Demi Fine Jewelry Market Size, Share & Industry Analysis, By Type (Bracelets, Earrings, Necklaces, Rings, and Others), By End User (Women and Men), By Sales Channel (Offline Store and Online Store), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

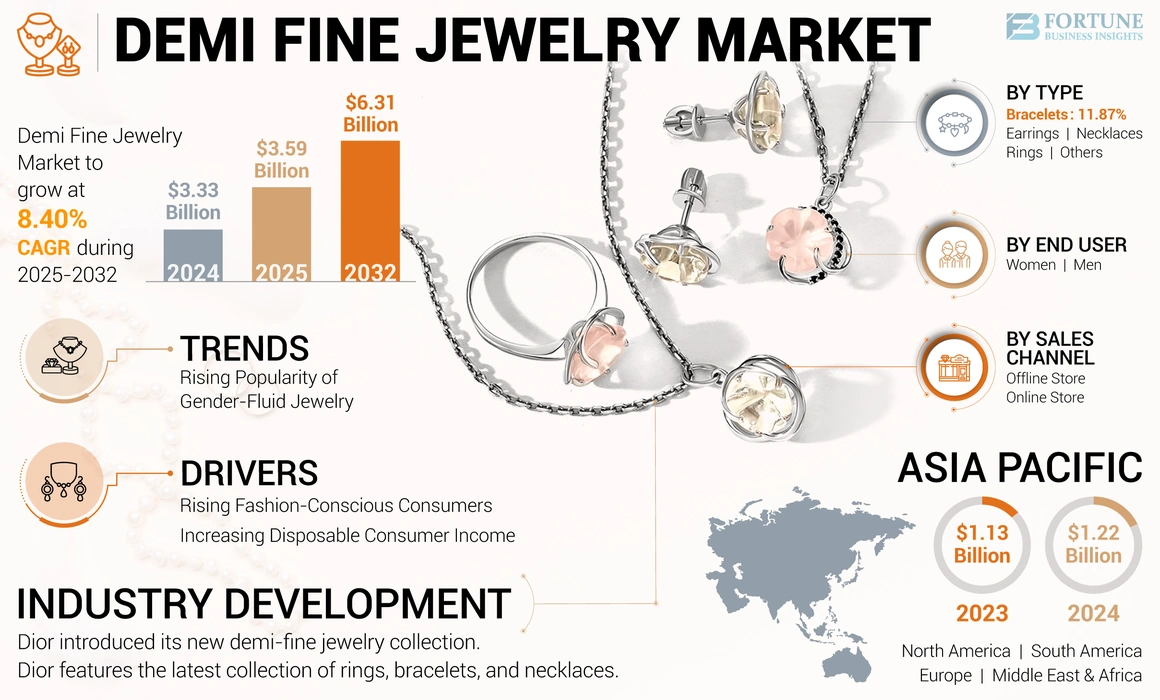

The global demi fine jewelry market was valued at USD 3.33 billion in 2024. The market is projected to be worth USD 3.59 billion in 2025 and reach USD 6.31 billion by 2032, exhibiting a CAGR of 8.40% during the forecast period. Asia Pacific dominated the demi fine jewelry market with a market share of 36.64% in 2024.

Demi fine jewelry refers to ornaments crafted with precious metals, such as vermeil gold and sterling silver. The demi fine jewelry category falls between expensive delicate jewelry items and cheap costume jewelry. Moreover, this type of jewelry can achieve good quality and command attractive prices by featuring a thick layer of 18k gold vermeil and a strong core of sterling silver.

Techniques such as pure gold plating over fine silver and rhodium plating over precious metals protect against scratches and tarnishing, increasing the product's durability and contributing to the demand. The global demi fine jewelry market share will likely increase significantly throughout the forecast period, given the rising consumer disposable incomes and the growing product popularity as an affordable substitute to fine jewelry. Comparatively low price range triggers demi fine jewelry sales, notably across Asian markets.

The COVID-19 pandemic impacted the growth of various industries globally in 2020. The COVID-19 crisis resulted in manufacturing disruptions and supply chain bottlenecks that negatively influenced the global demi-fine jewelry market trends in 2020. The pandemic resulted in delays in manufacturing demi-fine jewelry globally, thus severely impacting the market growth. The pandemic negatively impacted the import and export of demi fine jewelry, lowering manufacturers' profitability in 2020.

