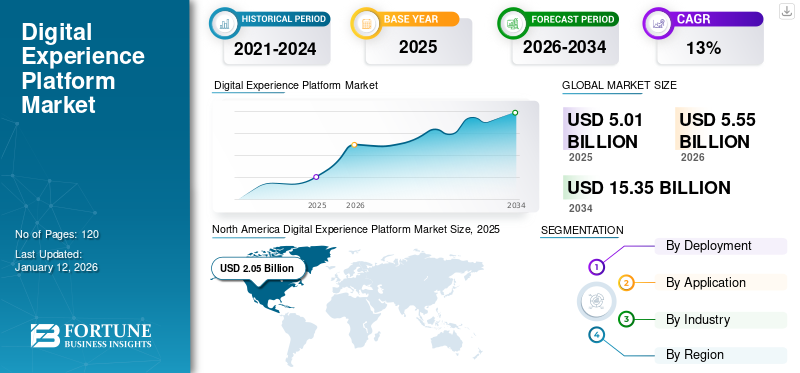

Digital Experience Platform Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud), By Application (Business-to-Consumer (B2C) and Business-to-Business (B2B)), By Industry (Government, BFSI, Retail, Healthcare, Automotive, Media & Entertainment, Energy & Utilities, IT & Telecommunication, and Others), and Regional Forecast, 2026 – 2034

DIGITAL EXPERIENCE PLATFORM MARKET SIZE AND FUTURE OUTLOOK

The global digital experience platform market size was valued at USD 5.01 billion in 2025. The market is projected to grow from USD 5.55 billion in 2026 to USD 15.35 billion by 2034, exhibiting a CAGR of 13.58% during the forecast period. North America dominated the digital experience platform market with a market share of 40.89% in 2025.

The Digital Experience Platform (DXP) develops, manages, and refines personalized content for customer experiences through various digital channels, including websites, mobile applications, and social media. DXPs combine functionalities such as content management systems, analytics, and customer relationship management to provide cohesive, data-based experiences adaptable to individual needs, deepening engagement and loyalty without requiring disconnected systems. This strategy allows companies to deliver omnichannel experiences, maintaining consistency across touchpoints and leveraging real-time analytics to respond to shifting customer demands.

The market growth is primarily driven by the rising demand for personalized and seamless digital experiences across industries.

Major market players such as Adobe, Oracle, and Salesforce develop advanced offerings to improve their DXP solutions. To remain competitive in this fast-moving market, they concentrate on embedding cutting-edge technologies such as artificial intelligence, machine learning, and cloud-native architecture.

IMPACT OF GENERATIVE AI

Implementation of Gen AI Capabilities Fuels Market Growth

Generative AI is essentially transforming the Digital Experience Platform (DXP) space by enabling new levels of intelligence, automation, and personalization. Historically, depending on fixed rules and human-written content, DXPs are now transforming into more complex systems that can create real-time, hyper-personalized experiences as per user.

With generative AI, sites can create content automatically, including product descriptions, marketing emails, and landing pages that are specific to individual customer segments or even singular individuals. For instance,

- In May 2025, Zoho enhanced its digital experience platform with new generative AI and workflow orchestration features powered by its AI engine, Zia. With the launch of "CRM for Everyone," users across different departments can now easily create reports, workflows, and custom modules using simple prompts.

The addition of generative AI is driving DXPs to break free from rigid workflows and allowing them to become smart and self-optimizing ecosystems.

IMPACT OF RECIPROCAL TARIFF

Recent Tariff Rates are Hampering Overall Market Growth

The imposition of reciprocal tariffs among countries has the potential to heavily disrupt the DXP market by driving up the cost of operating and changing vendor plans. For instance,

- If Country A puts a 25% tariff on imports of software products from Country B, Country B DXP providers will be constrained to hike subscription prices for customers in Country A, rendering their solutions less competitive relative to local offerings.

This could slow down business uptake as companies pay more for cloud-based solutions, AI products, and infrastructure pieces. Vendors could also accelerate localizations such as having in-country data centers or cooperating with local cloud providers to bypass tariff walls. A hypothetical instance between the U.S. and an emerging economy shows that:

- If the U.S. imposes tariffs on digital services, U.S. DXP providers, such as Adobe, may experience less competitiveness in that country, with domestic providers benefiting from an artificial edge.

These trade barriers would lead to the fragmentation of the global DXP market, with vendors needing to adjust price models, data hosting strategies, and partnership tactics to ensure market access, and businesses with harder ROI calculations for digital experience investments.

MARKET DYNAMICS

Digital Experience Platform Market Trends

Growth of Low-code/No-code Platforms to be a Key Trend in the Market

The growth of low-code/no-code (LCNC) platforms and self-service portals is transforming digital experience delivery with the ability of marketers, business analysts, and other non-technical users to design and manage digital content independent of IT organizations. For instance,

- In December 2024, Abundant Health Acquisition (aha!) partnered with Americaneagle.com to enhance patient digital experiences by integrating aha!’s low-code/no-code Health Experience Platform (HXP) with Site core.

The latest DXPs have drag-and-drop builders, AI-powered design tools, and visual workflow automation to empower "citizen developers" that develop everything from landing pages and dynamic forms to customer portals and targeted campaigns.

The shift toward no-code composability enables businesses to assemble modular digital experiences faster and at lower cost, accelerating time-to-market while maintaining scalability.

Market Drivers

Growth in E-commerce Adoption and Increase in Mobile Usage to Enhance Market Growth

The sudden boom in e-commerce and the rising dominance of mobile access have had a far-reaching impact on how organizations connect with their customers. Today, consumers anticipate seamless, intuitive, and personalized digital experiences across any device and channel they prefer. For instance,

- According to industry reports, 2.77 billion individuals worldwide are engaging in online shopping through specialized e-commerce websites or social media shops.

This has put a high demand for platforms as they are able to keep up with rapidly evolving user behaviors. DXPs are built to address these needs by allowing brands to provide consistent, contextual experiences on web, mobile, and app channels.

Additionally, DXPs enable rapid integration with e-commerce platforms, payment gateways, and mobile apps, further making them suitable for brands that want to boost their online shops. They further enable strong data and analytics functionalities, enabling businesses to gain in-depth insights into customer behavior and optimize their digital initiatives.

Market Restraints

Data Privacy and Security Concerns Restrain Digital Experience Platform Adoption

Digital Experience Platforms (DXPs) gather, process, and store large quantities of personal and behavioral data to provide customized user experiences. This consists of sensitive data including users' identities, preferences, browsing habits, and location information, and in industries such as healthcare and finance, Protected Health Information (PHI) and financial information.

Increasing international recognition of data rights enhances the concern among government regulatory environments such as GDPR (General Data Protection Regulation – EU), HIPAA (Health Insurance Portability and Accountability Act – US), and CCPA (California Consumer Privacy Act – US). These strictly regulate the way organizations handle the collection, processing, storage, and sharing of personal information. Failure to comply with these regulations can lead to significant fines, damage to reputation, and legal action. For instance,

- Fines under GDPR can go up to USD 22.6 million or 4% of the worldwide annual turnover.

- HIPAA infractions can cost up to USD 1.5 million annually for each category of violation.

Market Opportunities

Demand for Unified Customer Journey Create Lucrative Market Opportunities

Seamless capabilities have emerged as an essential differentiator in the experience-driven economy. Visionary organizations are acknowledging that customers no longer think of isolated channels but instead expect to have continuous, contextual interactions that bridge digital and physical touchpoints. For instance,

- In March 2025, Volkswagen Group (VWG) partnered with Capgemini to launch a large-scale CRM transformation using an omni channel Salesforce platform. The initiative called ONE.CRM aims to unify fragmented CRM systems across brands and regions, offering a 360-degree customer view and streamlined marketing, sales, and service processes.

