Database Monitoring Software Market Size, Share & Industry Analysis, By Component (Software and Services), By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and SMEs), By End User (BFSI, Healthcare, Government, IT and Telecom, Retail, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

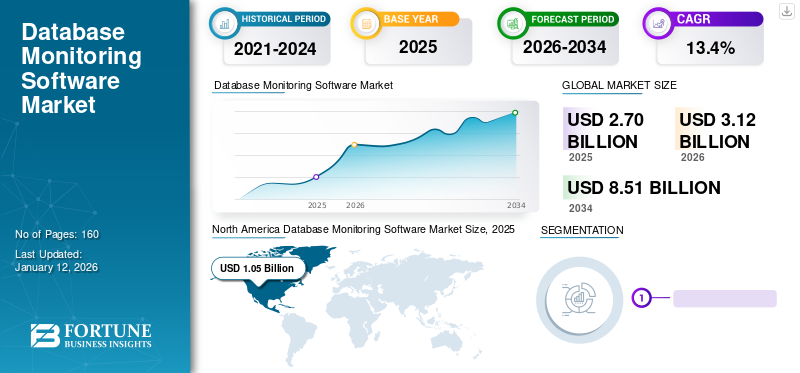

The global database monitoring software market size was valued at USD 2.7 billion in 2025. The market is projected to grow from USD 3.12 billion in 2026 to USD 8.51 billion by 2034, exhibiting a CAGR of 13.4% during the forecast period. North America dominated the global market with a share of 38.8% in 2025.

Database monitoring allows users to gather essential database performance metrics, which help optimize and improve the processes of the database. The use of database monitoring tools allows users to see how data is made available, used, and verified in an organization’s databases as well as their health, availability, and reliability. Database vendors integrate monitoring tools into their products to assist.

Global Database Monitoring Software Market Overview

Market Size:

- 2025 Value: USD 2.7 billion

- 2026 Value: USD 3.12 billion

- 2034 Forecast Value: USD 8.51 billion

- CAGR (2025–2032): 13.4%

Market Share:

- Regional Leader: North America held around 38.8% share in 2025.

- Fastest-Growing Region: Asia Pacific is projected to register the highest growth during the forecast period.

Industry Trends:

- Software segment leads the market, while services such as installation, integration, and consulting are growing rapidly with SME adoption.

- Cloud-based deployment is preferred due to scalability and remote visibility.

- Large enterprises dominate adoption, while SMEs are expanding usage through affordable service models.

- BFSI is the leading vertical, followed by healthcare, IT & telecom, government, and retail.

Driving Factors:

- Increasing data volumes across industries like BFSI, healthcare, and IT are boosting the demand for monitoring tools.

- Complex cloud and hybrid IT environments require proactive database performance management.

- Organizations focus on reducing downtime, optimizing performance, and ensuring a better end-user experience.

- Regulatory compliance and security requirements further drive adoption of centralized monitoring solutions.

The scope includes various software and services offered by leading players such as SolarWinds Worldwide, LLC, Heroix Corporation, Quest Software Inc., and others. These leading players are offering various products: database performance analyzer by SolarWinds, Datadog Database Monitoring by Datadog, SQL Server Monitoring offered by Spiceworks, and Data Applications Manager by ManageEngine. Also, data server monitoring tools are offered by Site24x7, remote data management solutions by Atera, and SQL Power Database Tools performance metrics are offered by Quest Software Inc.

Furthermore, these players are developing advanced technology such as AI, cloud, and machine learning-based monitoring tools. For instance,

- April 2022: Tata Consultancy Services (TCS) introduced the TCS ADD suite intuitive and agile risk-based monitoring solution for healthcare and clinical trials. It enables compliance with regulatory standards, helps in decision-making, and improves study efficiency. TCS ADD suite enables Contract Research Organizations and biopharmaceutical companies to identify risks with the help of advanced statistical algorithms.

- September 2021: Site24x7 launched a website content monitoring review tool that comprehensively monitors all servers, websites, and applications.

COVID-19 IMPACT

Rising Adoption of Database Software in Healthcare amid COVID-19 Aided Market Growth

The impact of COVID-19 pandemic positively impacted the global market during the projected period. This is accredited to the significant speed in the adoption of online social media platforms and surge in internet users during the pandemic.

