DWDM Market Size, Share & Industry Analysis, By Product Type (Optical Transmitter/Receiver, DWDM Mux/Demux Filters, Optical Add/Drop Multiplexers, Optical Amplifiers, and Transponders), By Bandwidth (Up to 10 Gbps, 40 Gbps, 100 Gbps, and More than 100 Gbps), By Industry (IT and Telecommunications, BFSI, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

DWDM MARKET SIZE AND FUTURE OUTLOOK

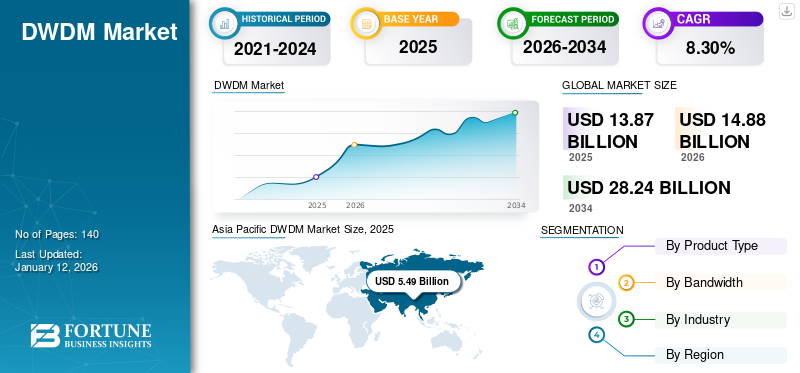

The global DWDM market size was valued at USD 13.87 billion in 2025. The market is projected to grow from USD 14.88 billion in 2026 to USD 28.24 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. Asia Pacific dominated the market with a share of 39.50% in 2025.

Dense Wavelength Division Multiplexing (DWDM) is a technology used in fiber-optic communications that allows various signals to be transferred concurrently over a single optical fiber by using different wavelengths (or channels) of laser light.

Market growth is expected to be driven by increasing data traffic and rising integration with 5G networks. The rapid growth of data centers, particularly with the rise of cloud computing and big data analytics, accelerates market growth. According to a Moody’s Rating report in 2024, the global data center capacity is expected to double over the next five years. Furthermore, technological innovations in optical networking enhance DWDM systems' capabilities, making them more efficient and cost-effective. This includes improvements in the architecture that reduce deployment costs while increasing bandwidth capacity. Thus, these factors are driving the market revenue.

The COVID-19 pandemic presented several market challenges but highlighted significant growth opportunities driven by increased digitalization and the need for a robust communication infrastructure. Moreover, the pandemic accelerated digital transformation across industries, with organizations rapidly adopting cloud-based applications, remote collaboration tools, and e-commerce platforms. Dense wavelength division multiplexing systems were crucial in supporting this transformation by providing the necessary bandwidth and connectivity.

IMPACT OF GENERATIVE AI

Integration of Generative AI with DWDM by Enhancing Capabilities to Fuel Market Growth

The rise of generative AI significantly influences data centers and network infrastructures, necessitating enhancements in both capacity and efficiency. Generative AI applications, which require real-time processing and low-latency responses, drive increased data traffic. This surge necessitates more robust network solutions to effectively manage the higher bandwidth demands. Moreover, deploying generative AI technologies leads to higher power consumption per rack in data centers. This poses challenges for existing infrastructures, which must adapt to support these energy-intensive applications. Enhanced dense wavelength division multiplexing systems can help optimize power usage by improving data transmission efficiency.

DWDM Market Trends

Growth in DWDM Spending to Emerge as a Key Market Trend

Data, voice, and video technologies are increasingly merging to create metro optical transport networks. This evolution is driven by the acceleration of evolving business strategies and service demands that focus on lowering overall operational costs. Many urban enterprises and service providers require scalable and flexible infrastructure equipment that can adjust to changing bandwidth needs. Key players in the market are designing platforms tailored for independent and competitive exchange carriers, large enterprises, and providers of networks for research and academia.

MARKET DYNAMICS

Market Drivers

Surge in Data Traffic and Rise in Global Internet Access to Aid Market Growth

The rapid increase in data traffic and rise in global internet access are major factors propelling the DWDM market growth. As more people and businesses depend on internet services for communication, entertainment, and operational needs, there is an urgent demand for high-capacity and dependable data transmission solutions. The dense wavelength division multiplexing technology meets this demand by enabling multiple data streams at the same time, which optimizes the use of the existing fiber optic infrastructure. This functionality is crucial for accommodating contemporary societies' and economies' escalating data requirements, thereby boosting the acceptance of dense wavelength division multiplexing systems.

