Pressure Sensor Market Size, Share & Industry Report Analysis By Connectivity Type (Wired and Wireless), By Technology (Piezoresistive, Capacitive, Electromagnetic, Resonant Solid-State, and Others), By Product Type (Absolute Pressure Sensors, Gauge Pressure Sensors, Differential Pressure Sensors, Sealed Pressure Sensors, and Vacuum Pressure Sensors), By Pressure Range (Up to 100 psi, 101 to 1000 psi, and Above 1000 psi), By Application (Automotive, Industrial, Healthcare, Consumer Electronics, Oil & Gas, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

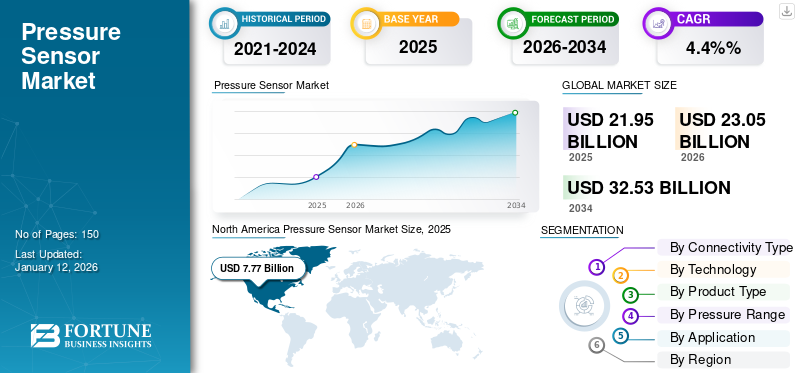

The global pressure sensor market size was valued at USD 21.95 billion in 2025 and is projected to grow from USD 23.05 billion in 2026 to USD 32.53 billion by 2034, exhibiting a CAGR of 4.4% during the forecast period. North America dominated the pressure sensor market with a share of 35.41% in 2025.

The pressure sensor market encompasses the development, production, and distribution of devices that detect, monitor, and control pressure in gases or liquids across various applications, including automotive, industrial, healthcare, consumer electronics, and others. These sensors convert pressure into an electrical signal, enabling accurate real-time monitoring and enhanced system performance.

The increasing adoption of these sensors in automotive safety systems, industrial automation, and medical devices are major driving factors for market growth. The COVID-19 pandemic temporarily disrupted manufacturing and supply chains. Additionally, the imposition of reciprocal tariffs in major economies has led to increased production costs and supply chain reconfigurations, slightly restraining market growth in certain regions.

Key players in the market include Robert Bosch GmbH, Honeywell International Inc., Texas Instruments, TE Connectivity, STMicroelectronics, Infineon Technologies AG, NXP Semiconductors, Sensata Technologies, Inc., Amphenol Corporation, and Omron Corporation. These companies focus on product innovation, strategic partnerships, and mergers and acquisitions to strengthen their market presence.

PRESSURE SENSOR MARKET TRENDS

Expansion of the Automotive Sector has Emerged as an Upcoming Market Trend

The growing integration of pressure sensor technology in advanced electronic systems is propelling the market. These electric and hybrid models of vehicles require numerous pressure sensors for applications such as tire pressure monitoring systems, engine and transmission control, fuel and brake systems, and airbag deployment. The growing emphasis on vehicle safety, performance, and regulatory compliance is encouraging automakers to adopt sensor technologies, thereby creating substantial growth possibilities for these sensor manufacturers.

Additionally, the rising global production of vehicles, coupled with the transition toward autonomous and connected cars, is further accelerating the demand for high-precision, compact, and reliable sensors. For instance,

- According to Next Move Strategy Consulting, the global autonomous vehicle market was valued at approximately 17,000 units in 2022. The market is projected to expand significantly, reaching an estimated 127,000 units by 2030.

Governments worldwide are enforcing stringent emission and fuel efficiency standards to incorporate sensors that can enhance engine competence and reduce environmental impact. Therefore, the factors mentioned above are propelling the pressure sensor market growth.

