Diaper Bag Market Size, Share & Industry Analysis, By Type (Backpack, Tote, Messenger-Style/Sling, and Others), By Material (Nylon, Polyester, Canvas, and Others), By Distribution Channel (Hypermarket, Specialty Store, Online/E-Commerce, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

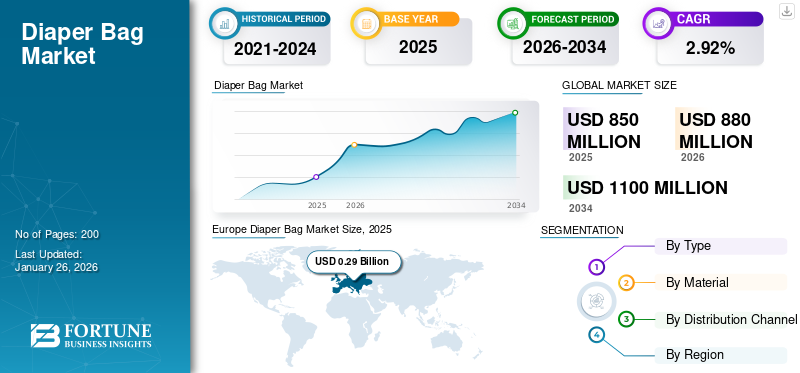

The global diaper bag market size was valued at USD 0.85 billion in 2025. The market is projected to grow from USD 0.88 billion in 2026 to USD 1.1 billion by 2034, exhibiting a CAGR of 2.92% over the forecast period. Europe dominated the diaper bag market with a market share of 34.16% in 2025.

Diaper bags are designed to hold essential baby care products, including diapers, wipes, toys, snacks, and bottles. Parents across countries highly demand the product as it features multiple pockets that can hold various products when traveling. These baby bags are also available in various appealing designs and colors, further supporting market expansion. Increasing focus on baby care and growing disposable income further boost product sales. In addition, various prominent players are operating in the market, including Carter’s, Inc., Sanrio Co., Ltd, Graco Children’s Products Inc., Trend Lab, and Petunia Pickle Bottom.

Global Diaper Bag Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 0.85 billion

- 2026 Market Size: USD 0.88 billion

- 2034 Forecast Market Size: USD 1.1 billion

- CAGR: 2.92% from 2026–2034

Market Share:

- Europe dominated the diaper bag market with a 34.16% share in 2025, driven by high-income levels, a strong demand for fashionable and functional baby bags, and a growing trend of outdoor activities among families.

- By type, Backpacks are expected to retain the largest market share in 2025, supported by their hands-free design, ease of use, and even weight distribution. Nylon remains the most preferred material due to its affordability, durability, and water-resistant properties.

Key Country Highlights:

- United States: High number of working mothers and increasing preference for eco-friendly diaper bags fuel market growth, along with strong retail infrastructure and online sales.

- India: Rising female labor force participation, coupled with government support for women’s employment, is boosting demand for convenient baby products like diaper bags.

- Japan: Despite declining birth rates, quality-conscious consumers support sales of premium baby accessories such as functional and stylish diaper bags.

- United Kingdom: Strong demand for designer baby bags and sustainable products sustains market growth, supported by popular local brands like Storksak and Babymel London.

- Brazil: Increased family-oriented recreational activities and growing interest in functional baby accessories like insulated and multi-compartment bags support market expansion.

Diaper Bag Market Trends

Incorporating the Latest Fashion Trends into the Product to Boost Demand

The demand for fashion-forward nappy bags is increasing notably among working mothers. They are seeking baby bags that are both functional and aesthetically appealing. In this regard, industry participants can incorporate the latest fashion trends into the product design to attract more customers. Moreover, increasing the product's features by including adjustable straps, additional compartments, insulated bottle holders, and stroller attachments makes it more convenient and functional for the user. In addition, companies can provide the option of adding personalized monograms and customized features in baby bags according to consumer requirements, thus contributing toward market growth.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Family Travelling to Drive Market Growth

Nappy bags are beneficial for parents while traveling with babies as they are comfortable to carry and are designed to hold various baby items. In this respect, the increasing number of families, including babies, prioritize traveling to spend quality time, discover new places, and relax, thus, boosting product sales.

