Corrugated Pipe Market Size, Share & Industry Analysis, By Product (Metal Corrugated Pipe and Plastic Corrugated Pipe {High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polypropylene (PP), and Others}), By Type (Single Wall Corrugated and Double Wall Corrugated), By Application (Water Management, Construction, Electrical & Telecommunications, Agricultural Fields, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

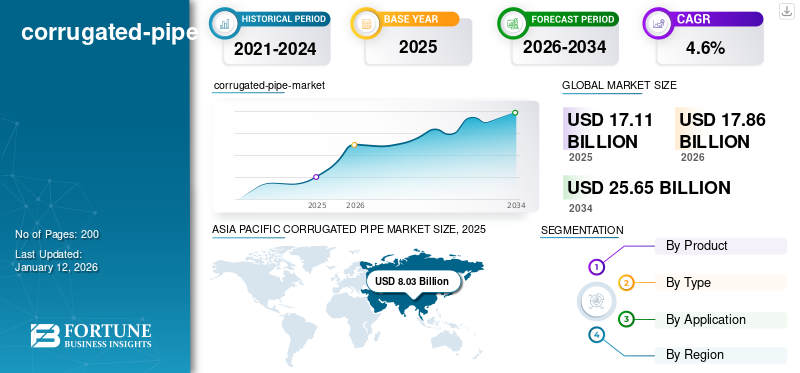

The global corrugated pipe market size was valued at USD 17.11 billion in 2025. The market is projected to grow from USD 17.86 billion in 2026 to USD 25.65 billion by 2034, exhibiting a CAGR of 4.6% during the forecast period. Asia Pacific dominated the Corrugated Pipe Market with a market share of 47% in 2025.

A corrugated pipe is a type of pipe that has a rippled or ridged outer surface and is usually made from materials such as high-density polyethylene (HDPE), polypropylene (PP), polyvinyl chloride (PVC), or metal (such as steel or aluminum). These pipes are used for drainage, stormwater management, sewage systems, culverts, cable protection, and agricultural irrigation. Their corrugated design provides excellent structural strength, flexibility, and resistance to external loads, making them ideal for both underground and above-ground installations.

The corrugated pipe market is propelled by increasing investments in infrastructure development, urban drainage systems, and agricultural modernization across developing and developed economies. In addition, the rising shift toward lightweight, durable, and cost-effective HDPE corrugated pipe piping solutions has led to widespread adoption in the construction and utility sectors. Environmental advantages such as recyclability and lower carbon footprint compared to traditional concrete or metal pipes further contributed to the growing demand.

The market encompasses several major players, including ASTRAL PIPES, Jain Irrigation Systems Ltd., Crown Pipes, Bina Plastic Industries Sdn. Bhd., and FRÄNKISCHE Industrial Pipes GmbH & Co. KG. Their broad portfolios, innovative launches, and strong geographic presence expansion have supported these companies' dominance in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Urbanization and Infrastructure Development to Propel Market Growth

Corrugated pipes, particularly those made from HDPE and PVC, are becoming an essential component in modern infrastructure projects due to their superior performance, lightweight design, and ease of installation compared to traditional concrete or metal pipes. Urban infrastructure projects often require extensive underground piping systems for drainage and cable protection.

- For instance, large-scale projects such as India’s Smart Cities Mission, China’s Sponge City Program, and urban renewal projects across the U.S. and Europe have created significant demand for advanced drainage systems where corrugated pipes are extensively used.

The growing construction sector in developing nations has amplified the requirement for cost-effective and sustainable piping materials. Through various infrastructure investment programs, billions of dollars are being allocated to upgrading sewage, drainage, and transportation systems globally.

- For example, in the U.S., infrastructure bills focused on rebuilding stormwater and wastewater systems are promoting the adoption of corrugated HDPE pipes as replacements for aging concrete pipelines.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices to Restrict Market Expansion

High-density polyethylene (HDPE), polypropylene (PP), and polyvinyl chloride (PVC) are petroleum-derived materials, making their pricing highly susceptible to fluctuations in global crude oil markets. Any abrupt increase in oil prices directly influences the cost of raw materials, consequently elevating the production expenses of corrugated pipes. Manufacturers frequently encounter difficulties in preserving profit margins amidst unpredictable raw material price fluctuations.

