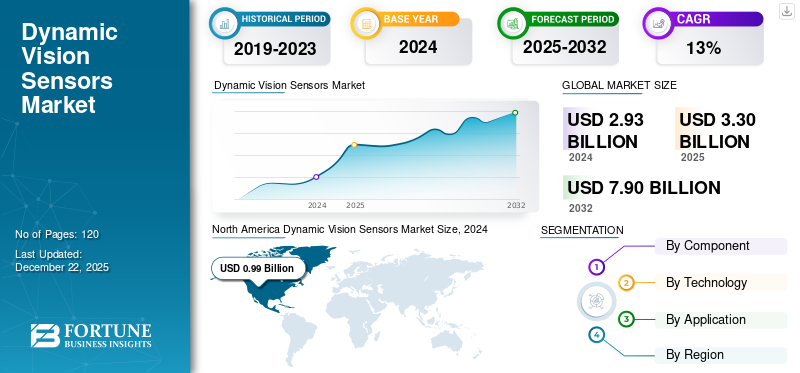

Dynamic Vision Sensors Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By Technology (Event, Frame, Hybrid (Event + Frame), Time-of-Flight, CMOS, and Others), By Application (Automotive, Healthcare, Energy & Utilities, Industrial, Aerospace & Defense, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

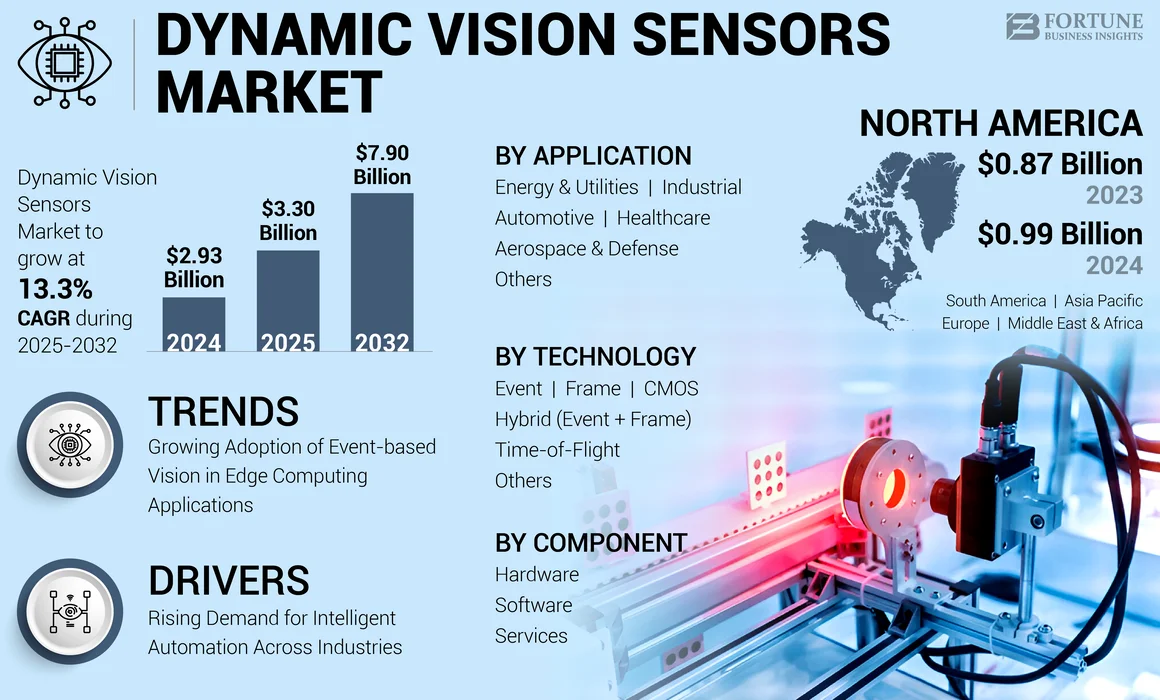

The global dynamic vision sensors market size was valued at USD 2.93 billion in 2024. The market is projected to grow from USD 3.30 billion in 2025 to USD 7.90 billion by 2032, exhibiting a CAGR of 13.3% during the forecast period.

