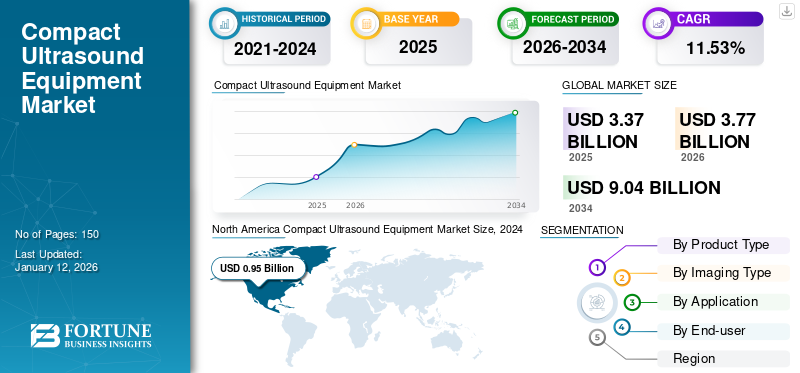

Compact Ultrasound Equipment Market Size, Share & Industry Analysis, By Product Type (Built-in-console and Touchscreen), By Imaging Type (2D Imaging, 3D Imaging, and 4D Imaging), By Application (Radiology, Gynecology, Cardiology, and Others), By End-user (Hospitals & Clinics, Diagnostics Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global compact ultrasound equipment market size was valued at USD 3.37 billion in 2025. The market is projected to grow from USD 3.77 billion in 2026 to USD 9.04 billion by 2034, exhibiting a CAGR of 11.53% during the forecast period. North America dominated the compact ultrasound equipment market with a market share of 40.75% in 2025.

Compact ultrasound equipment refers to ultrasound machines that are designed to be smaller and lighter than conventional console-style models, enhancing their portability and suitability for diverse clinical settings, particularly in areas with limited space or where mobility is essential. These systems typically provide similar or equivalent image quality and functionalities as their larger versions but in a more convenient and transportable design. The market growth is driven by the high burden of chronic illnesses and the growing focus on early detection and preventive healthcare measures.

- For example, as per the data provided by Springer Nature Limited in February 2025, the number of urinary tract infection (UTI) cases had reached 8.6 million, with an age-standardized prevalence rate (ASPR) of 105.4 per 100,000 individuals by the end of 2021.

Furthermore, the market is semi-consolidated with the presence of key players, such as Koninklijke Philips N.V., FUJIFILM Corporation, CANON MEDICAL SYSTEMS CORPORATION, and Konica Minolta, Inc., among others. Several market players are undergoing strategic partnerships to enhance their product offerings in the global market.

- For instance, in June 2021, Konica Minolta, Inc. signed an agreement with Mercury Medical for the distribution of ultrasound solutions in the anesthesia market. The agreement covers the distribution of the SONIMAGE HS2 compact ultrasound system throughout the U.S.

Furthermore, the increasing adoption of point-of-care (POC) diagnostics and advancements in ultrasound technology for effective diagnosis and treatment of several diseases are some of the additional factors supplementing market growth.

MARKET DYNAMICS

Market Drivers

Growing Prevalence of Chronic and Rising Geriatric Population is Likely to Propel Market Growth

Chronic illnesses frequently necessitate early and accurate diagnosis to ensure effective treatment. Ultrasound imaging serves as a non-invasive and economical diagnostic method that is extensively utilized for the detection and monitoring of various conditions, including cardiovascular diseases, cancer, and kidney disorders. The increasing incidence of these chronic illnesses is contributing to a rise in the use of ultrasound imaging globally.

- For example, as per the data provided by the National Institutes of Health (NIH) in September 2024, over 808,000 people in the U.S. were living with end-stage renal disease in 2023.

- Also, as per the data provided by the National Center for Biotechnology Information (NCBI) in January 2025, roughly 2.0 million people are anticipated to be diagnosed with cancer in the U.S. in 2025.

Additionally, the rising geriatric population globally further fuels the demand for diagnostic tools such as ultrasound, as this demographic pool is more prone to chronic conditions that require regular diagnosis and monitoring.

