million to four low carbon heat network projects across England in Leeds, London, Maidstone, and Cranbrook.

- October 2024: Uniper SE plans to divest its district heating operations in the Ruhr region following the state aid approval decision from the European Commission dated December 20, 2022. Uniper Wärme GmbH owns and operates around 700 km of district heating network in Ruhr.

- September 2024: The government of the U.K. allocated approx. USD 65 million for low-carbon heat network projects across London and the North of England. The projects will connect domestic and commercial developments to district heat networks.

- April 2024: The heating project in the Borsigstrasse waste incineration plant (MVB) in east Hamburg has started its operations, where district heating is generated using urban waste.

- December 2023: Johnson Controls introduced the York Cyk, a water-to-water heat pump for commercial buildings. It is designed for medium to large commercial buildings, university campuses, hospitals, industrial processes, and district energy applications.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.35% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (GWth) |

|

Segmentation |

By Heat Source

|

|

By Plant Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 36.84 billion in 2026 and is projected to reach USD 46.45 billion by 2034.

In 2025, the market value stood at USD 26.47 billion.

The market is expected to exhibit a CAGR of 3.35% during the forecast period.

The CHP segment led the market, by plant type.

Energy efficiency and sustainability need to support market growth

Alfa Laval, E.ON, and Statkraft are the top players in the market.

Europe dominated the global market share in 2025.

Government initiatives supporting market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us