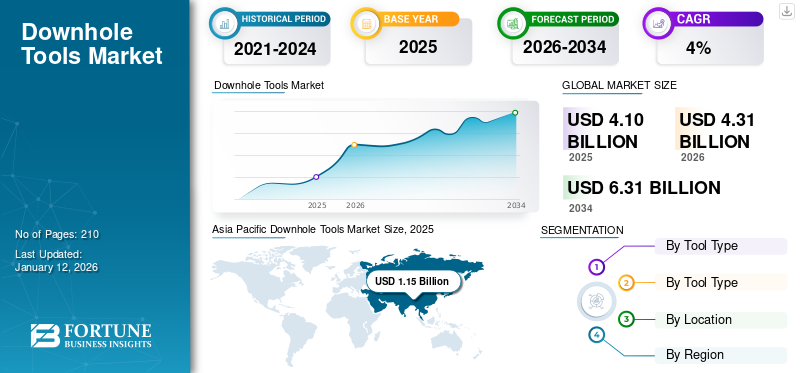

Downhole Tools Market Size, Share & Industry Analysis, By Tool Type (Drilling Tools, Pressure & Flow Control Tools, Handling Tools, Impurity Control Tools, and Others), By Application (Well Drilling, Well Completion, Well Intervention, Well Production, and Formation & Evaluation), By Location (Onshore, and Offshore {Shallow Water, Deepwater, and Ultra-Deepwater}), and Regional Forecast, 2026-2034

Downhole Tools Market Size and Future Outlook

The global downhole tools market size was valued at USD 4.10 billion in 2025. The is projected to grow from USD 4.31 billion in 2026 to USD 6.31 billion by 2034, exhibiting a CAGR of 4.95% during the forecast period. Asia Pacific dominated the global market with a share of 28.14% in 2025.

Downhole tools are types of oilfield equipment utilized during well drilling, completion, and intervention or workover tasks, aiding the oil well in maximizing production levels and ensuring a steady flow from a reservoir. These tools assist in reducing the expenses associated with conducting oil recovery activities from an oil well, enhancing the longevity of an oil well and thereby boosting the steady flow of fluid.

Halliburton is one of the major players in the market. The company delivers specialized downhole instruments to deal with a broad range of challenges through all stages of a well lifecycle. For instance, Pulsonix Tuned Frequency Amplitude (TFA) Service by the company is a tool designed to enhance the effectiveness of near-wellbore treatments. It eliminates deposits, emulsions, and polymer remnants from the vicinity of the wellbore, perforations, and screens. The solution is useful for numerous vertical and horizontal wells applications.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Global Energy Demand to Support Market Growth

Urbanization and industrialization have led to an increase in global consumption of energy, which is anticipated to drive exploration and production. Emerging economies in regions such as Asia Pacific are experiencing significant growth in energy consumption owing to economic expansion and increasing energy-intensive activities. For instance, China and India are investing heavily in oil and gas exploration activities in order to meet their growing domestic energy needs. Such a surge in demand for oil and gas has driven demand for downhole tools to support operations, enhance efficiency, and reduce operational costs.

Rising Exploration of Unconventional Resources to Aid Market Growth

The growing focus on unconventional resources, such as shale gas, tight oil, and others, is a major driver that supports market growth. The increasing depletion of conventional resources has led companies to undertake operations for unconventional resources, which has led to an increase in demand for downhole tools. Unconventional reservoirs are often present in hard-to-access areas and geologically complex formations. Downhole tools such as drills, pressure & flow control tools, and others are critical for navigating these challenging environments and maintaining efficiency.

MARKET RESTRAINTS

Oil Prices Volatility to Restrain Expansion of Global Downhole Tools Market

Oil price fluctuations create uncertainty, making it difficult for companies to plan investments in advanced tools and technologies. This could hamper the anticipated adoption of downhole tools. Further, exploration & production companies reduce their spending on new projects in case of high economic volatility. This results in decreased demand for downhole tools, which are critical for drilling and well-completion operations. Thus, the volatility of crude oil prices is a significant challenge for the market. The oil & gas industry is highly sensitive to price fluctuations, which impact drilling, exploration, and production activities.

