Distribution Substation Market Size, Share & Industry Analysis, By Type (Gas-Insulated Substations (GIS), Air-Insulated Substations (AIS), and Hybrid Substations), By Voltage (Low, Medium, and High), By Insulation (Solid Insulation, Liquid Insulation, and Gas Insulation), By Application (Industrial, Commercial, and Utility), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

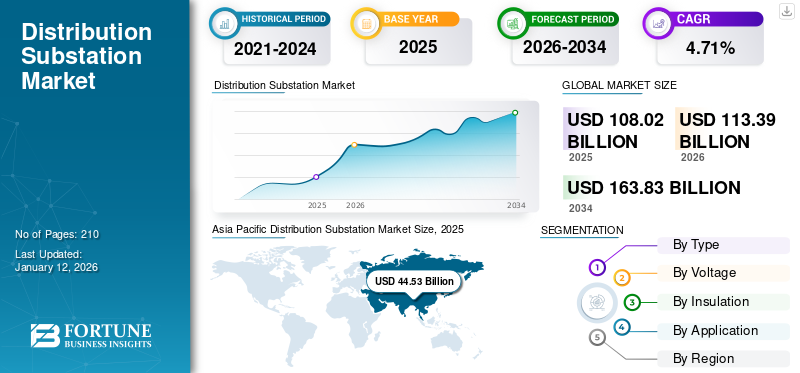

The global distribution substation market size was valued at USD 108.02 billion in 2025. The market is projected to grow from USD 113.39 billion in 2026 to USD 163.83 billion by 2034, exhibiting a CAGR of 4.71% during the forecast period. Asia Pacific dominated the global market with a share of 41.22% in 2025.

The distribution substation market demand is driven by factors such as increasing electricity consumption, the integration of renewable energy, and the need for grid modernization and smart grid technologies. Population growth and rising living standards lead to higher energy consumption across residential, commercial, and industrial sectors, necessitating the expansion and modernization of substations.

- In November 2024, Power Grid Corporation of India Limited acquired four major ISTS projects for the enhancement of integration and transmission of green energy across various states of India. The projects will be commissioned 24 months from the date of acquisition.

The increasing integration of renewable energy sources such as solar and wind into the grid requires modernized substations that can manage variable energy inputs and ensure grid stability. The need for reliable and uninterrupted power supply, especially in critical infrastructure and industries, drives the demand for robust and efficient distribution substations. The need to retrofit and refurbish existing grid infrastructure to improve efficiency and reliability also contributes to market growth.

Hyundai Heavy Industries (HHI), through its subsidiary HD Hyundai Electric, is a prominent player in the market. The company is known for its expertise in power transformers, electrical machinery for power distribution, and energy management solutions and is focused on becoming a leading smart solution provider.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Electricity Energy Consumption to Drive Market Growth

The distribution substation market is mainly driven by rapid growth in urbanization and industrialization, leading to increased electricity demand. Governments across the globe are heavily investing in grid modernization projects to improve energy efficiency and reduce transmission losses. Rising adoption of renewable energy sources such as solar and wind is also creating a need for advanced substations that can handle fluctuating power loads. Moreover, the integration of smart grid technologies and IoT-enabled systems is pushing utilities to upgrade aging infrastructure, thereby fueling market growth.

- According to the U.S. Energy Information Administration, U.S. power demand will increase to 4,179 billion kilowatt hours in 2025 and 4,239 billion kWh in 2026, up from the record of 4,082 billion kWh in 2024.

Increasing electricity demand will propel investment in grid infrastructure enhancements, which is expected to fuel demand for distribution substations across the globe over the forecast period.

MARKET RESTRAINTS

High Capital Investment to Limit Market Expansion

The market faces several restraints, such as high capital investment and long project development cycles that often deter small and mid-sized utility players. Regulatory hurdles, land acquisition challenges, and environmental clearance delays can significantly slow down new substation installations. Also, maintaining and upgrading old substation installations is a critical process that hampers the reliability and efficiency of the electricity.

Additionally, maintaining and upgrading old substations require significant downtime and can disrupt the power supply. The lack of a skilled workforce for handling digital substations and complex technologies also hampers market scalability. Economic instability in developing regions and fluctuating raw material prices for components such as transformers and switchgear add further constraints to the market’s sustainable growth. These factors are anticipated to restrain the distribution substation market share during the forecast period.

MARKET OPPORTUNITIES

Rapid Energy Transition to Smart Grid Generation to Create Growth Opportunities in the Future

The market holds vast potential with the increasing transition to smart grids and decentralized energy systems. There is growing opportunity in rural electrification projects, especially across Africa and the Asia Pacific, where governments and global agencies are investing in large-scale connectivity.

- In March 2025, Tata Power Delhi Distribution (Tata Power-DDL) announced a collaboration with FSR Global for smart grid innovation. The partnership is expected to facilitate comprehensive research projects for innovation in clean energy technologies.