Despite variations in software indices owing to budget restrictions, shutdowns, and stay-at-home orders across the globe, most chosen indexes have returned to pre-COVID-19 levels. Database monitoring software firms saw a surge in demand from healthcare, transportation, logistics, and consumer staples during the pandemic. The retail, energy, and hotel industries, on the other hand, saw a considerable drop in product demand.

Demand and usage was projected to rise in the mid to long term for software firms with significant profit margins and recurring income. Due to the implications of COVID-19, firms are reprioritizing automated database monitoring and cloud adoption, according to Redgate's annual state of database monitoring software report.

As IT infrastructures become increasingly diversified, the application's complexity grows exponentially. Database monitoring helps IT fix issues before affecting end users in such complex heterogeneous setups.

- According to a Redgate Software survey conducted in 2020, 79% of database professionals employed either in-house or paid monitoring tools, which is a 10% increase over the previous year. In addition, 86% of respondents said they were happy with paid monitoring solutions, up by 18% from the previous year.

As a result, the market share is likely to expand in future.

LATEST TRENDS

Download Free sample to learn more about this report.

Changing Landscape of Database Infrastructure to Propel the Market Growth

Database infrastructure is used to maintain and manage large amounts of data using several hardware and software components. Database monitoring remains one of the top tasks of Database Administrators (DBAs) despite all of these changes, and it continues to influence growth depending on how DBAs handle their roles.

Rapid use of cloud technology and mixed servers aids the market growth rate. IT firms must keep historical databases on-premises and in the cloud. Complex database difficulties result from such a hybrid server setup. Monitoring software closely monitors databases in such complicated database structures. This software has several benefits, such as minimizing outages & slowdowns of important components, helping to diagnose problems quickly, and reducing IT infrastructure expenses. It also aids in the reduction of breakdown costs and the avoidance of revenue loss caused by outages.

DRIVING FACTORS

Rise in Amount of Data Generated by Industries to Accelerate Demand for Database Monitoring Tool

Rising data generation in several industries, such as BFSI, IT & telecom, and the growing Internet of Things (IoT), created a massive demand for database monitoring software. Besides, the introduction of customer-interface applications and the deployment of cloud computing technologies in small and large industries are also surging the demand for database software. Also, an increase in the amount of data with the surge in internet penetration aids market growth. According to Cisco Systems Inc. Report in 2020, the data traffic per month reached 35.5 GB per month in 2021 and is rapidly growing. Such an increase in data traffic and data generation is anticipated to propel the market growth.

However, database performance issues account for almost 50% of the issues in applications as most of the data is stored. An installation of this software helps to eliminate downtime and optimize usage and performance. The software can also aid businesses in ensuring a better user experience and avoiding losses in revenue. The database monitoring tool can also continuously monitor resource usage such as disk space, CPU, I/O, and memory capacity. It also constantly tracks database performance, connectivity, and security. Thus, companies are installing monitoring software to avoid database performance-related issues.

RESTRAINING FACTORS

Laws and Regulations Associated with Software Development to Hamper Market Growth

The rising number of strict rules, laws, and regulations regarding software installation and development is expected to hinder market growth. Several laws include Intellectual Property (IPR) acts limiting software companies' expansion overseas. Some countries do not allow software commercial deployment and distribution for any open-source and paid database software and tools.

Further, in Europe, the General Data Protection Regulation (GDPR) has been mandated, effective since May 2018. Also, as per recent studies, approximately 60% of technology companies need to comply with the GDPR laws in Europe. This restricts innovations, hindering market growth to some extent.

SEGMENTATION

By Component Analysis

Need to Optimize and Enhance Database Performance to Boost Database Monitoring Software Segmental Share

By component, this market is divided into software and services. The software segment is expected to have the largest market share of 75.32% in 2026 and is expected to dominate during the study period. Various software tools are considered such as SolarWinds Database Performance Analyzer, Datadog, Quest’s Foglight, PRTG Network Monitor, and others. The rising adoption of this software by enterprises around the globe for optimizing the huge database and augmenting several performance parameters drives the market growth.

The services segment is expected to grow with the highest CAGR during the forecast period. This is primarily attributed to the adoption of the rising service by small & medium-scale startups and enterprises globally. The scope consists of various services such as AppPerfect’s database monitoring services, Datavail database monitoring services, and others. These database performance and data monitoring services help detect all critical database environments and help to manage several signal problems to ensure high performance. The services help in finding results, visualization, and processing.