- According to Ericsson, since the second quarter of 2024, there has been an ongoing decrease in mobile network data traffic growth rate. The anticipated annual growth rate for mobile network data traffic is projected to diminish further, dropping from 21% in 2024 to 16% by 2030. This indicates a Compound Annual Growth Rate (CAGR) of 19% throughout the entire forecast period.

Market Restraints

Complexity in Network Management to Hinder Market Expansion

The complexities involved in operating and managing dense wavelength division multiplexing networks can hinder the market’s expansion. It necessitates using advanced network management tools and expertise to guarantee optimal performance, identify faults, and troubleshoot issues. The complex process of multiplexing numerous wavelengths and preserving signal quality over longer distances requires specialized skills and knowledge. Organizations may struggle to find qualified staff to manage these responsibilities, resulting in operational inefficiencies and possible service interruptions. This complexity may discourage some businesses from implementing the DWDM technology, leading them to choose simpler options.

Market Opportunities

Growing Adoption of Smart Cities and IoT to Create Lucrative Market Opportunities

The rise of Internet of Things (IoT) devices and the advancement of smart cities present significant opportunities for the market. IoT applications, including smart grids, smart transportation, and smart healthcare, produce vast amounts of data that necessitate efficient transmission and handling. Dense wavelength division multiplexing offers high-capacity and dependable data transfer, which is essential for supporting these applications. Furthermore, increasing efforts to build smart cities, which integrate various IoT devices and systems to improve urban life, depend on strong communication networks made possible by this technology. The growing implementation of IoT and smart city initiatives is driving the need for dense wavelength division multiplexing, propelling the market’s expansion.

SEGMENTATION ANALYSIS

By Product Type

Exceptional Capability of Optical Transmitter/Receiver to Allow High-Capacity Communication Boosted Its Demand

Based on product type, the market is segmented into optical transmitter/receiver, DWDM mux/demux filters, optical add/drop multiplexers, optical amplifiers, and transponders.

The optical transmitter/receiver segment dominated the DWDM market share by 30.00% in 2026. This segment focuses on the technologies and components used to transmit data over optical fiber networks, allowing for high-capacity communication over long distances. The optical transmitters/receivers segment has been growing due to increasing data traffic demands, the rollout of 5G networks, and the expansion of cloud services.

The optical amplifier segment is anticipated to register the highest CAGR during the forecast period. These amplifiers are used to boost the signal strength in optical fibers without converting the signal to electrical form. When combined with DWDM technology, they help increase the capacity and efficiency of fiber optic systems by enabling multiple data streams to be transmitted simultaneously over different wavelengths.

By Bandwidth

Increasing Demand for High-Speed, High-Capacity Communication Networks Boosted Need for 100 Gbps Bandwidth

Based on bandwidth, the market is segmented into up to 10 Gbps, 40 Gbps, 100 Gbps, and more than 100 Gbps.

In terms of share, the 100 Gbps segment dominated the market in 2024, driven by the increasing demand for high-speed, high-capacity communication networks. This growth is also fueled by factors such as rising data traffic, deployment of 5G networks, and the need for enhanced infrastructure in data centers and telecom networks. The 100 Gbps segment is likely to capture 34.59% of the market share in 2026.

The more than 100 Gbps segment is anticipated to register the highest CAGR of 11.42% during the forecast period. This segment is driven by the ever-increasing demand for high-capacity, high-performance optical transmission systems capable of handling large-scale data traffic and supporting the needs of next-generation networks.

By Industry

IT & Telecommunications Segment Dominated Market with Growing Automation and Software-Defined Networking Technology

To know how our report can help streamline your business, Speak to Analyst

Based on industry, the market is categorized into IT & telecommunications, BFSI, retail & e-commerce, healthcare & life sciences, manufacturing, and others.

In terms of share, in 2024, the IT & telecommunications segment dominated the market. The rapid growth of IT and telecommunication sectors drives the demand for high-capacity, efficient, and scalable optical networks. Dense wavelength division multiplexing technology offers this by multiplying data transmission capacities over a single optical fiber. The growing trend of automation and software-defined networking, coupled with the reduction in deployment costs, will continue to drive the adoption of dense wavelength division multiplexing, making it an essential technology for the future of IT and telecommunications networks. The IT & telecommunications segment is likely to attain 27.56% of the market share in 2026.