- For instance, as per the data provided by the World Health Organization (WHO) in February 2025, the number of people aged 60 and above worldwide is projected to increase from 1.1 billion in 2023 to 1.4 billion by the end of 2030.

- Similarly, as per the data provided by the U.S. Centers for Disease Control and Prevention in May 2024, the prevalence of chronic disease increases as the population ages. Around 34.0% of people aged 65 years or older were living with chronic kidney disease (CKD) in the U.S. in 2023.

The growing prevalence of these disorders increases the demand for point-of-care ultrasound devices, thus driving the compact ultrasound equipment market growth.

Market Restraints

Rising Product Recalls and Shortage of Trained Technicians Impede Market Growth

Despite significant advancements in ultrasound imaging technology, various issues, including product recalls, regulatory warnings, and defective items, negatively affect the reputation of leading companies in the industry. Consequently, this leads to reduced sales, adversely impacting revenue and diminishing the brand image of such companies in the global market.

- For instance, in March 2024, Koninklijke Philips N.V. recalled its Class 2 5000 Compact Series Ultrasound Systems as these devices can burn patients due to temperature control issues.

- Similarly, in August 2021, Koninklijke Philips N.V. issued a Class 2 recall for its compact Sparq ultrasound device. This action was taken due to a problem related to battery data, which led to occasional system shutdowns, irrespective of the battery's actual condition or the presence of alternating current power.

Additionally, the rise in product recalls, coupled with a shortage of skilled technicians in countries such as Australia, the U.K., and Canada, is anticipated to restrict the market's growth potential throughout the forecast period.

- For example, according to data provided by the Clinical Radiology U.K. workforce census report in June 2024, the U.K. had a 30.0% shortage of clinical radiologists in 2023, which is expected to rise to 40.0% by the end of 2028 if no action is taken.

Market Opportunities

Increase in the Therapeutic Applications of Ultrasound Provides Lucrative Market Growth Opportunities

Traditionally, ultrasound had primarily served as a tool for diagnostic imaging; however, the ongoing advancements in technology are broadening the scope of these devices to address various medical conditions. This wide range of applications is prompting major market players to concentrate on researching novel ultrasound equipment. These can be utilized for cancer treatment, wound healing, neuromodulation, pain management, and even ultrasound-guided drug delivery and development activities in the global market.

- For instance, in May 2021, Insightec received market approval from the Brazilian Health Regulatory Agency (ANVISA) for its Exablate 4000 (Exablate Neuro) platform, which utilizes MR-guided, focused ultrasound to target deep brain tissue non-invasively. This device is used for treating essential tremor, tremor-dominant Parkinson's disease, and neuropathic pain that is resistant to medication.

Market Challenges

High Procuring Costs and Presence of Alternative Diagnostic Tools to Ultrasound Equipment are Major Market Challenges

The market encounters several challenges due to the availability of alternative diagnostic technologies, including CT (computed tomography), MRI (magnetic resonance imaging), and X-ray, which may provide more extensive imaging options. The operational costs of compact ultrasound devices are relatively low; however, the initial cost of acquiring advanced ultrasound devices is prohibitive for smaller healthcare providers, restricting adoption and expansion in various healthcare settings, especially in low-income regions.

- For instance, the price of compact ultrasound equipment typically ranges from USD 2,500 to USD 5,000.

Furthermore, the limited healthcare infrastructure in low-income areas complicates the market penetration of ultrasound devices. Such circumstances pose challenges to the market's growth.

Other Market Challenges

Shortage of Skilled Workforce is a Key Challenge for Market Growth

The sophisticated nature of ultrasound systems demands skilled operators, and many regions struggle with a shortage of trained technicians and sonographers who can effectively perform diagnostic procedures using compact ultrasound equipment.

Download Free sample to learn more about this report.

COMPACT ULTRASOUND EQUIPMENT MARKET TRENDS

Increasing Launch of Artificial Intelligence Integrated Ultrasound Devices is Considered a Significant Market Trend

Several prominent market players are focusing on the development of sophisticated devices and systems that incorporate artificial intelligence (AI). The purpose of these AI algorithms is to enhance both image quality and interpretation. They can analyze ultrasound images in real time, providing healthcare professionals with valuable insights that aid in accurate diagnoses. Additionally, the integration of AI into these devices improves the precision and efficiency of ultrasound examinations, leading to improved patient outcomes. This initiative aims to address specific limitations of traditional devices, such as the lengthy duration of examinations, poor image quality in certain instances, and the heavy reliance on technicians for image acquisition and interpretation. Consequently, the introduction of advanced AI-driven imaging systems by key players represents a significant trend that is enhancing the market growth throughout the forecast period.