GLOBAL DEMI FINE JEWELRY MARKET SNAPSHOT

Market Size & Forecast:

- 2024 Market Size: USD 3.33 billion

- 2025 Market Size: USD 3.59 billion

- 2032 Forecast Market Size: USD 6.31 billion

- CAGR: 8.40% from 2025–2032

Market Share:

- Asia Pacific led the global demi fine jewelry market with a 36.64% share in 2024, driven by rising disposable income, growing popularity of affordable luxury, and high cultural demand for jewelry in countries such as China, India, and Japan.

- By product type, earrings held the largest share in 2024, supported by rising demand for trendy, durable, and gender-fluid designs such as hoops, studs, and drops among fashion-conscious consumers globally.

Key Country Highlights:

- China: Strong urban middle class and gifting culture drive high-volume sales, particularly during traditional events like Chinese New Year.

- India: Festivals like Diwali and Lohri, along with rising disposable income and fashion-conscious youth, support robust demand.

- Japan: Traditional events and minimalistic fashion trends favor demi fine jewelry adoption among young women.

- United States: Leading market in North America due to premiumization trends, tech-integrated designs, and celebrity-driven brand collaborations.

- United Kingdom: Rising demand for gender-neutral and customizable jewelry, bolstered by online sales and influencer marketing.

- France & Germany: European consumers are drawn to fusion styles and personalized pieces incorporating semi-precious stones and modern craftsmanship.

- UAE & Saudi Arabia: High demand for traditional and customized pieces; strong raw material sourcing from Africa supports regional manufacturing growth.

- Brazil & South Africa: Increasing e-commerce penetration and popularity of lightweight, modern jewelry styles fuel demand among younger demographics.

Demi Fine Jewelry Market Trends

Rising Popularity of Gender-Fluid Jewelry to Fuel Market Growth

Gender fluidity is among the latest and critical trends in the jewelry and fashion industry. Consumers typically buy jewelry as gifts for special occasions and to show their individuality. In this respect, their attitudes toward gender rapidly evolve to include inclusivity and acceptance. They positively influence product sales and encourage industry players to create gender-fluid/genderless designs in demi fine ornaments.

Gender-fluid jewelry is gaining widespread popularity, with internationally renowned celebrities such as Harry Styles, Pete Davidson, and Ranveer Singh typically wearing and promoting genderless fashion. According to Taylor & Hart, a London, U.K.-based jewelry maker, there was a 228% increase in online searches for gender-neutral jewelry between 2020 and 2021, highlighting the increasing adoption of gender-fluid products. Therefore, increasing consumer demand for gender-neutral products will drive demi fine jewelry market growth in the forthcoming years.

- Asia Pacific witnessed demi fine jewelry market growth from USD 1.13 billion in 2023 to USD 1.22 billion in 2024.

Download Free sample to learn more about this report.

Demi Fine Jewelry Market Growth Factors

Increasing Disposable Consumer Income to Accelerate Product Sales

Economic growth in developed and developing countries leads to high disposable income and consumer affordability. As a result, consumers are increasingly willing to purchase items such as demi-fine ornaments featuring precious metals, positively influencing the global demi fine jewelry market trends. Moreover, the demand for jewelry worn during Indian festivals such as Diwali, Lohri, and Chinese New Year accelerates product adoption. In addition, the trend of gifting precious gemstones to friends and relatives, notably among high-income consumers globally, drives market growth.

North America and Europe are among the most urbanized regions globally, with emerging fashion trends, vast consumer bases, and distinct corporate lifestyles. Urbanized consumers in these regions usually spend part of their incomes on fashion and costume accessories, contributing significantly to the product demand.

Rising Fashion-Conscious Consumers to Increase Product Adoption Globally

Social media platforms such as Instagram, Facebook, and Snapchat are becoming increasingly popular for brands to communicate directly with consumers. The emergence of these platforms plays a vital role in positively influencing consumer behavior and are influential promoters of the latest fashion trends. Furthermore, the increasing consumer inclination towards trendy fashion jewelry owing to promotion through music videos, television series, and movies boosts the product demand globally. The growing trend of customized jewelry due to the influence of social media platforms also complements market growth. At a macro level, the rising fashion-conscious consumers' increasing awareness of external beauty triggers globally product demand.

