Baby Cloth Diaper Market Size, Share & Industry Analysis, By Category (Economic and Premium), By Distribution Channel (Online and Offline), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

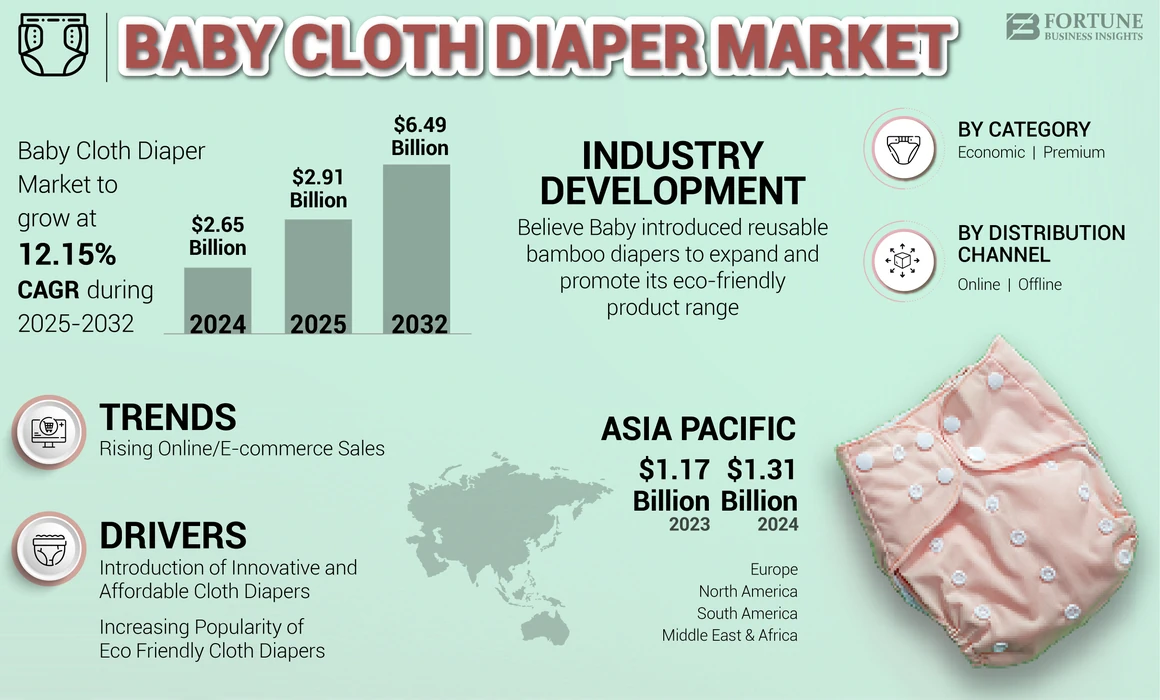

The baby cloth diaper market size was valued at USD 2.65 billion in 2024. The market is projected to grow from USD 2.91 billion in 2025 to USD 6.49 billion by 2032, exhibiting a CAGR of 12.15% during the forecast period. Asia Pacific dominated the baby cloth diaper market with a market share of 49.43% in 2024.

Baby cloth diapers, also known as cloth nappies, are reusable baby diapers developed using materials, such as cotton, hemp, and bamboo. They are available in various sizes, designs, and types, including pre-fold, flat, fitted, and pocket diapers. Increasing awareness regarding the cost efficiency and environmental benefits of baby cloth diapers will trigger their adoption globally.

For instance, in 2023, Bambino Mio, a U.K.-based reusable nappy company, collaborated with social enterprise Mamma's Laef to promote the benefits of using reusable cloth nappies in Vanuatu. Vanuatu-based consumers provided their feedback to the company, where 96% of them opined that they liked reusable nappies, and 85% of them expressed their intention to buy such products.

At a macro level, the increasing commitment among parents worldwide toward potty training will impede the market growth in the forthcoming years.

Global Baby Cloth Diaper Market Overview

Market Size:

- 2024 Value: USD 2.65 billion

- 2025 Value: USD 2.91 billion

- 2032 Forecast Value: USD 6.49 billion, with a CAGR of 12.15% from 2025–2032

Market Share:

- Regional Leader: Asia Pacific held the 49.43% market share in 2024, driven by growing awareness around baby hygiene, preference for chemical-free products, and wide adoption of reusable diapers in countries like India and China.

- Fastest-Growing Region: North America is witnessing fast growth due to rising environmental concerns, higher disposable income, and awareness of skin-safe diapering options.

- Category Leader: Economical segment led the market in 2024, owing to high affordability and availability of flat and pre-fold diaper types.

