Electric Detonator Perforating Gun Market Size, Share & Industry Analysis, By Application (Onshore and Offshore), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

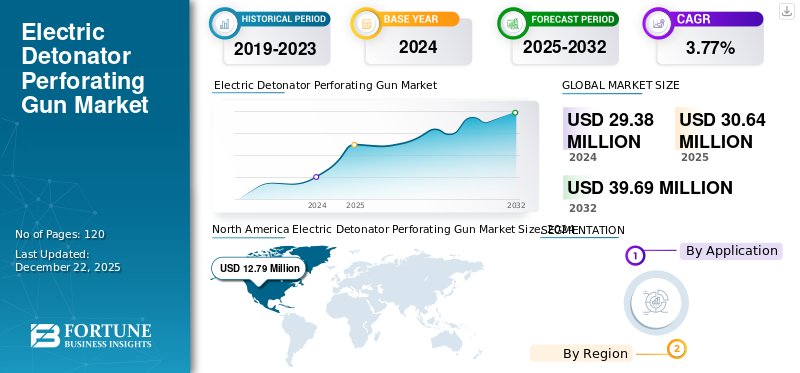

The global electric detonator perforating gun market size was valued at USD 29.38 million in 2024. The market is projected to grow from USD 30.64 million in 2025 to USD 39.69 million by 2032, exhibiting a CAGR of 3.77% during the forecast period. North America dominated the electric detonator perforating gun market with a share of 43.53% in 2024.

An electric detonator perforating gun is a specialized device used in oil & gas well completions to create perforations in the well casing, allowing hydrocarbons to flow from the reservoir into the wellbore. The system utilizes electric detonators as the initiation mechanism to trigger the shaped charges contained in the gun.

Moreover, the electric detonator perforating gun market growth is driven by the expansion of oil and gas exploration and production activities, particularly in unconventional reservoirs and offshore locations. This growth is also fueled by advancements in drilling technologies and the need for efficient perforation systems to optimize resource extraction.

Baker Hughes is one of the prominent players in the market, offering comprehensive perforating systems for well completion. The company provides SurePerf™, a rapid select-fire perforating system. The SurePerf system integrates a unique electrical ballistic transfer technology and various gun arrays to enhance the dependability of perforating operations.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Safe and Precise Well Completion Support Market Growth

The growing demand for enhanced safety and precision in well completion operations is anticipated to support global electric detonator perforating gun market growth. In the oil and gas industry, the wellbore environment is more complex and risk-intensive for operations such as deepwater, HPHT (High-Pressure, High-Temperature), and unconventional wells. Electric detonator perforating guns address these concerns by offering surface-controlled initiation, allowing operators to fire charges accurately at precise depth and time. With real-time monitoring and confirmation systems, operators can ensure that the perforation occurs as planned, improving overall operational efficiency.

MARKET RESTRAINTS

Decreasing Capital Expenditure of Oilfield Operators and Service Providers to Limit Market Expansion

The demand for electric detonator perforating is highly dependent on exploration, development, and production operations. These activities are often hampered by volatility in oil and natural gas prices, supply and demand, government regulation, and other socio-economic factors. Thus, service providers may reduce or defer major expenditures based on market conditions that may hamper the operations and overall demand for the market.

MARKET OPPORTUNITIES

Growth in Unconventional Oil & Gas Exploration Expected to Impact Market Growth Positively

The oil & gas industry is experiencing rapid changes. With maturing oil and gas wells, the need for finding other means and measures to support energy demand is rising, which has emphasized unconventional oil & gas exploration. Its rapid expansion of unconventional oil & gas exploration, especially in shale oil and tight gas, has significantly fueled demand for high-performance, reliable perforation systems. Electric detonator perforating guns are well-suited for such activities, owing to their ability to trigger multiple perforation events in a controlled sequence. These capabilities could potentially increase the electric detonator perforating gun market share.

Download Free sample to learn more about this report.

ELECTRIC DETONATOR PERFORATING GUN MARKET TRENDS

Increasing Demand for Efficient & Real-Time Monitoring Systems

The key market trends include the shift toward electronic and programmable systems that offer precise timing, real-time monitoring, and remote diagnostics, with wireless systems gaining traction for their simplified deployment and improved safety across challenging drilling environments. Moreover, the growing demand for high pressure, high temperature (HPHT) capable detonators, especially in North America and Asia Pacific regions due to the presence of rapid infrastructure and mining activates expansion.

Segmentation Analysis

By Application

Onshore Segment to Dominate Market Due to Its Simpler Development Processes

Based on application, the market is classified into onshore and offshore. The onshore application is expected to dominate the detonator used in the perforating gun industry, owing to the availability of conventional & unconventional deposits. Onshore fields typically involve simpler development processes, demand less capital investment, and face fewer logistical hurdles compared to offshore locations. These advantages make onshore drilling a more appealing and economical choice for many energy companies, resulting in an increased need for perforating guns and detonators utilized in these environments.