- For instance, in March 2025, Koninklijke Philips N.V. unveiled its latest artificial intelligence (AI)-enabled Compact Ultrasound 5500CV portable ultrasound system in the global market.

SEGMENTATION ANALYSIS

By Product Type

Emphasis of Market Players on Launch of Console-based Ultrasound Systems to Drive Built-in-console Segment’s Growth

On the basis of product type, the market is divided into built-in-console and touchscreen.

The built-in-console segment is anticipated to dominate the market during the forecast period. The growing focus of market players on the launch of novel console-based compact ultrasound machines to expand their product portfolio is one of the important factors driving segmental growth.

- For example, in November 2024, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. announced the launch of its Consona-Series, a console-based compact ultrasound system, powered by Mindray’s proprietary software-based beamformer Zone Sonography Technology+ (ZST+) in the global market.

Furthermore, the touchscreen segment is projected to grow at a considerable CAGR from 2025-2032, owing to the increasing introduction of touchscreen compact ultrasound systems that support a broad spectrum of diagnostic imaging applications.

By Imaging Type

Increasing Launch of Advanced Imaging Solutions to Contribute to 3D Imaging Segment Growth

Based on imaging type, the market is segmented into 2D imaging, 3D imaging, and 4D imaging.

The 3D imaging segment is anticipated to dominate the market throughout the forecast period, owing to the rising focus of market players on the development and launch of innovative compact ultrasound equipment to provide advanced imaging solutions.

- For example, in November 2022, Koninklijke Philips N.V. announced the launch of a next-generation compact portable ultrasound solution (Philips’ new Compact 5000 Series) at the Radiological Society of North America (RSNA) annual meeting in Chicago, U.S. This innovative device provides 3D imaging for cardiovascular, obstetrics and gynecology, point of care, and general imaging applications to enhance diagnostic precision and procedural efficiency.

The 4D imaging segment is expected to grow moderately during the forecast period. The growth of the segment is mainly attributed to the fact that, unlike traditional 2D or static 3D imaging, 4D imaging provides real-time visualization by offering clinicians a more comprehensive view during examinations.

On the other hand, the 2D imaging segment is projected to experience significant growth during the forecast period. This expansion is primarily driven by the widespread adoption of compact devices equipped with 2D imaging capabilities across various medical disciplines, including cardiology, emergency medicine, musculoskeletal assessments, and point-of-care testing.

- For example, Clarius portable ultrasound scanners featuring 2D imaging are utilized by emergency physicians to rapidly evaluate cardiac function or detect internal bleeding in emergency scenarios.

Furthermore, the increasing prevalence of chronic diseases, increasing product launches, and the escalating use of compact ultrasound devices in surgical procedures are some of the additional factors driving the segmental growth.

By Application

Rise in the Launch of Technologically Advanced Devices Contributed to Radiology Segment Dominance in 2024

Based on application, the market is divided into radiology, gynecology, cardiology, and others.

The radiology segment dominated by accounting for the major proportion of the compact ultrasound equipment market share in 2024. The dominant share of this segment was primarily attributed to the growing launch of portable, AI-enabled, and user-friendly devices that align with the increasing demand for efficient radiological diagnostics globally.

- For example, in March 2025, Wipro GE Healthcare announced the launch of the Versana Premier R3, an AI-enabled ultrasound system designed to enhance clinical efficiency, streamline workflows, and improve diagnostic accuracy.

On the other hand, the others segment is expected to grow at the highest CAGR from 2025-2032. The increasing prevalence of urological diseases, advancements in technologies, increasing product launches, and rising use of compact ultrasound devices during surgical procedures are some of the important factors driving segmental growth.