- For example, during periods of crude oil price spikes, such as in 2022, following the geopolitical tensions between Russia and Ukraine, polymer costs surged globally, forcing several pipe manufacturers in Europe and Asia to increase product prices or temporarily reduce production.

MARKET OPPORTUNITIES

Shift Toward Lightweight and Cost-Effective Piping Solutions to Create Lucrative Growth Opportunities

The growing preference for lightweight, durable, and cost-efficient piping systems is boosting the growth of the market. Traditional piping materials such as concrete, steel, or clay are often heavy, expensive to transport, and labor-intensive to install.

- For example, HDPE corrugated pipes can be up to 90% lighter than comparable concrete pipes while providing equivalent or superior structural strength. Their ease of handling reduces project timelines and overall labor costs, making them a more economical choice.

The global trend toward cost optimization in infrastructure development also drives the corrugated pipe market growth. Road construction authorities across Europe and the U.S. are using corrugated HDPE pipes for culverts and storm drains to replace conventional materials. Moreover, as environmental regulations push sustainable construction materials, the recyclable nature of thermoplastic corrugated pipes provides an additional economic and ecological advantage. Thus, as industries and governments aim to reduce construction costs without compromising quality, the adoption of lightweight and cost-effective corrugated pipes continues to expand globally.

CORRUGATED PIPE MARKET TRENDS

Growing Environmental Awareness and Sustainability Goals Are One of the Significant Market Trends

With the growing concern over climate change, carbon emissions, and plastic waste, industries are prioritizing materials that are both durable and recyclable. Corrugated HDPE and PP pipes fit this requirement as they are manufactured using eco-friendly processes and can be fully recycled at the end of their life cycle. Moreover, their lightweight nature leads to lower fuel consumption during transportation and installation, further reducing greenhouse gas emissions compared to heavier alternatives such as concrete or metal pipes. Governments and environmental agencies across regions such as Europe, North America, and Asia Pacific are implementing strict environmental regulations that favor the use of sustainable materials in infrastructure projects.

- For instance, the European Union’s Circular Economy Action Plan promotes the use of recyclable construction materials, driving demand for corrugated plastic pipes. Additionally, many manufacturers are developing bio-based or recycled polymer corrugated pipes, aligning with green building standards such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method).

MARKET CHALLENGES

Competition from Alternative Piping Materials to Hamper Growth

The intense competition from alternative piping materials, such as reinforced concrete pipes (RCP), ductile iron pipes, and fiberglass-reinforced plastic (FRP) pipes, hampers the market's growth. These traditional materials are still preferred for specific applications in heavy-load conditions, large-diameter sewer systems, and high-pressure water transport due to their perceived durability and long-standing acceptance among engineers and contractors.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Plastic Corrugated Pipe Held the Largest Market Share Due to Rising Urbanization

The market is segmented by product and is classified into metal corrugated pipe and plastic corrugated pipe.

The plastic corrugated pipe segment held the largest corrugated pipe market share 83.65% in 2026 and is expected to experience substantial growth. The plastic corrugated pipe is further divided into high-density polyethylene (HDPE), polyvinyl chloride (PVC), polypropylene (PP), and others. The growth is driven by the rising urbanization and growing demand for efficient water management and underground cable protection systems propel adoption. High-density polyethylene (HDPE) and polypropylene (PP) pipes are favored for their chemical resistance and flexibility in varying soil conditions.

The growth of the metal corrugated pipe coatings segment is associated with the increasing infrastructure development, which has heightened the demand for durable, load-bearing drainage and culvert systems. When galvanized or coated, these pipes provide exceptional structural strength and corrosion resistance, rendering them suitable for highways, bridges, and stormwater management systems.

By Type

Double Wall Corrugated Held the Dominant Share Owing to its Properties

The market is segmented by type and is classified into single wall corrugated and double wall corrugated.

The double wall corrugated segment held the largest market share 62.93% in 2026 and is expected to experience substantial growth due to its superior structural integrity, high flow efficiency, and longevity. These pipes are preferred for high-load applications in roadways, culverts, and large-scale drainage networks. The growing use of HDPE and PP double-wall designs enhances hydraulic performance and durability under heavy traffic or soil pressure. Moreover, infrastructure modernization projects, strict stormwater regulations, and the shift toward sustainable sewerage systems are fueling segment expansion globally.