The Dynamic Vision Sensors (DVS) market is focused on sensors that capture visual data based on pixel-level changes in real time. The technology offers advantages such as low latency, high temporal resolution, and reduced power consumption. It is ideal for applications including automotive, healthcare, energy & utilities, industrial, and aerospace & defense industries, where rapid response time is critical.

The market is driven by the rising demand for real-time, low-latency vision systems across these sectors. In addition, advancements in neuromorphic engineering and the integration of Artificial Intelligence (AI) are enabling energy-efficient and high-speed data processing, further driving the growth of the dynamic vision sensors market.

The key players in the market include Prophesee, Sony Corporation, Samsung, Qualcomm, SynSense, BrainChip, Terranet, RoboSense, Framos, and Infineon. These companies are driving enhancements in the real-time vision capabilities across various industries, driving the market expansion.

Impact of Reciprocal Tariffs

Reciprocal tariffs among major economies can adversely affect the market by increasing the cost of raw materials and essential electronic components. These cost escalations may lead to higher manufacturing expenses, which are typically passed on to end-users, thereby decreasing market competitiveness. Trade barriers can also disrupt global supply chains, resulting in production and deployment delays across various industries. For instance,

- According to the World Trade Organization, the implementation of reciprocal tariffs could reduce global merchandise trade volume growth by 0.6 percentage points in 2025. Moreover, ongoing trade policy uncertainty could further dampen growth by another 0.8 percentage points.

In response to these challenges, manufacturers may explore alternative sourcing strategies or relocate production facilities to tariff-free regions, leading to increased operational complexity and investment requirements. These disruptions can temporarily slow innovation and delay product availability. Hence, reciprocal tariffs pose a considerable risk to the steady growth of the market by creating economic and logistical uncertainties into an interconnected global industry.

Impact of Generative AI

Incorporation of Generative AI to Improve Capabilities of Dynamic Vision Sensors

The integration of generative AI into the dynamic vision sensors is expected to significantly enhance data interpretation and real-time decision-making capabilities. Generative AI models can process and simulate complex visual scenarios, enabling DVS-equipped systems to predict object behavior and improve motion tracking accuracy. This advancement is valuable in applications requiring quick and precise responses are critical.

Moreover, generative AI can aid in synthetic data generation, enabling the training of vision systems without relying solely on extensive real-world datasets. This supports faster development cycles and improves the adaptability of DVS solutions across diverse environments. For instance,

- The importance of synthetic data is growing, with industry specialists predicting that 60% of AI and analytics projects will incorporate synthetic data in 2024. Industries such as automotive, finance, and healthcare are increasingly adopting this technology due to its cost-efficiency and privacy protection benefits.

Therefore, the integration of generative AI will expand the application scope of dynamic vision sensors.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Intelligent Automation Across Industries to Drive Market Growth

The growing demand for real-time, low-latency vision systems in advanced technologies such as autonomous vehicles, robotics, and industrial automation drives the dynamic vision sensors market growth. For instance,

- Industry experts report that the global RPA market is projected to reach USD 64.47 billion by 2032. Around 3.4 million industrial robots are in use globally.

These applications require quick and precise motion detection to navigate complex environments and make split-second decisions. Dynamic vision sensors offer a significant advantage over traditional frame-based imaging systems in meeting these performance needs.

In industrial automation, the need for responsive and energy-efficient vision solutions is becoming increasingly crucial for enhancing operational efficiency and safety. DVS enables machines to monitor and react to fast-changing scenarios in real time, supporting predictive maintenance and minimizing downtime. Therefore, the growing adoption of intelligent automation across industries is accelerating the innovation in next-generation vision systems.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

High Cost of Development Along with Technical Complexity Can Hamper Market Growth

Limited awareness and adoption of dynamic vision sensors, compared to conventional image sensors, pose a challenge to market expansion. Additionally, the high initial cost of development and integration of DVS solutions can deter the adoption in small and medium-sized enterprises. Technical limitations, such as lower image quality for static scenes and the need for specialized algorithms to interpret event management data, further restrict the broader implementation. Moreover, the lack of standardized frameworks and interoperability across different platforms can slow down large-scale deployment across diverse industries. Therefore, the factors mentioned above can hamper growth despite increasing demand across various applications.

