Food Processing and Handling Equipment Market Size, Share & Industry Analysis, By Equipment (Processing Equipment, Packaging Equipment, and Service Equipment), By Application (Bakery & Confectionery Products, Meat and Poultry Products, Dairy Products, Beverages, and Others), and Regional Forecast, 2026-2034

Food Processing and Handling Equipment Market Size

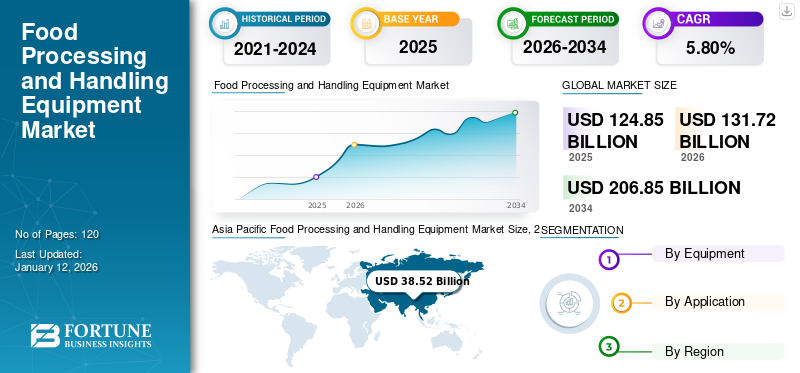

The global food processing and handling equipment market size was valued at USD 124.85 billion in 2025. The market is projected to grow from USD 131.72 billion in 2026 to USD 206.85 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. The Asia Pacific dominated the global market with a share of 30.90% in 2025.

The food processing and handling equipment is used to process raw items such, as meat, seafood, bakery, dairy, and confectionery, as there is a rising demand for processed foods.

Several companies are focusing on the integration of advanced concepts such as IoT to enhance the manufacturing process. Companies that are integrating IoT into their machinery are estimated to achieve enhanced food safety, cut down wastage, improved traceability, and reduced costs, while simultaneously lowering the risks associated with various food and packaging processes.

Major equipment manufacturers such as Bühler AG, JBT Corporation, IMA Group, and Tetra Pak International S.A. are investing in automation, smart sensors, and advanced processing technologies to enhance efficiency, precision, and food safety.

Impact of Reciprocal Tariffs

Rising Price Volatility of Raw Materials and Supply Chain Disruptions creates a barrier to Market Growth

The U.S.'s reciprocal tariffs on raw materials, packaging materials, agricultural and food-related products have reshaped the global food processing and handling equipment market. Tariffs on imports of agricultural inputs (e.g., fertilizers, farm machinery, and packaging equipment) and raw materials (e.g., steel, aluminum, etc.) will increase production costs for food processors, which can create a barrier for small to medium-sized companies to scale up their business and maintain a profit margin. Major players are also facing increased costs for operations and raw materials, reducing profit margins, while supply chain disruptions create delays in raw material deliveries.

- For instance, GEA Group Aktiengesellschaft's 18% of sales account for the U.S., with imports mainly coming from Europe and more than 50% from Germany. The tariffs' impact be passed on to customers, and most contracts contain pass-through clauses for tariff changes.

Production and manufacturing costs have risen owing to the increased cost of components, including compressors, pumps, and other components. According to OEC, Germany alone accounts for 24% of U.S. industrial food preparation machinery. The U.S.'s recent 20% tariff on EU products represents a serious obstacle for the EU economy.

FOOD PROCESSING AND HANDLING EQUIPMENT MARKET TRENDS

Technological Advancements and Sustainable Design Shape Market Growth

The hygiene-focused technological advances support regulatory compliance (e.g., FDA FSMA, EU Hygiene Package) and build consumer trust in brand safety, vital in the dairy, ready-to-eat, and meat sectors where contamination risks are highest. Integrating smart sensors, machine learning, and remote diagnostics transforms equipment monitoring. Moreover, advanced technologies such as predictive maintenance reduces unplanned downtime and boosts lifecycle efficiency.