With consumers increasingly perceiving demi fine jewelry as a symbol of self-expression and individuality, industry participants will likely develop customized items as a budget-friendly alternative to fine jewelry in the coming years. Industry players collaborate with celebrities to build brand reputation. For instance, in March 2024, Palmonas, an Indian demi fine jewelry startup, partnered with Shraddha Kapoor, a popular Bollywood actress, to join the company as a Co-founder. Such collaborations help startups penetrate domestic markets, notably through the e-commerce platform.

The rapidly evolving trend of accessible luxury within the jewelry category fuels the global demand for demi fine jewelry. Given the increasing product availability across retail stores and online channels, these items are becoming increasingly popular among young women in their late 20s and early 30s. While women in these age groups traditionally preferred shoes and handbags to jewelry, their focus is shifting to demi fine jewelry across countries, encouraging prospective industry participants and retailers to penetrate this high-potential jewelry category.

RESTRAINING FACTORS

Increasing Stringent Government Regulations to Limit the Market Growth

The European Union (EU) standard Commercial Policy covers all the essential measures affecting trade in products, goods & services, and all trade-related issues. For health reasons, the EU implemented a directive in 1994 to limit Nickel's use in jewelry products intended to be in contact with the skin, such as necklaces, bracelets, and rings.

In addition, the Fashion Jewelry & Accessories Trade Association (FJATA), a non-profit trade association specializing in clothing, jewelry, and fashion accessories regulations, enforces the ASTM F2923-11 standard for cadmium usage in children’s jewelry. As per this law, companies manufacturing jewelry are required to restrict the use of cadmium. Such stringent regulations concerning material use and manufacturing will likely discourage new players' market entry in the coming years.

Demi Fine Jewelry Market Segmentation Analysis

By Type Analysis

Growing Trend of Hoop and Long Link Designs to Fuel Earrings’ Demand

On the basis of type, the global market is segmented into bracelets, earrings, necklaces, and rings. The earrings segment holds a significant market share due to the rising demand for trendy jewelry and its increasing popularity among women. Demi fine earrings are witnessing increasing adoption among women globally, given their increasing need to look fashionable and enhance their appearance, paired with the growing trend of unique earrings such as link drop and double-drop. Moreover, the increasing consumer inclination toward earrings, such as dangles and studs, contributes significantly to the product demand.

The rings segment will likely ascend at a considerable growth rate throughout the forecast period due to rising trends and the popularity of personalized & spinning rings, notably among women across countries. Given the increasing global demand for layered and retro choker necklace designs, the Necklace segment is expected to grow steadily in the coming years.

- The Bracelets segment is expected to hold a 11.87% share in 2024.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Increasing Demand for Fusion Jewelry Designs to Attract Women

Based on end user, the global demi fine jewelry market analysis includes women and men. The women's segment holds the largest market share due to the wide availability of women's jewelry in innovative and modern product designs. Moreover, increasing social and financial independence and higher disposable incomes among women increase their purchasing power, triggering jewelry purchases globally. Furthermore, the rising trend of fusion jewelry combining traditional, ethnic, and modern jewelry attracts female consumers to make sizable purchases.

Gender fluidity is among the latest and key trends in the jewelry and fashion industry. Consumers typically buy jewelry as gifts for special occasions and to show their individuality. In this respect, their attitudes toward gender rapidly evolve to include inclusivity and acceptance. They positively influence product sales and enable industry players to create gender-fluid/genderless designs in demi fine ornaments. Furthermore, gender-fluid jewelry is gaining widespread popularity, with internationally renowned celebrities such as Harry Styles (a U.K.-based singer and actor), Pete Davidson (a U.S.-based actor and comedian), and Ranveer Singh (an Indian actor) typically wearing and promoting genderless fashion. According to Taylor & Hart, a London, U.K.-based jewelry maker, there was a 228% increase in online searches for gender-neutral jewelry between 2020 and 2021, highlighting the increasing adoption of gender-fluid products.

By Sales Channel Analysis

Expanding Number of Internet Users to Encourage Online Jewelry Shopping

Based on sales channel, the global market report covers offline store and online store. The offline store segment is expected to hold the largest market share during the forecast period owing to the wide availability of various brands and the rising consumer preference to physically verify the product quality and size before purchasing.

Despite the increasing consumer needs to purchase demi fine jewelry through offline distribution channels, online retail/ e-commerce channels will likely witness the fastest growth in the near term. The rapidly expanding number of internet and smartphone users globally, most notably in Asian countries such as India, China, and Japan, will likely boost product sales online in the forthcoming years. Unlike their offline counterparts, online stores allow consumers the shop 24x7, encouraging time-strapped consumers to prefer e-commerce channels for product purchases. Industry players also launch their websites to tackle rising product counterfeiting by reassuring consumers of product’s authenticity and quality.