The expansion of offshore operations is a significant driver supporting market growth. Offshore exploration and production activities in deep and ultra-deepwater settings present distinct challenges, including high-pressure and high-temperature conditions that necessitate specialized equipment and cutting-edge technology.

Electric Detonator Perforating Gun Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Electric Detonator Perforating Gun Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to account for the largest market share. Also, the U.S. and Canada are among the most technologically advanced markets in the oil & gas sector. Widespread development of unconventional resources, such as shale gas and tight oil formations, increases demand for advanced technologies, including electric detonator perforating guns. These guns offer the accuracy and control essential for targeting specific zones in complex well formations such as shale gas and tight oil.

U.S.

The U.S. government's investment in oil and gas production fosters both onshore and offshore exploration activities. As new oil and gas reservoirs are discovered, the demand for electric detonator perforating guns increases. These tools (perforating guns and systems) are essential for creating well casing and reservoir rock perforations. Hence, an increase in oil & gas exploration activities is expected to propel market expansion over the forecast period.

Europe

The market for electric detonator perforating in Europe is driven by the shift toward safer, environmentally responsible extraction technologies. Moreover, Europe’s emphasis on automation and remote operations, particularly in offshore assets, creates demand for surface-controlled perforation systems. Oilfield operators are collaborating on R&D for developing smart completion tools integrated with electrical initiators to improve the efficiency and safety of wells.

Asia Pacific

The Asia Pacific region is experiencing strong growth, owing to increased oil & gas exploration and production activity in emerging markets such as China, India, and Southeast Asia. The increasing investment in onshore and offshore development by oil companies to modernize equipment and processes is anticipated to support the adoption of electric detonator perforating guns. The technology could benefit the need for cost-effective, efficient, and safe well-completion technologies.

Latin America

In Latin America, Brazil and Mexico are leading in enhancing their oil & gas sector. The need for reliable and safe technologies for offshore and deepwater exploration is anticipated to support the market growth. Such environments demand high-precision tools that can perform safely under extreme pressure and temperature.

Middle East & Africa

The Middle East & Africa region is anticipated to grow, owing to increasing focus on operational efficiency and the highly established oil & gas sector. Arabia, UAE, and Oman are expanding their onshore and offshore developments, which is further anticipated to support market growth. Additionally, the market is driven by the increasing exploration and production of oil & gas, particularly unconventional resources, and the need for advanced extraction techniques to access these resources.

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Advancements to Support Market Growth

In January 2022, Hunting Energy Services' Titan Division, part of the international energy services company Hunting PLC, revealed an exclusive licensing partnership with Nammo Defense Systems Inc. to produce time delay fuses for Hunting's perforating applications. Time delay fuses allow operators to have a controlled delay for positioning perforating guns after the firing sequence has been initiated in a tubing-supported perforating process.

LIST OF KEY ELECTRIC DETONATOR PERFORATING GUN COMPANIES PROFILED

- Austin Powder (U.S.)

- Baker Hughes (U.S.)

- GEODynamics (U.S.)

- Owen Oil Tools (Netherlands)

- Hunting PLC (U.K)

- Halliburton (UAE)

- SLB (U.S.)

- Vigor Drilling Oil Tools and Equipment (China)

- SWM Technologies (U.S.)

- G&H Diversified Manufacturing, L.P. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2024: GEODynamics launched EPIC™ Flex Orbit Perforating System. This system offers customizable options to incorporate addressable switches, charges, and detonating cords from almost any OEM, enabling wireline companies and completion engineers’ maximum flexibility in the field.

- August 2024: Hunting PLC received a patent for a perforating gun system featuring a pre-wired loading tube assembly. It consists of upper and lower-end fittings, electrical connections, and a selective switch with an auto-shunting detonator, augmenting the orientation and functionality of shaped charge-loading tubes.

- December 2023: At SPE’s Hydraulic Fracturing Technology Conference, GeoDynamics introduced its EPIC Precision Suite and perforating guns. The EPIC Precision and EPIC Flex top-loading gun systems are engineered to accommodate various unconventional well configurations for highly dependable plug-and-perf completions.

- June 2023: DynaEnergetics unveiled DS Gravity 2.0, a compact, self-orienting perforating gun in the oil & gas industry. This product offers time-saving, improves perforation efficiency, and produces profitable wells.

- May 2023: SEF Energy acquired OSO Perforating, a company that manufactures and offers Perforating Systems.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.77% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 29.38 million in 2024 and is projected to reach USD 39.69 million by 2032.

In 2024, the North American market value stood at USD 12.79 million.

The market is expected to exhibit a CAGR of 3.77% during the forecast period of 2025-2032.

By application, the onshore segment is expected to lead the market during the forecast period.

Increasing demand for safe and precise well completion support is driving market growth.

Baker Hughes, SLB, and Halliburton are the top players in the market.

Growth in unconventional oil and gas exploration is expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us