Composite Cylinder Market Size, Share & Industry Analysis, By Tank Type (Type II, Type III, and Type IV), By Material Type (HDPE, Carbon, Aramid, and Others), By Gas Type (Industrial Gases, Medical Gases, and Others), By End-User (Industrial, Transportation, Aerospace & Defense, Healthcare, and Others), and Regional Forecast, 2026-2034

COMPOSITE CYLINDER MARKET SIZE AND FUTURE OUTLOOK

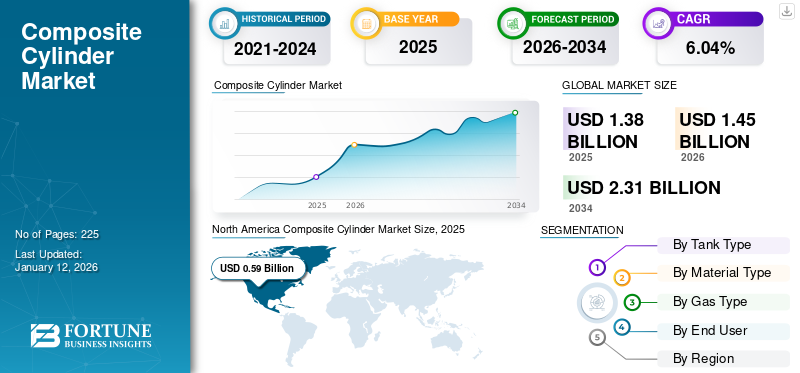

The global composite cylinder market size was valued at USD 1.38 billion in 2025. The market is projected to grow from USD 1.45 billion in 2026 to USD 2.31 billion by 2034, exhibiting a CAGR of 5.72% during the forecast period.

Cylinders with multiple layers, which consist of wound materials combined with resin over a metallic or non-metallic layer, are known as composite cylinders. Driven by the use of new-generation sustainable technology in the manufacturing process, these cylinders showcase numerous features. They have many end-uses, especially in aerospace & defense and transportation.

The increasing adoption of composite cylinders across various sectors due to their safety features, technological advancements, and alignment with global energy trends is propelling market growth significantly.

Hexagon Group have positioned themselves as frontrunners in the composite cylinder industry by implementing strategic growth and maintaining a strong product lineup. They serve a range of sectors, such as the LPG and CNG industries, which are witnessing a rise in demand driven by a transition toward more sustainable energy options.

Aircraft utilize composite cylinders to deploy escape slides and life rafts and supply emergency breathing oxygen to the crew and passengers. It is also used in space applications, coming off-the-shelf DOT and S-081 designs and customized designs for controlling gases, life support, and fuel systems. Additionally, they find use in firefighter and military Self-Contained Breathing Apparatus (SCBA), medical gas storage, and specialized applications such as lightweight ballistic-tolerant pressure vessels for military aircraft, ground vehicles, and high-altitude parachutists.

MARKET DYNAMICS

Market Drivers

Increased Preference for Composite Cylinders to Drive Market Growth

The market is primarily driven by rapid and continuous growth in end-user sectors. Due to their advantages over traditional cylinders and varied features, it is extensively utilized in the transport, aerospace & defense, and healthcare industries. The demand for these cylinders, particularly Type II and III, is increasing as these sectors undergo rapid expansion. They require materials with high thermal properties, reduced weight, high dimensional integrity, and excellent chemical resistance.

- A contract has been granted to Hexagon Purus, a subsidiary of Hexagon Composites, for the design, development, qualification, and production of high-performance Type IV composite pressure vessels for a new major aerospace customer's launch vehicle. Hexagon Purus has collaborated on its second project in the aerospace industry in the last two years. Its smart technology, combined with its world-leading expertise in lightweight, reliable, and safe high-pressure gas storage, is being utilized to support pioneering developments in space travel.

Technological Advancements to Drive Market Expansion

Technological developments in the market are attracting new consumers. There are new developments, such as the integration of digital technology with cylinders. For instance, in April 2024, Hexagon Ragasco and Linde, one of the major industrial gas companies of the world and premier LPG marketer in Norway, launched the Linktra Smart cylinder. Hexagon Ragasco is a business of Hexagon Composites. Hexagon Ragasco’s Linktra Smart cylinders have the Internet of Things (IoT) technology, which allows the connection of the cylinder to users' mobile phones, enabling consumers to see gas level along with notifications related to refill quickly. It helps the IT systems of LPG distributors gain insight into consumer usage patterns, which helps them with adequate logistics.

