DC Electric Motor Market Size, Share & Industry Analysis, By Power Output (Fractional Horsepower (Upto 1HP) and Integral Horsepower (Above 1HP)), By Voltage (Upto 1kV, 1kV-6.6kV, and Above 6.6kV), By Application (Industrial Machinery, Motor Vehicles, HVAC Equipment, Electrical Appliances, and Others), By End-User (Industrial, Commercial, Residential, Agriculture, and Transportation), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

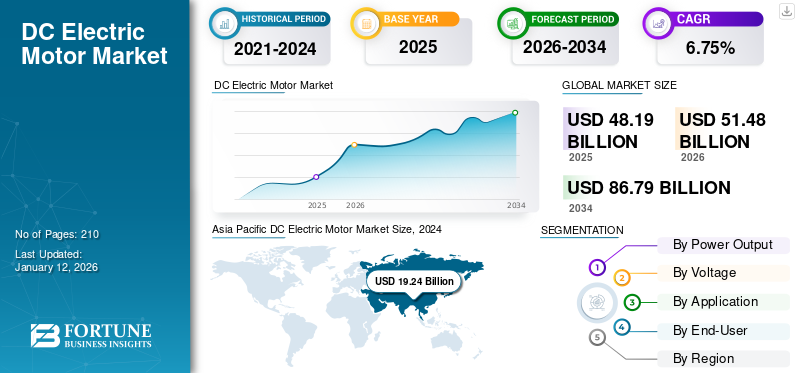

The global DC electric motor market size was valued at USD 48.19 billion in 2025 and is projected to grow from USD 51.48 billion in 2026 to USD 86.79 billion by 2034, exhibiting a CAGR of 6.75% during the forecast period. Asia Pacific dominated the global market with a share of 42.87% in 2025.

A Direct Current (DC) motor is a device that converts power generated from a direct current into mechanical energy. This is used in several applications including industrial and commercial. The principle of these motors is more simple compared to other motors. When the motor is sourced by DC, a magnetic field is created within the stator, enticing and resisting the magnets on the rotor, causing the rotor to start rotating. There is a growing trend towards automation in manufacturing and industrial processes. DC electric motors are essential components in robotics, conveyor systems, and other automated machinery, driving their market growth. Innovations in motor technology, such as improved materials and designs, have enhanced the performance and reliability of DC motors. These advancements make them more attractive for various applications, contributing to market growth.

AMETEK, a U.S.-based motors manufacturer and supplier, is one of the leading players in the global DC Electric Motors Market. The company offers a wide range of brushed and brushless motors designed specifically for aerospace and defense applications. The Motors are engineered to fulfill all existing RTCA/DO-160 standards and are certified for numerous business jets, helicopters, UAVs, and military ground vehicle uses globally. The company’s focused approach to aerospace and defense applications avails a competitive advantage for sector-specific motor offerings.

MARKET DYNAMICS

Market Drivers

Growing Reliance of Modern Household Appliances to Drive Market Growth

Modern household appliances gradually rely on DC electric motors for better performance and efficiency. In addition, the rising concern of energy savings products is also one of the major factors contributing to the market growth. Appliances, including washing machines, refrigerators, vacuum cleaners, and kitchen gadgets, use brushless DC (BLDC) motors for higher efficiency. For instance, the revenue generated in the household appliances market globally is expected to amount to USD 703.50 billion in 2025. This shows the direct and indirect demand for the related components, such as electric motors.

Market Restraints

High Maintenance Cost to Hinder Global Demand for the Product

DC electric motors usually face several issues owing to the failure of the system. This is majorly due to the insulation breakdown, bearing failure, and contamination in the overall motor system. Further, overheating of the motor creates challenges to perform well during operations. To maintain such filters, it needs daily maintenance which is high in cost. Hence, consumers prefer alternatives for the same applications. This factor contributes to the slow growth in the DC motors industry.