- Marel's Innova Food Processing Software has achieved widespread adoption in 2024. This highly flexible and fully scalable production control software suite empowers processors to efficiently manage, monitor, and optimize all facets of the production processes, encompassing everything from live bird handling to order dispatch and quality control.

Equipment providers focus on water- and energy-saving machinery to meet sustainability goals. Technologies such as high-pressure processing (HPP) and vacuum cooling are gaining momentum across sectors such as meat, dairy, and fresh produce.

Sustainability goals drive the need for equipment that uses less energy and water while cutting down on food and material waste. This shift is speeding up using non-thermal technologies, clean-in-place (CIP) systems, and modular equipment designs. These innovations boost operational efficiency and align with global ESG objectives and the growing consumer demand for clean-label products.

Download Free sample to learn more about this report.

MARKET DRIVERS

Integration of Automation and Robotics for Operations at Manufacturing Facilities Fortify Market Development

Equipment manufacturers are trying to incorporate ultra-modern automation and inculcate AI technologies and IoT to execute robotics. These efforts aim to increase food safety and strengthen supply chain across geographies. Manufacturers are also inclined toward performing product monitoring, remote maintenance, and self-diagnosis to increase efficiency of food processing and handling operations. These automated processing technologies can now be performed seamlessly as facilities comply with techniques prescribed under Industry 4.0. Equipment manufacturers focus on providing post-purchase smart services to their customers.

- In March 2024, GEA Group Aktiengesellschaft launched latest live product monitoring sensor, “NisoMate,” a sensor-based technology that helps control consistency and quality during the homogenization process. It also enables early detection of quality problems that help food and beverage manufacturers minimize waste.

Rising demand for Ready-to-Consume Convenient Food Boosts Market Growth

Dairy, meat, frozen snacks, and bakery products dominate the consumption pattern globally, necessitating more advanced food processing and handling technologies to meet volume, safety, and hygiene requirements. Changing consumer preferences toward healthy, protein-rich, and frozen food variants, particularly convenient food, create consistent demand in developing and developed markets.

Globally, there is a rising demand for convenient, shelf-stable, and ready-to-consume options, fueling the consumption of processed foods. Thus, food manufacturers are investing heavily in advanced machinery for sorting, preparation, cooking, chilling, freezing, and packaging to meet market demands, ensure product quality and safety, reduce waste, and maintain competitive production scales. India Brand Equity Foundation (IBEF) reported that in 2024, the food processing industry represented 32% of the total food market, making it one of the largest sectors in India.

MARKET RESTRAINTS

High Capital Investment Coupled with Operational and Regulatory Challenges to Hamper Market Growth

Using advanced equipment, especially systems that include automation and hygienic designs, require substantial upfront investment, making it difficult for small and mid-sized food processors to afford. Cost of setting up a medium-to-large food processing facility with modern gear falls between USD 50,000 to USD 500,000.

Rising utility costs such as water, electricity, and gas also create an obstacle for market development. The U.S. Energy Information Administration (EIA) reported that the average retail electricity price for industrial users in the U.S. went up gradually from USD 7.18 cents per kilowatt-hour in 2020 to USD 8.15 cents in 2024. This increase can affect the operating margins of small and mid-sized plants.

Strict food safety and quality rules are another major challenge. Meeting global standards such as HACCP (Hazard Analysis and Critical Control Points), GMP (Good Manufacturing Practices), and specific regulations such as the FDA's FSMA (Food Safety Modernization Act) in the U.S. or the EU Food Hygiene Regulations places significant efforts to invest in right equipment, cleaning processes, and traceability systems. Companies failing to comply these standards may face product recalls, heavy fines, or may lead to shutting down of facilities, often hitting smaller operators or those upgrading older equipment.