MARKET DYNAMICS

Market Drivers

Rising Demand for Consumer Electronics Drives Market Growth

The increasing integration of sensing technologies in devices such as smartphones, wearables, tablets, and smart home appliances drive market growth. For instance,

- Industry experts report that the Consumer Electronics market generated total revenue of USD 987 billion in 2022, reflecting a 4.4% decline compared to the previous year.

These sensors are being broadly adopted in mobile devices for functions such as altitude detection, indoor navigation, and weather forecasting. The growing consumer preference for compact, multifunctional, and smart devices is encouraging manufacturers to integrate advanced sensors that offer high precision, low power consumption, and miniaturized form components.

In addition, the proliferation of smart wearables, such as fitness trackers and smartwatches, is increasing demand for these sensors for monitoring physical activity, health parameters, and environmental conditions. The expansion of the global consumer electronics market, supported by rising disposable incomes and increased digital connectivity, is expected to maintain strong demand for innovative sensor solutions. For instance,

- According to the latest data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker, global wearable shipments are expected to grow by 6.1% by the end of 2024, reaching a total of 538 million units.

Therefore, increasing adoption of consumer electronics is a vital factor driving the pressure sensor market share.

Market Restraints

Pricing Pressure, Technological Complexity, and Strict Regulatory Compliance Need Hinder Market Growth

The market faces growth limitations due to pricing pressure, increasing technological complexity, and stringent regulatory compliance requirements. Intense competition compels manufacturers to offer high-performance sensors at reduced prices, impacting profit margins and limiting investments in innovation. Moreover, the need for advanced sensor features such as miniaturization, wireless connectivity, and integration with IoT platforms leads to design and production complexities. In addition, compliance with evolving regulatory standards across various applications increases development costs and time to market. Thus, the factors mentioned above present barriers to the widespread adoption of these sensor solutions.

Market Opportunities

Advancement of Industrial Automation and Widespread Adoption of Industry 4.0 Create Significant Growth Opportunities

The industries are increasingly integrating smart technologies and connected systems into their operations. For instance,

- According to the Interdisciplinary Center for Advanced Manufacturing Systems, the most implemented smart technologies are automation, 3D printing, and sensors/IoT, with approximately 50% of survey respondents currently in the implementation and usage phases.

These sensors are crucial in monitoring and controlling various parameters to ensure operational efficiency, safety, and predictive maintenance. These sensors are essential components in automated manufacturing setups, process control systems, and robotics, which require real-time pressure monitoring to avoid downtime and optimize performance.

Industry 4.0 initiatives highlight data-driven decision-making, interoperability, and machine-to-machine communication, which rely on accurate sensing technologies. The sensors are equipped with digital interfaces, and wireless connectivity is in high demand to support these smart manufacturing environments. Moreover, the growing implementation of the Industrial Internet of Things (IIoT) across various sectors makes these sensors vital for industrial ecosystems.

SEGMENTATION ANALYSIS

By Connectivity Type

Need for Superior Signal Reliability to Boost Segment Growth

Based on connectivity type, the market is divided into wired and wireless.

Wired connectivity leads the market due to its superior signal reliability, immunity to electromagnetic interference, and widespread use in industrial and automotive applications. The established infrastructure and less vulnerability to data loss make wired sensors preferable for severe operations. The segment dominated the market with a share of 85.02% in 2026.

Wireless connectivity is expected to grow at the highest CAGR owing to increasing adoption in IoT-enabled systems, remote monitoring, and applications where wiring is impractical or costly. Further, the surge in smart devices and advancements in low-power wireless communication technologies are driving its growth.

By Technology

Demand for Superior Compatibility with Critical Environments Drive Piezoresistive Segment Growth

Based on technology, the market is divided into piezoresistive, capacitive, electromagnetic, resonant solid-state, and others.

Piezoresistive technology holds the highest market share due to its high sensitivity, linearity, and compatibility with critical environments, making it ideal for automotive, medical, and industrial applications. Its cost-effectiveness also contributes to its widespread adoption across various sectors. The segment is expected to hold 39.62% of the market share in 2026.

Resonant solid-state sensors are expected to witness the highest CAGR of 7.11% during the forecast period, due to their long-term stability, high precision, and suitability for applications requiring minimal change of flow. The growing demand for high-accuracy sensors in critical applications is further accelerating their adoption.

