Electric Vehicle Battery Recycling Market Size, Share & Industry Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), By Type (Lithium ion, Lead-acid, Nickel, and Others), By Process (Pyrometallurgical and Hydrometallurgical), and Regional Forecast, 2025 – 2032

KEY MARKET INSIGHTS

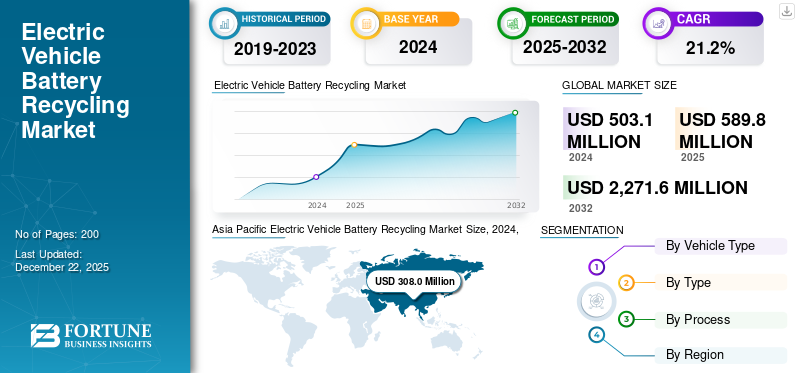

The global electric vehicle battery recycling market size was valued at USD 503.1 million in 2024. The market is expected to grow from USD 589.8 million in 2025 to USD 2,271.6 million by 2032, exhibiting a CAGR of 21.2% during the forecast period. Asia Pacific dominated the global market with a share of 61.22% in 2024.

The electric vehicle battery recycling industry covers the processes and technologies used to recover valuable materials from spent batteries, mostly those in electric vehicles (EVs). With the growing demand for electric vehicles globally, fueled by the need for sustainable transportation and the plummeting costs of EV technologies, the requirement for effective solutions in battery recycling has become more critical.

This market encompasses different types of vehicles, including passenger and commercial vehicles, and has various battery chemistries, such as lithium-ion, lead-acid, and nickel-based systems. Recycling these batteries involves the use of processes such as pyrometallurgical and hydrometallurgical methods for extracting key metals such as lithium, cobalt, and nickel, which are then used for the production of new batteries.

With increasing regulatory incentives toward sustainable actions to decrease environmental footprint and foster circular economy practices, the market is expected to expand largely, providing a green route for the management of EV batteries lifecycle and curbing resource depletion.

The market is experiencing significant growth driven by the expanding global EV fleet, which creates an increasing pool of vehicles approaching battery end-of-life cycles. As electric vehicle batteries degrade naturally over their typical 8-15 years lifespan due to factors such as usage patterns, environmental conditions, and charging behaviors, there is an emerging demand for substantial replacement.

Technological innovations in battery design and chemistry are motivating vehicle owners to upgrade to advanced systems offering superior range, enhanced charging speeds, and improved longevity. Government policies emphasizing battery recycling, circular economy principles, and sustainable transportation are also contributing to market expansion by creating structured frameworks for battery replacement and disposal processes.

The market is led by key players such as Umicore, Neometals Ltd., and Li-Cycle Corp. These companies focus on developing efficient and environmentally friendly recycling processes. The competitive edge is further enhanced by companies developing advanced recycling methods with minimal environmental impact, and innovations in battery chemistry and engineering. These companies, with their expertise, are positioning themselves as leaders in this market.

The market was highly impacted by the COVID-19 pandemic. This created major disruptions in production and demand, slowing down the recycling operations and decreasing the collection rates of discarded batteries. However, as countries started to get used to adversities brought by the pandemic, it became evident that there was a rapid shift toward sustainability and more focus on circular economy practices. This shift impelled companies to focus on recycling batteries as a key to address the surge in demand for electric cars. Additionally, growing consumer exposure to environmental matters during the crisis has stimulated investment in recycling technologies, creating a more robust market during the outcome of the crisis.

