Copper Mining Market Size, Share & Industry Analysis, By Process (Open-pit Mining and Underground Mining), By Grade (Below 0.5%, 0.5%-1.0%, 1.0%-1.5%, and Above 1.5%), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

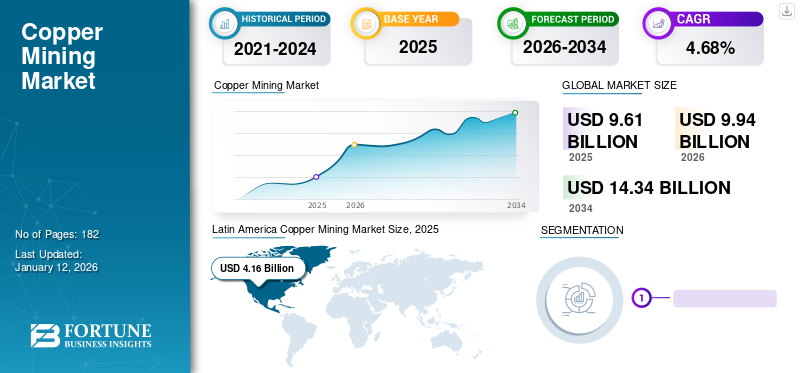

The global copper mining market size was valued at USD 9.61 billion in 2025 and is projected to grow from USD 9.94 billion in 2026 to USD 14.34 billion by 2034, exhibiting a CAGR of 4.68% during the forecast period. Latin America dominated the global market with a share of 43.37% in 2025. The Copper Mining market in the U.S. is projected to grow significantly, reaching an estimated value of USD 780.68 million by 2032, driven by the rising demand for minerals and metals as raw material in the construction, electronics, and consumer goods.

Copper is generally mined in composite ore, known as copper oxide ore and copper sulfide. The sulfide concentrates are smelted in furnaces to produce matte, which must be transformed and refined to produce anode copper. Finally, the finished product is made through the electrolysis refining process. Copper is a necessary component of so many products that the amount of copper we consume is a good indicator of any country's economy. Copper consumption is growing with the country's economy.

Global Copper Mining Market Overview

Market Size:

- 2026 Value: USD 9.94 billion

- 2034 Forecast Value: USD 14.34 billion

- CAGR: 4.68% from 2026 to 2034

Market Share:

- Regional Leader: Latin America with a 43.37% market share in 2025

- Process Leader: Open-pit mining dominates by production method due to its cost-efficiency and large-scale operations

Industry Trends:

- Strong dominance of open-pit mining, favored for lower operational costs and scalability

- Focus shifting to lower-grade ores as high-grade deposits are depleting, requiring advanced beneficiation methods

- Increasing digitization and automation in mining operations, with remote monitoring and robotics enhancing efficiency and safety

Driving Factors:

- Surging global infrastructure and energy demand, propelling copper usage in construction, electronics, and utilities

- Expansion of renewable energy and electric vehicle sectors, which require copper for wiring, motors, and grid infrastructure

- Latin America’s geological advantage, with copper-rich regions making it the leading producer

- Operational efficiency pressures driving the need for modern mining methods as high-grade resources deplete

- Adoption of technology-driven efficiencies, including automation, remote analytics, and robotics to improve safety, output, and cost control

Copper ores go through various stages of separation and processes to produce pure copper. In addition, based on the mining technique, the mining of copper is usually done by open pit mining, where a series of step benches are dug deeper and deeper into the earth. Then, blunt machines are used to bore holes in the hard rock, and explosives are inserted into the boreholes to blast and fracture the rock to remove the ore. Underground mining is used when the copper ore is not near the earth's surface. Miners dig a shaft into the ore deposit vertically or in a horizontal tunnel to do this.

The COVID-19 pandemic declined the market growth, and ongoing mining projects were also delayed due to government regulations. For context, building new infrastructures, such as 5G networks and electric vehicle charging stations, were postponed due to COVID-19. Additionally, demand for copper was poorly affected as industries were becoming economically weak due to the stoppage of business activity, which hampered the copper mining market growth. For instance, COVID-19 was discovered in China, the world's largest consumer of copper, due to which the demand and supply chain was disrupted as the worldwide shutdown of import and export was imposed.

In 2022, prices of technological materials, energy, fuels, and services increased significantly, influencing the level of costs generated by the companies. On the other hand, the uncertainty about the future global economic situation resulted in the weakening of the USD and increase in USD-denominated copper prices, translating into an increase in revenues from sales.

Copper Mining Market Trends

Government Investments in Infrastructure and Renewables will Create Market Opportunities

Government policies, regulations, and taxation frameworks can significantly impact the mining industry. Political stability, legal frameworks, mining codes, and fiscal policies affect investment attractiveness, licensing, and permitting processes.

Copper is essential for constructing infrastructure projects such as buildings, bridges, and electrical systems. Hence, government initiatives and policies promoting infrastructure development can significantly boost the market.