Furthermore, advancements in digital twin technology and automation create opportunities for predictive maintenance and remote operation. Public-private partnerships and favorable regulatory frameworks promoting renewable energy integration and digital transformation also open lucrative avenues for manufacturers and solution providers in the market. These factors are anticipated to fuel the distribution substation market growth in the coming years.

MARKET TRENDS

Growing Adoption of Automation & Advanced Technologies are Recent Market Trends

The growing popularity of digital substations has led to an increase in the adoption of digital technologies & substation automation. For instance, Artificial Intelligence (AI) and Machine Learning (ML) are widely used in these substations for fault detection & optimizing the grid operations. The use of edge computing technology facilitates real-time data processing, which reduces the reliance on centralized systems. Also, increasing grid complexities have led to an increase in demand for resilient communication networks facilitated by the use of advanced technologies.

- For instance, in October 2024, Schneider Electric announced the advancements in its digital grid solutions comprising distribution substations with net zero dashboard, grid resiliency, grid flexibility, and others to optimize the management of energy flows in the smart grids.

Segmentation Analysis

By Type

Rapid Adoption of Air-Insulated Substations (AIS) in Grid Modernization to Augment the Segment Growth

Based on type, the market is classified into Gas-Insulated Substations (GIS), Air-Insulated Substations (AIS), and hybrid substations. The air-insulated substations segment dominated the market share owing to its cost-effectiveness, ease of maintenance, and simpler design. Moreover, in grid modernization projects, substations with open-air design allow easy visual inspection and fault detection, reducing the need for specialized tools and personnel. AIS uses atmospheric air as the insulation medium between electrical components.

- For instance, in August 2023, GE Vernova’s Grid Solutions planned to supply two 500 kV air-insulated substations (AIS) to the municipalities of Currais Novos and Sao Tome, both in Rio Grande do Norte (RN) and a connection bay in Santa Luzia, Paraiba (PB).

The Gas-Insulated Substations (GIS) are anticipated to grow steadily as GIS uses a sealed environment filled with sulfur hexafluoride (SF6) gas as the insulating medium, allowing for compact designs and reduced environmental impact. GIS offers compactness, reduced footprint, enhanced reliability, and lower maintenance requirements compared to AIS.

- For instance, in January 2025, the Punjab State Transmission Corporation Limited, India, announced the development of a new 220 KV gas-insulated substation with a cost of USD 6.9 million equipped with over 10,000 industrial units located in Ludhiana, Punjab.

By Voltage

Growing Need for Efficient Energy Distribution to Fuel Medium Segment Growth

Based on voltage, the market is classified into low, medium, and high.

In distribution substations, Low Voltage (LV) typically refers to voltages up to 1000V, Medium Voltage (MV) between 1000V and 45kV, and High Voltage (HV) between 45kV and 230kV, with Extra High Voltage (EHV) being above 230kV.

The medium segment accounts for a major share due to its versatility in distributing power from substations to end-users across various sectors. It offers a balance between equipment size, efficiency, and reliability. These substations are used for short-distance power distribution, where voltages are not high enough to warrant a high-voltage substation.

They connect High Voltage (HV) power lines to Low Voltage (LV) distribution networks. Distribution substations act as a crucial link between high-voltage transmission networks and low-voltage distribution networks, converting high voltage to lower voltages suitable for homes and businesses and ensuring reliable and efficient power delivery.

By Insulation

Rising Adoption of Solid Insulation Segment in Renewable Energy Sector to Boost Market Growth

Based on insulation, the market is segmented into solid insulation, liquid insulation, and gas insulation. Among these, solid insulation emerged as the dominant segment and holds the largest market share. In distribution substations, insulation can be achieved using solid, liquid, or gas mediums, with solid insulation often found in cables and bushings, liquid insulation in transformers and cables for cooling and insulation, and gas insulation, especially SF6 gas, used in compact, high-voltage gas-insulated switchgear (GIS). It utilizes solid materials such as epoxy or polyurethane resin to separate and support electrical conductors.

- For instance, the solid insulation distribution substations offer superior electrical & thermal insulation, reliability, and safety, which is crucial for the intermittent nature of renewable energy sources, namely solar and wind.

By Application

High Demand for Distribution Substations in Utility Sector to Drive Market Share

Based on application, the market is segmented into industrial, commercial, and utility. The utility segment dominated the market. This dominance is attributed to the increasing demand for uninterrupted power supply and the growing need for efficient and reliable power grids. The utility sector widely uses distribution substations to safely & efficiently deliver electricity to the end-users. Also, by stepping down the voltage levels, these substations can minimize the power loss during distribution over shorter distances.

- For instance, in March 2025, ABB delivered solutions to three substations run by Uganda’s leading utility, Umeme Limited (UMEME), which manages and operates the state-owned leased electricity distribution network assets.

Distribution Substation Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Distribution Substation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America dominated the market with a valuation of USD 33.77 billion in 2025 and USD 35.11 billion in 2026. The North American distribution substation market is expected to continue its growth trajectory. Increased electricity demand owing to rising industrialization and population growth is driving the need for expanded and upgraded substation infrastructure.