MARKET DYNAMICS

Market Drivers

Growing Climate Concerns Fuel Demand for Sustainable EV Battery Recycling Solutions

Growing environmental awareness is significantly driving the growth of the market. With growing knowledge regarding climate change and the loss of natural resources, consumers as well as governments are emphasizing on adopting eco-friendly practices. This increased focus on being environment friendly has stimulated demand for efficient battery recycling to reduce the environmental footprint of spent electric vehicle batteries. Regulatory incentives and policies for the encouragement of circular economy initiatives reinforce this trend by challenging companies to invest in new recycling technologies. Recycling precious materials such as lithium, cobalt, and nickel from used batteries not only helps to reduce waste but also supports a more environmentally friendly supply chain for future electric vehicle and battery manufacturing. As more stakeholders appreciate the value of responsible battery disposal and recovery of resources, electric vehicle battery recycling is expected to witness significant growth.

For instance, in June 2025 (on World Environment Day), Maxvolt Energy Industries Ltd announced plans to expand its lithium battery recycling infrastructure. The NSE-listed clean energy firm aims to reduce its carbon footprint by setting up a new state-of-the-art recycling facility in NCR or Western Uttar Pradesh in India. The company currently operates a battery take-back and reuse programme covering over 85% of India’s pin codes.

Market Restraints

Infrastructure Deficiencies Create Barriers to the Market Expansion

One of the key factors restraining the market for electric vehicle battery recycling is limited infrastructure for efficient recycling systems. Most of the regions are not equipped with the right facilities and technologies to efficiently collect, process, and recycle retired electric vehicle batteries, hindering the recovery of valuable materials. Inadequate infrastructure can result in reduced recycling levels and more environmental issues related to battery disposal. Additionally, the high costs associated with establishing advanced recycling plants can deter investments, further slowing the market growth. As a result, there is a growing need for significant improvements and investments in recycling infrastructure to enhance efficiency and sustainability within the industry. These factors might hinder the market during the forecast period.

Market Challenges

Complex and Diverse Battery Chemistries Significantly Challenges the Market Growth

The market is confronted with a number of challenges, specifically the intricate and heterogeneous chemistries of batteries used currently. As manufacturers continue to use different battery types, including lithium-ion, lead-acid, and nickel-based systems, recycling operations need to adjust to accommodate these variations. Such complexity makes it difficult to recover valuable materials and results in inefficiencies and increased operational expenses. In addition, varying standards and regulations by different regions makes it more challenging for companies to have uniform recycling practices. Overcoming these issues is necessary as the industry grows so that it can achieve sustainable solutions, consequently maximizing the recovery of critical resources.

Market Opportunities

Strategic Partnerships Creates Opportunities for Closed-Loop EV Battery Systems

As electric vehicles rise in popularity, strategic partnerships provides an lucrative opportunity due to collaboration between battery manufacturers, OEMs, and recyclers. This creates a closed-loop system for battery material sourcing and recycling. It can ultimately improve efficiency, cut costs, develop superior recycling processes, and improve supply chains for materials used by future electric vehicle manufacturers.

For instance, in September 2024, Altilium Metals declared that it is building a lithium-ion battery recycling facility with an allied automaker on a project designed to produce and validate electric vehicle (EV) battery cells using materials recovered from end-of-life EV batteries. The project will demonstrate battery cells produced with recovered cathode active materials (CAM) which will be validated for use in vehicles produced by the U.K.-based JLR, formerly known as Jaguar Land Rover.

Electric Vehicle Battery Recycling Market Trends

Advancements in Recycling Technologies are Fueling the Market Growth

One of the prominent trend in the market is the growing use of hydrometallurgy, which provides a cleaner and more energy-efficient method of recovering usable material from discarded batteries. This process uses a reduced amount of energy and is less invasive environmentally than conventional pyrometallurgical procedures. As companies invest in these cutting-edge technologies, they enhance their capacities to recover precious metals including lithium, cobalt, and nickel, thereby supporting the circular economy and promoting sustainable practices in the automotive industry. Furthermore, the growing regulatory focus on sustainability and resource recovery is propelling the demand for innovative recycling solutions, solidifying hydrometallurgy's role as a key driver of market growth.

For instance, in December 2024, LICO Materials, a lithium-ion battery recycling and refurbishing firm, announced the inauguration of a battery recycling facility and is set to invest USD 29.4 million in its downstream hydrometallurgy plant in the following years. Such developments drive the electric vehicle battery recycling market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Vehicle Type

Passenger Cars Segment Leads the Market Due to the Widespread Adoption of EVs as Personal Cars

By vehicle type, the market is classified into passenger cars and commercial vehicles.