Companies are using next-generation platforms and building adaptive ecosystems where customers experience seamless transition between web, mobile, in-store, and new touchpoints. For instance,

- In September 2024, JACK & JONES launched the JACK & JONES Club, a new omnichannel loyalty app rolled out in over 780 stores across 15+ European markets. The app connects in-store and online shopping, offering personalized rewards and a seamless customer experience. Early results show a 40% increase in basket size among members, boosting engagement and sales.

Organizations that execute these capabilities effectively are experiencing tangible benefits in customer retention, operational effectiveness, and revenue growth, as seamless experiences create higher conversion rates and increased brand loyalty.

SEGMENTATION ANALYSIS

By Deployment

Rising Demand for Cloud-based Solutions to Upsurge Segmental Growth

The market is segmented into on-premise and cloud on its deployment.

Cloud-based deployment holds the highest share and is expected to grow at the highest CAGR during the forecast period. The dominance of cloud-based DXP deployment is due to its intrinsic cost, scalability, and innovative advantages over on-premises solutions. Cloud platforms work on pay-as-you-go models, unlike the conventional on-premises systems with high initial investment in hardware and recurrent maintenance charges. Cloud deployment segment held 68.13% of the share in 2026.

Cloud DXPs also facilitate fast deployment, with rollout periods cut from months to weeks, with automatic updates and access to the most recent AI and security capabilities without human intervention. For instance,

- In September 2024, Avaya launched its Experience Platform (AXP) Public Cloud in India, offering AI-powered customer experience solutions across industries, including healthcare and telecom. The platform supports multiple deployment models and features AI self-service, advanced analytics, workforce engagement tools, and a generative AI assistant, Avaya Ada, to enhance customer and employee interactions.

On-premise deployment which is considered less dominant, remains a preferred choice for organizations requiring greater control over data and infrastructure. It ensures enhanced data privacy, compliance with strict regulatory standards, and complete customizations of systems.

By Application

Rising Demand for DXP by B2C Businesses Drive Segmental Growth

Based on application, the market is segmented into Business-to-Consumer (B2C) and Business-to-Business (B2B).

B2C businesses is expected to hold 60.41% of the majority share in 2026 in DXP adoption, as these platforms are used to craft frictionless, personalized customer experiences that generate direct revenue. Retailers, banks, and media companies deploy DXPs to enable omnichannel commerce, instant checkout flows, and AI-powered recommendations. Additionally, recent product launches in the industry also support this trend. For instance,

- In February 2025, Klaviyo launched Klaviyo B2C CRM, the first CRM built specifically for B2C brands. It unifies marketing, analytics, and customer service into one AI-powered platform, helping brands deliver seamless, personalized experiences across the customer journey.

The B2B business network is expected to grow with the highest CAGR of 14.69% during the forecast period, as businesses automate intricate sales processes and relationship-based procedures. Manufacturers, SaaS companies, and distributors are rolling out these platforms to facilitate self-service portals, propose automation, and provide account-specific content on a larger scale. B2B models focus on automating multi-stakeholder buying processes, enhancing sales enablement, and offering data-driven insights across extended decision cycles. For instance,

- In August 2024, Adobe launched Journey Optimizer B2B Edition, a new generative AI tool within its digital experience platform tailored for B2B. It unifies CRM, CDP, and marketing data to personalize content, streamline campaigns, and improve buyer engagement. Designed for complex B2B journeys, it also strengthens Adobe’s enterprise AI and offerings.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Increasing Usage of Technology by Retail Sector to Drive the Segment’s Expansion

The market is classified into government, BFSI, retail, healthcare, automotive, media & entertainment, energy & utilities, IT & telecommunication, and others, based on industry.

The retail sector is the major shareholder of the DXP market based on its growing requirement for seamless omni channel experiences as well as immediate bottom-line impact. Retailers use DXPs to integrate e-commerce, mobile apps, and in-store experiences with capabilities such as real-time inventory scanning, personalization, and contactless checkout. The retail segment is expected to hold 29.37% as the market share in 2026. For instance,

- In December 2024, H&M Group acquired a minority stake in a retail technology platform, Voyado that enables retailers, online businesses, and brands to establish enduring connections with their customers.

- In May 2023, Prada Group partnered with Adobe to link online and physical customer interactions instantly, boosting loyalty and sales.

BFSI is expected to rise with the highest CAGR of 15.72% during the forecast period, as digital transformation modifies customer needs in this conventional industry. BFSI companies need DXPs that provide personalization while accommodating strict compliance requirements, enabling features such as biometric authentication, financial well-being dashboards, and cross-channel journey adaptation while accommodating stringent security laws. For instance,

- In April 2025, Candescent, a top independent digital banking platform in the U.S., revealed that Farmers & Merchants Bank, located in Stuttgart, Ark., has chosen Candescent’s Digital Banking platform to enhance its customer experience and provide more sophisticated features for both individual and commercial banking.

DIGITAL EXPERIENCE PLATFORM MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Digital Experience Platform Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America is projected to reach USD 2.05 billion in 2025 and USD 2.26 billion in 2026. North America holds a majority of the digital experience platform market share due to its established digital infrastructure and early mover advantage with new technology adoption. The region also has significant DXP vendors, such as Adobe and Oracle, along with companies that have advanced digital transformation plans. A competitive corporate environment compels businesses to spend on high-end DXP solutions to improve customer interaction, automate processes, and retain a technological advantage. For instance,

- In April 2025, the Canada Premier League (CPL) launched a new website and app to provide fans of Canada’s domestic professional men’s soccer league an enhanced digital experience that connects them more closely to the League and its teams.

In North America, the U.S. dominates the market, fueled by advanced technology and a significant emphasis on providing customized customer experiences. The U.S. market is anticipated to hit USD 1.64 billion in 2026.

Download Free sample to learn more about this report.

South America

South America's consistent digital experience platform market growth is due to the region's long overdue but fast-paced digital maturation. Brazil's vibrant fintech market and Argentina's compulsory electronic invoicing regimes are compelling businesses to digitize customer interaction platforms.

The market continues to be cost-conscious, moving toward modular cloud DXP offerings over monolithic solutions, with growth in areas such as agribusiness digitization, neobanking, and modernization of public sector digital services.

Europe

Europe is expected to be the second largest market of value USD 1.59 billion in 2026 and grow at the second-largest CAGR of 28.40%, driven by a unique convergence of regulatory, technology, and other different market forces that set it apart from other markets. The region's robust data governance environment, with GDPR and developing digital sovereignty laws, has established a requirement for privacy-by-design platforms capable of providing personalized experiences while continuing to be compliant. Additionally, recent investment in the region for patient engagement and workflow automation in medical practices also supports this trend. For instance,

- In January 2025, Nelly raised USD 52 million to develop its platform for medical practices. The Patient Experience Platform and Financial Operating System (FinOS) offered by the company allow practitioners to optimize their workflows while delivering a completely digital experience for patients.

The U.K. market size is expecting to hit USD 0.50 billion while the market in Germany is projected to reach USD 0.33 billion and France’s market is likely to be USD 0.25 billion in 2025.

Middle East & Africa

The Middle East & Africa is the fourth-largest region, expected to hit USD 0.36 billion in 2026 and grow at a steady CAGR, driven by fast-paced digital infrastructure development and changing consumer habits. Gulf Cooperation Council (GCC) countries are driving adoption through smart city projects that require next-generation digital experience management capabilities.

The region’s growth is generated by initial digital transformation contrasting to optimization, with specific strength in banking digitization, telemedicine platforms, and cross-border commerce solutions leading to enhanced regional payment ecosystems. The GCC market is anticipated to reach USD 0.14 billion in 2025. For instance,

- In October 2024, PwC Middle East partnered with Liferay, a provider of digital experience platforms to enhance customer’s digital experiences in the Middle East. This collaboration aims to merge Liferay’s DXP technology with PwC Middle East’s proficiency in advisory services and technology implementation, providing a comprehensive range of digital solutions to enhance customer engagement strategies.