The gynecology segment held the second-largest market share in 2024, owing to the increasing number of pregnancies and women's health concerns that necessitate accurate diagnosis. Also, increasing regulatory approvals and new product launches for the compact ultrasound devices used for women's health examinations are anticipated to enhance the segment's growth throughout the forecast period.

- For example, in October 2022, Koninklijke Philips N.V. announced that it had received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its newest compact ultrasound system, the innovative 5000 compact series. This device is used for gynecological applications.

Furthermore, the cardiology segment is projected to grow at the second-largest CAGR during the forecast period. The growing prevalence of cardiovascular disease and the increasing need for early diagnosis to avoid cardiac-related complications are expected to boost the demand for ultrasound equipment for cardiology applications.

- For instance, as per the data provided by the British Heart Foundation in January 2025, more than 7.6 million people in the U.K. were living with heart or circulatory diseases.

By End-user

Increasing Hospitalizations for Chronic Diseases to Augment Hospitals & Clinics Segment Growth

Based on the end-user, the market is divided into hospitals & clinics, diagnostic centers, and others.

The hospitals & clinics segment is expected to dominate the market throughout the forecast period. The dominance of this segment is primarily attributed to increasing hospital admissions due to cardiovascular, kidney, gynecological diseases, and pregnancy-related issues.

- For instance, as per the data provided by the Department of Health & Social Care in January 2025, approximately 218,606 patients were hospitalized across the medical facilities of England in 2024 for the treatment of coronary heart disease. Therefore, rising hospitalizations for the treatment of chronic diseases increase demand for accurate diagnosis, thereby driving segmental growth.

Also, the opening of new hospitals and clinics providing ultrasound diagnosis is further supplementing segmental growth.

- For example, in November 2024, the community heart failure clinic at Ely Community Diagnostic Center was launched in ELY, England.

Furthermore, the increasing expenditure on healthcare systems across developing countries, including India, Mexico, Iran, etc., has also been enhancing segmental growth.

The diagnostic centers segment is anticipated to grow moderately during the forecast period. The growth of the segment is due to its widespread use in routine diagnostics and the growing demand for point-of-care services. Also, the growing government focus on opening new diagnostic centers to provide advanced imaging options for a larger population suffering from several medical conditions is supplementing the segment’s growth.

- For example, as per the data provided by the National Health Service (NHS) England in March 2025, the twelve community diagnostic centers (CDCs) were open across London by March 2025. Also, the NHS announced the further opening of two new diagnostic centers by the end of 2025 to provide a range of diagnostic tests that allow patients to receive life-saving checks closer to their homes.

The other segment is anticipated to grow stagnantly during the forecast period due to the rising adoption of compact ultrasound devices at research centers.

COMPACT ULTRASOUND EQUIPMENT MARKET REGIONAL OUTLOOK

In terms of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Compact Ultrasound Equipment Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market with a 40.75% share in 2024. The region generated revenues of USD 1.21 billion in 2025. The dominance of this region is largely attributed to the presence of advanced healthcare infrastructure and the high burden of chronic diseases across the region. In addition, the growing focus of industry players on new product launches is aiding in the U.S. market growth.

- For example, in October 2021, Mindray Medical International introduced the TE7 Max, a novel point-of-care ultrasound system. This system was developed to provide physicians with more extensive and customizable workflow protocols compared to traditional point-of-care ultrasound (POCUS) scanners.

Europe

Europe held a moderate market share in 2024. The growing focus of industry players on new product launches is one of the main factors driving market growth in this region.

- For instance, in July 2023, CANON MEDICAL SYSTEMS CORPORATION launched Aplio Flex and Aplio Go ultrasound systems in the European market. Both systems are compact, maneuverable, and technologically advanced, and developed to fulfill the growing demand for advanced systems to support a wide range of imaging tasks.

Moreover, the increase in the aging population, which upsurges the prevalence of chronic diseases requiring diagnostic imaging, combined with advancements in medical technology, are some of the major factors increasing the adoption of ultrasound systems, supplementing market growth in this region.

Asia Pacific

Asia Pacific accounted for the second-largest share of the market in 2024 and is expected to grow at the highest CAGR throughout the forecast period. The increasing geriatric population suffering from chronic diseases and rising awareness about early diagnosis of diseases are some of the prominent factors boosting market growth in this region.