The passenger car segment currently holds the largest electric vehicle battery recycling market share due to its widespread adoption. The recycling demand for this segment is expected to show higher growth during the forecast period as automakers actively form partnerships and close-loop recycling systems. This eventually set up a circular economy for valuable metals such as nickel, cobalt, and lithium, and other metals.

The commercial vehicle segment holds the second-largest share of the market and is expected to show significant growth during the forecast period. As the use of electric buses, trucks, vans, and other commercial vehicles increases, this segment is expected to propel the market.

For instance, in February 2024, Volkswagen Group partnered with Ecobat to collect and recycle electric vehicle batteries. Under this agreement, high-voltage batteries will be collected from Volkswagen dealers, distributors, and end-of-life recycling centres and processed at the Darlaston site.

To know how our report can help streamline your business, Speak to Analyst

By Type

Lithium-ion Segment Dominates the Market Due to its Widespread Use in Batteries Across Various Platforms

Based on type, the market is classified into lithium-ion, lead acid, nickel, and others.

The lithium-ion segment currently holds the largest market share due to its widespread adoption and demand for lithium ion batteries in various modern electric vehicles. This segment is expected to show effective growth during the forecast period as advancements in sorting, disassembly, and material recovery technologies continues to upsurge. This segment is also expected to show immense growth during the forecast period driven by advancements in this segment and its widespread adoption.

In March 2024, Durapower, GLC Recycle, and Green Li-ion, a trio of Singapore-based companies, reached an agreement to offer the recycling of lithium-ion batteries into new battery materials in Southeast Asia. End-of-life batteries collected by Durapower Holdings Pte. Ltd. will be directed to GLC Recycle Pte. Ltd., which operates a battery materials recycling facility in Laos. GLC Recycle will also work with Green Li-ion on what the firms call advanced battery recycling technology.

The nickel and other battery segments held a notable market share in 2024 and is expected to show prominent growth during the forecast period as the focus on Nickel recovery rises with advancements in battery recycling technology.

By Process

Hydrometallurgical Process Leads as They More Efficient

Based on the process by which batteries are recycled, the market is categorized into pyrometallurgical and hydrometallurgical.

The pyrometallurgical segment holds the largest share of the market due to its ability to process mixed battery waste by heating it to a high temperature, thereby converting it into a slag that can be purified into metals. However, this traditional approach is less efficient and raises concerns as it is not environmentally friendly.

The hydrometallurgical process shows higher potential for growth during the forecast period. This process is comparatively newer, and recovers materials more efficiently while causing less impact on the environment, especially if the waste created during the process is properly disposed or treated. The hydrometallurgical process uses aqueous chemistry to selectively leach out metals and recover them, leading to more efficient and better recovery of materials. This process is expected to show fastest growth during the forecast period due to its scalability, lower environmental impact, and better material recovery from future battery chemistries.

Vehicle Battery Recycling Market Regional Outlook

By region, the market is studied across Europe, Asia Pacific, North America, and the rest of the world.

North America

Asia Pacific Electric Vehicle Battery Recycling Market Size, 2024, (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held a significant market share in 2024 with a market value of USD 56 million. The region is expected to show rapid growth owing to federal initiatives and the rapid expansion of battery recycling infrastructure. For instance, the introduction of end–of–life battery regulations by the U.S. Environmental Protection Agency has encouraged standardized collection programs for batteries and eventually leading to more batteries ending up in recycling plants instead of landfills.

The U.S. holds the largest market share of 87.44% in 2024 in North America. The U.S is expected to show great growth fueled by a modular approach to recycling plants aimed at reducing per-unit expenses of recycling batteries, driven by funding from the U.S. Department of Energy.

Asia Pacific

Asia Pacific holds the largest share of the market. This dominance is owed to massive EV production and adoption in this region, especially in countries including China, South Korea, and Japan. China particularly holds a large market share in this region, driven by aggressive government mandates. In 2024, The International Energy Agency introduced the “Specifications for the Comprehensive Utilization of Waste EV Batteries 2024”, after which China mandated a recovery rate of 90% for lithium and 98% for nickel, cobalt, and manganese, in the smelting process. Governments are undertaking steps to handle and manage battery waste in this region across countries such as India, Korea, and Japan, with the introduction of stringent policies and is expected to drive the market substantially during the forecast period.