Market Restraints

Higher Comparative Costs of Composite Cylinders than Metal Cylinders May Hamper Industry Growth

Manufacturing a composite cylinder is a complex and advanced process, which is why the price of these cylinders is much higher than that of metal ones. In numerous developing nations, the cost is twice as high, posing a threat to the expansion of the market.

- The current price for the 5 kg composite FTL cylinder is ~ USD 30.17, which includes taxes. The cost of refilling fluctuates based on the delivery location. In India, the price range for a metal cylinder with a refill is between ~ USD 17-20.

Market Opportunities

Rising Demand in Automotive Industry to Create Growth Opportunities

A composite cylinder has emerged as a leader in minimizing vehicle weight, which in turn has led to a notable decrease in fuel consumption. The market has a bright outlook both now and in the future, particularly for lightweight options, as there is an increasing emphasis on environmental sustainability and fuel efficiency. Established cylinder manufacturers are adapting their business strategies by diversifying and enhancing their product lines. A significant shift is occurring in the cylinder market on a regional level. This new development is expected to drive substantial growth for local players, while existing companies are likely to face intense competition in the near future.

Market Challenges

Limited Awareness and Adoption in Emerging Markets is one of the Market Challenges

In some regions, awareness regarding composite cylinders is low and users often use conventional metal cylinders due to familiarity with them and cost problems. Emerging markets such as Africa are price-sensitive compared to other regions. In addition, the metallic cylinder manufacturers have established a presence in emerging markets with good economies of scale. This creates challenges for manufacturers to penetrate the market more quickly.

COMPOSITE CYLINDER MARKET TRENDS

Growing Popularity of Hydrogen as a Clean Energy Source with High-pressure Storage Needs is One of the Key Market Trends

Hydrogen, a flammable and explosive gas, enables fast charging and discharging in high-pressure gaseous hydrogen storage systems at room temperature, necessitating high-strength pressure-resistant containers. With a diameter of only 0.982nm, hydrogen atoms can potentially permeate or cause metal degradation, leading to hydrogen embrittlement, pressure vessel corrosion, and the heightened risk of leakage and explosion, particularly under high pressure. The increasing demand for high-pressure hydrogen storage has led to a rising need for composite materials and cylinders among end-users.

Download Free sample to learn more about this report.

IMPACT OF COVID-19 ON THE GLOBAL MARKET

The impact of COVID-19 on the global market growth was minimal due to the contradictory use of industries. Industrial activity slowed down, but the use of medical gases was at its peak due to the pandemic. The development of new technologies in response to COVID-19 aimed to assist millions of individuals with respiratory-related illnesses in oxygen therapy. Luxfer Gas Cylinders has introduced its first Non-Limited Life (NLL) medical cylinders to support the healthcare industry. These oxygen cylinders are designed to aid patients affected by conditions that cause breathing difficulties, such as coronavirus and Chronic Obstructive Pulmonary Disease (COPD), which impacts 65 million people globally and leads to over 3 million deaths worldwide each year.

SEGMENTATION ANALYSIS

By Tank Type

Advanced Characteristics of Type III Tanks are Increasing the Product Demand across Many Industrial Verticals

By tank type, the market is divided into Type II, Type III, and Type IV.

The Type III segment dominated the market share by 0.63% in 2024. The Type III cylinder, also called the fully wrapped composite cylinder, features a metal liner that is entirely encased in a composite or fiber resin. Layers of fiber, known for their strength and impact resistance, completely envelop the cylinder, and a proprietary pattern of epoxy resin matrix is applied on top to enhance durability and performance. This results in an exceptionally lightweight and robust cylinder that can withstand higher pressures than traditional all-aluminum cylinders.

Furthermore, the type IV is the fastest due to its adoption in transportation applications. It is being adopted in transportation applications due to its advantages such as being lightweight, resistant to corrosion, and with a high volume-per-weight ratio. These cylinders are frequently utilized in weight-sensitive applications such as buses, trucks, and other vehicles.

By Material Type

Carbon Segment Leads Owing to Use of Specialty Lightweight Carbon Material

By material type, the market is segmented into HDPE, carbon, aramid, and others.

