Elevator and Escalator Market Size, Share & Industry Analysis by Product (Elevators, Escalators, and Moving Walkways), By Business (New Equipment, Maintenance, and Modernization), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Elevator and Escalator Market Size

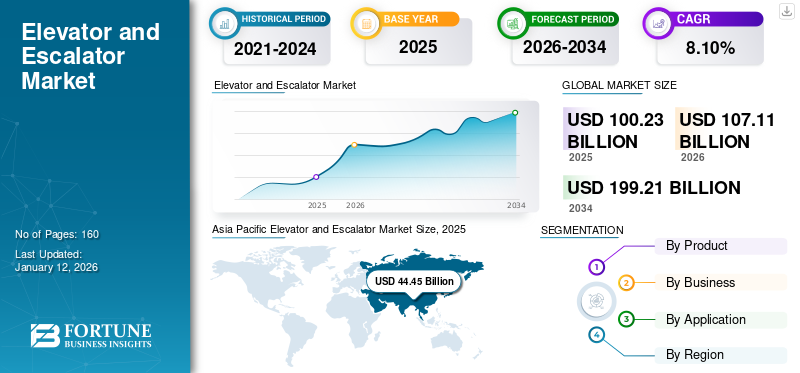

The global elevator & escalator market size was valued at USD 100.23 billion in 2025. The market is projected to grow from USD 107.11 billion in 2026 to USD 199.21 billion by 2034, exhibiting a CAGR of 8.10% during the forecast period. Asia Pacific dominated the global market with a share of 44.45% in 2025. The elevators & escalators market in the U.S. is projected to grow significantly, reaching an estimated value of USD 28.42 Bn by 2032, driven by the government initiatives and increasing investment in infrastructure.

Elevators and escalators are generally used in residential, commercial, and industrial spaces. Moving walkways are generally installed at airports, metro stations, and railway stations for vertical transportation. Additionally, pneumatic lifts, wheelchair lifts, and glass lifts are some of the products available in the market. These products are used in the industrial sector to move concrete materials, goods, and inventory from one floor to another.

Increasing investment in residential and commercial buildings across developed and developing countries results in global market growth. Moreover, major governments have planned to invest in skyscrapers and the tallest building projects, which is expected to drive the market growth. For instance, in January 2024, the government of Saudi Arabia planned to invest around USD 500 billion for the development of a twin skyscraper for 500 meters (1,640 feet). This skyscraper houses a mix of retail, residential, and office spaces. Rapid urbanization has fueled the need for smarter and more efficient technologies.

Many companies that specialize in elevators are now manufacturing escalators. The market players are observed to continue innovating and rethinking their technological inputs to incorporate better efficiency, lifespan, safety, and reliability in both escalators and elevators. For instance, according to the World Bank Group, the urbanization rate in China is projected to grow from 45% in 2010 to 70% by 2030. All such factors drive the growth of the global elevators and escalators market.

The COVID-19 pandemic negatively impacted the elevator and escalator market in China in the short term. It is owing to halted construction, and manufacturing facilities across the globe. Moreover, disruption in supply chain of raw materials restrained the growth of the market during the COVID-19 pandemic. The industry showed signs of recovery as governments implemented stimulus measures and the industry adapted to the new normal. After COVID-19 pandemic, the manufacturers are bringing new technological advancements in the product portfolios, which is anticipated to provide positive growth for the industry.

Elevator and Escalator Market Trends

Smart Elevators and Green Lift Strategies to Provide a New Wave of Advancements in the Elevator and Escalator Industry

The introduction of environment friendly elevators has played an important role in the growth of the green building market. These elevators operate with much less energy and require much less space to install. There are also several green strategies available to eco-modernize existing traditional elevators. Therefore, the increasing shift toward eco-friendly products is likely to increase the size of the market. The global energy consumption has been rising continuously. As a result, consumers and companies are prioritizing the adoption and development of sustainable products such as recycled materials, LED lights, and water-soluble paints, which are among the elements of green elevators.

