Dairy Processing Equipment Market Size, Share & Industry Analysis, By Product Type (Pasteurizers, Homogenizers, Separators, Evaporators & Drying Equipment, Membrane Filtration Equipment, and Others), By Application (Processed Milk, Cream, Milk Powder, Cheese, Protein Ingredient, and Others), and Regional Forecast, 2026-2034

REPORT OVERVIEW

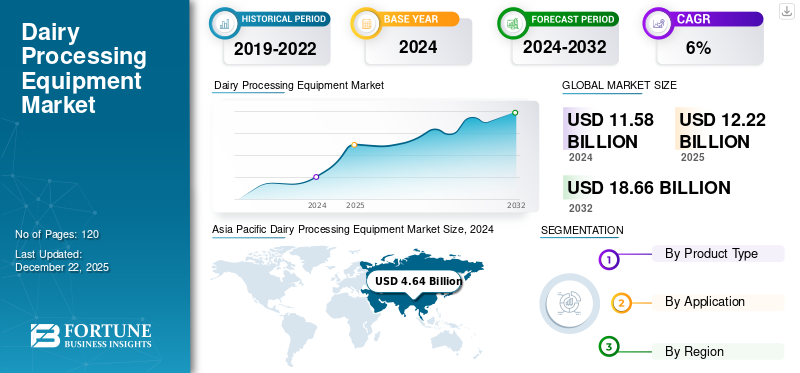

The global dairy processing equipment market size was valued at USD 11.58 billion in 2024 and is projected to grow from USD 12.22 billion in 2025 to USD 18.66 billion by 2032, exhibiting a CAGR of 6.50% during the forecast period. The Asia Pacific dominated global market with a market share of 42.25% in 2025.

Dairy processing equipment includes several machines and systems required to produce dairy products, such as milk, cream, butter, cheese, yogurt, protein ingredients, and ice cream. Equipment, such as pasteurizers, homogenizers, separators, evaporators & drying machines, membrane filtration, churning machines, clean-in-place systems, cooling tanks, and mixing equipment are considered in the market’s research scope.

Pasteurizers are used to heat milk to eliminate harmful bacteria from the raw milk. They find application in the manufacturing of several dairy products, including processed milk, cheese, yogurt, butter, cream, and ice cream. All types of pasteurizers, such as batch and vat pasteurizers have been considered during the research study for dairy processing equipment.

Homogenizers are industrial equipment used to reduce particle size and produce consistent dairy mixtures. They are applicable in the production of several dairy products including milk, cream, yogurt, ice cream, and milk powder. These machines help improve texture, make dairy products more digestible, and enrich product quality.

The market growth is driven by the increasing demand for processed dairy products, growing milk production, rising health & wellness trends, and increased urban population in developing economies. Higher urbanization often leads to shifts in lifestyle and eating habits. Urban populations are more exposed to diverse food cultures and tend to adopt diets that include more packaged foods, including yogurt, cheese, and flavored milk. This will drive the demand for specialized dairy processing equipment that can produce functional dairy products. A supportive policy environment and private investment in several regions favored the expansion of dairy product manufacturers, thereby increasing equipment demand during the forecast period. According to the World DataBank, developed countries, such as Europe and the U.S. consume more processed dairy products than fresh dairy products. More than 50% of the total dairy products consumed per capita is processed food.

The COVID-19 pandemic boosted the market as it led to increased health consciousness among a growing population, driving the demand for the equipment.

IMPACT OF TECHNOLOGY ON MARKET

Rapid Technological Advancements to Drive Market Growth

Innovations in dairy processing equipment focus on reducing energy and water wastage, which not only decreases operational costs, but also aligns with a company’s sustainability goals. Equipment that helps reduce greenhouse gas (GHG) emissions is in high demand. To cater to this demand, major players are launching innovative dairy processing equipment with lower carbon footprint. For instance,

- In May 2024, Tetra Pak expanded its homogenizer product portfolio by integrating Circle Green stainless steel, a material that has a 93% lower carbon footprint compared to that of the global average of the stainless steel industry. Circle Green stainless steel homogenizers offer food & beverage companies a viable path to reduce their Scope 3 emissions and achieve their net-zero goals.

The dairy industry is increasingly adopting automation to enhance efficiency, reduce labor costs, and minimize human error. Key players are integrating dairy processing equipment with advanced sensors for real-time monitoring and early detection of potential quality issues. For instance,

- In March 2024, GEA Group Aktiengesellschaft announced the launch of the latest live product monitoring sensor “NisoMate” for homogenizers. NisoMate, a sensor-based technology, helps control consistency and quality during the homogenization process. It also enables early detection of quality problems that help food & beverage manufacturers minimize waste.

In recent years, advancements in various non-thermal technologies, such as High-Pressure Processing (HPP), pulsed electric field, and membrane filtration have displayed the potential to produce shelf-stable dairy products with retained nutritional qualities. The latest techniques are transforming dairy production at a rapid pace. Undoubtedly, the transformation, owing to the use of advanced technologies, will easily fulfill the demand for dairy products. Companies that have adopted modern technology for dairy production are enjoying the lead and high production rate.

MARKET TRENDS

Rising Health and Wellness Trends to Fuel Market Growth

The consumption of food products that offer health benefits in addition to basic nutrition has increased in recent times. Also, milk production and preference for various types of functional dairy products have increased. Products such as yogurt and fermented milk are trending worldwide and consumed in high numbers. Consumer’s increasing focus on personal health is the key reason for the growing demand for functional dairy products. According to a 2023 Food and Health Survey by the International Food Information Council, around 52% of surveyed American individuals followed a specific eating pattern or diet, and 18% of these individuals considered high protein food most commonly in their diet.

Milk is regarded as a nearly complete food since it is a vital source of protein, fat, and other essential nutrients. Milk and dairy products are a major part of the everyday diet, primarily for vulnerable groups, such as school children, infants, and old people. As consumers become more health-conscious, the demand for dairy products that are high in nutritional value, such as protein-rich, low-fat, and probiotic-enhanced products is expected to increase further during the forecast period. This trend has led dairy processors to invest in advanced equipment that are capable of producing these specialized products. Equipment that facilitates fermentation and separation processes is also being increasingly sought after.

MARKET DYNAMICS

Market Driver

Rising Demand for Dairy Products to Augment Market Growth

Milk production takes place across the world. The demand for dairy products, such as milk, cheese, butter, and yogurt continues to grow worldwide owing to population growth, rising disposable incomes, health awareness, and urbanization.

According to the Food and Agriculture Organization of the United Nations (FAO), the global milk production rose by more than 77%, from 524 million tons in 1992 to 930 million tons in 2022. With around 25% of the total global milk production, India is the world’s largest milk producer, followed by the U.S., Pakistan, China, and Brazil. According to the U.S. Department of Agriculture (USDA), the global cheese consumption is expected to reach a record high of 21.6 million metric tons by 2024. Currently, the global cheese consumption is up 1.2% compared to 2023 and 5.7% compared to 2019.

In addition, the Organization for Economic Co-operation and Development (OECD) expects the global butter consumption to increase by 19% by 2026. The rising demand for dairy products is significantly impacting the dairy processing equipment industry. Dairy companies are increasingly investing in milk processing facilities to address the increasing demand for dairy products.

Market Restraint

High Initial Investment Cost to Impede Market Growth

The dairy processing equipment, particularly advanced and automated systems, require a significant initial investment. This investment includes costs of purchasing, installing, and maintaining the equipment, which can be challenging, especially for small and medium-sized businesses. Automation in dairy processing yields long-term savings. However, the upfront costs associated with incorporating fully automated systems can be a significant barrier for companies with budget constraints.

Dairy processing machines require regular maintenance that involves cleaning & sanitation and preventive maintenance to ensure efficiency, regulatory compliance, and product quality. The cost and complexity of maintaining such equipment can deter companies from adopting or upgrading to more advanced systems. In addition, economic downturns or uncertainty can result in cautious investment behavior among companies, which can delay the purchase of new equipment or upgrading to advanced systems.

Market Opportunity

Rising Investment and Robust Support by Governments to Offer Ample Market Growth Opportunities

Governments are investing heavily in dairy infrastructure to address the growing domestic demand. This includes the establishment of new dairy processing plants and modernization of existing facilities. For instance,

- In June 2024, The U.S. Department of Agriculture (USDA) announced a USD 12 million fund to support various dairy initiatives, including the expansion of processing capacity through the Dairy Business Innovation Initiatives (DBI). This initiative supports small and mid-sized dairy businesses by helping them get access to advanced production and processing techniques for the development of value-added products.

- In March 2024, Mother Dairy, a wholly-owned subsidiary of the Indian National Dairy Development Board (NDDB), announced USD 90 million investment for setting up two advanced dairy, fruit, and vegetable processing plants. Around USD 60 million of this investment will be directed toward establishing an advanced dairy facility.

Government initiatives and subsidies in many countries are encouraging the growth of the dairy industry, leading to increased demand for processing equipment. Governments often offer tax incentives, grants, and low-interest loans to dairy processing companies to encourage investment in new equipment and technologies. This financial support make it easier for companies to upgrade or expand their processing facilities, driving the dairy processing equipment market growth.

SEGMENTATION ANALYSIS

By Product Type

Pateurizers to Dominate Market Owing to Increasing Demand from Small, Medium, and Large Dairy Manufacturing Companies

Based on product type, the market is classified into pasteurizers, homogenizers, separators, evaporators & drying equipment, membrane filtration equipment, and others.