The mining industry, mainly of copper, will likely increase significantly due to increased investment in construction and construction projects. For example, over 100 smart city projects are underway worldwide, creating tremendous opportunities for the construction industry. Rapid urbanization in emerging economies and ongoing construction projects worldwide lead to increased copper consumption.

Furthermore, copper is also widely used in renewable energy infrastructure and EVs to build electrical wiring, transformers, batteries, and charging infrastructure, and the regulation related to the adoption of renewable energy and EVs will also push the demand for mining of copper.

Download Free sample to learn more about this report.

Copper Mining Market Growth Factors

Demand for Copper due to Economic Growth and Technological Advancement is Likely to Push the Market

The primary driver of this industry is the demand for copper as a raw material in various sectors, including construction, infrastructure development, electrical and electronics, transportation, and manufacturing. Furthermore, increasing population, urbanization, and industrialization in developing countries have increased copper demand.

The overall economies of countries and regions significantly impact the mining industry as there is a higher need for copper in infrastructure projects, power generation, and manufacturing activities. Moreover, the development of infrastructure projects such as power grids, telecommunications networks, transportation systems, and urban development rely on copper for electrical wiring, plumbing, and various construction grades, which will likely boost the market growth.

Global refined copper production increased by 1% from 24.5 million tons (20.7 million tons from primary sources and 3.8% from secondary sources) in 2020 to 24.9 million tons of refined copper (20.8 million tons from primary sources and 4.1 million tons from secondary sources) in 2021.

Focus on Decarbonization and Clean Energy to Boost Market Growth

If deprived of green technologies like wind turbines, electric vehicles, solar panels, and energy storage systems, the evolution to a low-carbon economy to alleviate climate change would not be possible. Nevertheless, these technologies rely on different minerals and metals, including copper, cobalt, nickel, and aluminum, whose production must increase significantly to meet demand.

To cut emissions related with carbon-intensive energy production, the business should replace fossil fuels and its produced electricity with sustainable biofuels, renewable energy, and green hydrogen. For instance, eliminating diesel use in mining gear may remove up to 40% of a mine site’s emissions.

In addition, policymakers can support an evolution to net zero mining by founding stricter and clearer guidelines for mining operations and subsidizing green energy. Such positive changes will drive the copper mining market directly and indirectly, owing to active decarbonization.

RESTRAINING FACTORS

Environmental Impact Coupled with Workforce-Related Issue is Likely to Hinder the Market Growth

Copper mining operations can have social and environmental impacts, particularly when they are located in or near populated areas. Local communities may experience disruptions such as displacement, loss of livelihoods, or conflicts over land and resource rights. Furthermore, workforce issues and safety-like effects of occupational exposures to hazardous substances and accidents that cause injury, illness, and death to workers hinder the market growth. Moreover, the extraction and processing of copper ores can have significant environmental impacts, such as soil erosion, deforestation, habitat destruction, and water pollution. Additionally, mining of copper often occurs in regions with limited water resources, which can strain local water supplies and impact surrounding ecosystems as the extraction and processing of copper require significant amounts of water.

Consequently, there is a growing emphasis on sustainable mining practices and environmental regulations that mining companies must comply with. Mining companies and industry stakeholders continually work to address these constraints through technological advancements, improved sustainability practices, community engagement, and strategic planning. However, overcoming these challenges require collaboration between industry, governments, and local communities to ensure responsible and sustainable mining practices.

Copper Mining Market Segmentation Analysis

By Process Analysis

Open Pit Mining Dominated the Market Owing to their Cost Effectiveness for Larger Scale Copper Extraction

The market is segmented into open-pit mining and underground mining based on process. Open pit mining, also known as surface mining, is the most prevalent sort of mining, and dominate the market with share of 73.54% in 2026, which involves removing the top layer of the ground to gain access to the minerals beneath. Mining of copper is usually done by open pit mining, where a series of step benches are dug deeper and deeper into the earth. Then blunt machines are used to bore holes in the hard rock, and explosives are inserted into the boreholes to blast and fracture the rock to remove the ore.

Furthermore, underground mining is another method/process across the mining industry generally used to extract mining ores and materials deep beneath surface mining. Underground mining is used when the copper ore is not near the earth's surface. Miners dig a shaft into the ore deposit vertically or in a horizontal tunnel to do this.

By Grade Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Demand of Copper Based Materials from the Growing Construction Industry is Likely to Push the Market Growth

The market is segmented based on grade as below 0.5%, 0.5%-1.0%, 1.0%-1.5%, and above 1.5%. The 1.0%-1.5% segment holds a dominant market share with 46.57% in 2026 globally due to its adoption of copper-based supportive equipment and tools such as wires and cables. Furthermore, the demand for mining of copper is likely to grow due to the increasing demand for wires and cables from the construction industry. The highest quality copper, 99.9% pure, is used in electrical Grades where high conductivity is required. Such factors create the demand for the best copper grade in particular sectors.