MARKET OPPORTUNITIES

Rising Demand across Developing Economies and Government Schemes Create Growth Opportunities

Developing economies such as India, Brazil, ASEAN, and South Africa are witnessing rapid urbanization, growing population, and increasing demand for processed and packaged food. Moreover, rising disposable income and lifestyle shifts will create strong growth avenues for manufacturers of food processing and handling equipment.

Governments globally recognize the significance of the food processing sector as a key driver for agricultural value addition, food security, employment generation, exports promotion, and overall economic growth. Consequently, numerous nations have implemented dedicated schemes and initiatives to bolster food and beverage industry.

- In February 2025, the Ministry of Food Processing Industries in India has sanctioned 1,608 projects, including 536 Food Processing Units, under the PMKSY schemes being implemented across the country. Since these schemes were launched, USD 710.3 million (RS 6,198.76 crore) has been disbursed in grants and subsidies.

A rise in health awareness, increasing participation of women in workforce, and changing consumer preference toward ready-to-eat, dairy, and hygienically packaged products are expected to push the market further.

SEGMENTATION ANALYSIS

By Equipment

Processing Equipment Segment’s Exponentially Growth is Due to its Ability to Cater High Demand

By equipment, the market is classified into processing equipment, packaging equipment, and service equipment. Processing equipment is further divided into processing equipment and pre-processing equipment. Packaging equipment is further divided into filling, bottling, case cartooning, labelling, palletizing, and service equipment is sub-divided into cooking & preparation equipment, refrigeration equipment, ware washing equipment, storage & handling equipment, others (serving equipment).

The food processing equipment segment is projected to grow exponentially in the near future, owing to its ability to cater high demand across the food and beverages industry. accounting for 47.75% market share in 2026 Increasing sales of ready-to-consume foods and beverages are set to bolster sales of the processing equipment over the slated period of time.

The service equipment segment is projected to have a remarkable market share owing to the growing demand for refrigerators and ovens. The equipment used in the food service industry, namely, commercial kitchens, hotels, and restaurants, is generating revenues from sales, post-purchase service, and equipment replacement.

The packaging equipment segment is anticipated to have considerable market revenue owing to increasing demand for dietary and perishable food products and increasing health awareness. In packaging equipment filling sub-segment is holding prominent revenue. Labelling segment is also gaining popularity due to the increasing use of labeling machine to attach brand names and other information on product.

By Application

To know how our report can help streamline your business, Speak to Analyst

Bakery and Confectionery Products Segment Hold a Dominant Share Due to Increasing Consumption of Bakery Products across Cafes in Urban Areas

Based on application, the market is classified across bakery & confectionery products, meat and poultry products, dairy products, beverages, and others.

Bakery & confectionery food products are witnessing growth in the U.K., Germany, and France, as bread and other related bakery products are a staple across the region accounting for 35.23% market share in 2026. Several processing machines are used in commercial bakeries to produce bread of several applications and shapes in large quantities and in less time. As per the Federation of Bakers, the average bread consumption in the European Union (EU) is about 50 kg per person every year.

The expanding utilization of dairy items across Asia Pacific is estimated to enhance market development over the forecast timeline. As per the data revealed by the NIPFA, the dairy industry in India was expected to reach around USD 140 billion by the end of 2020.

The global beverages industry is witnessing significant growth owing to the increasing consumption of alcoholic drinks, soft drinks, and fruit juices.

The meat & poultry products segment is anticipated to grow with its increasing consumption, which is anticipated to propel North America’s market size. According to the North America Meat Institute, in 2024, the U.S.'s meat production (excluding poultry) totaled 27.04 billion pounds while poultry production totaled 54.9 billion pounds.

The others segment consists of grains, nuts, fruits, and vegetables, and it is likely to experience substantial growth, owing to moderate demand and limited requirements for their processing and packaging.