By Product Type

Growing Demand across Various Applications to Fuel Absolute Pressure Sensors Segment Growth

By product type, the market is categorized into absolute, gauge, differential, sealed, and vacuum.

Absolute pressure sensors dominate the market as they provide accurate pressure measurements relative to a perfect vacuum, making them essential for applications in weather forecasting, altimetry, and aerospace. The segment is estimated to attain 29.92% of the market share in 2026. Its capability to deliver consistent results under changing atmospheric conditions enhances its effectiveness. For instance,

- In May 2023, STMicroelectronics launched the MEMS water and liquid-proof absolute pressure sensor designed for industrial applications. The sensor is backed by a declared 10-year longevity program, ensuring long-term reliability and support.

Sealed pressure sensors are expected to grow at the highest CAGR of 7.73% during the forecast period, due to their suitability for underwater and high-moisture applications. Their increasing use in industrial processing, HVAC, and marine applications is propelling its growth.

By Pressure Range

Higher Demand for Low to Mid-pressure Applications to Boost Segment Growth

By pressure range, the market is sub-segmented into up to 100 psi, 101 to 1000 psi, and above 1000 psi.

Sensors with up to 100 psi lead the market due to their suitability for a broad range of low- to mid-pressure applications, including medical devices, HVAC systems, and consumer electronics. Their compact size and lower manufacturing cost make them ideal for markets that produce goods on a large scale. The segment is likely to gain 50.39% of the market share in 2026.

The 101 to 1000 psi range is expected to witness the highest CAGR of 6.09% during the forecast period (2025-2032), as demand grows in sectors such as oil & gas, automotive, and industrial automation that require robust sensors for high-pressure monitoring. Advancements in sensor durability and accuracy contribute to their rising adoption.

By Application

To know how our report can help streamline your business, Speak to Analyst

Widespread Use in the Automotive Sector to Propel Segment Growth

The market is classified by application into automotive, industrial, healthcare, consumer electronics, oil & gas, and others.

Automotive leads the market owing to extensive usage in applications such as Tire Pressure Monitoring Systems (TPMS), engine management, and braking systems. The segment is set to hold 29.01% of the market share in 2025. Regulatory mandates on safety and emissions control further fuel their integration into automobiles. For instance,

- In October 2024, Future Electronics announced the availability of the Melexis Triphibian family of MEMS pressure sensors featuring advanced patented technology. This innovation presents a significant advancement for the automotive sector and related industries.

Consumer electronics are expected to grow at the highest CAGR of 7.63% during the forecast period, due to the rising integration of these sensors in wearable devices, smartphones, and smart home systems. The trend toward miniaturization and multifunctionality in consumer devices is driving the demand.

PRESSURE SENSOR MARKET REGIONAL INSIGHTS

North America

North America Pressure Sensor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 7.77 billion in 2025 and USD 8.22 billion in 2026, owing to the presence of major industry players, advanced technological infrastructure, and strong adoption across various sectors. For instance,

- In September 2023, Baker Hughes launched its Druck hydrogen-rated pressure sensors, developed specifically for hydrogen-related applications. These sensors are suitable for use in gas turbines, hydrogen production electrolysis, and hydrogen filling stations.

Download Free sample to learn more about this report.

The region benefits from a large number of investments and a mature customer base that demands advanced sensing solutions. Additionally, regulatory frameworks promoting safety and energy efficiency in the U.S. further drive the adoption of these sensors in the region. The U.S. market is set to reach a valuation of USD 4.8 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific market is the third largest market, expected to gain USD 5.52 billion in 2026, driven by rapid industrialization, urbanization, and expanding consumer electronics and automotive industries. China is anticipated to hold USD 1.6 billion in 2026. China, India, South Korea, and Japan are witnessing increased demand for smart devices, electric vehicles, and industrial automation, which rely heavily on these sensors. For instance,

- According to EY statistics, India is projected to record the highest real GDP growth rate among all countries, with an estimated average of 6.5% during 2024 to 2029. This strong growth outlook highlights India's leading position in the global competitive landscape over the forecast period.

India is projected to gain USD 1.05 billion in 2026, while Japan is estimated to hit USD 1.28 billion in the same year.

Europe

Europe is the second leading region, anticipated to hold USD 5.99 billion in 2026, exhibiting a CAGR of 4.54% during the forecast period, due to its strong automotive industry, emphasis on environmental monitoring, and early adoption of smart industrial solutions. For instance,

- According to the European Union, the number of battery-only electric passenger cars in EU countries surpassed 4.4 million in 2023. This figure represents an increase of approximately 88 times compared to 2013 and 12 times compared to 2018.

The region's robust manufacturing base and stringent regulations regarding emissions and workplace safety contribute to steady demand. The U.K. market is expanding, expected to reach a market value of USD 1.45 billion in 2026. Furthermore, the increasing adoption of automation and Industry 4.0 practices supports the sustained usage of these sensors across various sectors. Germany is likely to gain USD 1.26 billion in 2025, while France is projected to be valued at USD 1.04 billion in the same year.

Middle East & Africa and South America

South America is the fourth leading region, estimated to hit USD 1.94 billion in 2025. Middle East & Africa, as well as South America, are anticipated to grow at an average rate due to the moderate adoption of such sensors across industries such as oil & gas, automotive, and manufacturing. Economic instability and limited technological penetration in some countries slightly hinder market expansion. However, gradual growth in industrial development and increasing foreign investments offer growth opportunities in the regions. The GCC market is accounted to hold USD 0.41 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Their Market Position

Players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Top Pressure Sensor Companies Profiled:

- Robert Bosch GmbH (Germany)

- Honeywell International Inc. (U.S.)

- Texas Instruments (U.S.)

- TE Connectivity (Ireland)

- STMicroelectronics (Switzerland)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (Netherlands)

- Sensata Technologies, Inc. (U.S.)

- Amphenol Corporation (U.S.)

- Omron Corporation (Japan)

- Emerson Electric Co. (U.S.)

- ABB Ltd. (Switzerland)

- Denso Corporation (Japan)

- WIKA Instrumentation (India)

- First Sensor AG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- In March 2025, Biotech Fluidics introduced QuickStart, a high-precision digital in-line pressure sensor designed for easy integration into a wide range of instrument fluidic pathways. It enhances monitoring capabilities, supporting improved performance and reliability in fluidic systems.

- In January 2025, Emerson launched the AVENTICS DS1 dew point sensor that is capable of real-time tracking of dew point, humidity, temperature, and compressed air quality from a single device.

- In November 2024, at the China International Import Expo 2024, ABB unveiled a preview of its new pressure transmitter portfolio, designed to deliver high-performance and ultra-precise measurements for industrial and utility applications.

- In November 2024, OMRON Healthcare received De Novo authorization from the U.S. FDA to market its latest home blood pressure monitors enabled with AI-powered atrial fibrillation detection.

- In May 2024, Parker Hannifin launched the SCP09 pressure sensor, offering a robust and reliable solution for a broad range of hydraulic applications. The sensor is contamination-resistant and well-suited for both mobile machinery and industrial environments.

- In March 2024, Amphenol All Sensors Corporation launched the AUAV Series pressure sensors, offering dual airspeed and altitude sensing in a compact design to improve payload capacity in UAVs.

- In February 2024, Tekscan launched a pressure mapping sensor tailored to the unique demands of battery R&D and manufacturing. The system provides actionable insights by detecting potential design issues, contributing to improved reliability and safety in energy storage solutions.

- In January 2024, Sensata Technologies launched the 129CP Series Digital Water Pressure Sensor, aimed at enhancing smart pressure monitoring for water utilities and supporting efforts to reduce water waste.

REPORT COVERAGE

The report provides a detailed analysis of the pressure sensor industry and focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.4% from 2026 to 2034 |

|

Segmentation |

By Connectivity Type, Technology, Product Type, Pressure Range, Application, and Region |

|

Segmentation |

By Connectivity Type

By Technology

By Product Type

By Pressure Range

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 32.53 billion by 2034.

In 2025, the market size stood at USD 21.95 billion.

The market is projected to grow at a CAGR of 4.4% during the forecast period.

Automotive is leading the market.

The rising demand for consumer electronics drives the market growth.

Robert Bosch GmbH, Honeywell International Inc., Texas Instruments, and TE Connectivity are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us