Contract Sterilization Services Market Size, Share & Industry Analysis, By Service Type (Terminal Sterilization, Aseptic Processing, and Others), By Processing Type (Batch Sterilization and Continuous Sterilization), By Delivery Mode (On-Site and Off-Site), By Method (Steam Sterilization, Hydrogen Peroxide Sterilization, Ethylene Oxide Sterilization, and Others), By End User (Hospitals & Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

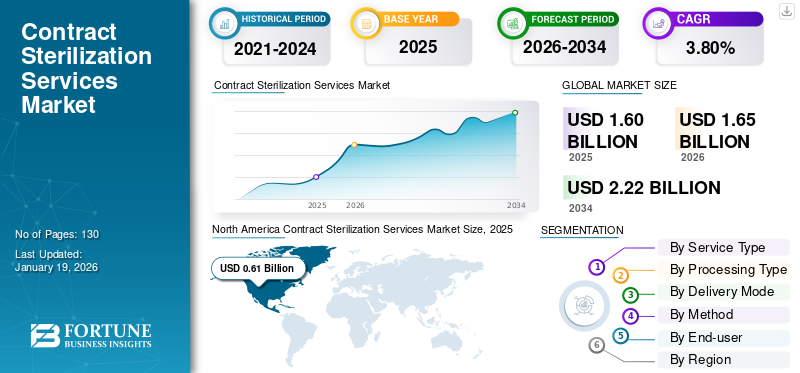

The global contract sterilization services market size was valued at USD 1.6 billion in 2025. The market is projected to grow from USD 1.65 billion in 2026 to USD 2.22 billion by 2034, exhibiting a CAGR of 3.80% during the forecast period. North America dominated the contract sterilization services market with a market share of 38.16% in 2025.

Contract sterilization services refer to the outsourcing of the sterilization process to third-party service providers who handle the sterilization of medical devices and pharmaceutical products. This includes items such as vials, syringes, ampoules, surgical instruments, and implants. Sterilization services are crucial for companies lacking in-house sterilization infrastructure or seeking to reduce regulatory and operational burdens while maintaining GMP-compliant, safe, and sterile product output for global distribution.

The growth of the global market is attributed to an extensive shift of medical device and pharmaceutical companies toward outsourcing. Moreover, increasing regulatory complexity, the need for specialized sterilization methods, and the surge in biologics and single-use medical devices are also expected to positively impact the expansion of the contract sterilization services market. In addition, as companies prioritize core R&D and minimize capital investment in sterilization infrastructure, they turn to contract service providers for efficient, scalable, and compliant solutions.

Some of the major players in the market are Steris Corporation, Sterigenics U.S., LLC, and Ecolab. These players focus on technological advancements, extensive investments, and strategic agreements to maintain substantial market share.

MARKET DYNAMICS

Market Drivers

Rising Demand for Sterile Pharmaceutical and Medical Device Products to Accelerate Market Growth

The growing need for sterile pharmaceutical formulations and medical devices is a key driver of the global market. With the surge in parenteral drug delivery, including biologics and injectable therapies, the requirement for aseptic processing has increased. On the other hand, the growing use of single-use medical devices such as catheters, surgical tools, and diagnostic kits has further augmented sterilization needs. In addition, market players are also focusing on the installation of improved machines with extensive functionalities and capabilities, leading to the contract sterilization services market growth.

- For instance, in February 2025, Recipharm announced the addition of an advanced modular sterile filling system. This newly installed equipment is capable of performing aseptic filling within A Grade A isolator. Moreover, the system operates as per GMP (Good Manufacturing Practice) standards.

Furthermore, pharmaceutical companies and medical device manufacturers are increasingly preferring the outsourcing of sterilization to ensure scalability, regulatory compliance, and access to advanced sterilization technologies. In emerging markets, healthcare infrastructure development and expanding medical device imports also contribute to outsourcing trends.

Market Restraints

Regulatory Barriers Coupled with Complex Guidelines to Deter Market Growth

Stringent regulatory barriers and critical compliance requirements complicate the landscape of contract sterilization services. These services are inspected by the health authorities and regulatory bodies, which enforce stricter standards for validation, maintenance, and process control. Moreover, stringent standards set by organizations such as the Environmental Protection Agency (EPA) have established sterilization service providers to adhere to strict guidelines, particularly regarding sterilization agents, including ethylene oxide (EtO).

- For instance, according to 2025 data published by the U.S. Environmental Protection Agency (EPA), the EPA has determined it necessary to implement a maximum EtO concentration limit of 600mg/L for new sterilization cycles by 2035.

Furthermore, the validation of sterilization processes, especially for complex medical devices or combination products, demands technical expertise and substantial time. Customizing sterilization parameters without affecting product integrity adds additional pressure, subsequently hampering the business interest of service providers.