Europe

Europe holds the second-largest market share in the market. This is driven by EU regulations imposed on batteries, which mandate specific recovery targets. This has resulted in battery manufacturers increasingly investing in recycling infrastructure to comply with the imposed standards. With developments in infrastructure and increasing financial incentives, this region showcases effective growth during the forecast period.

Rest of the World

The rest of the world holds a notable market share. As regulatory frameworks are imposed in developing countries, this region is expected to show a moderate growth rate during the forecast period. As international agencies encourage circular economies around the battery recycling market, first movers in this region can have opportunities to capitalize during the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Strategic Integrations By Key Players to Catalyze the Competitive Landscape

The market is rapidly expanding, driven by strategic partnerships, technological investments, and vertical integration by key players. Companies including Li-Cycle Holdings Corp, Umicore NV/SA, Redwood Materials, and others are actively expanding their network to secure critical materials for recycling. The landscape is witnessing investments in developing advanced hydrometallurgical processes and closed-loop recycling technologies. The focus is shifting toward sustainability, robust supply chains, and compliance with ever-changing regulations. With innovations and collaborations, this market is expected to showcase exponential growth over the forecast period.

List of Key Electric Vehicle Battery Recycling Companies Profiled

- Umicore NV/SA (Belgium)

- Neometals Ltd. (Australia)

- Li-Cycle Corp. (Canada)

- Recyclico Battery Materials Inc. (Canada)

- Accurec-recycling GmbH (Germany)

- Fortum (Finland)

- Cirba Solutions (U.S.)

- Contemporary Amperex Technology Co., Limited (CATL) (China)

- Ecobat (U.S.)

- Shenzhen Highpower Technology Co., Ltd. (China)

- Redwood Materials Inc. (U.S.)

- Gem Co., Ltd. (China)

- Ascend Elements, Inc. (U.S.)

- BatX Energies (India)

- Glencore (Switzerland)

- Ace Green Recycling (U.S.)

- Primobius GmbH (Germany)

- Attero Recycling Pvt. Ltd. (India)

- Trishulavel Eshan Pvt. Ltd. (Li-circle) (India)

- Eramet (France)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Livium’s battery recycling subsidiary Envirostream Australia signed a new agreement with the Australian arm of Chinese manufacturing conglomerate BYD that broadens the scope of previously agreed services to include the recycling of commercial vehicle batteries and energy storage systems.

- April 2025: Livium Ltd, through its wholly owned subsidiary Envirostream Australia Pty Ltd. entered into a landmark recycling agreement with Sell & Parker Pty Ltd, expected to generate revenues exceeding USD 5 million over its three-year term.

- March 2025: Umicore entered into two separate agreements for the supply of precursor cathode active materials (pCAM) for electric vehicle batteries with CNGR and Eco&Dream Co. (E&D). The two mid-to-long-term contracts are part of Umicore’s sourcing diversification strategy and complement the Group’s manufacturing of pCAM in Finland, which has an annual production capacity of 20,000 tons, and China, where capacity is at 80,000 tons a year.

- December 2024: American Battery Technology Company (NASDAQ: ABAT) secured a USD 144 million grant contract from the U.S. Department of Energy to build its second lithium-ion battery recycling facility. The new facility will have a processing capacity of 100,000 tonnes/year of battery materials, five times larger than their first plant.

- October 2024: Hyundai Auto Canada partnered with Canadian company Lithion as its official recycling partner for electric vehicle batteries. The collaboration follows an agreement from 2021 that validated Lithionʼs recycling technology. Under the new contract, Lithion will work with more than 250 Hyundai and Genesis dealers across Canada to support the collection and recycling of lithium-ion batteries.

REPORT COVERAGE

The electric vehicle battery recycling market research report provides a detailed market analysis and focuses on key aspects such as leading market participants, competitive landscape, and type. Besides this, it includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.2% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Vehicle Type

|

|

By Type

|

|

|

By Process

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 503.1 million in 2024.

The market is poised to grow at a CAGR of 21.2% during the forecast period (2025-2032).

By vehicle type, the passenger car segment captures the largest share due to the increased adoption of EVs globally.

The market size in North America stood at USD 56 million in 2024.

Large established companies such as Umicore NV/SA, Neometals Ltd., Li-Cycle Holdings Corp., Recyclico Battery Materials Inc., and Accurec-recycling GmbH dominate the electric vehicle battery recycling market.

Asia Pacific held the largest share of the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us