MARKET OPPORTUNITIES

Technological Advancements & Innovations Presents Significant Opportunities for Market Players

Technological advancements in downhole tools have increased their reliability, efficiency, and cost-effectiveness, rendering them essential in both conventional and unconventional drilling operations. The capacity of these tools to endure extreme subsurface conditions and their contribution to minimizing operational downtime are crucial elements driving their extensive use. Furthermore, the growth of shale gas exploration, particularly in areas such as North America and the Middle East, has led to an increased need for downhole tools since these regions necessitate accurate and effective drilling techniques to access their resources.

MARKET CHALLENGES

High Maintenance Costs and Equipment Wear and Tear to Pose Major Challenge for Market

The extreme conditions encountered during downhole operations present challenges for the equipment being utilized in the process. These environments often involve high temperatures, pressure, and other natural elements that impact the durability and reliability of downhole tools. Abrasive materials such as sand and rock cuttings degrade the functionality and performance of downhole tools. Thus, such harsh environments lead to wear and tear of equipment, resulting in frequent maintenance and replacement of downhole tools.

DOWNHOLE TOOLS MARKET TRENDS

Rising Uptake for Optimization of Exploration and Production Activities is a Latest Trend

Operators and oilfield service companies are spending a significant amount on drilling a hydrocarbon well. Extraction of oil and gas encompasses different operations such as drilling, well completion, well intervention, well production, and others. Many companies are emphasizing enhancing E&P activities through cutting-edge technologies. Therefore, the growing adoption of advanced technologies to yield oil and gas efficiently is likely to propel the downhole tools market.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The emergence of the COVID-19 pandemic brought various difficulties to the market. The oil and gas sector faced significant setbacks due to strict government lockdowns, operational difficulties, and reduced demand, leading to economic issues that obstructed the expected market growth.

The global downhole tools market growth was adversely affected by COVID-19, with numerous Production and exploration projects being paused and various companies around the world postponing significant oil and gas projects and investments in the industry.

SEGMENTATION ANALYSIS

By Tool Type

Drillings Tools Segment Anticipated to Dominate as It Ensures Efficient & Safe Drilling Operations

Based on tool type, the market is classified into drilling tools, pressure & flow control tools, handling tools, impurity control tools, and others.

The drilling tools segment accounted for the dominant market share of 33.52% in 2026, as these tools play a crucial role in well drilling operations by enabling the creation of borewells, which are vital for accessing underground oil, gas, and water resources. The major drilling tools used in oil & gas operations include drill pipes, drill collars, stabilizers, mud pumps, blowout preventers, and others. The oil well drilling is a complex operation and engages a number of personnel, services, and an array of machinery. The Bottom Hole Assembly (BHA) encompasses all the drilling tools such as drill bit, drilling mud motors, stabilizers, drilling jars, drilling pipes, reamers, and others. The assembly assists in efficiently drilling a well and ensures the safety of personnel working on site. Similarly, various types of tools are used during the Exploration and Production (E&P) of hydrocarbons.

The pressure & flow control tools segment is expected to grow significantly during the forecast period. These instruments are essential for regulating and overseeing fluid movement, maintaining ideal pressure levels in the wellbore, and avoiding possible blowouts. As oil and gas firms explore deeper and more intricate reservoirs, the requirement for accurate pressure regulation grows increasingly crucial. Pressure gauges and flow control devices are necessary to monitor the pressure and flow of the oil and gas. Moreover, progress in new drilling methods, including hydraulic fracturing and horizontal drilling, increases the need for these tools, as they assist in preserving well integrity and enhancing oil and gas production rates.

By Application

Spike in Exploration and Production Operations to Underpin Well Drilling Segment

Based on application, the market is segmented into well drilling, well completion, well intervention, well production, and formation & evaluation.

The well drilling segment accounted for the dominant market share. Well drilling is a highly complex task, and managing a drilling rig fleet is even more intricate owing to which the demand for downhole tools in well drilling is high. The use of downhole tools for well drilling effectively determines the path of rig movements between the target and drilling locations, owing to which their popularity is increasing. The segment is expected to dominate the market share of 38% in 2025.

The well completion segment is anticipated to observe growth. As exploration shifts to increasingly difficult environments, the demand for sophisticated tools that enhance well completion, including liners, packers, and flow control devices, has risen. These instruments aid in boosting reservoir output by strengthening wellbore integrity and guaranteeing effective hydrocarbon extraction. Moreover, the growing emphasis on minimizing downtime and enhancing operational efficiency has propelled the use of advanced completion technologies.

Formation & Evaluation segment is anticipated to exhibit a CAGR of 6.35% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Location

Onshore Segment to Dominate Market Share as Onshore Drilling is Cost-Effective and Easy

Based on location, the global market is segmented into onshore and offshore.

The onshore segment dominates the market share owing to relatively easy accessibility and lower cost of onshore operations compared to offshore operations. Onshore Drilling is less expensive, which encourages companies to invest in onshore projects and drive demand for downhole tools for onshore operations. The segment is expected to dominate the market share of 77.09% in 2026.

The offshore segment is anticipated to grow at the fastest GAGR of 4.72% during the forecast period, owing to increasing efforts by exploration & production companies to locate reserves at offshore locations to meet the growing energy demand. This, in turn, is anticipated to fuel demand for robust and specialized downhole tools for operations in harsh and remote locations.

DOWNHOLE TOOLS MARKET REGIONAL OUTLOOK

The market has been studied geographically across seven main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America is anticipated to account for the second-highest market size of USD 0.96 billion in 2025, exhibiting the second-fastest growing CAGR of 4.81% during the forecast period. North America region holds a significant share of the global market. The region has led the adoption of advanced technologies for drilling and other well-related operations. Further, the considerable growth in shale gas and tight oil production necessitates the need for downhole tools required in horizontal wells and hydraulic fracturing. Moreover, increasing initiatives to improve well efficiency and lower operational expenses promote the use of advanced downhole equipment.

Asia Pacific Downhole Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

U.S.

Growth in Shale Oil & Gas Industry to Support Market Growth

The U.S. shale sector, notably, has been growing as innovations in drilling technology, such as horizontal drilling and hydraulic fracturing, keep enhancing efficiency. Moreover, as oil prices become more stable, there has been an increase in investments for both new wells and the upkeep of current ones. This demands sophisticated downhole equipment for drilling, wellbore intervention, and completion procedures to guarantee secure and effective extraction. The U.S. market size is estimated to hit USD 0.82 billion in 2026.

Europe

Europe is to be anticipated as the third-largest market with USD 0.71 billion in 2026. The European region is anticipated to grow gradually over the coming years. As countries in Europe strive to improve energy security and lessen reliance on foreign sources, drilling activities in established and new oil fields have risen. Moreover, the region's emphasis on maximizing current oil wells and increasing output via improved recovery methods has spurred the need for specialized downhole tools. Additionally, progress in tool technology that enables more accurate and efficient operations corresponds with the region's objectives for economical and sustainable energy extraction. The market value in U.K. is expected to be USD 0.08 billion in 2026.

On the other hand, Norway is projecting to hit USD 0.14 billion and Russia is likely to hold USD 0.39 billion in 2025.

Asia Pacific

Asia Pacific held the largest market in 2026 of USD 1.22 billion. The region also dominated the market in 2025 by USD 1.15 billion. The considerable increase in oil and gas exploration within the region, fueled by China, India, and Australia, propels market expansion. It also results in a surge in energy requirements as both government and private entities invest substantially in enhancing exploration and production initiatives in both conventional and unconventional reserves. Moreover, improvements in drilling technology, alongside the demand for more effective extraction techniques, are driving the use of sophisticated downhole tools. Offshore initiatives in the South China Sea and various regions also play a role in this increase, as these instruments are vital for improving drilling effectiveness and output in deep water activities. The market value in China is expected to be USD 0.57 billion in 2025.

On the other hand, India is projecting to hit USD 0.21 billion and Indonesia is likely to hold USD 0.17 billion in 2025.

India

Growing Exploration and Production (E&P) Activities to Drive Market Growth

The country's increasing emphasis on boosting local oil and gas output stimulates the need for downhole tools. With India striving to lessen its reliance on imported energy, there has been a significant increase in investments in Exploration and Production (E&P) activities. The government's actions have additionally encouraged E&P projects. These initiatives necessitate sophisticated downhole instruments for drilling, completion, and well intervention to enhance productivity and boost efficiency in demanding conditions.

Latin America

Latin America is an emerging market for downhole tools, which is anticipated to be driven by offshore exploration and unconventional resource development. The increasing use of oil and gas for energy and industrial purposes is fueling exploration and production activities, along with the need for downhole tools in Latin America.

Middle East & Africa

Middle East & Africa region is estimated to hit USD 1.10 billion as the fourth-largest market in 2026. The market in the Middle East & Africa is expected to grow at the fastest CAGR owing to the presence of high oil-producing countries in the Middle East region. Saudi Arabia and the UAE are some of the most prominent countries globally in the oil & gas sector. The region's high dependency on the oil & gas industry necessitates the need for advanced and improved tools to maintain efficiency and strengthen operations. Saudi Arabia region is anticipated to hit USD 0.20 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Innovative Offerings by Market Players to Assist & Enhance Oilfield Operations

Globally, Schlumberger Limited (SLB), NOV, TechnipFMC, and others are some of the key players in the market. NOV is a global supplier for drilling and intervention operations. The company is engaged in the business of designing, manufacturing, and offering critical tools and equipment for the oil & gas industry. NOV's downhole technologies offerings assist businesses in drilling, intervention, completion, and other downhole operations.

List of Key Downhole Tools Companies Profiled:

- National Oilwell Varco (U.S.)

- Schoeller-Bleckmann Sales (U.S.)

- Weatherford (Switzerland)

- Halliburton (U.S.)

- Core Laboratories (Netherlands)

- Baker Hughes (U.S.)

- Hunting PLC (U.K.)

- Schlumberger (U.S.)

- RPC, Inc. (U.S.)

- APS Technology Inc. (U.S.)

- Flotek Industries, Inc. (U.S.)

- TechnipFMC (U.K.)

- United Drilling Tools Ltd (India)

- Rival Downhole Tools (U.S.)

KEY INDUSTRY DEVELOPMENTS:

December 2024 – SLB received an integrated services contract for more than 100 wells across nine ultra-deepwater rigs of Petrobras' offshore fields in Brazil. SLB aims to provide its SpectraSphere solution, which offers pressure measurements and performs downhole fluid analysis.

November 2024 – Archer Limited completed the acquisition of Wellbore Fishing & Rental Tools, LLC (WFR) in all cash transactions. WFR is a US-based well technology company focused on oil and gas fishing operations.

September 2024 – Oilfield Service Professionals LLC, a provider of oilfield technology and service solutions, collaborated with Alpha Oil Tools, which enables the former to access downhole drillable technology such as Hydra-Set™ Hydro-Mechanical Bridge Plug and Cement Retainer offered by Alpha Oil Tools.

September 2024 – Dril-Quip, Inc., developer, manufacturer, and provider of equipment and services for the global offshore and onshore oil and gas industry, merged with Innovex Downhole Solutions, Inc., designer and manufacturer of products to support global upstream onshore and offshore activities. The merger is aimed at providing a combined comprehensive portfolio of the companies to offer optimal solutions to customers.

September 2023 – Legacy Directional Drilling, LLC, a drilling services provider, acquired Renegade Oil Tools, LLC, a manufacturer of high-performance drilling motors and their components. The acquisition aims to strengthen combined capabilities and provide a unique value proposition for customers.

REPORT COVERAGE

The global downhole tools market research report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.88% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Tool Type, Application, Location, and Region |

|

Segmentation |

By Tool Type

|

|

By Application

|

|

|

By Location

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 4.31 billion in 2026.

The market is likely to grow at a CAGR of 4.88% during the forecast period of 2026-2034.

The onshore segment is estimated to dominate the market during the forecast period.

The market size of Asia Pacific stood at USD 1.22 billion in 2026.

Rising exploration of unconventional resources is likely to drive market growth.

National Oilwell Varco, Schoeller-Bleckmann Sales, Weatherford, Core Laboratories, and Baker Hughes are the top players in the market.

The global market size is projected to record a valuation of USD 6.31 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us