The single wall corrugated segment is projected to experience significant growth in the coming years. The growth of the segment is driven by affordability, ease of transport, and low installation costs. Their simplicity makes them highly attractive for developing economies and rural projects. Moreover, the rising number of housing and smart city developments drives adoption for minor drainage and utility protection purposes. Increasing awareness of water conservation and improved distribution systems boosts the growth of the segment.

By Application

Water Management Segment to Exhibit a Significant CAGR Owing to Inadequate Drainage Infrastructure

Based on application, the market is segmented into water management, construction, electrical & telecommunications, agricultural fields, and others.

To know how our report can help streamline your business, Speak to Analyst

The water management segment is expected to dominate the market during the forecast period. The growth of the segment is driven by rising global concerns over water scarcity, urban flooding, and inadequate drainage infrastructure. Their flexibility and leak-proof design ensure efficient flow management, while lightweight properties reduce installation time. Additionally, smart water management programs and government initiatives to upgrade drainage and sewer networks in Asia Pacific and the Middle East are accelerating adoption. Furthermore, the segment is set to hold a 52.97% share in 2026.

The construction segment is witnessing favorable growth throughout the forecast period, attributed to the rapid urban development and infrastructure projects, such as highways, tunnels, and rail networks are major drivers. Contractors increasingly prefer corrugated pipes for their ease of handling and long-term performance. Furthermore, the increasing focus on sustainable construction materials and reduced lifecycle costs continues to strengthen market penetration.

The electrical & telecommunications segment is expected to experience favorable growth over the projected period. The growth of the segment is associated with the growing installation of underground cable networks for smart cities, fiber optics, and power distribution. Corrugated pipes offer high flexibility, crush resistance, and protection against moisture and corrosion.

The agricultural fields segment is driven by the need to improve crop yield and prevent waterlogging in farmlands. Lightweight and flexible properties enable easy installation over large areas.

Corrugated Pipe Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

ASIA PACIFIC CORRUGATED PIPE MARKET SIZE, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025, valued at USD 8.03 billion, and is projected to maintain its leading share in 2026, reaching USD 8.47 billion. The factors fostering the dominance of the region include rapid urbanization, government-backed infrastructure investments, and expanding agricultural irrigation systems. China, India, and Southeast Asian nations are major growth centers, where large-scale drainage and construction projects utilize cost-effective plastic corrugated pipes. The region’s growing telecom and power distribution sectors also spur demand for protective conduit pipes. Favorable manufacturing economics and increasing local production capacities sustain long-term growth. In 2026, the China market is estimated to reach USD 4.81 billion.

- China is the largest and fastest-growing market, supported by massive infrastructure investments and rapid urbanization. Government initiatives such as the “New Infrastructure Plan” and rural revitalization programs have spurred extensive demand for stormwater drainage, agricultural irrigation, and sewage systems. Plastic corrugated pipes, particularly HDPE variants, are preferred due to affordability, ease of installation, and suitability for large-scale urban and rural projects. The country’s growing focus on sponge city development and urban designs that enhance rainwater absorption and flood control further accelerates adoption.

To know how our report can help streamline your business, Speak to Analyst

Europe is anticipated to witness notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 3.8%, the second-highest amongst all regions, and reach a valuation of USD 2.94 billion in 2025. The market's growth is driven by stringent environmental and wastewater regulations, especially under the EU Water Framework Directive. The region favors recyclable plastic corrugated pipes for sustainability and a reduced carbon footprint. Infrastructure modernization in Germany, France, and the U.K., coupled with the growing adoption of underground cable protection systems, boosts demand. Green infrastructure initiatives and flood control measures drive steady market expansion. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 0.55 billion, Germany to record USD 0.79 billion, and France to record USD 0.42 billion in 2026.

After Europe, the market in North America is estimated to reach USD 3.51 billion in 2025 and secure the position of the third-largest region in the market. The growth of the market is driven by strong investments in stormwater management, highway rehabilitation, and smart infrastructure projects. The U.S. Environmental Protection Agency’s (EPA) regulations promoting sustainable drainage systems enhance demand for both metal and plastic corrugated pipes. HDPE and double-wall corrugated variants are widely adopted due to their durability and compliance with environmental standards. In 2026, the U.S. market is estimated to reach USD 3.20 billion.