Market Opportunities

Rapid Expansion of Biopharmaceutical Manufacturing and Personalized Medicine to Create Lucrative Opportunities for Market Players

The increasing adoption of biopharmaceuticals and the rising shift toward personalized medicine present significant opportunities for the market. Biologics, cell and gene therapies, and patient-specific drugs are highly sensitive to contamination, requiring stringent sterility standards throughout their manufacturing. Unlike traditional pharmaceuticals, these products often cannot be terminally sterilized and must rely on aseptic processing under tightly controlled and monitored environments. As pharmaceutical companies expand their pipelines with advanced biologics and personalized treatments, they require sophisticated sterilization capabilities that are costly and complex.

Moreover, regulatory authorities and market players are focusing on extensive investments to boost their capabilities. This technological upgrade is also projected to offer a lucrative opportunity for market growth.

- For instance, in February 2024, NovaSterilis received a grant of USD 1.75 million from the NIAID (National Institute of Allergy and Infectious Diseases). This funding is awarded to the company to enhance its scCO2 terminal sterilization platform, designed for use in the pharmaceutical and biotechnology industries.

Market Challenges

Limited Availability of Skilled Workforce and Technical Expertise Offers Substantial Challenge to Market Growth

A persistent challenge facing the market is the shortage of skilled personnel and technical expertise. Sterilization processes, especially those involving high-risk biologics, medical implants, or combination products, demand a deep understanding of microbiology, material science, and regulatory compliance.

Many service providers, particularly those in developing regions or newly entering the market, struggle to recruit and retain such expertise. This talent gap often leads to delays in project initiation, risk of non-compliance, or compromised process efficiency.

CONTRACT STERILIZATION SERVICES MARKET TRENDS

Integration of Digital Technologies and Automation in Sterilization Workflows to Fuel Market Development

Integration of automation and digital technologies into sterilization workflows can effectively improve the workflow and outputs. Providers are incorporating advanced software systems for real-time monitoring, data logging, and compliance tracking across sterilization cycles. These platforms enhance traceability, reduce manual errors, and facilitate compliance with stringent regulatory frameworks by generating automated audit trails and validation records.

- For instance, in January 2024, Multiply Labs, a robotics and automation manufacturing company, entered into a strategic collaboration with Fedegari Group with an aim to improve its automation capability for the sterilization of cell therapy robotic systems.

These digital advancements are optimizing operational efficiency and reducing labor dependency and increasing client confidence in outsourced sterilization quality. As pharmaceutical and medical device companies increasingly demand transparency and reliability in contract operations, digital and automated capabilities are becoming a critical differentiator in provider selection.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a considerably positive impact on the contract sterilization services market. During the early phases, disruptions in global supply chains and lockdowns led to temporary shutdowns of sterilization facilities and delayed non-essential medical procedures, affecting service volumes. However, the urgent need for sterile medical supplies, including personal protective equipment (PPE), diagnostic kits, ventilator components, and injectable drugs, drove a surge in demand for sterilization services.

In response, authorities accelerated the approval of sterilization products under emergency use authorization, further boosting market growth.

- For instance, in December 2020, Ecolab received the FDA’s Emergency Use Authorization for its Bioquell Technology System for on-site decontamination and reuse of specific N95 respirators, helping healthcare facilities address shortages and protect frontline workers during the COVID-19 pandemic.

SEGMENTATION ANALYSIS

By Service Type

Standardized Protocols To Boost Terminal Sterilization Segment Growth During The Forecast Period

Based on service type, the market is divided into terminal sterilization, aseptic processing, and others.

The terminal sterilization segment held a major contract sterilization services market share in 2024. Their dominance is attributed to their broad applicability, cost-efficiency, and regulatory preference. Moreover, contract service providers often prioritize terminal sterilization due to its standardized protocols, lower validation complexity, and compatibility with bulk processing. Besides, strategic developments by service providers are also estimated to boost segment growth.

- For instance, in May 2025, Sterigenics, a Sotera Health company, announced expansion of its facility in North Carolina. The company plans to install a new X-Ray facility near its existing gamma facility.

The aseptic processing segment is likely to witness substantial growth during the forecast period owing to increasing investments in biologics and personalized medicine. Contract sterilization providers are expanding their aseptic capabilities to meet the demand for high-value, sensitive pharmaceutical products.

- For instance, in February 2024, Grand River Aseptic Manufacturing (GRAM) announced expansion of its warehouse center in Michigan, U.S. This additional space will help the company to boost its vial filling & finishing capabilities.

By Processing Type

Superior Production Efficiency of Batch Processing to Boost Segment Growth

Based on processing type, the market is bifurcated into batch sterilization and continuous sterilization.

The batch processing held a significant portion of the market in 2024 due to its flexibility, traceability, and suitability for a wide range of products. In batch sterilization, defined product lots are processed together under controlled parameters, allowing for tailored sterilization cycles and strict documentation. Moreover, batch processing also supports small to medium production volumes, which is ideal for clients with limited or variable output.

Continuous sterilization is expected to exhibit significant CAGR during the forecast period. This sterilization is especially suited for large-volume parenteral drugs, vaccines, and biologics, where maintaining sterility at scale is critical. The growing need for real-time processing, automation, and compliance with stringent cGMP requirements drives its adoption.

- For instance, in May 2023, JBT Corporation announced the launch of its new JBT 2.1m Pressure Rotary. The newly introduced rotary sterilizer technology has wider applications in continuous sterilization.

By Delivery Mode

Off-site Sterilization Segment Led due to its Flexibility

Based on delivery mode, the market is fragmented into on-site and off-site.

The off-site segment dominated the global market in 2024 and is expected to expand at the fastest CAGR during the forecast period. The growth is attributed to the flexibility to handle large volumes of instruments, lower capital investment requirements, and access to specialized equipment and expertise. In addition, the trend of manufacturers to avoid capital-intensive sterilization installations is also projected to have a positive impact on segment growth.

- For instance, in October 2024, Steris mentioned that off-site reprocessing ensures safe, compliant reprocessing of medical devices, reducing the burden on hospitals and improving patient care.

The on-site segment accounted for a substantial share of the global market in 2024 and is expected to grow at a marginal CAGR. On-site sterilization services provide potentially faster turnaround time for sterile supplies, closer control over the sterilization process, and potentially reduced transportation costs.

By Method

Growing Number of Product Launches Boosted Steam Sterilization Segment Growth

Based on method, the market is divided into steam sterilization, hydrogen peroxide sterilization, ethylene oxide sterilization, and others.

The steam sterilization segment dominated the market in 2024 and is expected to expand at the fastest CAGR during the forecast period. It uses saturated steam under pressure and is widely accepted for sterilizing heat and moisture-resistant items such as surgical instruments, metal tools, glassware, and certain textiles. Moreover, steam sterilization is highly compatible with a broad range of reusable and hospital medical products, making it the preferred choice in clinical settings. Furthermore, an increasing number of products and system launches are contributing to a favorable environment for segment growth.

- For instance, in October 2023, Advanced Sterilization Products (ASP) announced a significant expansion in its steam sterilization monitoring portfolio. The new systems enable effective monitoring of sterile processing departments in healthcare facilities. The company developed a new portfolio especially for SPD/CSSD.

The hydrogen peroxide sterilization segment accounted for a substantial share of the global market in 2024 and is expected to grow at a significant CAGR. As healthcare facilities increasingly seek scalable solutions for sterilizing and decontaminating spaces and instruments. Hydrogen peroxide sterilization services offer several advantages, including broad-spectrum efficacy, ability to penetrate complex surfaces, and compatibility with various materials.

By End-user

Rising Cases of Hospital-Acquired Infections Boosted Hospitals & Clinics Segment Growth

By end-user, the market is segregated into hospitals & clinics, pharmaceutical & medical device manufacturers, and others.

The hospital & clinics segment dominated the global market in 2024 and is expected to expand at the fastest CAGR during the forecast period. The growth is attributed to rising cases of hospital-acquired infections (HAIs), which are increasing the demand for sterilization services in these settings. Moreover, the increasing use of surgical instruments is also driving the need for instrument reprocessing, which is expected to fuel the segment’s growth.

The pharmaceutical & medical device manufacturers segment held the second-largest market share in 2024. The increasing requirement for the sterilization of devices among medical device manufacturers is expected to drive the segment’s growth in the forthcoming years.

- For instance, in September 2021, Sterigenics U.S., LLC and Nelson Labs opened a significantly expanded, state-of-the-art microbiological testing laboratory and increased sterilization capacity in Wiesbaden, Germany, to meet growing demand from the European medical device and pharmaceutical industries.

CONTRACT STERILIZATION SERVICES MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Contract Sterilization Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.61 billion in 2025 and USD 0.63 billion in 2026. The region’s leadership is attributed to its mature healthcare industry, presence of global medical device manufacturers, and strict regulatory standards from agencies such as the FDA and EPA.

The U.S. demonstrates strong demand for terminal and aseptic sterilization services, driven by high surgical volumes and stringent infection control mandates. Moreover, the growing adoption of advanced sterilization techniques such as hydrogen peroxide and E-beam, coupled with the expansion of biologics production, is estimated to have a positive impact on market growth.