The carbon segment dominates the market. It offers an innovative and groundbreaking solution for the high-pressure gas cylinder market. The use of advanced lightweight materials such as high-performance carbon fiber and thermoplastic polymers with UV protection results in a cylinder that weighs only a third of traditional steel cylinders while maintaining excellent mechanical and chemical resistance. The segment is expected to dominate the market share of 55.45% in 2026.

Furthermore, carbon composite gas cylinders are ideal for storing large volumes of high-pressure gas in a lightweight container. These cylinders are extremely lightweight and can withstand high internal pressures, being up to 70% lighter than conventional alloy steel cylinders.

Additionally, High-Density Polyethylene (HDPE) is the second largest shareholder in the market. This segment is anticipated to exhibit a CAGR of 5.47% during the forecast period. It has been adopted in the residential and transportation sectors due to its corrosion-free and lightweight nature. Indian Oil uses HDPE LPG composite cylinders, which are used in residential end-usage.

By Gas Type

Industrial Gases Segment Leads Due to Rising Gas Usage as Vehicle Fuel

By gas type, the market is subdivided into industrial gases, medical gases, and others.

The industrial gases segment dominates the market due to their rising use in transportation, aerospace and defense, and industrial usage. In 2017, LPG composite cylinders were commercialized in many countries to be included in gas carriers and storage for transportation use. The segment is expected to dominate the market share of 84.42% in 2026.

In India, LPG cylinders have entered the Indian market, and the Ministry of Petroleum and Gas has granted the state-owned Hindustan Petroleum Corporation (HPCL) a license. Although there have been attempts to test fiber bottles, which are better and easier than the metal ones used, since 2012, these bottles have not entered the market due to the lack of approvals from different institutions such as the Indian Standards Institute. One of the advantages of these cylinders is that they do not explode even in the event of a fire, and due to their light appearance, customers can see the amount of liquefied air in the cylinders, which is a deterrent.

Medical gases are a composite of nitric oxide, nitrous oxide, carbon dioxide, medical air, and they are used for different medical purposes for the well-being of patients. This segment is anticipated to exhibit a CAGR of 4.72% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Aerospace & Defense Segment Leads Market Due to High Cylinder Usage for Drones, Aircraft, and Military Calibration

Based on end-user, the market is divided into industrial, transportation, aerospace & defense, healthcare, and others.

The aerospace & defense segment is the leading segment due to the wide applications of composite cylinders in the defense sector. Aircraft structural composite cylinders are increasingly relying on high-performance composites, which are also being considered for use in space and underwater applications. Furthermore, glass-reinforced epoxy cylinders are widely used for structural composites due to their low shrinkage, ease of fabrication, chemical resistance, and superior mechanical and electrical properties. The segment is expected to dominate the market share of 38.34% in 2026.

Composite cylinders are essential in various applications, ranging from fueling important equipment in manufacturing to ensuring accuracy in medical treatments and even enhancing the longevity of packaged goods in the food and beverage industry.

In the industrial sector, gas cylinders are the second largest segment in the market and are essential for the safe storage and transport of vital gases necessary for chemical reactions. Additionally, synthesis operations depend on industrial gases as raw materials, enhancing the efficiency of processes and facilities. These gases play a vital role in improving process economics, boosting product quality, ensuring the safety of plants, and supporting environmental protection.

The transportation segment is anticipated to exhibit a CAGR of 8.46% during the forecast period.

COMPOSITE CYLINDER MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Composite Cylinder Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Technological Advancements in the Region to Boost Market Growth

North America is the dominant region in the composite cylinder market. The regional market value in 2024 was USD 0.59 billion, and in 2024, the market value led the region by USD 0.55 billion. It is a growing market with advancements in technology and the adoption of new policies to increase the penetration of composite cylinders in the region. The growth of LPG as fuel for transportation, aircraft carriers, drones, and others, is accelerating the demand for cylinders in the region.

Hexagon Agility, a division of Hexagon Composites, has partnered with Brudeli Green Mobility, a Norwegian electric transmission technology company located in Hokksund, to revolutionize the North American truck market for Class 7 and 8 vehicles. This collaboration will see the integration of Hexagon Agility’s Compressed Natural Gas and Renewable Natural Gas (CNG/RNG) systems with Brudeli's patented plug-in Power hybrid technology. The combined offering will enable fleets to maintain diesel-like duty cycles, achieve substantial fuel cost savings, meet decarbonization targets, and comply with strict emissions regulations.