FOOD PROCESSING AND HANDLING EQUIPMENT MARKET REGIONAL OUTLOOK

On the basis of regional ground, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Food Processing and Handling Equipment Market Size, 2025 To get more information on the regional analysis of this market, Download Free sample

Asia Pacific’s market dominated the market with a valuation of USD 38.52 billion in 2025 and USD 41.14 billion in 2026. value is projected to show dynamic growth in response to the region’s rising disposable income and shifting consumer preference toward convenience food & instantly processed food. Additionally, the rapidly developing food products manufacturing industry across India and China further enhances the market’s share.The Japan market is projected to reach USD 6.25 billion by 2026, the China market is projected to reach USD 21.87 billion by 2026, and the India market is projected to reach USD 5.38 billion by 2026.

China is the largest contributor to the food and beverages industry owing to its significant population. Additionally, the country stands as the number one importer of agricultural products. The U.S. remains the largest destination for Chinese goods exports and the second-largest source of U.S. imports. In 2024, China's U.S. exports and imports comprised 14.7 percent and 6.3 percent respectively. For export and import, China is the third and second largest source for the U.S.

To know how our report can help streamline your business, Speak to Analyst

The demand for food processing, servicing, and packaging equipment is expected to have progressive market growth across North America. This factor was mainly due to the swiftly developing food & beverage industry and changing consumer preference for frozen food products. According to the American Frozen Food Institute (AFFI), in 2022, frozen food generated approximately USD 72.2 billion in U.S. retail sales. The rising numbers of food manufacturing plants in the U.S. are also expected to provide impetus to regional industry. The U.S. market is projected to reach USD 21.66 billion by 2026.

Europe is anticipated to witness significant cumulative market growth over the forecast period due to increasing investments in expanding production facilities. Germany holds the prominent position. However, the U.K. and France are following the growth trend of Germany during the forecast period owing to the availability of advanced machine manufacturing facilities. It is due to the increasing food processing and restaurant industry in these countries. The UK market is projected to reach USD 5.86 billion by 2026, while the Germany market is projected to reach USD 16.84 billion by 2026.

The extensive increment in the urban population across Latin America, especially in Brazil and Mexico is expected to bolster market development prospects. According to the statistics published by the Foreign Agriculture Service section of the U.S. Department of Agriculture, in 2024, the food processing industry of Brazil registered a revenue of USD 233 billion.

Moreover, robust infrastructure setup, substantial private sector and public sector investments, and decreased regional tariffs are critical factors propelling the market in the Middle East & Africa. For instance, the food processing sector of the UAE witnessed the participation of 568 players, which are essentially small and medium-size entities. These companies are capable of satisfying the requirement of the Middle East region and are also increasing exports in cross-border trade.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Forming Strategic Co-Operations with Processing and Packaging Solution Providers

Buhler AG, GEA, Alfa Laval, and JBT Corporation are some of the prime market players. Due to the involvement of numerous participants, the market currently has a fragmented structure. Key players are striving for mergers and acquisitions of smaller entities while simultaneously working on venturing into collaborations and joint ventures to operate efficiently and have a diversified presence.

- For instance, in March 2025, Alfa Laval, a prominent equipment manufacturer, announced a binding put option agreement to acquire cryogenics business from Fives Group. The proposed acquisition is to strengthen Alfa Laval’s portfolio of heat transfer and pump products for gas liquefaction.

Similarly, in January 2025, John Bean Technologies Corporation (JBT) completed the takeover of Marel, an Icelandic food processing equipment manufacturer. JBT Corporation has changed its name to JBT Marel Corporation, with a new stock ticker symbol, "JBTM". This merger combines JBT's manufacturing, product development, and cost control strengths with Marel's innovation capabilities and intellectual property portfolio.

Major market players are acquiring equipment providers with low maintenance costs while expanding their product portfolio and geographic presence. Additionally, prominent market players are investing heavily in the research and development division to introduce new product launches and elevate product diversity in the existing product portfolio.

LIST OF KEY FOOD PROCESSING AND HANDLING EQUIPMENT COMPANIES PROFILED

- Buhler Ag (Switzerland)

- JBT Corporation (U.S.)