The healthcare & life sciences segment is expected to record the highest CAGR of 11.50% during the forecast period due to the increasing need for high-bandwidth, low-latency, and reliable communication networks in these sectors. The DWDM technology, which enables the transmission of large volumes of data over a single optical fiber, is becoming increasingly crucial for healthcare organizations, research institutions, and life sciences companies as they require fast, secure, and scalable networks to manage and transfer vast amounts of sensitive data, including medical records, imaging files, and genomic data.

Asia Pacific DWDM Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

DWDM MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific held a major market share in 2024, accumulating a value of USD 5.14 billion, driven by ongoing technological advancements, demand for higher-speed data transfer, and expansion of critical sectors, such as telecommunications, cloud services, and IoT. The market in the region is expected to see increased adoption of high-capacity systems and innovations in integration with other technologies, such as SDN and NFV, thereby enhancing the flexibility and efficiency of optical networks in the region.

Download Free sample to learn more about this report.

China is one of the largest and fastest-growing markets for the Dense Wavelength Division Multiplexing technology. The country's rapid development of digital infrastructure, high demand for broadband and mobile data, and ongoing technological advancements in telecommunications are key factors driving the adoption of DWDM solutions. The market in China is estimated to be USD 2.07 billion in 2026.

India’s market size is foreseen to be valued at USD 0.81 billion and Japan is likely to be USD 1.34 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

The dense wavelength division multiplexing market in South America is growing steadily, driven by the increasing demand for high-speed data transmission, internet expansion, and the need for scalable networks. This technology allows multiple data channels to be transmitted simultaneously over a single optical fiber by using different wavelengths and is a key enabler of high-capacity, efficient communication systems. The region is undergoing significant infrastructure modernization, which will present opportunities for dense wavelength division multiplexing system providers to address these evolving needs.

Europe

Europe region is to be anticipated the third-largest market with USD 3.03 billion in 2026. Europe is estimated to grow at the highest rate during the forecast period, driven by the growing demand for high-speed internet, the rollout of 5G networks, increasing reliance on cloud computing, and the need for reliable and scalable data centers. The integration of dense wavelength division multiplexing with emerging technologies, such as SDN, NFV, and machine learning, will further enhance network flexibility and automation, making it easier for European operators to meet the dynamic demands of the digital age. The market in U.K. is estimated to be USD 0.63 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 0.6 billion in 2026 and France’s likely to be USD 0.34 billion in 2025.

Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 1.05 billion in 2026. The Middle East & Africa is projected to register a significant growth rate in the global market during the forecast period. The region has seen significant investment in upgrading and expanding its telecommunications infrastructure. Telecom operators are deploying dense wavelength division multiplexing technology to enhance their backbone networks, thereby supporting faster internet speeds and larger data volumes. Major players, such as Etisalat (UAE), Vodacom (South Africa), and MTN (Nigeria), are investing in optical networks to handle the growing demand for broadband and mobile services. The GCC countries’ market is expected to showcase USD 0.38 billion in 2025.

North America

North America to be anticipated the second-largest market with USD 4.39 billion in 2026, recording the second-largest CAGR of 8.54% during the forecast period. The region has a high level of internet penetration, with both residential and business users demanding faster internet speeds and higher capacity. The growing consumption of video streaming, cloud computing, gaming, and other data-intensive applications is driving the need for high-speed networks. Dense wavelength division multiplexing provides a solution by increasing the capacity of fiber-optic networks, thereby allowing telecom operators to meet the needs of both consumers and businesses without the need to lay additional fiber. The U.S. market size is estimated to be USD 3.14 billion in 2026.

The increasing consumption of High-Definition (HD) video, 4K/8K streaming, cloud applications, online gaming, and social media has led to a massive surge in data traffic. DWDM provides the high capacity needed to support this growing demand for bandwidth, especially in metropolitan and long-haul fiber-optic networks in the U.S.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Use Merger & Acquisition, Partnership, and Product Development Strategies to Expand Business Reach

Major players operating in the market are providing advanced dense wavelength division multiplexing by offering secured transmission and increased bandwidth of optical signal. They are focusing on signing acquisition agreements with small and local firms to increase their business operations. Moreover, partnerships, mergers & acquisitions, and key investments will also boost the demand for this technology.

List of DWDM Companies Studied:

- Adtran, Inc. (U.S.)