REGIONAL INSIGHTS

The global market is geographically segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Asia Pacific Demi Fine Jewelry Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific market is expected to ascend at the most significant CAGR during the forecast period. Led by China, India, and Japan, the rapidly expanding middle-class population and increasing disposable incomes fuel the Asia Pacific market growth. Additionally, the increasing trend and popularity of wearing jewelry for traditional/formal events such as Shogatsu, Diwali, Chinese New Year, and weddings encourage industry participants to innovate their product designs to attract more Asian consumers.

North America is the second largest market for demi fine jewelry and growing consumer awareness regarding appearance, increasing affordability, and the broadening availability of unique & fashionable jewelry is projected to support the market growth during the forecast period. The U.S. is the region's most prominent regional domestic market, with technologically advanced jewelry manufacturing. In addition, the increasing availability of 3D-designed and lightweight demi-fine jewelry boosts product demand across North America.

The European market's growth is driven by the rising trend of customized jewelry and the surging demand for fusion jewelry featuring wood, glass, and metal. Furthermore, innovations in unique colored semi-precious stones and the blurring lines between Western & Eastern jewelry designs.

Demi fine jewelry sales across the South American, Middle Eastern, and African markets are estimated to witness positive growth in the foreseeable future. The high demand for customized and traditional design jewelry, notably in Saudi Arabia, UAE, and South Africa, drives the regional market growth. Moreover, Africa is a prominent supplier of raw materials such as semi-precious stones, beads, brass, and copper, encouraging new players' entry.

Key Industry Players

Key Players to Focus on Product Development to Stay Competitive

The market for demi-fine jewelry is moderately competitive and is characterized by small and internationally reputed market players. Manufacturers usually invest in research & development (R&D) activities to innovate their product offerings. In this respect, major market players increasingly focus on developing innovative products featuring recycled metals to cater to consumers' growing demand. They also launch innovative designs to increase consumer interest in their product offerings.

List of Top Demi Fine Jewelry Companies:

- Missoma (U.K.)

- Monica Vinader Ltd. (U.K.)

- Sarah & Sebastian Ltd. (Australia)

- Otiumberg (U.K.)

- Edge of Ember (U.K.)

- Loren Stewart (U.S.)

- Astley Clarke Limited (U.K.)

- Catbird (U.S.)

- Curteis (U.S.)

- WWAKE, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Tanzire, an Indian online store specializing in demi fine jewelry, launched Missoma, a U.K.-based demi fine jewelry brand, to target the Indian audience.

- May 2023: Little Liffner, a Stockholm-based handbag brand announced to launch its first collection of demi fine jewelry. According to the company, the new collection is made from baroque pearls and cool natural stones.

- February 2023: Dior, an LVMH Moët Hennessy Louis Vuitton brand, launched Dioramour, its new demi-fine jewelry collection. The latest collection featured bracelets, rings, and necklaces.

- April 2022: Pura Vida, a Costa Rica- based jewelry manufacturer, launched its first demi fine collection. According to the company, the new collection features jewelry made from 18k gold plating, hypoallergenic sterling silver, and real gemstones such as moonstone, opal, white topaz, and natural diamonds.

- August 2021: Signet Jewelers, a Bermuda-based jewelry company, launched its first demi fine collection featuring premium quality metals designed by designers such as Luv AJ and Kendra Scott.

- February 2021: Missoma Ltd., a U.K.-based brand, launched a new demi fine jewelry collection using 14-karat white and yellow gold, including recycled gold elements and ethically-sourced diamonds.

REPORT COVERAGE

The market report analyzes the market in depth and highlights crucial aspects, such as prominent companies, product types, end users, sales channels, and regions. Besides this, the report provides insights into the latest market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to recent market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.40% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End User

|

|

|

By Sales Channel

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.33 billion in 2024.

The market is likely to record a CAGR of 8.40% during the forecast period of 2025-2032.

By type, the earrings segment is expected to dominate the market throughout the forecast period (2025-2032).

Increasing consumer disposable income globally is accelerating market growth.

Missoma, Monica Vinader Ltd., Astley Clarke Ltd., Otiumberg, Edge of Ember, and others are the leading companies globally.

Asia Pacific dominated the global market in 2024.

Increasing stringent government regulations are expected to restrain product deployment throughout the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us