Furthermore, elevator manufacturers are leveraging alternatives to rope and pulley systems, such as gearless motor systems and magnetic motors. The green projects in the elevator & escalator industry are attracting investments from manufacturers that are likely to influence the growth rate of the market. For instance, in March 2023, Hyundai Elevator planned to introduce a new non-contact elevator button that uses infrared sensors and an AI-based mechanism. The use of smartphones and API platforms operates this new technology. These are the latest trends in the market.

Download Free sample to learn more about this report.

Elevator & Escalator Market Growth Factors

Increasing Investment in Infrastructure to Propel Industry Growth

The increasing infrastructure spending in emerging economies is fueling the market growth. In addition, the UNCTAD Trade and Development report analyzes more than 40 developing countries, emphasizing infrastructure projects across developed and developing countries. Rising government investment in the building of highways, schools, airports, railway stations, and urban infrastructure will create the demand for such products and drive market growth. For instance, according to Invest India Report, India plans to invest USD 1.4 trillion in infrastructure in the next five years from 2024 to 2029. Additionally, the Policy Forum stated that China’s smart city investment was around USD 30.4 billion in 2018 and is expected to reach more than USD 59.9 billion by 2023. All such investments in infrastructure building drive the growth of the global elevator and escalator market growth.

RESTRAINING FACTORS

Rise in Elevator and Escalator Casualties to Impact Market Growth

Surging concern about accidents occurring in the transportation of elevators and escalators, which is restraining the market growth. According to the U.S. Bureau of Labor Statistics, approximately 17,000 people were injured and more than 30 casualties were recorded from these accidents in the U.S. in 2020. However, increased safety measures in commercial and industrial premises are expected to reduce accidents during repair and maintenance work. Furthermore, initiatives toward improving the quality of the products and the high-security measures implemented by manufacturers available in the market would help reduce the number of accidents.

Elevator and Escalator Market Segmentation Analysis

By Product Analysis

Elevator Segment Dominated the Market Owing to Increasing Demand from Evolving Infrastructure

Based on product, the market is categorized into elevators, escalators, and moving walkways.

The elevator segment is projected to dominate the market with a share of 69.64% and a market size of USD 74.59 billion in 2026. This is owing to rising demand from the residential, commercial, and industrial sectors. Additionally, the growth in the aging population across China, India, and others creates the demand for elevators, which fuels the market growth.

The escalator segment is projected to grow steadily during the forecast period, owing to rising demand from commercial parks, high rise buildings, amusement parks, and shopping malls. In addition, rising number of shopping malls, and commercial spaces across the globe, which fuels the growth of the market.

The moving walkway segments are projected to grow at a moderate growth rate during the forecast period, owing to rising construction of new airports, metro stations, and railway stations across diversified locations drives the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Business Analysis

Maintenance Segment Dominated Due to Rising Product Launch and Product Development Initiatives

Based on business, the market is segmented into new equipment, maintenance, and modernization.

The maintenance segment is projected to dominate the market with a share of 51.39% and a market size of USD 55.04 billion in 2026. This is owing to the adoption of product development and product launches as key developmental strategies by major manufacturers. For instance, in March 2024, Otis Worldwide Corporation received an order for the modernization of 34 elevators in Burj Khalifa based in the U.A.E. The Burj Khalifa is the world’s tallest building. Further, the company got a maintenance and modernization contract for ten years.

The new equipment segment has significantly contributed to the market’s revenue growth. This is due to a surge in urbanization, rising construction activities, and the installation of new elevators and escalators from the residential and commercial sectors.

Additionally, the modernization segment is projected to grow with the highest CAGR of 8.8% during the forecast period due to the keen implementation of green technology, which has increased the influx of residential, commercial, and industrial space modifications in the recent past. For instance, in August 2023, Fujitech Singapore Corporation Ltd, a subsidiary of Fujitec Co. Ltd, installed around 19 modernized elevators across Singapore. This modernized elevator offers features such as the ease of installation, greater comfort, and more stability. These factors contributed to the global elevator and escalator market share.

By Application Analysis

Residential Segment Dominated the Market Owing to High Product Adoption

Based on application, the market is segmented into residential, commercial, and industrial.

The residential segment is projected to dominate the market with a share of 68.48% in 2026. This is owing to rising product penetration across multi-homes, and residential apartments. In addition, increasing investment in the residential sector will drive the market growth. For instance, according to the World Resources Institute, China is expected to spend more than USD 13 trillion on buildings by 2030. Such favorable instances drive the elevator & escalator demand.

The commercial segment is projected to grow moderately given that such products are installed in office buildings, educational institutes, hotel chains, and shopping malls. Additionally, growing trends toward adaptable designs that are eco-friendly and emission-free enhance the demand for elevators from commercial sectors.

The industrial sector to grow decently during the forecast period. It is owing to growth in industrialization across Germany, France, and Italy, among others, enhanced the demand for freight lifts and material lifts from the manufacturing and automotive sectors. In addition, major players such as Schindler Group, Mitsubishi Electric Corporation, and others are engaged in offering customized industrial lifts to the market.

REGIONAL INSIGHTS

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Asia Pacific Elevator and Escalator Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

According to our analysis, Asia Pacific is projected to dominate the market with a valuation of USD 44.45 billion in 2025, increasing to USD 47.83 billion in 2026. Growth in tourism across economies in Asia Pacific, including India, China, Japan, and others, has driven the demand for elevator & escalator products. Moreover, major manufacturers try to bring new products into the Asian market. For instance, in February 2023, Hyundai Elevator introduced a new technology with AI prediction technology to 1,100 elevators, which reduces the number of stoppages and time by 43% using vertical transportation. This technology is made using artificial intelligence (AI) and big data-enabled prediction technology. Such an advancement in elevator technology helps to reduce traveling time. The Japan market is projected to reach USD 4.22 billion in 2026, while the India market is valued at USD 2.32 billion in the same year.

China to Witness Noteworthy CAGR with Increasing Development of Smart Products

China is projected to maintain its dominance during the forecast period due to the rising geriatric population and growth in the construction industry across China, which enhances the elevator and escalator demand among residential and commercial sectors, which drives the market growth. Moreover, new equipment and modernization services projects are carried out and may be completed in the upcoming years, which creates the demand for such products to drive the market growth. For instance, in November 2022, Kone Corporation received an order to install 28 Kone elevators and 228 escalators for a metro line project in Chongqing, China. This order also consists of two years of maintenance services. All such factors drive the growth of the market. The China market is projected to reach USD 34.41 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is experiencing a steady growth rate attributed to the expansion of intelligent building concepts and the modernization of traditional building structures. Market participants have a strong presence across the U.S. and Canada and are constantly working on the modernization of buildings by providing elevator & escalator services to their end-users. A rise in eco-friendly infrastructural activities and the development of smart cities across the U.S., which enhances the demand for elevators and escalators, drives the growth of the market during the forecast period. Further, increasing penetration of maintenance and modernization services by key players across North America, drives the growth of the market. The U.S. market is projected to reach USD 17.78 billion by 2026. The UK market is expected to reach USD 3.77 billion by 2026.

Europe is set to experience modest growth during the forecast period owing to the renovation and development of high-rise building infrastructure across Germany, the U.K., France, and others. In addition, the increasing geriatric population in countries such as Germany, Greece, the U.K., and Spain, among others, created the demand for elevator modernization services across Europe. For instance, the aging population in Germany grew by 1.2 from 2021 to 2022. Such a growth in the aging population drives the elevator and escalator demand, bolstering the growth of the market. The Germany market is estimated to be USD 10.73 billion by 2026.

The Middle East & Africa and Latin America markets are expected to grow decently during the forecast period, owing to the rising number of high skyscraper buildings across Dubai, Saudi Arabia, and Qatar, among others. Additionally, the government brings investment for the expansion of new infrastructure buildings across residential and commercial sectors to drive market growth. For instance, according to Saudi Arabia Vision 2030, the Saudi Arabian government planned to invest around USD 1,865.4 billion by 2030 from 2016. Such favorable factors drive market growth. The Latin America market is projected to reach USD 2.74 billion by 2026, representing a 2.60% share in 2025.