- In the U.S., the market’s growth is driven by infrastructure rehabilitation and environmental sustainability initiatives. The Infrastructure Investment and Jobs Act (IIJA) has accelerated pipeline replacement and smart water management projects across states. Adoption of HDPE and double-wall corrugated pipes is increasing due to their cost efficiency, corrosion resistance, and compliance with EPA guidelines on sustainable drainage and wastewater systems. Additionally, the growth of telecommunications and renewable energy infrastructure boosts the use of corrugated conduits for cable protection.

The Latin America and Middle East & Africa regions will witness moderate growth in this market over the forecast period. The market in Latin America in 2025 is set to record USD 1.09 billion in valuation. The market's growth is driven by the rising construction activities, water management challenges, and government initiatives for rural development. Brazil and Mexico are key contributors, where investments in urban drainage, sewage, and agricultural irrigation are growing.

In the Middle East & Africa, GCC is set to attain the value of USD 0.74 billion in 2025, attributed to the rapid urban development, desalination projects, and the need for efficient water and wastewater infrastructure. GCC countries are increasingly adopting corrugated pipes for stormwater and underground cabling in smart city projects. In Africa, expanding agriculture and basic sanitation programs are propelling demand for cost-effective plastic corrugated pipes.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Are Adopting Business Expansion Strategies to Maintain Their Positions in the Market

Manufacturers are expanding their business operations to gain a competitive edge in the industry and alleviate the threats of new entrants. Some of the key market players include ASTRAL PIPES, Jain Irrigation Systems Ltd., Crown Pipes, Bina Plastic Industries Sdn. Bhd., and FRÄNKISCHE Industrial Pipes GmbH & Co. KG. Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their reach.

LIST OF KEY CORRUGATED PIPE COMPANIES PROFILED

- ASTRAL PIPES (India)

- Jain Irrigation Systems Ltd. (India)

- Crown Pipes (India)

- Bina Plastic Industries Sdn. Bhd. (Malaysia)

- FRÄNKISCHE Industrial Pipes GmbH & Co. KG (Germany)

- Contech Engineered Solutions LLC (U.S.)

- JM Eagle Inc. (U.S.)

- Pars Ethylene Kish Co. (Iran)

- Dutron (India)

- Thai-Asia P.E. Pipe Co., Ltd.(Thailand)

KEY INDUSTRY DEVELOPMENTS

- November 2023: ADS announced the establishment of a new state-of-the-art corrugated thermoplastic pipe manufacturing plant in Lake Wales, Florida (100-acre site; complements Sebring & Winter Garden), representing a significant capacity expansion in the U.S. Southeast.

- August 2021: Lane Enterprises acquired Pacific Corrugated Pipe Company (PCPC), a manufacturer and distributor of stormwater management and construction products. The acquisition creates one of the largest American manufacturers of stormwater pipe products in both plastic and metal pipe. The combined organization offers corrugated plastic and metal pipe, fabricated fittings, steel structural plate, aluminum structural plate, StormKeeperTM chambers, slotted drains, gabions, custom fabrication, and rebar and custom powder coatings.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.6% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, By Type, By Application, and By Region |

|

By Product |

· Metal Corrugated Pipe · Plastic Corrugated Pipe o High-Density Polyethylene (HDPE) o Polyvinyl Chloride (PVC) o Polypropylene (PP) o Others |

|

By Type |

· Single Wall Corrugated · Double Wall Corrugated |

|

By Application |

· Water Management · Construction · Electrical & Telecommunications · Agricultural Fields · Others |

|

By Geography |

o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

The global corrugated pipe market size is projected to grow from $17.86 billion in 2026 to $25.65 billion by 2034

In 2025, the market value stood at USD 8.03 billion.

The market is expected to exhibit a CAGR of 4.6% during the forecast period (2024-2034).

The plastic corrugated pipe segment led the market by product in 2025.

The key factors driving the market are the rapid urbanization, growing infrastructure and drainage development, and rising investments in water management and agricultural irrigation systems.

ASTRAL PIPES, Jain Irrigation Systems Ltd., Crown Pipes, Bina Plastic Industries Sdn. Bhd., and FRÄNKISCHE Industrial Pipes GmbH & Co. KG. are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

The major factors expected to favor product adoption in the market are ease of installation, superior corrosion resistance, recyclability, and compliance with sustainable construction standards.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us