- For instance, in September 2024, BGS announced its expansion into the U.S. market with the development of a fully automated E-Beam irradiation at its new location in Pittsburgh. This initiative aims to offer a safe and effective alternative to gamma and EtO sterilization for medical devices. Operations at this site are expected to begin in mid-2025.

Europe

The market in Europe held a significant share in 2024 and continues to be key region in the contract sterilization services market, driven by increasing outsourcing from pharmaceutical and medical device companies seeking GMP-compliant sterilization solutions. Moreover, countries such as Germany, U.K., and France are witnessing heightened demand due to regulatory guidelines from healthcare authorities. In addition, investments by market players are also projected to drive the market in Europe by 2032.

- For instance, in December 2020, STERIS announced the opening of a new ethylene oxide (EO) facility in the Czech Republic to support the medical device manufacturers with efficient service offerings that involve ethylene oxide.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period, making it the fastest-growing region in the market, driven by rising pharmaceutical production, growing medical device manufacturing hubs, and government-backed healthcare expansion. Moreover, the active involvement of market players in expanding operations across emerging countries will further accelerate regional growth.

- For instance, in April 2024, STERIS announced the expansion of its existing X-ray sterilization processing facility at Suzhou, China.

Latin America and Middle East & Africa

Latin America and the Middle East are gradually gaining momentum in the market. In Latin America, countries such as Brazil are witnessing growth due to increased surgical procedures and the expansion of local pharmaceutical manufacturing. In the Middle East and Africa, countries are focusing on investments in healthcare infrastructure and medical manufacturing, driving demand for outsourced sterilization to meet international quality standards.

- For instance, according to the data published by investdubai.gov.ae, Dubai aimed to attract USD 2.5 billion worth of investments in manufacturing industries and pharmaceutical research in 2022.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Emphasize Facility Expansion to Boost their Market Share

The global market is semi-consolidated, with STERIS accounting for the highest share in the global market due to its wide range of services portfolio. The increasing focus on facility expansion of prominent players such as Sotera Health and others is aimed at strengthening operational capabilities. Additionally, other players such as Ecolab, BGS, VPT Rad, Inc., and others are also actively engaged in order to expand their percentage in the global contract sterilization services market. The industry is witnessing a rising trend of acquisitions and mergers, with key players seeking to consolidate their position and boost their market share.

LIST OF KEY CONTRACT STERILIZATION SERVICES MARKET COMPANIES PROFILED

- STERIS (U.S.)

- Sterigenics U.S., LLC (Sotera Health) (U.S.)

- Medistri SA (Switzerland)

- E-BEAM Services, Inc. (U.S.)

- BGS (Germany)

- VPT Rad, Inc. (U.S.)

- Scapa (U.S.)

- Microtrol Sterilisation Services Pvt Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Sterigenics U.S., LLC signed an agreement to acquire Nordion for around USD 727.0 million. Nordion would operate as a standalone company within Sterigenics U.S., LLC, ensuring a stable supply of Cobalt-60 for gamma sterilization.

- November 2024: Vance St. Capital acquired Prince Sterilization Services, LLC., increasing its investment in the life-sciences and medical sector.

- January 2023: Ionisos acquired a facility from Studer Cables AG in Switzerland to increase its electron beam capacity for providing sterilization services.

- December 2022: Medistri SA announced that it had been granted a building permit for expansion at its Domdidier headquarters, adding new production and storage facilities to increase sterilization capacity and staff by 20%. This strengthened the company’s range of service offerings in the market.

- May 2022: Sterigenics U.S., LLC expanded its Columbia City, Indiana facility by installing a new electron beam accelerator. This significantly increased the company’s capacity to sterilize medical and pharmaceutical products to meet growing global healthcare demands.

REPORT COVERAGE

The global market analysis provides market size and forecast by service type, processing type, delivery mode, method, and end-user segment. It covers market dynamics and emerging market trends. It offers insights into the prevalence of key conditions, new product launches, and key industry developments. The report provides an in-depth analysis of the competitive landscape, including insights into market share distribution and detailed profiles of leading companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.80% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Service Type

|

|

By Processing Type

|

|

|

By Delivery Mode

|

|

|

By Method

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.65 billion in 2026 and is projected to reach USD 2.22 billion by 2034.

In 2025, the market value stood at USD 0.61 billion.

The market is expected to exhibit a CAGR of 3.80% during the forecast period.

By delivery mode, the off-site segment led the market.

The key factors driving the market are the increasing number of surgeries to boost the market and the growing initiatives by government and regulatory bodies to support sterilization.

Steris, Sterigenics U.S., LLC, and Ecolab are the top players in the market.

North America dominated the contract sterilization services market with a market share of 38.16% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us