For instance, in May 2024, Booking.com, a Netherlands-based digital travel platform, reported that travel accommodation and flight searches by families have increased for the summer season by 8% and 21%, respectively, as compared to 2023. According to the company, top global destinations for families included Durres (Albania), Tangier (Morocco), Florida (U.S.), Sevilla (Spain), Tokyo (Japan), Dubrovnik (Croatia), and Bangkok (Thailand).

Rising Number of Working Women to Increase the Product Demand

Working women across countries travel frequently with their babies due to nursing needs and the limited availability of childcare providers. Hence, they demand baby bags as it helps them to carry baby essentials while traveling easily. As a result, the increasing number of working women globally fuels product demand and positively impacts the global diaper bag market growth. For instance, in October 2023, the Ministry of Statistics and Programme Implementation, Government of India, reported that female labor force participation in India has increased by 4.2% compared to 2022. Government initiatives, including workplace safety, skill development, girl’s education, and entrepreneurship facilitation, have resulted in the female labor force growth, thus driving the market growth.

Market Restraints

Declining Fertility and Birth Rates to Hamper the Product Sales

Fertility and birth rates in countries such as Japan, Italy, and Ukraine are declining owing to factors such as the increasing cost of raising children and the easy availability of contraceptives. This factor affects the demand for the product and impedes the market growth. For instance, according to the Ministry of Health, Labor and Welfare (MHLW), a Tokyo, Japan-based government department, in 2023, the fertility rate in the country declined by 0.06 points to 1.20 compared to 2022. It was the eighth year-on-year decline witnessed in the country. Furthermore, according to the United Nations, a U.S.-based intergovernmental organization, global fertility is expected to decline to 2.1 children per woman in 2050 from 2.3 in 2021.

Market Opportunities

Growing Demand for Sustainable Products to Provide Growth Opportunities

Demand for sustainable products has increased in recent years across countries due to their environmental benefits and limited carbon footprint. Consumer interest in sustainable baby bags is also growing as they are both functional and environmentally friendly. These bags are developed using materials such as recycled polyester, organic cotton, hemp fabric, and canvas, which are manufactured with fewer pesticides, less energy, and less water than conventional materials. As a result, they promote ethical production and do not contain harmful materials. Market players can prioritize offering sustainable baby bags, which will assist them in attracting eco-conscious consumers and escalating product sales.

Market Challenges

Easy Availability of Alternative Products to Impact the Product Sales

Many parents throughout countries prefer a regular bag instead of nappy bags as they are fashionable and can be used for occasions other than baby care. Individuals also consider this product unnecessary as baby items such as wipes, diapers, and bottles can be carried in a regular bag with a large space. These factors collaboratively decline the product demand and hampers the market expansion. Furthermore, fluctuations in the cost of raw materials such as leather, nylon, and polyester due to factors including production disruptions, natural disasters, economic trends, and geopolitical events impact the overall profit margins of the manufacturer.

Impact of COVID-19

The COVID-19 pandemic hampered the market growth due to a significant decline in travel worldwide. Safety measures imposed across countries, such as social distancing and work-from-home policies, hampered travel and product demand. In addition, the temporary shutdown of offline shops and halt in production activities due to government restrictions affected product availability and sales. However, nappy bag adoption increased, especially through online stores, as numerous consumers focused on online shopping during the pandemic.

SEGMENTATION ANALYSIS

By Type

Easy Carry & Hand Free Design of Backpacks Led to Their Dominance

Based on type, the market is divided into backpacks, totes, messenger-style/slings, and others.

The backpack segment dominated the global market with a share of 38.64% in 2026, driven by the high popularity of backpack forms among parents due to their easy-to-carry and hands free design. The product is convenient as it features two straps that evenly distribute weight and make it easy to carry over the shoulders. These factors fuel product sales and increase segmental growth.

Additionally, the tote segment holds the second largest market share owing to the fashionable design and aesthetic appeal of tote nappy bags, which have increased their adoption. The product typically features extra compartments, making accessing and organizing baby products easy.

To know how our report can help streamline your business, Speak to Analyst

By Material

Affordability & Lightweight of Nylon Bags Increased the Product Sales

The global market is segmented based on materials: nylon, polyester, canvas, and others.

The nylon segment held the largest global diaper bag market share of 42.05% in 2026. Nylon nappy bags' durability and lightweight increases consumers' interest in the product. These bags are easy to maintain and available at an affordable price. They are water resistant and protect items inside the bag from wet conditions. These features collectively trigger product demand and accelerate segmental growth. This segment is expected to hold 41.55% of the market share in 2025.

Additionally, the polyester segment held the second largest market share as polyester baby bags are designed to withstand rough handling, increasing consumer preference. Moreover, the easy availability of these bags in various designs positively impacts segmental growth. This segment is anticipated to grow at a CAGR of 3.17% during the forecast period (2025-2032).

By Distribution Channel

Extensive Product Range & Convenience to Boost Hypermarkets Segment Expansion

The market is categorized into hypermarkets, specialty stores, online/e-commerce, and others, based on distribution channels.

The hypermarkets segment will lead the market throughout the forecast period. These retail outlets offer a convenient buying experience and a range of nappy bags from various brands. They also frequently provide discounts and offers, which increases consumer interest in purchasing. This segment is projected to gain 43.18% of market share in 2026.

Moreover, the online/e-commerce segment will grow fastest with a CAGR of 4.33% during the forecast period (2025-2032). Online platforms allow access to product reviews and compare prices easily. Furthermore, these sales channels save shopper’s efforts and time, increasing consumer inclination toward the segment.

Diaper Bag Market Regional Outlook

Geographically, the global market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Europe

Europe Diaper Bag Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 0.29 billion in 2025 and USD 0.3 billion in 2026, driven by growing demand for fashionable accessories, including baby bags featuring unique designs and colorful prints among modern parents. The U.K. market continues to expand, predicted to be valued at USD 0.04 billion in 2026. Rising interest in outdoor activities among families with babies also increases the sales of baby bags, as it helps parents easily carry essential baby items while traveling. Preference for premium quality baby products paired with high-income levels in countries such as the U.K, Germany, and France further support regional expansion. In addition, several companies such as Miss Lulu Bags, Storksak, and Babymel London offer user-friendly and functional nappy bags in Europe. Germany is poised to reach a market value of USD 0.05 billion in 2026, while France is set to hit USD 0.04 billion in the same year.

North America

North America held the second largest market share in 2024 and is expected to reach a valuation of USD 0.25 billion in 2025. This region is expected to grow with a CAGR of 3.04% during the forecast period (2025-2032). Numerous working women who frequently travel with their babies and prefer baby bags for higher convenience drive this growth. Effective retail infrastructure and significant growth in online shopping platforms further trigger North America's product sales. The U.S., region's most prominent market, benefitted from rising sustainability trends and escalating sales of nappy bags developed using eco-friendly materials such as hemp, cotton, and recyclable polyester. Key players in the country, including Carter’s, Inc., Graco Children’s Products Inc., Skip Hop, Trend Lab, and Petunia Pickle Bottom, also emphasize providing the product in various materials, appealing designs, and features to meet consumer needs, thus supporting the country’s growth. The U.S. market is predicted to gain the valuation of USD 0.16 billion in 2026.

Asia Pacific

Asia Pacific is the third largest market, anticipated to reach a market value of USD 0.18 billion in 2025. The rising population and changing consumer lifestyles in the region support the Asia Pacific market growth. China is poised to be valued at USD 0.05 billion in 2026. In addition, as the number of working women having a baby increases in countries such as India, China, Australia, and Japan, the demand for baby products that promote convenience, such as baby bags, will increase. Social media platforms further increase product awareness among Asian consumers, positively influencing regional expansion. Convertible-style baby bags, which can be used as messenger bags, totes, or backpacks, are also becoming increasingly popular due to consumer demand for versatile or multifunctional products. India is set to acquire USD 0.03 billion in 2026, while Japan is anticipated to reach a valuation of USD 0.02 billion in the same year.

South America

South America is the fourth leading region, projected to be worth USD 0.08 billion in 2025. Interest in family travel and recreational activities such as picnics and camping accelerates the product adoption in the South American market. Furthermore, modern parents in the region prefer functional baby accessories, including nappy bags with features such as insulated pockets, multiple compartments, stroller clips, and ample storage. The rising inclination toward online shopping for baby products due to its convenience is also expected to provide significant growth opportunities to companies operating in the region.

Middle East & Africa

Increasing standards of living and fashion consciousness are expected to drive demand for premium quality and stylish nappy bags in the Middle East & Africa. Preference for eco-friendly products also increases the sales of sustainable baby bags across the region. Moreover, consumer spending on baby products has increased due to rising awareness regarding baby care. Growing urbanization and usage of daycare facilities further contribute to the product demand. The UAE market is expected to stand at USD 0.03 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Developing a Variety of Products & Partnering with Other Brands to Strengthen the Market Presence of Key Players

The global market includes several international and local companies providing a variety of baby bags such as backpacks, totes, and sling bags. Market players emphasize producing baby bags in multiple patterns, colors, and designs to attract more end users and strengthen their market positions. Brands are also implementing strategies such as collaboration with other key players to launch new products and expand their customer reach. In addition, investments in brand marketing and expanding online sales networks will provide lucrative growth opportunities to industry participants in the forthcoming years.

List of Key Diaper Bag Companies Profiled

- Carter’s, Inc. (U.S.)

- Sanrio Co., Ltd (Japan)

- Graco Children’s Products Inc. (U.S.)

- Trend Lab (U.S.)

- Petunia Pickle Bottom (U.S.)

- Storksak (U.K.)

- Babymel London (U.K.)

- Futuristik (India)

- Motherly (India)

- Miss Lulu Bags (U.K.)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Crown Crafts, Inc., a U.S.-based baby products company, acquired Baby Boom Consumer Products, Inc., a U.S.-based baby products company providing nappy bags. The acquisition helped the company in expanding its product portfolio.

- February 2022: yoboo, a Japan-based child and maternity products company, unveiled a new diaper bag. The product is developed using high-quality materials and has passed international tests to ensure durability.

- September 2020: Dior, a France-based luxury brand, launched its baby stroller and a matching diaper bag in collaboration with Inglesina, an Italy-based baby products company. The products are available across the Middle East, Singapore, Europe, China, Japan, and Hong Kong.

- November 2019: Thrive International, Inc., a U.S.-based company offering parenting products, acquired two baby product brands, Moby Wrap and Petunia Pickle Bottom, providing diaper bags.

- March 2019: Pottery Barn Kids, a U.S.-based company offering kids products, collaborated with Mark & Graham, a U.S.-based home goods and luggage company, to launch a functional and fashionable collection of changing pads and diaper bags. The new product line is available on both the companies’ websites.

REPORT COVERAGE

The market report analyzes the market in-depth and highlights crucial aspects such as prominent companies, types, materials, and distribution channels. Besides this, the research report also provides insights into the world travel market, market share, and market trends analysis.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 2.92% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market was USD 0.85 billion in 2025 and is anticipated to reach USD 1.1 billion by 2034.

Ascending at a CAGR of 2.92%, the global market will exhibit steady growth over the forecast period.

By type, the backpack segment is expected to dominate the market throughout the forecast period.

Increasing family travel to drive market growth.

Carters, Inc., Sanrio Co., Ltd, Graco Childrens Products Inc., Trend Lab, and Petunia Pickle Bottom are the leading companies worldwide.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us