By Deployment Analysis

Stable Availability and Accessibility Features of Cloud-based Model to Surge its Deployment among Enterprises

Based on deployment, the market is segmented into cloud and on-premises.

Among these, the cloud segment is expected to have the largest market share of 71.87% in 2026. The solutions help enterprises observe applications and services in the cloud. It helps to provide valuable insights from data and provides alerts on upcoming issues and disruptions. Rising cloud adoption by enterprises around the globe and increasing cloud infrastructure developments aid market growth.

By Enterprise Type Analysis

Rising Digitization Strategies with Surge in Government and Private Investments Aids Large Enterprises Segment Growth

On the basis of enterprise type, the market is bifurcated into large enterprises and SMEs.

Large enterprises segment is expected to account for majority of market share of 64.89% in 2026 since they are required to collect and retain large amounts of data in databases that must be reviewed regularly. Rising digital transformation initiatives around the globe aid the database monitoring software market growth. According to the IDC Report published in 2020, the global digital transformation initiatives were valued at USD 6.8 trillion and are growing rapidly with a surge in adoption by large enterprises. Large organizations maximize database uptime to maintain high productivity and deliver database requests using various database monitoring tools.

Also, major players in the market are developing and launching advanced database monitoring software solutions for large and small-scale enterprises. For instance,

- In January 2022, the potential of the PRTG hosted monitoring solution was expanded by Paessler's monitoring experts. The development ensured the availability of monitoring services across the globe. The solutions offer an ease of integration with networks and systems, allowing IT professionals to simultaneously explore data centers, traditional infrastructure, or service environments using one tool.

A growing number of startups globally with the surge in digital transformation initiatives is expected to propel the growth of the SMEs segment. The segment share is anticipated to exhibit the highest CAGR during the forecast period. According to the National Association for the Self-Employed Organization, the U.S. had more than 31.7 million small and medium scale enterprises in 2020.

By End User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Demand to Manage Huge Amount of Data from Banking Customers to Drive BFSI Segment Growth

Based on end user, the market is divided into BFSI, healthcare, government, IT and telecom, retail, and others (airlines, education).

The BFSI segment has a huge customer base that requires advanced data monitoring software solutions to access millions of customer data. The banks access these data through mobile apps, banking websites, and other multiple devices. Database software allowed the BFSI to monitor global customer experience and application performance. BFSI is expected to have the largest share in the market owing to the surge in adoption of advanced tools and software by several banking firms. For instance,

- In January 2022, the RBL Bank in India collaborated with Alphabet’s Google LLC for adopting its advanced customer analytics and data management and monitoring solution. The collaboration enabled the management of customer data using analytics tools. It enabled effective cross-selling of the banking product launched to the large customer base and significantly reduced customer acquisition costs.

The monitoring software gives businesses complete access to their digital shops' consumer interactions and IT infrastructure. Retailers can create exceptional customer experiences, expedite digital transformations, and quickly fix performance issues by monitoring customer-facing apps.

Also, the government segment is growing with a moderate CAGR during the forecast period due to a surge in IT services’ investment for digital transformations.

REGIONAL INSIGHTS

North America Database Monitoring Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is fragmented into five major regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America

North America held the largest database monitoring software market share in 2024 and is expected to remain dominant during the forecast period. North America dominated the market with a valuation of USD 1.05 billion in 2025 and USD 1.19 billion in 2026. This is primarily attributed to the presence of several key players such as Heroix Corporation, SolarWinds Worldwide, LLC, Quest Software, Inc., and others in this region. Also, the U.S. government is investing a considerable amount in digitizing public sector activities. The Biden administration in the U.S. added an investment of USD 9.0 billion to the Modernization Technology Fund for building cybersecurity and IT services across governments. The U.S. market is projected to reach USD 0.78 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period, owing to surge in digital transformation investments by government and private companies. Government organizations and leading private companies are adopting open source database monitoring software and tools. According to the State of Enterprise open-source report by Red Hat in 2021, more than two-thirds of IT leaders, followed by DevOps (56%) and digital transformation (51%), use open-source software for infrastructure modernization in Asia Pacific. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.24 billion by 2026, and the India market is projected to reach USD 0.12 billion by 2026.