- For example, the data provided by the Longitudinal Ageing Survey in India (LASI) 2021 report in January 2021 stated that the self-reported prevalence of diagnosed cardiovascular diseases was 34.6% in 2020 in India.

Latin America and Middle East & Africa

The compact ultrasound equipment market in Latin America and the Middle East & Africa is expected to grow at a considerable CAGR during the forecast period. The rising burden of chronic diseases such as diabetes, cancer, hypertension, and others contribute largely to the region's demand for compact ultrasound equipment for the diagnosis of these diseases.

The growing focus of market players on strategic initiatives to improve healthcare in remote communities across Latin America and the Middle East & and Africa is enhancing market growth.

- For example, in July 2024, the Philips Foundation partnered with SAS Brazil to unveil an innovation lab focused on digital health education. This initiative offers high-quality training, utilizes ultrasound technology, and functions as a research platform to assess the effects of emerging healthcare technologies while promoting policy reforms to enhance primary care.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Market Players on New Product Launches to Enhance Their Product Offerings

The global compact ultrasound equipment market consists of key players such as GE HealthCare, CANON MEDICAL SYSTEMS CORPORATION, Koninklijke Philips N.V., and Siemens Healthineers AG, among others, offering a wide range of compact ultrasound diagnostic products. The growing focus of companies on participating in medical conferences to create product awareness among consumers is one of the major reasons for companies' significant share in the global market.

- For example, in March 2025, Koninklijke Philips N.V. showcased the latest version of its AI-powered Compact Ultrasound 5500CV portable ultrasound system at the 2025 American College of Cardiology (ACC) annual scientific session and expo. This event was held from 29th to 31st March 2025 in Chicago, U.S.

Moreover, other market players include FUJIFILM Corporation, Esaote SPA, Butterfly Network, Inc., and several small-scale companies across the globe. These companies are focusing on strategic partnerships and acquisitions to expand their geographic presence in the global market.

List of Key Compact Ultrasound Equipment Companies Profiled

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Butterfly Network, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Konica Minolta, Inc. (Japan)

- FUJIFILM Corporation (Japan)

- Esaote SPA (Italy)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- March 2024 - Butterfly Network, Inc. launched a specialty product, the iQ+ Bladder, in the U.S. This comprises an iQ+ Bladder probe, user-friendly software, a compact rolling cart, a tablet, and a power splitter, all designed to provide an ultrasound-based bladder scanner that enables nurses to obtain automated bladder volume measurements and 3D visualizations quickly.

- January 2024 - Esaote SPA participated in the 2024 Arab Health Program to launch two new ultrasound systems- MyLab A50 and MyLab A70. These systems are compact, battery-operated, lightweight, and mobile in design to meet the demands of most healthcare professionals.

- June 2023 - Koninklijke Philips N.V. announced its participation in the American Society of Echocardiography Event (ASE) 2023, which was held from 23rd to 26th June 2023 in Maryland, U.S. During the event company showcased its Ultrasound Compact 5500CV to create product awareness among the consumers.

- November 2022 - Konica Minolta, Inc. launched Sonimage MX1 Platinum, a point-of-care ultrasound system. The system improves the resolution of ultrasound images by offering speckle reduction and smoothing image graininess.

- October 2022 - Koninklijke Philips N.V. showcased its new Ultrasound 5000 Compact Series at the American College of Emergency Physicians (ACEP) Scientific Assembly 2022. This event was held in San Francisco, California, U.S. from 1st to 4th October 2022.

REPORT COVERAGE

The global compact ultrasound equipment market report provides a detailed competitive landscape and market insights. It focuses on key aspects such as competitive landscape, product type, imaging type, application, and end-user. In addition to the global compact ultrasound equipment market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.53% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Imaging Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 3.77 billion in 2026 and is projected to reach USD 9.04 billion by 2034.

In 2025, the market value stood at USD 1.21 billion.

The market will exhibit steady growth at a CAGR of 11.53% during the forecast period (2026-2034).

By application, the radiology segment led the market.

The growing prevalence of chronic diseases and the rising geriatric population are the key driving factors of the market.

Koninklijke Philips N.V., Canon Inc., Esaote SPA, and Butterfly Network, Inc. are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us