MARKET OPPORTUNITIES

Rise in Autonomous Vehicles to Present Significant Opportunities for the Market

The increasing adoption of autonomous vehicles and Advanced Driver-Assistance Systems (ADAS) creates a significant growth opportunity for the market. For instance,

- Business experts project a significant increase in the number of autonomous vehicles, with the market expected to grow from approximately 17,000 units in 2022 to an estimated 127,000 units by 2030. This growth reflects the expanding adoption and development of autonomous vehicle technology.

Autonomous vehicles rely on high-speed, real-time vision systems to navigate and make split-second decisions, making DVS a technology. DVS sensors have low latency and high temporal resolution, offering enhanced motion detection and object-tracking capabilities. This is crucial for ensuring safety and efficiency in autonomous driving.

In addition to autonomous vehicles, ADAS applications in commercial and passenger vehicles are further driving DVS technology demand. These systems require continuous monitoring of dynamic surroundings to assist functions with collision avoidance, lane-keeping, and adaptive cruise control. As the automotive industry moves toward greater automation and enhanced safety features, the integration of DVS technology offers significant growth prospects for the market.

DYNAMIC VISION SENSORS MARKET TRENDS

Growing Adoption of Event-based Vision in Edge Computing Applications Fuels Market Growth

Unlike traditional frame-based systems, DVS captures only changes in a scene, significantly reducing data load and enabling faster processing. This makes them well-suited for edge computing environments, where real-time performance and low power consumption are essential. The integration of DVS with edge devices is gaining traction across sectors such as smart surveillance, autonomous navigation, and industrial automation. These applications benefit from the high temporal resolution and energy efficiency of event-based vision, enhancing system responsiveness and operational reliability. As edge computing continues to expand, the demand for DVS technologies is expected to accelerate, fueling the market growth. For instance,

- According to the industry experts spending guide, global expenditure on edge computing is projected to reach USD 228 billion in 2024. This represents a 14% increase compared to spending levels in 2023.

Segmentation Analysis

By Component

Mandatory Implementation of Device Setup Drives Hardware Segment Growth

Based on component, the market is trifurcated into hardware, software, and services.

Hardware holds the highest share of the market due to the foundational role of sensors, cameras, and related devices in the system setup. These physical components are integral to the functionality of DVS technology and form the core of most implementations across various applications.

Software is expected to grow at the highest CAGR during the study period. This growth is driven by the increasing demand for advanced algorithms, data processing tools, and software solutions for interpreting the event-based data captured by DVS, particularly in applications such as autonomous vehicles and robotics.

By Technology

Wide Use across Various Applications Boosts Event Segment Growth

By technology, the market is classified into event, frame, hybrid (event + frame), time-of-flight, CMOS, and others.

The event segment holds the largest share of the market due to its superior capability in capturing high-speed, low-latency events, making it ideal for real-time applications such as robotics and automotive systems.

Hybrid technology (event + frame) is expected to grow at the highest CAGR. This technology combines the benefits of both event-based and frame-based systems, offering a versatile solution suitable for event planning that requires both high-speed motion tracking and detailed scene information.

By Application

Increasing Adoption of ADAS to Boost Automotive Segment’s Growth

By application, the market is divided into automotive, healthcare, energy & utilities, industrial, aerospace & defense, and others.

Automotive holds the highest share of the market, driven by the demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles, which rely heavily on DVS technology.

Healthcare is expected to grow at the highest CAGR during the study period. The increasing use of dynamic vision sensors in medical imaging, diagnostic systems, and surgery robotics presents significant growth opportunities in this sector.

Dynamic Vision Sensors Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Dynamic Vision Sensors Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominates the market due to its robust technology infrastructure, significant investment in research and development, and early adoption of advanced technologies. The presence of leading players in the automotive, robotics, and industrial automation sectors further strengthens the region's position. Additionally, the increasing demand for autonomous vehicles and ADAS in the region drives the widespread adoption of DVS technology. The U.S. holds a significant share of the market, driven by strong R&D investments and widespread adoption across industries. The country is also supported by a robust tech ecosystem and favorable government initiatives that promote automation and AI integration.

- For instance, Industry specialists report that the North American autonomous vehicle market is growing rapidly, with the U.S. market projected to reach USD 55.83 billion by 2030, up from USD 16.76 billion in 2023.