- IMA Group (Italy)

- Tetra Pak International S.A. (Tetra Laval) (Switzerland)

- The Middleby Corporation (U.S.)

- Paul Mueller Company, Inc. (U.S.)

- Krones AG (Germany)

- GEA Group Aktiengesellschaft (Germany)

- ALFA LAVAL (Sweden)

- Dover Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: GEA has introduced bake extruder at IBA Dusseldorf (Germany) designed to meet the bakery industry’s evolving demands of medium to large biscuit manufacturers. The latest innovation supports the high volume and high speed applications and deliver high flexibility, hygienic operation, and productivity.

- May 2025: JBT Marel showcased complete production lines from live handling through deboning to packaging and automated AGVs, emphasizing modularity and sustainability at IFFA 2025.

- February 2025: Middleby Corporation announced plans to spin off its Food Processing business into a standalone, publicly traded company. The spin-off will distribute shares of the new entity to Middleby’s existing shareholders and is expected to be completed by early 2026, subject to board approval and SEC filings. The transaction is structured as a tax-free distribution for U.S. federal income tax purposes.

- May 2024: Tetra Pak has expanded its homogenizer lineup by integrating Circle Green stainless steel, which has a carbon footprint that’s 93% lower than the global industry average. This innovative solution allows food and beverage companies to reduce their Scope 3 emissions and work towards their net-zero goals.

- January 2024: Ska Fabricating, engaged in the design and development of automated packaging line equipment, announced the acquisition of GR-X Manufacturing, which operates as a manufacturer of beverage packaging line solutions. The acquisition will help the company to elevate its product portfolio diversity and will also strengthen its position in the market.

REPORT COVERAGE

The scope of the study includes three major applications of the equipment: processing, packaging, and service. The research report encompasses an in-depth analysis of the global food processing and handling machinery market dynamics and competitive landscape. Additionally, it highlights the recent developments, including mergers and acquisitions and new product launches across countries that would help gauge the market scenario. The report also includes macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment · Processing Equipment o Pre-processing Equipment o Processing Equipment · Packaging Equipment o Filling o Bottling o Case Cartooning o Labelling o Palletizing · Service Equipment o Cooking & Preparation Equipment o Refrigeration Equipment o Ware washing Equipment o Storage & Handling Equipment o Others (Serving Equipment) |

|

By Application · Bakery & Confectionery Products · Meat & Poultry Products · Dairy Products · Beverages · Others (Grain, Fruit, and Nut & Vegetable) |

|

|

By Region · North America (By Equipment, Application, and Country) o U.S. (By Application) o Canada (By Application) · Europe (By Equipment, Application, and Country) o Germany (By Application) o U.K. (By Application) o France (By Application) o Italy (By Application) o Rest of Europe · Asia Pacific (By Equipment, Application, and Country) o China (By Application) o India (By Application) o Japan (By Application) o Rest of Asia Pacific · Middle East & Africa (By Equipment, Application, and Country) o GCC Countries (By Application) o South Africa (By Application) o Rest of the Middle East & Africa · Latin America (By Equipment, Application, and Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America |

Frequently Asked Questions

Fortune Business Insights estimates that market was valued at USD 124.85 billion in 2025.

In 2034, the market is expected to be worth USD 206.85 billion.

The market is anticipated to grow at a CAGR of 5.80% over the forecast period (2026-2034).

Asia Pacific is a dominant region and was valued at USD 38.52 billion in 2025.

Within equipment, the processing equipment segment is expected to be the leading segment in the market during the forecast period.

The incorporation of robotics and automated technologies in manufacturing plants and increasing demand for hygienic convenience food products are expected to drive the market's growth.

Rising investment in the food processing industry is the latest market trend.

Buhler Ag, JBT Corporation, IMA Group, Tetra Pak International S.A. (Tetra Laval), The Middleby Corporation, Paul Mueller Company, Inc., Krones AG, GEA Group Aktiengesellschaft, ALFA LAVAL, and Dover Corporation.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us