The pasteurizers segment is expected to dominate the market during the forecast period. Pasteurizers account for almost one-fourth of the total revenue market share due to increasing demand from small and medium-scale enterprises and large dairy manufacturing companies. These machines offer extended shelf life, safety, and quality of products, thereby eliminating several health issues by killing harmful viruses and bad microorganisms.

Homogenizers segment captured 21% of the market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

The evaporators & drying equipment segment is poised to record the highest CAGR during the forecast period. This equipment plays a crucial role in the production of concentrated milk products. The rising demand for powdered dairy products is propelling the need for efficient evaporators and drying equipment.

By Application

Raising Awareness about the Importance of Healthy Diet to Augment the Segement Growth for Processed Milk

Based on application, the market is segmented into processed milk, cream, milk powder, cheese, protein ingredient, and others.

The processed milk segment is expected to register the highest CAGR of 7.17% and dominate the market during the forecast period. Processed milk has remained the most popular dairy product, thereby accounting for the highest revenue market share of about 32%. Rising discretionary income and growing consumer awareness about healthy diet will enhance the segment’s growth.

Consumer demand for flavorful and tasty food is quite strong across diverse geographic regions. The surging cream production and increasing technological advancements and innovations are boosting the demand for dairy equipment. The segment is likely to hold 25% of the market share in 2025.

DAIRY PROCESSING EQUIPMENT MARKET REGIONAL OUTLOOK

The market covers five major regions - North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

ASIA PACIFIC

Asia Pacific Dairy Processing Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the largest and fastest-growing market, driven by large population, urbanization, high demand for advanced processing equipment, supportive government initiatives, and evolving retail landscape. The region accounted for the highest dairy processing equipment market share of about 36.7% in 2023. The regional market value in 2024 was USD 4.64 billion, and in 2023, the market value led the region by USD 4.35 billion. Changing dietary habits and automated systems will boost the dairy equipment market growth in the region during the forecast period. The market value in China is expected to be USD 2.48 billion in 2025.

Download Free sample to learn more about this report.

On the other hand, India is projecting to hit USD 0.44 billion and Japan is likely to hold USD 1.38 billion in 2025.

China Set to Dominate Market Due to Dynamic Demographics and Rising Disposable Income

Dynamic demographics, rising discretionary incomes, and improving living standards are a few of the prominent factors resulting in China’s dominance in the dairy processing equipment market. China accounted for half of the total revenue market share in 2023, followed by Japan.

- For instance, according to China’s Ministry of Agriculture and Rural Affairs, the per capita consumption of dairy products grew by 10.4% in 2021 as compared to 2020.

NORTH AMERICA

North America region is to be anticipated as the third-largest market with USD 2.04 billion in 2025. Several campaigns and new initiatives by the domestic governments are favoring the market growth in this region. Manufacturers, to expand their presence within their countries, are heavily investing in their production capacity. For instance,

- Walmart has announced an investment of about USD 350 million in a milk processing facility in Texas. The new manufacturing facility is commissioned to open by 2026.

The U.S. market is estimated to be USD 1.96 billion in 2025. Changing consumer preferences, increasing demand for fast food, and expanding retail demand are boosting the growth of dairy products, ultimately driving the market in North America. Supportive government investments and workforce shortage are a few of the key factors that will surge the sales of advanced processing machinery in the region’s dairy sector. For instance,

- In February 2024, Agriculture and Agri-Food Canada announced an investment of about USD 89 million in over 49 projects under the Supply Management Processing Investment Fund.

EUROPE

Europe is anticipated to account for the second-highest market size of USD 3.52 billion in 2025, exhibiting the second-fastest growing CAGR of 6.17% during the forecast period. Europe will experience steady growth owing to the subdued demand and increasing policy pressures. Rising domestic consumption and exports of value-added products, such as cheese and butter are surging the demand for dairy products. The market value in U.K. is expected to be USD 0.94 billion in 2025.

On the other hand, Germany is projecting to hit USD 1.37 billion and France is likely to hold USD 0.47 billion in 2025. Changing prices and ongoing reductions in milk flows have also impacted the market growth. However, international manufacturers are penetrating into the European market through heavy investments. For instance,

- TH Group from Vietnam invested about USD 204 million in the construction of a dairy farm and dairy processing plant in 2019.

Manufacturing companies are heavily investing in expansion strategies in European countries to meet the rising requirements across borders. Strong demand for products, such as cheese, butter, yogurt, and other dairy products across regions will further boost the regional market growth. For instance,

- Valio has made a significant investment totaling over USD 64 million in the Lapinlahti plant for the cheese production process. The investment is intended to help the company expand its existing facility to increase cheese production capacity and commission its new production line by 2026.

MIDDLE EAST & AFRICA

The Middle East and Africa is anticipated to be the fourth-largest market with a value of USD 1.01 billion in 2025 and experience moderate growth during the forecast period as a result of a growing population, expanding foodservice sector, and increasing retail landscape. Governments across the region are focused on boosting their imports of dairy products through significant investment in collaboration with manufacturing partners. The GCC market size is estimated for USD 0.58 billion in 2025. For instance,

- Russia has planned to penetrate into the Arab market by increasing its dairy product supplies by 15-20% annually. The targeted Arab countries include the U.A.E., Saudi Arabia, Oman, Tunisia, and others.

LATIN AMERICA

Several supportive policies and tax reforms in countries across Latin America are further contributing to the demand for dairy processing equipment. Although, the COVID-19 pandemic impacted the market due to supply chain disruptions, the market has rebounded to pre-pandemic levels. For instance,

- Brazil’s Ministry of Agriculture and Livestock issued a proposal for milk producers in October 2023.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players to Focus On Strengthening their Market Position with Continuous Developments

The global market is moderately fragmented and predominantly driven by a few established players, such as GEA Group Aktiengesellschaft, IDMC Limited, IWAI Kikai Kogyo Co., Ltd., Izumi Food Machinery, John Bean Technologies Corporation, Krones AG, Paul Mueller Company, Inc., SPX FlOW, SUNRISE INDUSTRIES, and Tetra Laval S.A. These players are striving to expand their market presence at the regional level through expansion and strategic investment. They are developing innovative technologies for end users to minimize their operational costs. For instance,

- In February 2024, Lyra’s UV pasteurization technology optimized the energy consumption of a dairy production plant by 91%. This technology in the dairy industry aids in significant savings of energy.

List of Key Companies Studied:

- GEA Group Aktiengesellschaft (Germany)

- IDMC Limited (India)

- IWAI Kikai Kogyo Co., Ltd. (Japan)

- Izumi Food Machinery (Japan)

- John Bean Technologies Corporation (U.S.)

- Krones AG (Germany)

- Paul Mueller Company, Inc. (U.S.)

- SPX FLOW (U.S.)

- SUNRISE INDUSTRIES (India)

- Tetra Laval S.A. (Switzerland)

- HOMMAK (Turkey)

- Harvest Hi-tech Equipments (India) Pvt. Ltd. (India)

- INOXPA (India)

- Christakis Agathangelou Ltd. (Cyprus)

- Buhler Group (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: GEA Group Aktiengesellschaft announced the acquisition of South West Dairy Services, a family-owned business, to strengthen its presence in South West England and improve its product portfolio in the region.

- May 2024: Paul Mueller Company, Inc. announced the expansion of its facility at its headquarters with an investment of USD 20 million. The company is investing in its infrastructure to address its record backlog growth over the past 2 years. The new facility will be of 100,000 square feet dedicated to the production and improvement of the company’s research & development initiatives.

- May 2024 – SPX FLOW announced an infusion vessel to enable Ultra High Temperature (UHT) infusion systems to have less product waste, longer running times, and more yield. UHT infusion systems process many popular products, including dairy and plant-based beverages.

- March 2024: GEA Group Aktiengesellschaft announced the launch of the latest live product monitoring sensor “NisoMate” for homogenizers. NisoMate, a sensor-based technology, helps control consistency and quality during the homogenization process. It also enables early detection of quality problems that help food & beverage manufacturers minimize waste.

- March 2024: Krones AG’s subsidiary Milkron presented its latest membrane filtration systems at Anuga Food Tec Germany. The latest system is developed to cater to various applications, including dairy products and plant-based alternatives.

REPORT COVERAGE

The report provides an in-depth analysis of the industry dynamics and competitive landscape. It also provides market estimation and forecast based on technology, end user, and regions. It provides various key insights into recent developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Region

|

|

|

Companies Profiled in the Report

|

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 12.22 billion in 2025.

In 2034, the market is expected to reach a valuation of USD 21.44 billion.

The market is projected to grow at a CAGR of 6.50% during the forecast period.

The pasteurizers segment is expected to lead the market over the forecast period.

The increasing milk production, rising health & wellness trends, and increased urban population in developing economies will fuel the market growth.

Growing demand for appetizing and healthier dairy products is boosting the growth of the market.

GEA Group Aktiengesellschaft, IDMC Limited, IWAI Kikai Kogyo Co., Ltd., Izumi Food Machinery, and John Bean Technologies Corporation are the leading companies in this market.

The Asia Pacific dominated global market with a market share of 42.25% in 2024.

The consumer’s increasing focus on personal health is the key trend that is expected to augment the market growth.

Based on application, the processed milk segment is projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us