Industry Trends:

- E-Commerce Expansion: Online platforms like Amazon and Flipkart boost accessibility and sales.

- Premiumization of Products: Growth in hybrid, all-in-one, and pocket diapers offering superior comfort and performance.

- Sustainability & Eco Trends: Strong push toward organic cotton, bamboo, and hemp-based reusable diapers.

- Brand Collaborations: Strategic tie-ups (e.g., Bambino Mio & Mamma’s Laef) help promote cloth diaper adoption in emerging markets.

Driving Factors:

- Cost-Effectiveness & Reusability: Long-term savings compared to disposable diapers fuel demand.

- Environmental Impact Awareness: Rising concern over disposable diaper waste drives shift to cloth.

- Product Innovation: Launch of leak-proof, breathable, and skin-safe designs supports adoption.

- Supportive Demographics: Young parenting population and increased urbanization in developing regions.

- Government & NGO Campaigns: Awareness programs promote sustainable diapering alternatives.

COVID-19 IMPACT

Increased Online Shopping During Pandemic across Countries Favored the Market Growth

The COVID-19 pandemic positively influenced the growth of the baby cloth diaper market. The increased adoption of online shopping platforms for buying daily essentials to avoid the risk of getting infected by shopping at physical retail outlets accelerated product sales internationally. Furthermore, the need for personal care and hygiene to avoid the spread of coronavirus triggered the demand for these products, most notably in 2020 and 2021. However, the limited operations of industry participants and closure of physical retail outlets, including departmental stores, pharmacy shops, and wholesale stores due to the government-imposed lockdowns, negatively impacted the sales of personal care products across different countries. Despite supply chain disruptions within offline distribution channels caused by the pandemic, the increasing consumer demand for alternatives to disposable diapers to lower baby care expenditure will likely positively influence the market’s trends in the future.

Baby Cloth Diaper Market Trends

Rising Online/E-commerce Sales to Support Market Growth

A significant growth in the online sale of baby cloth diapers, notably in 2020 and 2021, has boosted product sales across international markets, favoring the baby cloth diaper market growth. Moreover, growth in the penetration of e-commerce platforms in the global markets will significantly influence the product’s sales. E-commerce brands, such as Flipkart and Amazon provide a wide variety of diapers, ranging from economical to premium categories. Furthermore, the growing demand for baby cloth diapers from online shoppers will act as an opportunity for manufacturers and retailers to accelerate their sales. Various brands, including SuperBottoms, offer a wide range (in terms of size and price range) of cloth diapers for newborns on their websites. Key industry players, such as SuperBottoms and Procter & Gamble are also partnering with internationally renowned e-commerce platforms, such as Amazon and Flipkart to sell cloth diapers.

- Asia Pacific witnessed baby cloth diaper market growth from USD 1.17 billion in 2023 to USD 1.31 billion in 2024.

Download Free sample to learn more about this report.

Baby Cloth Diaper Market Growth Factors

Introduction of Innovative and Affordable Cloth Diapers to Fuel Product Adoption

The growing demand for innovative baby cloth diapers among parents who prefer soft and premium fabrics for their babies' sensitive skin will fuel the product demand globally. In addition, cloth diaper manufacturers are introducing new varieties of diapers that offer superior dryness and leak protection to achieve product differentiation. For instance, in June 2023, Charlie Banana, a Procter & Gamble brand, launched a new collection of reusable diapering products by using fully recyclable FSC-certified paper packaging, thus eliminating the use of plastic materials. Furthermore, cloth diapers are budget-friendly compared to disposable diapers and are easier to use, thereby increasing their popularity in many countries. Manufacturers, such as SuperBottoms provide high-quality, budget-friendly, sustainable, and reusable diapers for babies.

Moreover, the introduction of innovative and affordable baby cloth diapers for newborns and infants will also boost the product demand across the world. For instance, in August 2021, Bdiapers, an India-based diaper brand, introduced eco-friendly and affordable hybrid cloth diapers for the Indian market. The diapers are waterproof, offering ample room for air circulation for babies. In addition, major diaper manufacturers are investing in marketing and promotional activities to accelerate the sales of cloth diapers in developed and developing economies.

Increasing Popularity of Eco Friendly Cloth Diapers to Boost Market Expansion

Baby cloth diapers are reusable diapers made with skin friendly and sustainable materials, such as wool fiber, cotton, or bamboo are widely popular among new parents. However, disposable diapers often contain various chemicals and absorbent gels, a factor that can hamper their sales worldwide. According to the United Nations Environment Programme (UNEP), every minute, more than 300,000 disposable diapers end up in landfills, which are the third largest contributors to landfills and environmental impacts globally. Moreover, according to Statistics Canada, a government agency in Canada, around 1.5 billion disposable diapers are discarded in the country each year, ending up in landfills. In this regard, the rising popularity of reusable diapers as a sustainable option will fuel the growth of the market. According to a study by the U.K. Environment Agency, the production of cloth diapers uses 3 times lesser energy, 2.5 times lesser water, and 20 times lesser raw materials than disposable diapers, making them more sustainable and driving their sales.

The popularity of high-quality cloth diapers made with sustainable materials, such as cotton and hemp that are safe for babies is growing steadily. Moreover, an increasing number of brands are providing sustainable cloth diapers, which will favor the market expansion. Various brands, including Dyper, Charlie Banana, Wink, Esembly, Thirsties, and Smart Bottoms, also provide eco-friendly diapers in unique styles, prints, and colors, thereby positively influencing consumers' purchase decisions.

In addition, manufacturers of cloth diapers are developing eco-friendly products to promote sustainability. For instance, Babee Green, a U.S.-based organic cloth diaper company, uses organic and natural fibers, including environmentally friendly organic cotton, hemp, or merino wool that are budget-friendly. Major industry players are also emphasizing on the need for comfort and convenience for babies, along with product affordability and sustainability. For instance, Thirsties, a U.S.-based diaper manufacturer, provides cloth diapers in different sizes and colors. The diapers are waterproof and made with breathable material, ensuring comfort to the baby.

RESTRAINING FACTORS

Fluctuating Raw Material Prices to Restrict Market Growth

Cotton is one of the most commonly used materials in cloth diapering products as it is a breathable material with high absorption properties. Cotton absorbs moisture that can prevent skin rashes on babies, which makes it a popular choice for diaper manufacturers globally. However, fluctuating raw material prices can directly impact the production costs, which in turn influences the final price of diapers. This factor can restrict the market’s expansion in the future. Other raw materials used to make cloth diapers, including hemp, bamboo, and wool fibers, also experience price fluctuations every year, making it challenging for industry players to fix their profit margins.

Rising cotton prices impact production expenses. In this regard, the high cost of reusable diapers can be attributed to high raw material and production costs, along with increased logistics and transportation costs. Furthermore, the COVID-19 pandemic caused supply chain disruptions, high inflation, and raw material shortages, leading to increased product prices. The Russia-Ukraine war and political & trade tensions also affected raw material costs, thereby decreasing the baby cloth diaper market share.

Baby Cloth Diaper Market Segmentation Analysis

By Category Analysis

Economical Segment Held The Largest Share Due To Its Affordability

Based on category, the market is segmented into economical and premium.

The economical segment, which includes flats & pre-fold cloth diapers and additional diaper sheets & inserts, held the largest market share in 2022. In comparison to premium cloth diapers, pre-fold diapers are available at an affordable price and can be easily dried after usage when combined with diaper sheets. Moreover, rising consumer preference for cost-effective alternatives to disposable diapers, including flat and pre-fold cotton diapers, will contribute significantly to the demand for economical diapers.

The premium segment covers product categories, such as fitted, pocket, hybrid, all-in-one, all-in-two, and multiple-layered cloth diapers. The launch of innovative absorbent fitted, hybrid, and all-in-one diapers will likely increase the parents' preference for buying such products, thereby driving the premium segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Offline Distribution Channels to Become Widely Popular Owing to Vast Product Availability

Based on distribution channel, the market is divided into online and offline.

The offline segment is expected to retain its dominance throughout the forecast timeframe. Rise in the presence of baby care product manufacturers, retailers, and supermarkets offering premium reusable diapers will increase the product sales considerably, thereby contributing to the growth of the offline segment. For instance, in August 2023, SuperBottoms, an Indian cloth diaper manufacturer, received investments worth USD 5 million in a series of A1 funding rounds from investment ventures Lok Capital and Sharrp Ventures to increase its product category and conduct retail expansion projects in India.

REGIONAL ANALYSIS

The market is studied across North America, Asia Pacific, Europe, South America, and the Middle East & Africa.

Asia Pacific Baby Cloth Diaper Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest market share in 2024, favored by the growing concerns regarding the baby’s hygiene and prevention of skin issues. Moreover, the popularity of reusable diapers made without chlorine processing (ECF), synthetic fragrances, phthalates, and parabens is increasing among health-conscious parents throughout Asia Pacific. Furthermore, numerous players are focusing on expanding their product portfolios.

For instance, in November 2021, SuperBottoms, an India-based cloth diaper manufacturing company, raised venture debt funding of over USD 0.36 million from Alteria Capital, an Indian venture fund, to expand its product portfolio.

Europe is one of the major regional markets that benefitted from the increasing birth of babies. For instance, according to Eurostat, a government agency, in 2021, 4.09 million babies were born across the European Union, with 1.53 live births per woman. Furthermore, various international players are focusing on partnerships to expand their reach in the region. For instance, in January 2020, Bare and Boho, an Australia-based cloth diaper brand, partnered with Aldi, a Germany-based supermarket chain, to offer its reusable ethical cloth diapers across Germany.

In addition, increasing awareness about the benefits of cloth diapers, including enhanced ventilation, heightened comfort, and skin-friendliness, is prompting new parents/consumers to switch to cloth diapers across North America, positively influencing the baby cloth diaper market forecast.

The rising consumer awareness regarding the negative effects of disposable diapers on babies' skin and environment challenges associated with them will increase the demand for reusable diapers across South American markets.

Furthermore, the large amount of waste generated across the Middle East & African countries, including the U.A.E., South Africa, and Saudi Arabia, is expected to increase the adoption of eco-friendly products that can be used multiple times and reduce waste, such as reusable diapers, in the coming years.

List of Key Companies in Baby Cloth Diaper Market

Key Players to Develop Innovative Products to Stay Competitive

Key market players are focusing on developing baby cloth diapers in various designs, colors, and sizes to attract more customers and expand their customer base. For instance, in June 2023, Procter & Gamble Company, a U.S.-based consumer goods company, unveiled a new collection of reusable diapering products through its Charlie Banana brand. The collection featured 13 new patterns & designs and improved packaging that utilized completely recyclable FSC-certified paper. Furthermore, prominent industry participants are offering products through both online and offline channels to gain a competitive advantage and accelerate their product’s sales.

List of Key Companies Profiled:

- The Procter & Gamble Company (U.S.)

- Babee Greens (U.S.)

- Thirsties Baby (U.S.)

- Cotton Babies, Inc. (U.S.)

- Modern Cloth Nappies

- LittleLamb (U.K.)

- Kinder Cloth Diaper Co. (U.K.)

- Jingjiang Bes Baby & Children Products Co., Ltd. (China)

- Bambino Mio (U.K.)

- Superbottoms (India)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 – Believe Baby, a U.S.-based diaper brand, introduced reusable bamboo diapers to expand and promote its eco-friendly product range.

- November 2022 – Esembly, a U.S based cloth diaper & accessories brand, partnered with Cloth Diaper Kids, a Canada-based cloth diaper retailer, to expand its reach across Canada.

- March 2022 - Sumo, a German baby cloth diaper brand, launched a durable, fitted cloth diaper containing a waterproof cover, sewn pocket, and washable absorbent pads in a biodegradable design. The product’s core design uses a mix of needle punch and thermal bonding technologies to ensure superior absorbency and launderability even after multiple usage cycles.

- July 2021 – SuperBottoms, an India-based mother and baby care brand, launched a cloth diaper named UNO 2.0 for new parents. The company has a patent pending for its diaper design. These reusable diapers can be washed more than 300 times, which makes them super economical and a viable eco-friendly option.

- March 2020 – ClothDiaper.com, a U.K.-based baby care products supplier, reported a 1,000% and 500% jump in its baby wipes and cloth diaper sales respectively due to an increase in the trend of baby care products purchase amid the COVID-19 pandemic.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product categories, and distribution channels. Besides, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.15% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Category

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global baby cloth diaper market was valued at USD 2.65 billion in 2024 and is projected to grow to USD 6.49 billion by 2032.

The market is likely to record a CAGR of 12.15% over the forecast timeframe of 2025-2032.

The demand for cloth diapers is driven by environmental concerns, cost-effectiveness, and skin safety.

Asia Pacific dominated the global market in 2024 with 49.43% share, fueled by high birth rates, growing environmental awareness, and the increasing popularity of reusable, chemical-free diapering options in countries like India and China.

Yes. Cloth diapers are made from natural fibers like cotton, hemp, or bamboo, which are gentle on sensitive skin.

Yes. Cloth diapers reduce waste and environmental impact. Studies show that they use 3x less energy, 2.5x less water, and 20x fewer raw materials than disposables over time.

Key trends include the rise of premium and hybrid diaper products, eco-conscious packaging, and brand collaborations to promote sustainability.

Top brands include SuperBottoms, Charlie Banana, Bambino Mio, Thirsties, Babee Greens, and Procter & Gamble’s Charlie Banana line.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us