U.S.

U.S. Records Rapid Market Growth Due to the Presence of Established Consumer Base

The aerospace industry is observing a rise in the use of cylinders due to strict regulations aimed at cutting carbon emissions from aircraft. To illustrate, the Federal Aviation Administration (FAA) put forth a regulation in 2024 to introduce advanced fuel-efficient technologies on larger aircraft constructed after January 2028 to decrease carbon pollution. The U.S. market size is estimated to hit USD 0.54 billion in 2026.

In addition, the weight of the cylinder is a crucial factor in the aerospace sector. The rising interest of the aerospace sector is anticipated to propel industry growth over the coming years in the U.S.

Europe

Preference for Composite Cylinder from the Transportation Sector to Drive Market Growth

Europe is anticipated to account for the second-highest market size of USD 0.4 billion in 2026, exhibiting the second-fastest growing CAGR of 5.85% during the forecast period. Composite cylinders are utilized in various industries in Europe due to their versatility and performance characteristics. One key application is the transportation and storage of Compressed Natural Gas (CNG). As there is a growing focus on reducing greenhouse gas emissions and shifting toward cleaner energy sources, CNG has become an appealing alternative fuel for vehicles, especially in urban areas. The use of cylinders enables safe and efficient storage of CNG onboard vehicles, leading to extended driving ranges and supporting the widespread adoption of natural gas-powered vehicles throughout Europe. The market value in U.K. is expected to be USD 0.07 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.09 billion and France is likely to hold USD 0.02 billion in 2025.

Asia Pacific

Rising Use of CNG Cars to Drive composite cylinder Product Demand

The Asia Pacific region is to be anticipated as the third-largest market with USD 0.27 billion in 2026. The use of CNG cars in developing countries in the Asia Pacific region has significantly increased, resulting in a higher demand for cylinders. The operational benefits of cylinders might further replace metallic cylinders in the coming years in the region, consequently driving the market growth. Substantial investments in CNG infrastructure, such as the development of refueling stations and distribution systems, are essential for accommodating the rising number of CNG vehicles. Enhanced infrastructure alleviates range anxiety for consumers, promoting greater adoption of CNG-powered automobiles. Nations such as India are quickly broadening their CNG refueling networks to satisfy the escalating demand.

The rising healthcare sector in developing countries such as India, China, and Southeast Asia is expected to contribute to the demand for market growth. The market value in China is expected to be USD 0.09 billion in 2026.

On the other hand, India is projecting to hit USD 0.03 billion and Japan is likely to hold USD 0.04 billion in 2026.

Latin America

Growth of End-users in Developing Countries to Create Growth Opportunities

In Latin America, the market's future appears bright with potential across industries such as aerospace, transportation, and healthcare. The market growth is primarily driven by the rising prevalence of Natural Gas Vehicles (NGVs) and the escalating demand for lightweight cylinders with higher pressure requirements and increased gas carrying capacity per cylinder. Emerging trends, such as the rise of green fleets and the advancement of type IV tanks, directly influence the industry's dynamics.

Middle East & Africa

Rising Consumer Interest to Drive Middle East Market Growth

The Middle East & Africa is expected to reach USD 0.09 billion in 2026 as the fourth-largest market.

In September 2024, Emirates Gas, a subsidiary of ENOC Group, announced its participation in the 20th edition of the Abu Dhabi International Hunting and Equestrian Exhibition. During the event, Emirates Gas would present its most recent industry innovation comprising the latest generation of LPG Composite Cylinders developed for caravans. The new unique cylinder is manufactured using advanced composite materials that are safe and lightweight.

This development implies the rising consumer interest in lightweight cylinders. These factors drive the market growth in the Middle East. The GCC market size is estimated to reach USD 0.04 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Innovating and Launching Unique Products to Stay Ahead in the Market

The global market is mostly fragmented, with key players such as Hexagon, Time Technoplast, Aburi Composites, Evas, and others operating in the industry. Aburi Composites supplies composite LPG cylinders, as well as technology and manufacturing solutions, and is highly regarded in the specialized cylinder sector of the gas distribution industry.

Furthermore, in 2023, Hexagon Ragasco (a business of Hexagon Composites and Linde, the industrial gas company and the leading LPG marketer) launched AGA smart cylinders as part of a pilot program in Norway. Its digital age LPG technology allows the connection of its composite cylinders to consumers' mobile phones and the IT systems of LPG distributors.