Market Opportunities

Advancements in the Electric Motor to Boost EV Performance have Emerged as a Lucrative Opportunity for Market Growth

In recent years, manufacturers have continuously focused on advancements in the electric motor. The growing demand for electric vehicles drives the market globally. The rising popularity of EVs in developing countries is influencing the demand for electric DC motors. Moreover, the placement of EVs is gaining push for contradicting the effects of global warming, whose impact is seen across all regions. Hence, it demands energy-efficient motors driven by the AC & DC technology that is sustainable to climate change.

DC ELECTRIC MOTOR MARKET TRENDS

Integration of Artificial Intelligence and the Internet of Things (IoT) into Motor Systems

DC motors can be quickly integrated into Internet of Things systems to enable remote motor control and monitoring. This connectivity enables more intelligent and efficient operation of applications like smart home devices and industrial automation systems. For instance, in February 2025, Innomotics, a leading motor and large-drive system supplier, announced that it is utilizing digital twin technology and Ansys multiphysics simulation to enhance their MV drives with artificial intelligence (AI) capabilities. The MV drives were designed to convert MV power at a set frequency and amplitude (50 or 60 Hz) to an intermediate DC voltage and then back to variable frequency and amplitude AC power. Thus, the electric machine's power and speed may be easily adjusted to suit the needs of the user. Such innovations are anticipated to boost the DC electric motor market trends in the coming years.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Power Output

Fractional Horsepower (Up to 1HP) is Dominating the Market Owing to the Rapid Advancements in Household Appliances

By power, the market output is segmented into fractional horsepower (Up to 1HP) and integral horsepower (Above 1HP).

Fractional Horsepower (Up to 1HP) is considered as the dominating segment owing to growth in modern household appliances, and consumer electronics. Their wide applications in residential areas have influenced market advancements in recent years.

Integral horsepower (Above 1HP) is the fastest-growing segment driven by the use of commercial and industrial automation such as automated machines. Heavy equipment and relatable devices in modern applications are boosting the DC electric motor market globally.

By Voltage

Motors Up to 1 kV are generally more Cost-effective Compared to Higher-Voltage Options

The market by voltage is fragmented into Up to 1kV, 1kV - 6.6kV, and Above 6.6kV segment.

Up to 1kV is the dominating segment owing to its use in daily electric devices such as fans, washing machines, cleaning devices, and other home appliances. The rising demand for automatic appliances is driving the demand for electric motors.

1kV-6.6kV is considered the fastest-growing segment owing to the recent investments from domestic businesses. Medium voltage machinery has been influencing the market growth of motors in recent years. This is also backed by commercial applications such as heating solutions and others.

By Application

Rising demand for EVs is Fueling the Demand for Motor Vehicles

The global market is segmented into HVAC equipment, motor vehicles, electrical appliances, and industrial machinery based on its application.

Motor vehicle is the dominating segment globally, driven by the rising demand for EVs. DC and AC electrical motors are the essential components of electric vehicles. Hence, the growing demand for EVs is boosting the market growth for DC electric vehicles.

Industrial machinery has been the fastest-growing segment in recent years, influenced by the advancement in industrial equipment. For instance, In March 2022, Kirloskar Oil Engines Limited (KOEL), an industry leader in engines, launched high-efficiency voltage electric motors that will dominate the machinery sector in all applications across industries.

By End-User

Transportation segment Dominate the Market Backed by Advancement in Passenger Vehicles

By the end-user segment, the market is divided into industrial, commercial, residential, agriculture, and transportation.

The transportation sector has been dominating in recent years, backed by the rising demand for personal vehicles. This is also influenced by the change in lifestyle and the rising spending power of consumers. For instance, as per the data of IEA, over 14 million new electric personal cars were recorded globally in 2023, carrying their total number on the roads to 40 million.

Industrial is the fastest-growing segment driven by the industrial expansion associated with modern technology. The need for automated systems in industrial applications is backing the DC electric motor market.

DC ELECTRIC MOTOR MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific DC Electric Motor Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 20.66 billion in 2025 and USD 22.19 billion in 2026., driven by rapid urbanization and industrialization. The spending power of consumers is rising on a daily basis due to the need for automated products in urban houses. Moreover, industrial expansion in emerging countries such as China, South Korea, and India is also creating a demand for advanced DC electric motors. The automotive industry in China boosted the demand for electric motors due to the high production of electric vehicles in the nation. For instance, in China, the total registration of new electric cars reached around 8.1 million in 2023, cumulative by 35% comparative to 2022. This growth in electric car sales was the major reason for the growing demand for DC electric motors.