- In May 2024, the Government of the U.S. announced plans to modernize the country’s electrical grid to cater to clean energy and power outages in the regions of the U.S. Such government initiatives are expected to propel market growth in the area.

The growing share of renewable energy sources such as wind and solar requires advanced substations to manage intermittent power generation and grid stability. Moreover, incentives and mandates related to clean energy and grid modernization are expected to drive investments in substation infrastructure.

Europe

Europe's distribution substation market is mainly driven by the region's increasing push toward decarbonization and smart grid integration. EU policies such as the Green Deal and Fit for 55 are prompting large investments in renewable energy, requiring substations to handle complex load balancing. Germany, France, and the U.K. are modernizing aging infrastructure and integrating digital substations to enhance grid resilience and flexibility. The rise of electric vehicles and distributed energy resources is also reshaping demand patterns.

Asia Pacific

The Asia Pacific distribution substation market is experiencing robust growth, driven by rapid urbanization, industrialization, and increased energy demand, particularly in China, India, and Southeast Asian nations.

- According to the National Energy Administration, China’s spending on power transmission increased by 19% to USD 72 billion, followed by major investments for the increase in power generation capacity.

The Asia Pacific region's rapid economic growth and increasing industrialization are fueling a surge in electricity demand, necessitating investments in reliable and scalable power infrastructure. The development of modular and prefabricated substations, which can be deployed quickly with minimal environmental impact, is gaining traction in the region. Such factors are fostering the market growth in the region.

Latin America

The Latin America distribution substation market is expanding steadily, driven by rural electrification initiatives and increased demand for energy. Brazil, Mexico, and Chile are investing in grid expansion and renewable energy integration, especially solar and wind. The region presents strong potential, especially in upgrading outdated systems and implementing smart technologies to improve energy reliability and access in remote areas.

Middle East & Africa

The Middle East & Africa (MEA) distribution substation market is experiencing growth, driven by increasing electricity demand, rising investments in grid infrastructure, and the need for efficient and reliable power distribution systems. The region is increasingly focusing on integrating renewable energy sources such as solar and wind, requiring efficient distribution systems to manage intermittent power generation. The adoption of smart grid technologies, such as digital substations and advanced metering infrastructure, offers opportunities for improving grid efficiency and reliability.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies are Collaborating with Local Governments to Expand Market Share

The global market is fragmented, with companies such as Hyundai Heavy Industries, ABB, Eaton, Siemens, and others accounting for a significant share. For instance, in January 2025, Eversource announced the development of the largest underground electrical substation in the U.S. The project was developed through a partnership between BXP and Cambridge Development Authority. Focusing on significant investments in the enhancement of power transmission and upgradation of electricity infrastructure has supported the companies’ share in the market.

LIST OF KEY DISTRIBUTION SUBSTATION COMPANIES PROFILED

- Hyundai Heavy Industries (South Korea)

- ABB (Switzerland)

- Eaton (Ireland)

- Siemens Energy (Germany)

- Mitsubishi Electric (Japan)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Toshiba Energy Systems Solutions Corporation (Japan)

- General Electric (U.S.)

- Larsen Toubro (India)

KEY INDUSTRY DEVELOPMENTS

- July 2024: Iberdrola partnered with Ormazabal to design, construct, and deliver mobile substations. The key features of the substation include Ormazabal cpg.0 primary distribution switchgear with a 24 kV / 1600 A / 25 kA busbar, alongside protection and control equipment.

- January 2024: Hitachi Energy launched digital substation technology equipped with SAM600 3.0, a Process Interface Unit (PIU) used to enhance transmission utilities to increase the adoption of digital substations.

- May 2022: Schneider Electric launched the 2nd generation metalclad power distribution substation category, which caters to compact solutions for utility, energy, and commercial industries.

- September 2021: Linxon announced the completion of 400 kV AIS substation construction located in Bihar, India, for POWERGRID Mithilanchal Transmission Limited (PMTL). The new substation caters to the state’s increasing electricity demand.

- December 2021: General Electric partnered with UK Power Networks (UKPN) to develop and launch a smart substation project, which is designed to support renewable energy generation and distribution across the U.K.

REPORT COVERAGE

The global distribution substation market analysis provides market size & forecast by all the segments included in the report. It contains details on the market dynamics and substation market trends expected to drive the market in the forecast period. It offers information on key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and investments in key countries. It covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.71% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Voltage

|

|

|

By Insulation

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 108.02 billion in 2025 and is projected to record a valuation of USD 163.83 billion by 2034.

In 2025, the market value stood at USD 44.53 billion.

The market is expected to exhibit a CAGR of 4.71% during the forecast period of 2026-2034.

The utility segment led the market by application.

The increasing electricity consumption is expected to drive market growth.

ABB, Mitsubishi Electric, Netcontrol Group, Rockwell Automation, and others are the top players in the market.

Asia Pacific dominated the market in 2025 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us