Europe

Europe holds a significant share of the market due to its strong automotive and industrial sectors, which increasingly integrate DVS for safety, automation, and efficiency. The European Union's focus on innovation, coupled with stringent regulations around vehicle safety and environmental standards, further boosts the adoption of DVS applications. For instance,

- The EU made notable progress in reducing road fatalities, with the fatality rate dropping from 60 per million inhabitants in 2012 to 46 in 2024.

Advancements in robotics and healthcare applications further contribute to the market's growth in Europe.

Asia Pacific

The market is witnessing increased interest from key players and market players across Asia Pacific, fueled by rising disposable incomes and expanding applications in sectors such as event management and event planning. Companies such as American Express Global Business Travel are leveraging DVS technology to enhance attendee tracking and engagement at corporate events, trade shows, and musical festivals. Event organizers are also adopting these sensors to monitor real time crowd movements and optimize event hosting logistics. The region is expected to grow at the highest CAGR in the market, driven by rapid demand for live streaming, music festivals, and cultural events. The region's increasing investments in AI, automation, and smart manufacturing are creating significant demand for high-performance vision systems. For instance,

- IDC's latest spending guide indicates that AI spending in the Asia Pacific region is expected to reach USD 45 billion in 2024, with projections to grow to USD 110 billion by 2028, reflecting a CAGR of 24% from 2023 to 2028.

Additionally, the growing presence of major technology manufacturers in China, India, and Japan contributes to the region's accelerated growth.

Middle East & Africa and South America

The Middle East & Africa and South America are expected to grow at an average rate in the market due to relatively moderate adoption and smaller investments in emerging technologies compared to other regions. However, regional developments in smart manufacturing and transportation systems are expected to increase the demand for DVS technology in these regions gradually.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen their Market Position

Companies are launching new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. These strategic product launches help companies maintain and grow their dynamic vision sensors market share in a rapidly evolving industry, positively impacting the regional/local economy.

LIST OF KEY DYNAMIC VISION SENSORS COMPANIES PROFILED

- Prophesee (France)

- Sony Corporation (Japan)

- Samsung (South Korea)

- Qualcomm (U.S.)

- SynSense (China)

- BrainChip (Australia)

- Terranet (Canada)

- RoboSense (China)

- Framos (Canada)

- Infineon (Germany)

- STMicroelectronics (Switzerland)

- Onsemi (U.S.)

- Canon (Japan)

- NEC (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025 - TDK Corporation announced the production of its InvenSense SmartSonic ICU-30201 ultrasonic ToF sensor. The sensor is designed to enhance contextual awareness in applications requiring precise presence, proximity, and distance measurements.

- November 2024 - Sony introduced the IMX925, a new industrial image sensor featuring a backlit CMOS global shutter with a 24.55 MPixel resolution, 2.74 µm pixel size, and a frame rate of 394 fps.

- October 2024 - Sony released the ISX038 CMOS image sensor for mobile cameras that processes and output RAW and YUV images simultaneously. The sensor also supports ADAS and autonomous driving systems with RAW image processing.

- July 2024 - STMicroelectronics introduced the VL53L4ED, a new ToF proximity sensor designed for high-accuracy, short-range measurements. The sensor features an extended operating temperature range of -40°C to 105°C, making it suitable for applications requiring enhanced thermal resilience.

- April 2024 - OmniVision launched two new CMOS image sensors designed for machine vision applications. The company also established a dedicated Machine Vision Unit to develop innovative solutions for robotics, logistics barcode scanners, industrial automation, and Intelligent Transportation Systems (ITS).

- June 2023 - SynSense released its Speck Demo Kit. This compact development module is designed to facilitate rapid deployment and validation of event-based neuromorphic vision applications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of dynamic vision sensors solutions. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 7.90 billion by 2032.

In 2024, the market was valued at USD 2.93 billion.

The market is projected to grow at a CAGR of 13.3% during the forecast period.

By component, hardware segment lead the market.

Rising demand for advanced features across various applications is a key factor driving market growth.

Prophesee, Sony Corporation, Samsung, and Qualcomm are the top players in the market.

North America dominates the market in terms of share.

By application, the healthcare sector is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us