In November 2022, Adventus Mining Corporation selected STRACON-RIPCONCIV, a well-established Peruvian mining contractor for a copper-gold project open pit mining agreement in Ecuador.

REGIONAL INSIGHTS

This market is categorized across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Latin America is experiencing growth in the industry due to a combination of geological factors, such as increasing demand for copper, favorable investment conditions, and advancement in mining.

Latin America

Latin America Copper Mining Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Latin America accounted for the highest copper mining market share with valuation of USD 4.16 billion in 2025, owing to the wide presence of copper mines. For instance, Chile in the region accounted for the world’s largest copper producer and exporter. Peru is another major copper producer in the region. The Antamina, Tocquepala, and Las Bambas mines contribute significantly to country copper production. Moreover, various collaboration strategies among the companies are also boosting the production activities in the region. For instance, in August 2023, Corporación Nacional del Cobre de Chile (Codelco) and Anglo American collaborated to increase their production output in the region. The U.S. market is projected to reach USD 0.55 billion by 2026.

Asia Pacific

Furthermore, the mining industry plays a crucial role in defining various countries’ GDP in the Asia Pacific region. For instance, the Australian mining industry accounts for around 75% of the country's exports and contributes significantly to Australia's workforce and thriving economy. In Australia, there are over 300 mines distributed across all states. The resources sector is highly relevant for economic activity and accounts for approximately 9% of the GDP and 60% of the exports. The China market is projected to reach USD 0.94 billion by 2026.

List of Key Companies in Copper Mining Market

The global market is considerably fragmented, with various players operating at the national, regional, and global levels. The market participants are significantly focusing on developing high performance with enhanced operational characteristics to fortify their foothold in the industry.

Production at the Chilean mining giant Codelco, the world’s largest copper mining company, declined 10% year-on-year to 1,553 thousand tonnes in 2022. The production of the company was affected by the lower grade and copper recovery at the Ministro Hales mine and at Chuquicamata and El Teniente divisions.

Other key industry participants include Freeport-McMoRan Inc., BHP Billiton Ltd., Glencore International AG, Southern Copper Corp, and many other small, medium, and large players. These organizations continuously focus on expanding their product/service offering and reach across the market.

List of Key Companies Profiled:

- Codelco (Chile)

- Freeport-McMoRan Inc. (U.S)

- BHP Billiton Ltd. (Australia)

- Glencore International AG (Switzerland)

- Southern Copper Corp (U.S.)

- Zijin (China)

- First Quantum (Canada)

- KGHM (Poland)

- Rio Tinto (U.K.)

- Anglo American (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 – Glencore announced to sign a binding agreement with Norsk Hydro ASA, one of the world’s leading low-carbon aluminum companies, to acquire a 30% equity stake in Alunorte S.A. and a 45% equity stake in Mineracão Rio do Norte S.A. On completion of this transaction, the company will join the Alunorte joint venture with Hydro and the other minority shareholders.

- April 2023 - Rio Tinto, an Angelo Australian company, has acquired the Platina Scandium Project from Platina Resources Limited in USD 14 billion, a high-grade scandium resource in (NSW) Australia. The project, near Condobolin in central New South Wales (NSW), comprises a long-life, high-grade scalable resource that could produce up to 40 tons per annum of scandium oxide for an estimated period of 30 years.

- April 2023 - KGHM announced that it stayed in the first place in the list of the world’s largest silver mines in the World Silver Survey 2023. For many years, KGHM has been one of the world's largest silver producers, whose 16% of the company’s revenue comes from silver sales.

- March 2023 - First Quantum Minerals Ltd. agreed with Rio Tinto to progress the next phase of the La Granja copper project in Peru. La Granja is one of the largest undeveloped copper resources in the world, with a published Inferred mineral resource of 4.32 billion tons at 0.51 percent copper and the potential for substantial expansion.

- February 2023 - Anglo American agreed to acquire a 9.9% minority interest in Canada Nickel Company Inc., which owns the Crawford Nickel project in Ontario, Canada. The company will also provide technology expertise to the Crawford project and has the exclusive right to purchase up to 10% of recoveries of nickel concentrate, iron, and chromium contained in the magnetite concentrates and any corresponding carbon credits from the Crawford project.

REPORT COVERAGE

The global copper mining market research report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service process, and leading grades. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors contributing to market growth in recent years.

An Infographic Representation of Copper Mining Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.68% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Thousand MT) |

|

Segmentation |

By Process

|

|

By Grade

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 9.61 billion in 2025.

The global market is projected to grow at a CAGR of 4.68% over the forecast period.

The market size of Latin America stood at USD 4.16 billion in 2025.

Based on process, the open-pit mining segment holds the dominating share in the global market.

The global market size is expected to reach USD 14.34 billion by 2034.

Demand for copper due to economic growth and technological advancement is likely to push the market growth

Codelco and Freeport-McMoRan Inc. are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic