Elevator Maintenance Market Size, Share & Industry Analysis, By Component Maintained (Traction Systems, Hydraulic Systems, Control System, Cabin Interiors, Door & Safety Systems, Communication Systems, and Others), By Building Type (Residential Buildings, Commercial Buildings (Offices & Malls), Industrial Facilities, Public Infrastructure, and Hotels & Hospitality), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

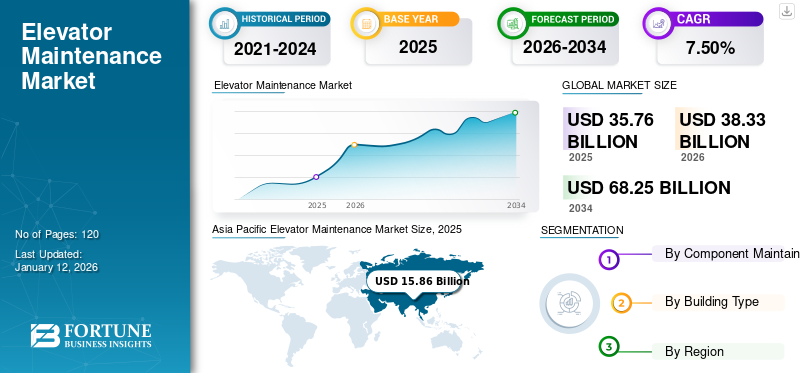

The global elevator maintenance market size was valued at USD 35.76 billion in 2025 and is projected to grow from USD 38.33 billion in 2026 to USD 68.25 billion by 2034, exhibiting a CAGR of 7.50% during the forecast period. The Asia Pacific dominated global market with a share of 44.30% in 2025.

Maintenance of elevators aids in reducing disruptions, preventing injury or death, and ensuring the elevator complies with regulations established by local and national jurisdictions. Elevators require ongoing maintenance and inspection according to guidelines provided by the governmental authorities, such as the Chief Labor Officer (CLO), the Bureau of Indian Standards (BIS), or the U.S. Occupational Safety and Health Administration (OSHA), for operational safety to ensure public safety.

Download Free sample to learn more about this report.

The market comprises a variety of services and activities that ensure elevators operate safely, reliably, and efficiently in different types of buildings. With servicing new elevators, the market also includes routine inspections, preventative maintenance, repairs, and modernization to ensure safety issues are addressed and existing elevator systems have an extended service life. Maintenance practitioners check mechanical and electrical components, lubricate moving components, replace worn components, and perform software or control system updates.

The market is composed of both investors with in-house teams and specialized third-party service teams that can contract tailor-made plans focused on maintenance for owners and facility managers. Prominent companies currently operating in the elevator maintenance market include Otis, Kone, Schindler, and Thyssenkrupp among others.

MARKET DYNAMICS

ELEVATOR MAINTENACE MARKET TRENDS

Integration of IoT and Digitalization Transforms Elevator Maintenance into a Proactive, Data-Driven Process

IoT and digitalization have rapidly changed elevator maintenance from reactive or time-based maintenance to a proactive data-informed process. This has been made possible through the use of sensors that are installed throughout the elevator system – motors, brakes, doors, cables, etc. – that collect real-time performance data continuously. The sensors transfer data over networks to a cloud platform, creating a digital platform. The maintenance companies can use the platform to connect remotely to monitor the elevator's health and performance parameters and receive notifications about anomalies and issues before they become failures and breakdowns.

The digital transformation provides substantial benefits for both service providers and elevator owners. Service providers can now pivot to value-added managed services, allocate available resources, and, through asset insights, be in a position to act more quickly. For the building owner, this change together improves elevator reliability, reduces unexpected downtime, lowers maintenance costs given predictive maintenance takes place, improves safety compliance, and provides more extensive data for asset management. The move to connected elevators, digital maintenance platforms, and preventative maintenance continues to drive efficiencies and will ultimately define the competitive landscape in the market. More than ever, services and building performance show the need to exceed lift standards in all aspects.

MARKET DRIVERS

Technological Advancements Enable Predictive Maintenance in Vertical Transportation, Driving the Market Growth

The elevator industry is highly influenced by growing needs for efficient vertical transportation and building strategies to accommodate the growing urban infrastructure. As structures expand vertically and become more intricate, reliability and continuous service become paramount for vertical transportation. As a result, being consistent and continual are crucial maintenance strategies that prioritize ongoing and safe elevator service. Predictive maintenance, commonly known as condition-based maintenance (CBM), identifies components’ weaknesses and prevents breakdowns with minimal disruption to service by using real-time performance data derived from a system of Internet-of-Things (IoT) sensors that are adhered to the elevator components.

Predictive maintenance also provides a holistic assessment regarding the lifecycle of vertical transportation. Performance trends and wear patterns can be analyzed, thus allowing service providers to determine optimal schedules to organize useful resources, maintain safety, and reduce costs. Shifting to predictive maintenance represents a paradigm shift in traditional elevator maintenance models and is a considerably contributing to the elevator market growth and change. This is also allowing vertical transportation services to be safe, reliable, and efficient in an increasingly demanding environment.

MARKET RESTRAINTS

Aging Infrastructure and Safety Concerns Hinders the Market Growth

The prevalence of aging infrastructure in the elevator and escalator sector poses a considerable challenge to the market. Numerous buildings, specifically in few parts of Europe, are still using elevators over 20 years old with outdated technologies such as screw conveyor-based systems and hydraulic systems. Moreover, maintaining these systems is highly challenging due to a shortage of replacement parts and specialized technical skills that can (and will) often increase the expense of maintenance and lead to challenging downtimes for owners. This ultimately affects the elevator maintenance market, as the service provider often struggles in providing timely or affordable maintenance services to older equipment, thus limiting the overall market size.

In addition, the increasing occurrence of accidents and safety issues related to aging elevators and escalators can also pose risks to the demand for elevators and their maintenance services. Many owners may defer from upgrades or maintenance due to a cautious desire to remain within a budget and therefore pose a risk of regulatory compliance, knowing that a lack of proper maintenance, upgrades, and safety may endanger the buildings’ tenants and visitors.

MARKET OPPORTUNITIES

Technological Advancements Accelerate Construction Activity, Unlocking New Market Opportunities

Due to rapid advancements in technology, the construction industry has undergone change and innovation previously unable to be imagined. Digital tools such as artificial intelligence, generative AI, drones, and robotics have increased efficiencies, aided in project management, improved design accuracy, and positively impacted the safety on job sites. While these technologies offer advances in efficiency and cost, they also allow construction firms to take on more complex projects, respond to market demands, and more effectively address labor shortages.

As a result, the construction industry has seen numerous opportunities for business, particularly in markets where infrastructure investment and new real estate development are increasing. As governments and private developers invest heavily in smart cities, sustainable buildings, large-scale infrastructure, and construction development companies willing to embrace new technologies, put themselves in the best position to capture a larger share of a growing construction market. This drives the growth, increases profit margins, and offers a sustainable future for leading firms in real estate and construction.

Segmentation Analysis

By Component Maintained

Rapid Urbanization and Technological Advancements Propel the Traction System’s Segmental Growth

Based on component maintained, the market is classified into traction systems, hydraulic systems, control systems, cabin interiors, door & safety systems, communication systems, and others.

The traction systems segment has the highest elevator maintenance market share. The reasons for their dominance include extensive use in high-rise buildings and mechanical complexity, which requires regular and specialized maintenance. In addition, as the traction elevators provide vertical movement for tall structures, safety and operational reliability are paramount, making room for continued demand for elevator maintenance. Because of the high degree of dependence on specialized knowledge, commissioned parts, and materials, traction is expected to continue to elevate maintenance spending over every other elevator category.

Door and safety systems account for a significant part of the market, mainly due to safety regulations and high volumes of door service needs.

At the same time, control systems have the highest growth rate in the market. Increased use of smart elevator technologies and advanced automation are contributing to the increased demand for maintenance services in this category, and have the potential to foster greater demand in the future. As buildings become increasingly technologically complex, the need for regular maintenance of the control and communication systems should become more, not less, pronounced, leading the way for the availability of elevator maintenance.

By Building Type

Urban Expansion and Commercial Development Drive the Residential Buildings Segmental Growth

Based on building type, the market is classified into residential buildings, commercial buildings (offices & malls), industrial facilities, public infrastructure, and hotels & hospitality.

Residential buildings account for the largest share of the market. The sheer volume of residential buildings, especially in areas undergoing rapid urbanization, and frequent need for regular maintenance to ensure the safety of daily users, contribute to the segment’s dominance. The continuous daily activity in apartment complexes or condominiums means that there is a large commitment to maintenance and significant demand in this market area. An international trend of incorporating elevators into the everyday function of modern residential developments also maintains the claim of the transport market being at the front of the residential category.

The commercial building segment has a significant market share due to operational standards and frequent use, but overall, it has a smaller share than the residential segment.

The hotel & hospitality facilities segment is growing at the fastest by CAGR. The growth of the tourism and travel segment, investments in luxury hotels, and guest safety & experience are driving the demand for advanced and maintained elevator systems. Therefore, elevator maintenance for hotels and hospitality facilities is growing quickly, thus indicating a wider industry trend across global travel and hospitality modernization.

Elevator Maintenance Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Elevator Maintenance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region is experiencing robust and sustained growth, supported by rapid urbanization, construction activity, and smart and energy-efficient elevators. Asia Pacific dominated the global market in 2025, with a market size of USD 15.86 billion. Elevator maintenance market growth in this region remains strong despite high initial capital costs and complexities through regulation. Continued demand through residential and commercial development, especially in developing economies, will continue to support growth in the future. China, as a main player in the region, sees extremely strong demand fueled by high-rise development and urbanization. The status of the real estate market in the country may impact new installations and service needs. Still, continued investment in modernization and predictive technologies will aid in ensuring safety and efficiency.

North America

The region is experiencing stable and technology-driven growth, supported by a mature building infrastructure with strict safety regulations and is dense with elevators in commercial and residential applications. Pre-established service for the equipment and a performance-driven market with a focus on advanced technologies such as IoT and predictive maintenance, offers assurance of mitigated risks of not complying with new safety and compliance codes across the region. Also manufacturers in U.S. are focusing on implementation of IoT sensors, AI-based predictive diagnostics, cloud systems, and energy-saving modernization solutions in order to expand maintenance scopes and services.

Europe

Europe is undergoing modernization-led and sustainability-focused growth, fueled by developed infrastructural standards and regulations and a large number of existing elevators that need modernization. The region is highly focused on energy efficiency, sustainability, and the adoption of smart building technologies, which are influencing maintenance practices.

Rest of the World

The market in the rest of the world region is gradually expanding, driven by advances in urbanization, infrastructure development, and modernization of elevators/elevator systems. In contrast, upward momentum is less compared to the developed regions, safety awareness, and regulatory advances are contributing to steady demand for service.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in their Dominating Position in the Market

The elevator maintenance industry is dominated by several global giants with extensive service networks and a strong focus on technological innovation. Companies such as Otis, Kone, Schindler, and Thyssenkrupp have established themselves as leaders by offering comprehensive maintenance, modernization, and digital monitoring solutions across diverse building types. Their global reach and investment in smart technologies, such as predictive analytics and IoT integration, help ensure reliability, safety, and energy efficiency for clients all over the globe.

Japanese firms, including Mitsubishi Electric and Fujitec, are recognized for their advanced engineering, quality standards, and strong presence in Asia and beyond. These companies emphasize continuous improvement in service delivery, leveraging automation and robust after-sales support to maintain high customer satisfaction. Regional players, including Johnson Lifts and Hyundai Elevator, are also expanding rapidly, capitalizing on urbanization trends and increasing demand for modernization in emerging markets.

The industry is further shaped by specialized companies such as Hitachi, Toshiba, and Stannah, which focus on niche segments such as high-rise solutions, home elevators, and accessibility products. Chinese manufacturers, including Hosting Elevator, are gaining traction with large-scale production capabilities and competitive service offerings, contributing to a dynamic and evolving competitive landscape.

LIST OF KEY ELEVATOR MAINTENANCE COMPANIES PROFILED

- Otis (U.S.)

- Kone (Finland)

- Schindler (Switzerland)

- Thyssenkrupp (Germany)

- Mitsubishi Electric (Japan)

- Fujitec (Japan)

- Hyundai Elevator (South Korea)

- Hitachi (Japan)

- Toshiba (Japan)

- Johnson Lifts (India)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Otis Worldwide Corporation got a contract from Emaar Properties to modernize 34 elevators and 8 escalators in Burj Khalifa in Dubai, UAE (the tallest building in the world). The contract included a ten-year service agreement. Otis aims to modernize the elevator management system to enable real-time remote monitoring and provide highly efficient operations.

- October 2023: KONE Corporation announced that the sale of its Russian operations to S8 Capital, a varied holdings company based in Russia, is completed.

- October 2023: TK Elevator GmbH launched its EXO Renew Series of elevators for low-rise and high-rise residential buildings. The differentiation of this series is versatility and the use of 100% green electricity. The new and improved series announced a decrease in energy consumption of 28% over that of the previous model.

- August 2023: In Gurgaon, India, Fujitec India Private Ltd, a subsidiary of Fujitec Co. Ltd, was awarded the order for 538 elevators for a large residential housing project. The elevators will be produced at Fujitec's high-rise facility in Chennai and are set to be produced prior to the end of 2025.

- July 2023: Around 150 elevators are supplied by Schindler as part of the partnership with Umm Al Qura in Saudi Arabia, which is installed in Makkah. The elevators and platform elevators are part of the Schindler 5000 and Schindler 7000 series, for owners in hotels and restaurants, with the goal of enhancing passenger movement.

REPORT COVERAGE

The global elevator maintenance market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of malocclusion in key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and the number of Elevator Maintenance in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.50% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component Maintained

|

|

By Building Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 38.33 billion in 2026 and is projected to reach USD 68.25 billion by 2034.

In 2025, the market value stood at USD 15.86 billion.

The market is expected to exhibit a CAGR of 7.50% during the forecast period.

The residential building led the market by building type in terms of market share.

The key factors driving the market are the technological advancements that enable predictive maintenance in vertical transportation.

Otis, Kone, Schindler, and Thyssenkrupp are the top players in the market.

Asia Pacific dominated the market in 2025.

Major factors expected to favor product adoption in the elevator maintenance market include rapid urbanization and increased construction of commercial and residential buildings, along with technological advancements such as smart monitoring and predictive maintenance systems that enhance safety, reliability, and operational efficiency.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us