Europe

Europe is growing with a moderate CAGR during the forecast period owing to a surge in the adoption of cloud computing services among enterprises. According to the European Union Organization Report in 2021, approximately 41.0% of enterprises have adopted cloud services. Such an increase in the adoption of cloud computing and rising digitalization aids global database performance monitoring growth. The UK market is projected to reach USD 0.16 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America and the Middle East & Africa

South America and the Middle East & Africa are growing with a moderate CAGR during the forecast period owing to rapidly increasing digital disruption. The governments of the Middle East countries, including Bahrain, the GCC, and the UAE have planned to implement the core digital technology adoption initiatives.

KEY INDUSTRY PLAYERS

Rising Development of Advanced AI-based Technology Tools by Key Players in the Industry Aids Market Growth

The market players are intended to expand their customer base by acquiring several growth strategies such as partnerships, mergers, acquisitions, and others. These players are also planning to develop new products by expanding their technological investments in research and development. For instance,

May 2023 – Datadog announced new features and integration at the Microsoft Build Conference with Microsoft Azure. Support for the Azure Arc, OpenAI service, and cloud cost management is included in these announcements. The launch helped Azure organizations to manage their costs, migrate from the cloud, and monitor Artificial Intelligence (AI) models.

March 2023 – SolarWinds expanded its business in Asia Pacific and joined forces with some of the region's most powerful systems integrators to increase its presence on the market. As part of its partnership to improve information technology operations for enterprises, it recently announced an AI service offering with Indian HCL Technologies that provides 5G mobile network operators with interoperability capabilities.

List of the Key Companies Profiled:

- SolarWinds Worldwide, LLC (U.S.)

- Heroix Corporation (U.S.)

- eG Innovations (U.S.)

- Quest Software Inc. (U.S.)

- VirtualMetric (Netherlands)

- Red Gate Software Ltd (U.K.)

- Sematext Group (U.S.)

- Nagios Enterprises, LLC (U.S.)

- PAESSLER AG (Germany)

- dbWatch AS (Norway)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 – Datadog, Inc. announced the general availability of Data Stream Monitoring, making it easy for organizations to monitor and manage the performance of applications that rely on messaging systems such as RabbitMQ. Data Streams Monitoring allows organizations to prevent and correct delays and disruptions by automatically displaying all dependencies and key health indicators on any streaming data pipeline.

- April 2023 – Dynatrace, a leader in unified monitoring and security, announced that it has achieved a new AWS cloud based operations competency in the category of monitoring and security. Dynatrace determines its expertise in helping customers create a strong and scalable framework for their end-to-end cloud operation by attaining this competence.

- April 2023 – The Weaviate.io, a developer of an AI native vector database with Index Ventures' participation, announced a USD 50.0 million funding round led by Index Ventures and supported by Battery Ventures. To take advantage of a rapidly growing market for AI application development, the capital allows the team to expand and speed up its popular open source database and new Weaviate cloud service.

- August 2022 – Datadog, Inc. announced an expanded monitoring for Microsoft Azure Database and Microsoft SQL Server Platforms. This support enables engineers and database administrators to quickly resolve and identify database performance problems such as incorrect indexes in SQL Server, slow and costly queries, and application bottlenecks.

- August 2021 – Datadog, Inc. launched its Database Monitoring (DBM) tool for database administrators and engineers. These tools enable quick visibility regarding any issues raised during slow-running database queries.

REPORT COVERAGE

An Infographic Representation of Database Monitoring Software Market

To get information on various segments, share your queries with us

The research report includes regional analysis, market dynamics, and market segmentation to give a better understanding to the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Deployment, Enterprise Type, End User, and Region |

|

By Component |

|

|

By Deployment |

|

|

By Enterprise Type |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 8.51 billion by 2034.

In 2025, the market size stood at USD 2.7 billion.

The market is projected to grow at a CAGR of 13.4% over the study period.

Based on deployment, the cloud segment is likely to lead the market.

The rise in amount of data generated by industries creates database performance issues to drive the market growth.

Heroix Corporation, SolarWinds Worldwide, LLC, PAESSLER AG, Quest Software Inc., eG Innovations, and Oracle Corporation are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with a remarkable CAGR over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic