Coiled Tubing Services Market Size, Share & Industry Analysis, By Service (Well Intervention {Well Completion & Well Cleaning} and Drilling), By Application (Onshore and Offshore) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

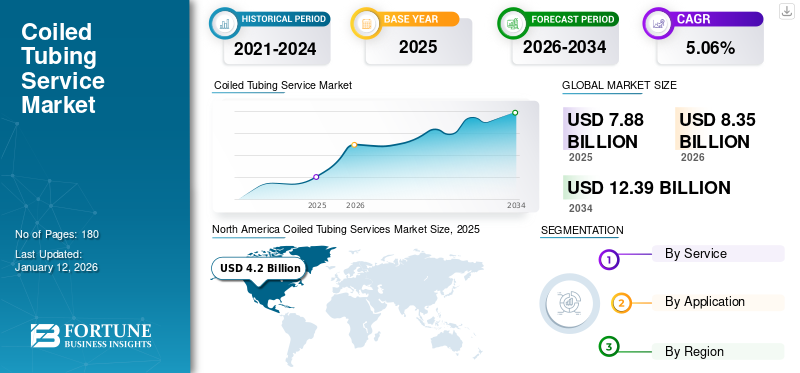

The global coiled tubing services market size was valued at USD 7.88 billion in 2025 and is projected to grow from USD 8.35 billion in 2026 to USD 12.39 billion by 2034, exhibiting a CAGR of 5.06% during the forecast period. The North America dominated the global coiled tubing services market with a share of 53.32% in 2025. Coiled Tubing Services Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 5.15 billion by 2032.

In the oil and gas industry, coiled tubing operation is a method employed for well intervention that does not utilize conventional drill pipes. It uses a continuous coil of piping, usually crafted from steel or composite materials, wrapped around a large spool and subsequently placed into the wellbore. This technique enables multiple tasks to be carried out efficiently within the wellbore. Coil tubing is also utilized during well completion and workover operations. The coiled tubing technology is frequently used to deploy tools and materials through production casing or tubing and exploring applications such as shales, tight gas, and tight oil.

Baker Hughes is one of the prominent players operating in the energy industry that provides advanced technology and services. The company offers oilfield equipment and solutions, turbomachinery & process solutions, software & analytics, measurement, testing & control technologies. Baker also offers coiled tubing systems and services for helping clients make wellbore interventions more safe, predictable, efficient, and effective.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Well Intervention Operations is Driving Coiled Tubing Services Market

High spending in global upstream and operational activities has enabled oil companies to invest heavily in well-intervention operations. The increasing production and exploration activities coupled with growth in unconventional resources are the major factors driving the global coiled tubing services market growth. Well interventions are done primarily to maintain or increase production, extend the durability of the wells, and resolve significant issues in the wells, which helps to improve the well productivity. Furthermore, the oil & gas upstream sector is improving its operational activities and increasing production. All these factors are driving the demand for coiled tubing market.

Increasing Investment in E&P activities and Growing Initiatives for Exploring Hydrocarbon Aids Market Growth

The growing oil demand provides lucrative growth opportunities for operators to invest more in drilling operations to meet the increasing energy demand. Enormous economic development has also added to the growth of the oil and gas industry. Hence, the U.S. is primarily focused on the tight oil sector to become the global supplier of oil and gas. Coiled tubing has been used in several well intervention activities and drilling operations and, therefore, delivers a cost-effective production method to produce a large amount of oil and gas. Thus, coiled tubing is an essential service for the production of hydrocarbons, which underpins the growth of the coiled tubing service market.

MARKET RESTRAINTS

Fluctuating Crude Oil Prices and Raw Material Prices to Hinder Market Growth

The market for coiled tubing services is greatly influenced by changes in crude oil prices. Prices of crude oil are dependent on the change in policy, variability in demand & supply, and fluctuations in the global market scenario. Increasing awareness for protecting the environment from developing as well as developed economies has affected crude oil prices. The maintenance cost involved in delivering coiled tubing services is quite high. Hence, volatility in crude oil prices and high maintenance costs restrain market growth. This recurring trend affects long-term strategies and investments in new products and services within the sector.

MARKET OPPORTUNITIES

Development of Shale Oil Industry to Support Market Growth

The development of domestic oil shale resources has contributed significant attention in the past decade, which primarily includes emerging recovery technologies, high oil prices, increasing global demand for liquid hydrocarbons, and the downfall in U.S. conventional oil production. In recent years, various initiatives have been taken by private and government entities to encourage the development of a domestic oil shale industry. Coiled tubing operations are essential for improving the extraction of shale oil, which propels the market demand in the projected period.

MARKET CHALLENGES

High Initial Investment and Competition from Alternative Methods Could Significantly Challenge Market Growth

The tools, technology, and skilled workforce required for the setup of coiled tubing units are costly. This could pose a difficulty for smaller companies or those with restricted resources. Hydraulic fracturing and wireline represent various alternative well intervention techniques that rival coiled tubing. The market potential could be limited if operators opt for different technologies instead of coiled tubing, depending on specific well conditions and project needs.

COILED TUBING SERVICES MARKET TRENDS

Strong Global Economic Growth is Projected to Underpin a Robust Increase in Oil Demand

Increasing investment by the U.S. and OPEC in exploration and production activities to meet the rising demand for oil and gas is projected to provide a lucrative market for the energy and power industry. The fastest-growing source of global oil demand is petrochemicals in the U.S. The increasing share of the U.S. has explored new energy sources for cheap domestic energy feedstock. Moreover, coiled tubing techniques deliver several advantages over conventional drilling and workover operations. Rapid mobilization and rig-up, a smaller environmental footprint, and a reduction in time associated with pipe handling while running in and out of the hole are estimated to drive the coiled tubing service market during the forecast period.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The outbreak of the COVID-19 pandemic presented a major risk to the market due to restrictions in transportation and the halt in industrial and commercial activities, resulting in a slowdown in oil demand. Firms in various regions have similarly halted significant oil and gas initiatives. Moreover, the COVID-19 pandemic significantly affected crude oil prices, drilling operations, production processes, and the oil and gas supply chain.

SEGMENTATION ANALYSIS

By Service

Increased Efficiency and Reduced Costs Help Well Intervention Segment to Dominate Market Share

Based on service, the market is classified into well intervention (well completion & well cleaning) and drilling.

The well intervention segment is anticipated to dominate the coiled tubing services market share. Coiled Tubing (CT) enhances well intervention by offering a flexible, continuous pipe system for various operations, including wellbore cleaning, simulation, and tool deployment, leading to increased efficiency, reduced costs, and minimized environmental impact, as it allows for interventions on live wells. The segment is poised to capture 68.70% of the market share in 2026.

The drilling segment is expected to grow with a considerable CAGR of 5.83% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment to Dominate Market Owing to Benefits Associated with Coiled Tubing

Based on application, the market is segmented into onshore and offshore.

Onshore segment is anticipated to dominate market share as the onshore coiled tubing services offer efficient and cost-effective well intervention and maintenance, enabling various operations such as cleanouts, stimulation, and logging, with benefits including reduced rig time, increased safety, and enhanced well control. This segment dominated the market in 2026 with a share of 74.96%.

The offshore segment is also anticipated to grow exponentially during the forecast period. In offshore applications, CT services are utilized to eliminate blockages such as sand, scale, and debris from the wellbore to guarantee ideal flow and production. It enables fluid movement within the wellbore, even when the well experiences pressure. This is essential for different well control activities and to uphold well integrity.

COILED TUBING SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Coiled Tubing Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Dominated Market Share Owing to Increase in Shale Oil and Gas Exploration Activities

North America dominated the market with a valuation of USD 4.2 billion in 2025 and USD 4.46 billion in 2026. The North America coiled tubing services market is experiencing growth, driven by increasing investments in shale oil and gas exploration and development and the demand for well-intervention operations. The market is dominated by the U.S., with the region expected to maintain its leadership due to robust E&P activities and the shift toward horizontal wells.

U.S.

Rising Demand for Well Intervention Operations to Support Market Growth

Maturing oil fields and the need for enhanced recovery and well maintenance is driving the demand for coiled tubing services, which are essential for various well intervention activities. The overall increase in oil and gas production, both onshore and offshore, is contributing to the growth of the coiled tubing market, as these operations require efficient and effective well-intervention techniques. The U.S. market is estimated to reach a market value of USD 3.69 billion in 2026.

Europe

Demand for Coiled Tubing Services in Maturing Oilfields in Region to Support Market Growth

Europe is the second largest market set to be worth USD 1.33 billion in 2026, exhibiting a CAGR of 15.94% during the forecast period (2026-2034). A significant number of Europe’s oil and gas wells are aging, necessitating regular maintenance and intervention to sustain production levels. The U.K. market continues to grow, anticipated to reach USD 0.14 billion in 2026. As oil fields mature, the need for well intervention services, such as stimulation, re-perforation, and sand control, increases, boosting the demand for coiled tubing services. Also, rising energy consumption across Europe has led to heightened exploration and production activities, which fuels the need for efficient well intervention techniques, such as coiled tubing services, to enhance oil & gas recovery rates. Norway is set to acquire USD 0.17 billion in 2025, while Russia is estimated to be worth USD 0.68 billion in the same year.

Asia Pacific

Growing Energy Demand in Region to Support Market Growth

Asia Pacific is the fourth largest market expected to be valued at USD 0.83 billion in 2026. The growing energy demand in the region is anticipated to support the growth of the region's market. The energy demand in China, India, Southeast Asia, and other countries is increasing owing to rapid urbanization and industrialization in the region. China is set to grow with a value of USD 0.44 billion in 2026. As energy requirements in the area keep growing, along with the necessity to tap into more intricate and demanding oil and gas reservoirs, the usage of coiled tubing technology is anticipated to rise, propelling the market's growth in the Asia Pacific region. Indonesia is projected to reach a market value of USD 0.07 billion in 2025, while India is estimated to be valued at USD 0.09 billion 2026.

Latin America

Latin America, spearheaded by Brazil and Mexico, represents another growing market for coiled tubing services as the area progresses in tapping its offshore and onshore oil and gas assets, frequently utilizing coiled tubing services for well intervention and drilling operations.

Middle East & Africa

The Middle East & Africa is the third largest market anticipated to grow with a value of USD 1.1 billion in 2026. This is a key region in the global market, with Saudi Arabia, the UAE, and other nations facilitating major oil and gas activities. The extensive hydrocarbon resources in the region and the continuous initiatives to improve oil and gas extraction have driven the need for coiled tubing services. Saudi Arabia is likely to hit USD 0.32 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Growing Coiled Tubing Services Deployment in Offshore Fields

Globally, Baker Hughes, Halliburton, Weatherford, and others are some of the key players in the market. In June 2024, Baker Hughes, a company specializing in energy technology, obtained a major contract from Petrobras for workover and Plug and Abandonment (P&A) services in offshore fields in Brazil. Baker Hughes’ comprehensive strategy will utilize wireline, coiled tubing, cementing, and other services across all of Petrobras’ offshore fields.

List of Key Coiled Tubing Services Companies Profiled:

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- SLB (U.S.)

- Calfrac Well Services Ltd. (Canada)

- Trican (Canada)

- C&J Well Services (U.S.)

- Jereh Energy Services Corporation (Saudi Arabia)

- TAQA (UAE)

- Tacrom (Germany)

- Helix Energy (U.S.)

- AnTech Ltd (U.K.)

- EXALO DRILLING S.A. (Poland)

- Petrospec (Canada)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Tenaris showcased its newest solutions in coiled tubing at the 2024 SPE/ICoTA Well Intervention Conference and Exhibition. The company introduced BlueCoil® technology, which is stated to provide improved fatigue resistance, greater strength, and enhanced reliability to extend the lifespan of coiled tubing applications.

- September 2023 – Eastern Energy Services took over the assets of Conquest Completion Services. Conquest offers large-diameter coiled tubing units and oilfield chemicals aimed at improving reservoir performance. The purchase enhances Eastern's completion, intervention, and production services across various basins as well as conventional fields in the U.S.

- May 2023 – Uzma, an energy services company located in Malaysia, obtained a contract with the oil firm Valeura Energy Inc. The 3-year agreement entails supplying coil tubing equipment and services in the Gulf of Thailand.

- September 2022 – ProPetro Holding Corp. announced the divestiture of coiled tubing assets. The assets were acquired by STEP Energy Services, a provider of coiled tubing and hydraulic fracturing solutions.

- July 2021 – ADNOC offered drilling contracts to ADNOC Offshore to Schlumberger, ADNOC Drilling, and Halliburton. The contracts encompass coiled tubing services featuring thru-tubing downhole tools, stimulation services that involve equipment and chemical/fluid systems, and others, along with production logging tools, saturation monitoring, and well integrity assessments.

Investment Analysis and Opportunities

- Kontinental Energy Services collaborated with Gulfstream Services Inc. (GSI), a U.S.-based upstream oil and gas company, to provide tools and services. The collaboration has two objectives: enhancing KES’ ability to back the growth of oil and gas in Africa and promoting GSI’s worldwide expansion. GSI will offer a comprehensive, third-party iron management program that ensures customer-owned assets operate at optimal performance, cementing, coiled tubing, HWO, and flowback assistance packages, along with spool and gate valves.

- In December 2024, Abu Dhabhi’s NMDC Group’s subsidiary signed a binding agreement to purchase a 70% stake in Emdad, a comprehensive service provider focusing on the oil and gas, utilities, and industrial areas.

REPORT COVERAGE

The global coiled tubing services market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies market. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.06% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service, Application, and Region |

|

Segmentation |

By Service

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.88 billion in 2025.

The market is likely to grow at a CAGR of 5.06% during the forecast period of 2026-2034.

The well intervention segment is estimated to dominate the market during the forecast period.

The market size of North America stood at USD 4.2 billion in 2025.

Growing demand for well intervention operations is driving the market.

Some of the top players in the market include Baker Hughes, Halliburton, Weatherford, and others.

The global market size is projected to record a valuation of USD 12.39 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us