Key Industry Players

Major Players Engaged in Adopting Product Launches, Product Development, and Acquisitions as Key Strategic Moves to Gain a Competitive Edge

Key companies in the market are Kone Corporation, Schindler, Otis Worldwide Corporation, TK Elevator GmbH, SJEC Corporation, and Mitsubishi Electric Corporation, among others. These players are engaged in adopting product launches, acquisitions, and product development as key developmental strategies to gain an edge over their competitors. For instance, in January 2024, Otis Brazil, a subsidiary of Otis Worldwide Corporation, completed the modernization of 13 elevators at 21 residential buildings in Sao Paulo, based in Brazil. Furthermore, the company has been contracted for maintenance services and modernization services for 3 years.

List of Top Elevator and Escalator Companies:

- Fujitec Co. Ltd (Japan)

- Hitachi Ltd (Japan)

- Hyundai Elevator Co Ltd (South Korea)

- Kone Corporation (Finland)

- Mitsubishi Electric Corporation (Japan)

- Otis Worldwide Corporation (U.S.)

- Schindler (Switzerland)

- SJEC Corporation (China)

- TK Elevator GmbH (Germany)

- Toshiba Corporation (Japan)

KEY INDUSTRY DEVELOPMENT:

- March 2024: Otis Worldwide Corporation received an order for the modernization of 34 elevators in Burj Khalifa based in the U.A.E. The Burj Khalifa is the world’s tallest building. The company got a maintenance and modernization contract for ten years.

- October 2023: TK Elevator GmbH launched the new EXO Renew Series of elevators for low-rise and high-rise residential buildings. It is versatile, designed for using 100% green electricity and requires 28% less energy compared to other models.

- August 2023: Fujitec India Private Ltd, a subsidiary of Fujitech Co. Ltd, received an order of 538 elevators for large-scale residential housing projects in Gurgaon, India. These elevators would be manufactured and supplied from a high-rise elevator manufacturing facility based in Chennai, India. This order would be completed by the end of 2025.

- July 2023: Schindler signed a partnership with Umm AI Qura, based in Saudi Arabia, to provide 150 elevator orders for installation at Makkah, Saudi Arabia. This order includes 65 Schindler 5000 series elevators, 44 Schindler 7000 series elevators, and five elevators for the platform. These elevators help to improve passenger transportation from restaurants and hotels.

- March 2023: Hyundai Elevator Co. planned to introduce a new non-contact elevator button that uses infrared sensors and an AI-based mechanism. A smartphone and API platform operates this new technology.

- September 2022: Hitachi Ltd introduced a new touchless operating panel for monitoring and controlling elevators and escalators. It has features such as enabling touchless use, a simplified method, and operating through a numerical pad.

- June 2022: Fujitech Taiwan Co. Ltd, a subsidiary of Fujitech Co. Ltd, expanded its elevator plant in Taiwan. The basic aim of the expansion was to increase the production capacity of elevators by 1,000 in Taiwan by 2022.

REPORT COVERAGE

The report provides an in-depth analysis of the dynamics of the elevators and escalators industry and the competitive landscape. The report also provides market estimation and forecast based on product type, business, application, and region. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, By Business, By Application, and By Region |

|

Segmentation |

By Product

By Business

By Application

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market was valued at USD 100.23 billion in 2025.

In 2034, the market is expected to reach USD 199.21 billion.

The market is projected to grow at a compound annual growth rate (CAGR) of 8.10% during the forecast period (2026-2034).

The elevators segment is expected to lead the market over the forecast period.

Increasing infrastructure investment and rise in adoption of energy-efficient elevators and escalator are expected to propel the market growth

Otis Corporation, Schindler, TK Elevator GmbH, and KONE Corporation are the leading companies in this market

Asia Pacific held the major share of the market in 2025 owing to increasing residential and commercial infrastructure projects.

The increasing adoption of green-labeled products is one of the emerging trends in the market.

The maintenance business is expected to lead the market over the forecast period.

By application, the residential segment is the leading segment in this market and held the largest share in 2025, owing to the high demand for multi-family homes, and residential apartments

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us