- Alcatel-Lucent (France)

- Lumentum Operations LLC (U.S.)

- Ciena Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Fujitsu Limited (Japan)

- Huawei Technologies (China)

- Infinera Corporation (U.S.)

- ZTE Corporation (China)

- Tejas Networks (India)

- LightRiver (U.S.)

- i3D.net (U.S.)

- IPG Photonics Corporation (U.S.)

- Corning Incorporated (U.S.)

- Ericsson (Sweden)

- Sino-Telecom Technology Co., Inc. (China)

- Ribbon Communications Operating Company, Inc. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Axpo (Switzerland)

- PPC Broadband, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

October 2024: Ribbon Communications Inc., a provider of IP optical networking solutions and real-time communication technologies, announced that it had completed a long-haul Dense Wave Division Multiplexing deployment for Airtel. Airtel implemented Ribbon’s Apollo 9600 group of open and programmable optical transport platforms, accommodating C+L bands throughout their network. This deployment equipped Airtel with a long-haul network capacity of 51.2 Tbps, efficiently addressing its increasing bandwidth demands.

May 2024: PacketLight Networks, a company specializing in OTN and DWDM tools, showcased Quantum Key Distribution (QKD) over DWDM connections in collaboration with Toshiba, a provider of QKD systems and technologies. This demonstration highlighted combining Toshiba’s QKD technology with PacketLight’s OTN-encoded transport solutions to create secure, efficient, and accessible quantum-safe communication networks.

February 2023: Nokia announced the implementation of the first DWDM network that operates at 600G per wavelength in collaboration with Viettel, the largest telecommunications provider in Vietnam. This network utilizes Nokia's cutting-edge PSE-V super-coherent optical engines (PSE-Vs), enabling the transmission in the C-band of a 600Gb/s channel to link Viettel's primary core sites. This Data Center Interconnect solution allowed Viettel to fulfill future demands for a high-capacity, low-latency, and resilient network necessary for cloud services, 5G, and the increasing consumer appetite for the internet and video access.

July 2022: Ribbon Communications Inc. revealed that it was chosen by BoFiNet, a wholesale supplier of telecommunications infrastructure both nationally and internationally, to improve its national backbone network throughout Botswana. Ribbon delivered to BoFiNet, a multi-terabit optical network that integrates DWDM transport with OTN switching.

May 2022: Fujitsu revealed that Vívaro Telecom chose the 1FINITY platform for a new DWDM network deployment in Texas designed to improve high-speed data services linking the U.S. and Mexico. This open and modular platform provided scalable 400G wavelengths to meet the growing bandwidth demands of contemporary applications, including those that facilitate remote work.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The dense wavelength division multiplexing industry represents a dynamic segment within the broader telecommunications market, driven by rising demand for higher bandwidth and advancements in optical technology. Investors should closely monitor market trends, technological innovations, and regional developments to identify promising opportunities within this growing field. For instance,

- In November 2024, Megalink, an internet service provider located in Espírito Santo, was extending its services to additional states, especially in southern Bahia and eastern Minas Gerais. In response to the growing demand from its customers for greater transmission capacities, the company invested in developing a strong fiber optic network utilizing the Dense Wavelength Division Multiplexing technology and solutions from Padtec.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as leading companies, product/service types, and the leading product industry. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Product Type, Bandwidth, Industry and Region |

|

Segmentatio

|

By Product Type

By Bandwidth

By Industry

By Region

|

|

Companies Profiled in the Report |

Adtran, Inc. (U.S.) Alcatel-Lucent (France) Lumentum Operations LLC (U.S.) Ciena Corporation (U.S.) Cisco Systems, Inc. (U.S.) Fujitsu Limited (Japan) Huawei Technologies (China) Infinera Corporation (U.S.) ZTE Corporation (China) Tejas Networks (India) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 28.24 billion by 2034.

In 2026, the market was valued at USD 14.88 billion.

The market is projected to record a CAGR of 8.30% during the forecast period.

By product type, the optical transmitter/receiver segment led the market in 2026.

The surge in data traffic and rise in global internet access will aid the market’s growth.

Adtran, Inc., Alcatel-Lucent, Lumentum Operations LLC, Ciena Corporation, Cisco Systems, Inc., Fujitsu Limited, Huawei Technologies, Infinera Corporation, ZTE Corporation, and Tejas Networks are the top players in the market.

Asia Pacific held the highest market share in 2025.

By industry, the healthcare & life sciences segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us