Some of the Key Companies Profiled in the Report:

- Hexagon Group (Norway)

- Time Technoplast (India)

- Amtrol Alfa (Portugal)

- Aygaz (Turkey)

- Dragerwerk (Germany)

- Evas (UAE)

- Faber Industries (Italy)

- Luxfer Gas Cylinders (U.S.)

- Quantum Fuel Systems Technologies (U.S.)

- Sinoma (China)

- Worthington Cylinder (U.S.)

- BTIC America Corp (U.S.)

- Santekn (U.S.)

- Rubis Caribbean (Barbados)

- Aburi Composite (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- In October 2024, Hexagon Composites divested its Hexagon Ragasco division to Worthington Enterprises while simultaneously obtaining a 49% interest in its Sustainable Energy Solutions (SES) division. Hexagon Ragasco has achieved sales of over 20 million glass fiber-reinforced composite cylinders on a global scale. SES serves as a supplier in Europe for Type 3 and 4 high-pressure composite cylinders designed for the storage and distribution of Compressed Natural Gas (CNG), hydrogen, and industrial gases.

- In June 2024, Time Technoplast Ltd was awarded an additional contract to supply composite cylinders (LPG) with an approximate total worth of INR 55 crores (USD 6.43 million). This increased demand is due to the positive feedback from end users regarding the numerous benefits of using composite cylinders, such as being explosion-proof, lightweight, and having a translucent body. Following the successful completion of the initial order and the encouraging reception from consumers, the subsequent order has been issued. Additionally, ongoing discussions are being held with Bharat Petroleum Corporation Limited (BPCL) and Hindustan Petroleum Corporation Limited (HPCL).

- In June 2024, Time Technoplast was granted the final approval by the Petroleum and Explosives Safety Organization (PESO) to manufacture and supply high-pressure Type-IV composite cylinders for hydrogen. According to the company, it is the inaugural Indian company to obtain final approval for the production and distribution of Type-IV cylinders for hydrogen.

- In September 2023, Hexagon Purus established a new manufacturing facility for hydrogen cylinders in the heart of Germany, specifically in Kassel. The new center is specifically configured to produce over 40,000 Type 4 cylinders, which are suitable for various applications, including fuel cell vehicles. The company has stated that the production capacity at the new location can be increased as needed, with the exact maximum capacity not being explicitly specified.

- In August 2020, Time Technoplast (TTL) revealed the development of Type-IV carbon fiber composite cylinders. Following this announcement, the company secured a INR 41.6 crore (USD 4.87 million) order from a gas distributor for the supply of its lightweight product to be utilized in CNG cascades. The current order book is approximately INR 53.6 crore (USD 6.27 million), which the company anticipates fulfilling in the present fiscal year. TTL is also engaged in discussions with various OEMs regarding the potential applications of the product in buses, passenger cars, and trucks.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Innovation in technology and advanced material use in the industry is giving companies many investment opportunities. On 22nd June 2024, after the unveiling of the type IV composite cylinder in the market, Time Technoplast saw a significant increase of 12.72%, reaching a new 52-week high of INR 334.90 (USD 3.92) per share. The surge in stock price was a result of the company obtaining official approval from the Petroleum and Explosives Safety Organisation (PESO) for the production of Type-IV Composite Cylinders for Hydrogen.

Hexagon, Aburi Composites, and others in the market present similar investment opportunities. The innovation of Type V is in the industry pipeline, which may lead to further investments in the composite material sector and the cylinder industry.

REPORT COVERAGE

The report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations in producing composite cylinders. Besides, the report offers insights into the market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.04% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Tank Type, By Material Type, By Gas Type, By End User, and By Region |

|

Segmentation |

By Tank Type

|

|

By Material Type

|

|

|

By Gas Type

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 1.38 billion in 2025.

The market is likely to grow at a CAGR of 6.04% over the forecast period (2026-2034).

The industrial gases segment is expected to lead the market over the forecast period.

The market size of North America stood at USD 0.59 billion in 2025.

End users are increasingly preferring composite cylinders due to their ease of handling and partial visibility, which is a key factor driving the market.

Some of the top players in the market are Hexagon Group, Time Technoplast, Aburi Composites, and others.

The global market size is expected to reach USD 2.31 billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us