North America

North America is considered one of the leading markets in upcoming years. This is owing to the presence of electric motor manufacturers in the region. Moreover, the availability of the technology in the region backs the DC electric motor market growth.

U.S. is the dominating segment in North America driven by the rising adoption of electric vehicles. The wide product portfolio of EVs is boosting the market growth. For instance, as per the data of IEA, the U.S. holds around 10% share in the global market, including imports and exports of cars.

Europe

Europe is growing rapidly owing to the region's focus on modern home appliances. The growing focus of companies on modern home appliances such as HVAC systems, washing machines, fans, water pumps, and refrigerators is backing the electric motor market in the EU. Moreover, European countries are focusing on energy-efficient products in recent years driven by strong government regulations. This key factor is backing the DC electric motor in emerging countries such as Germany, France, the U.K. and others.

Latin America

Latin America has witnessed steady growth in recent years, driven by the government's focus on electric vehicles. The push for energy-efficient products to control climate change is influencing the market growth. Moreover, transportation and industrial applications boost the advancement of DC electric motors.

Middle East & Africa

The Middle East & Africa demonstrated higher growth due to the increasing adoption of technological developments and advancements in industrial equipment. The industrial expansion in the UAE, Saudi Arabia, and other countries boosts DC electric motor applications. Moreover, rising infrastructure projects in the Middle East & Africa influence electric motors by adding commercial appliances to the projects.

COMPETITIVE LANDSCAPE

Key Industry Players

Advancements in DC Electric Motor to Deliver Sustainable Products Pushes the Market Growth

Key players are compiling in-house technologies to deliver efficient products and services to consumers through a strong product portfolio. This is influenced by the rising need for sustainable products and environmental concerns that are pushing companies to bring innovative offerings. For example, Parvalux Electric Motors Ltd has been delivering technologically advanced DC motors and associated products to several industrial applications, such as material handle equipment, in recent years.

List of Key DC Electric Motor Companies Profiled

- ABB (Switzerland)

- AMETEK (U.S.)

- Johnson Electric (China)

- Siemens (Germany)

- Rockwell Automation (U.S.)

- GE (U.S.)

- Nidec Motor Corporation (Japan)

- WEG (Brazil)

- Toshiba Corporation (Japan)

- Hitachi (Japan)

- Mitsubishi Heavy Industries (Japan)

- TECO-Westinghouse Motor Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In March 2025, Technology manufacturers from North America, covering Lucid, Canoo, and Rivian, are introducing their advanced electric vehicles in upcoming months, driven by the rising demand for EVs in the U.S.

- In February 2025, The Auto Care Association and MEMA Aftermarket Suppliers welcome associates to an exclusive webinar presenting global strategy consulting business Strategy, as it reveals estimates for the electric vehicle (EV) market and its impact on the automotive aftermarket.

- In November 2024, Scooter India (HMSI) & Honda Motorcycle officially entered into EV two-wheelers in India as it introduced the electric variety of its iconic Activa scooter called the Activa E & Activa QC1—such product launches associated with the electric motor to drive the market growth.

- In October 2024, Volvo Construction Equipment (Volvo CE) successfully launched the fully electric wheel loader. That can deliver the same powerful performance as its diesel complement and has already experienced rigorous testing in the extreme heat of the UAE.

- In May 2024, ABB introduced an energy-efficient and sustainable motor and inverter package for electric buses, highlighting the first 3-level inverter for buses, which enables a larger lifespan and noteworthy energy efficiency gains with up to 12% fewer motor losses on typical drive cycles.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the electric motor. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.75% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power Output

|

|

By Voltage

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 48.19 billion in 2025.

In 2025, the market value stood at USD 20.66 billion.

The market is expected to exhibit a CAGR of 6.75% during the forecast period.

The transportation segment led the market by end-user.

Demand for modern household appliances to drive market growth

Some of the top major players in the market are ABB, Rockwell Automation, and GE.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us