Asia Pacific

Asia Pacific is expected to become the third-largest region with the market value to hit USD 1.13 billion in 2026 and grow with the highest CAGR due to accelerated digitalization and growing internet penetration. Rising economies such as India, China, and Southeast Asian countries are experiencing an increase in mobile-first customers, e-commerce expansion, and government-driven digital initiatives. For instance,

- In September 2024, Life Insurance Corporation elected Infosys to propel its digital transformation using the NextGen Digital Platform, emphasizing omni channel experiences and data-driven hyper-personalization for customers, agents, and employees.

Growth in super apps (WeChat, Grab, Paytm) and social commerce platforms also fuels the need for flexible and scalable DXPs that facilitate multiple digital touchpoints. The Indian market size is expecting to hit USD 0.18 billion while the market in China is projected to reach USD 0.42 billion and Japan’s market is likely to be USD 0.26 billion in 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players are Engaging in Strategic Alliances, Mergers, and Acquisitions to Keep Up with Changing Technology

The market players are focusing on new innovative products & services due to the increasing demand for more advanced platforms. Market players are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world. Adobe, Acquia, Oracle, Sitecore, Salesforce, ContentSquare, Liferay Inc., Squiz, and Ibexa, among others, are the key players in the market.

Long List of Companies Studied (including but not limited to)

- Adobe (U.S.)

- Acquia (U.S.)

- Oracle (U.S.)

- Sitecore (U.S.)

- ContentSquare (France)

- Magnolia International Ltd (Switzerland)

- Salesforce, Inc. (U.S.)

- Liferay Inc. (U.S.)

- Kentico Xperience (Czechia)

- Crownpeak Technology, Inc. (U.S.)

- CoreMedia Gmbh (Germany)

- Squiz (Australia)

- Progress Software Corporation (U.S.)

- Pimcore (Austria)

- Ibexa (Norway)

- Open Text Corporation (Canada)

…and more

KEY INDUSTRY DEVELOPMENTS

- May 2025: GOCare, a leading SaaS provider of broadband service, announced that Socket Fiber, a Missouri-based ISP, opted for its digital customer experience platform to enhance customer engagement and operational efficiency. The platform enables proactive notifications and omnichannel support, reducing call volumes and support costs while improving customer satisfaction.

- February 2025: Mobicom Corporation partnered with Circles to launch Xplore, an AI-powered SaaS Platform, which is designed to customize user experiences, enhance engagement, and unveil new digital possibilities.

- October 2024: TMG announced the partnership with Contentsquare to enhance customer data-driven digital experiences. The collaboration enables TMG to use advanced analytics, improve customer journey insights, optimize use experiences, and deliver measurable growth for enterprise clients.

- August 2024: Iron Mountain launched the Iron Mountain Insight Digital Experience Platform. With the help of DXP, users can utilize the platform to retrieve, oversee, regulate, and profit from both physical and digital data.

- July 2023: Kapture CX, a SaaS-based customer experience platform, has secured USD 4 million in Series A funding, with Cactus Venture Partners (CVP) leading the round as an early growth-stage venture capital firm. Kapture CX will use the funding to grow its footprint in international markets, improve its product range, and bolster its team.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.68% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Deployment, Application, Industry, and Region |

|

Segmentation |

By Deployment

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

Adobe (U.S.), Acquia (U.S.),Salesforce, Inc. (U.S.), Oracle (U.S.), Sitecore (U.S.), ContentSquare (France), Magnolia International Ltd (Switzerland), Liferay Inc. (U.S.), CoreMedia Gmbh (Germany), Squiz (Australia), Open Text Corporation (Canada), and Pimcore (Austria) |

Frequently Asked Questions

The market is projected to reach USD 15.35 billion by 2034.

In 2025, the market was valued at USD 5.01 billion.

The market is projected to grow at a CAGR of 13.58% during the forecast period.

The Business-to-Consumer (B2C) is expected to hold the highest share.

Growth in e-commerce adoption and increase in mobile usage to enhance the market progress.

Adobe, Acquia, Oracle, Salesforce, and Sitecore are the top players in the market.

North America dominated the digital experience platform market with a market share of 40.89% in 2025.

By industry, BFSI is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us