Embedded AI Market Size, Share & Industry Analysis, By Component (Hardware and Software & Services), By Deployment Mode (Edge, Cloud, and Hybrid), By Data Type (Sensor Data, Image and Video Data, Numeric Data, Categorical Data, Text and Audio Data, and Others), By End-user (BFSI, Automotive, Healthcare, Consumer Electronics, Manufacturing, Retail & E-commerce, IT & Telecom, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

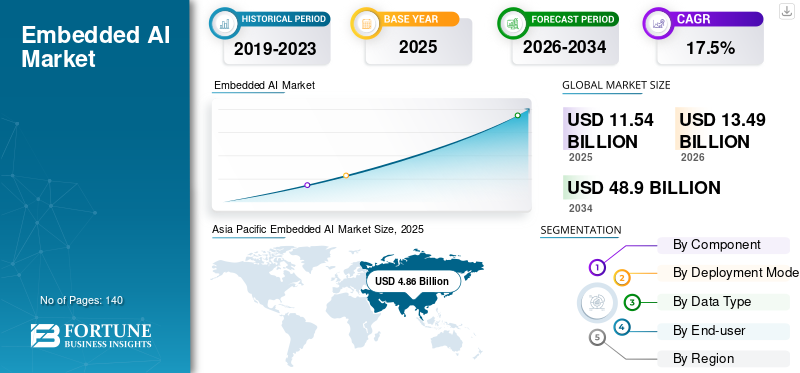

The global embedded AI market size was valued at USD 11.54 billion in 2025. The market is projected to grow from USD 13.49 billion in 2026 to USD 48.90 billion by 2034, exhibiting a CAGR of 17.5% during the forecast period. Asia-specific dominated the global market with a share of 42.11% in 2025.

The market refers to the ecosystem of hardware, software, and integrated technologies. It enables artificial intelligence processing to be performed directly on devices and edge systems, rather than relying solely on cloud-based computation. These components are deployed across a wide range of end-users, including BFSI, automotive, healthcare, consumer electronics, manufacturing, retail and e-commerce, IT and telecom, and other sectors that require localized, real-time intelligence. These solutions are being increasingly integrated into embedded devices and resource constrained devices, which play a crucial role in advanced AI and machine learning capabilities at the edge.

Further, leading players in this market include NVIDIA Corporation, Qualcomm Incorporated, NXP Semiconductors N.V., STMicroelectronics N.V., Texas Instruments Incorporated, Renesas Electronics Corporation, Arm Holdings plc, Intel Corporation, MediaTek Inc., and Hailo Technologies Ltd.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Real-Time, On-Device Intelligence to Drive Market Growth

The market is benefiting from the growing demand for instant AI processing that does not rely on cloud connectivity. Industries such as automotive, manufacturing, and consumer electronics increasingly rely on embedded intelligence to enable faster decision-making and enhanced operational efficiency. For instance,

- Industry experts project that more than 90% of vehicles sold in 2030 will be connected, up from about 50% today, highlighting the growing need for real-time, on-board intelligence in automotive systems.

The shift toward autonomy and smart device ecosystems continues to drive the market growth. As a result, these solutions play a crucial role in delivering low-latency, secure, and reliable performance across critical applications.

MARKET RESTRAINTS

High Complexity and Cost of Developing Specialized Embedded AI Hardware and Software to Hamper Market Growth

Developing embedded AI systems requires substantial investment in specialized processors, firmware optimization, and tightly integrated software stacks. For instance,

- Cisco’s Annual Internet Report had projected 3.6 networked devices and connections per person globally in 2023, underscoring the massive scale of hardware and software that needed to be engineered and maintained, adding to the complexity and cost for embedded AI deployments.

The need for advanced engineering expertise and long development cycles increases the overall cost for manufacturers and solution providers. Limited standardization across hardware architectures further complicates development efforts and integration processes. These challenges collectively restrict wider adoption, particularly among small and mid-sized enterprises with constrained budgets.

MARKET OPPORTUNITIES

Rising Adoption of Embedded AI in Safety-Critical Automotive and Healthcare Applications to Present Lucrative Growth Opportunities

Embedded AI technologies are being increasingly incorporated into advanced driver-assistance systems, medical diagnostics, and monitoring devices, where reliability and real-time decision-making are essential. For instance,

- Remote patient monitoring statistics indicate that nearly 50 million people in the U.S. already use remote monitoring devices and approximately 69% of healthcare organizations are utilizing or planning to use such tools, illustrating strong momentum for technology in medical diagnostics and monitoring.

These sectors are investing in high-performance, energy-efficient AI accelerators to enhance operational safety and improve accuracy. Regulatory support for intelligent, safety-enhancing technologies is further reinforcing demand. As a result, automotive and healthcare deployments represent high-value growth avenues for technology providers.

EMBEDDED AI MARKET TRENDS

Increasing Integration of Embedded AI into Edge IoT and Autonomous Systems to Emerge as a Key Market Trend

A major trend shaping the market is the rapid convergence of embedded AI applications with edge IoT platforms and autonomous technologies. For instance,

- The Ericsson Mobility Report forecasts that short-range IoT connections will increase from 10.2 billion in 2022 to 28.7 billion by 2028, reflecting the rapid proliferation of edge and IoT endpoints where technology can be deployed.

Organizations are deploying compact AI accelerators and optimized processors within distributed devices to enhance local analytics and system responsiveness. Advances in lightweight AI models and power-efficient chip architectures support this trend. As adoption expands, the technology is becoming central to next-generation smart infrastructure, robotics, and intelligent mobility solutions.

SEGMENTATION ANALYSIS

By Component

Hardware Segment Dominated Due to its Foundational Role in AI Enabled Edge Intelligence

Based on component, the market is divided into hardware and software & services.

The hardware segment led the market in 2025. This has been recorded as AI-enabled processors, sensors, accelerators, and system-on-chip solutions form the foundational layer required to integrate intelligence directly into devices and edge systems.

The software & services segment is expected to grow at the highest CAGR of 19.0% during the forecast period. This is owing to the rising demand for AI model optimization, deployment platforms, lifecycle management tools, and consulting services that help enterprises customize and maintain embedded AI solutions.

By Deployment Mode

Edge Deployment Leads Owing to its Ability to Support Low Latency, Privacy, and Offline AI Processing

Based on deployment mode, the market is classified into edge, cloud, and hybrid.

The edge deployment mode accounts for the largest share of the market, owing to the embedded AI workloads, which are executed locally on devices to meet stringent requirements for low latency, data privacy, and offline operation.

The hybrid segment is projected to record the maximum CAGR of 18.6% over the forecast period. This has been estimated as organizations increasingly combine on-device inference with cloud-based training, updates, and orchestration to balance performance, scalability, and cost.

By Data Type

Sensor Data Dominates Driven by its Central Role in Real Time Device Decision Making

Based on data type, the market is divided into sensor data, image and video data, numeric data, categorical data, text and audio data, and others.

The sensor data segment dominates the market since a majority of use cases, particularly in industrial, automotive, and consumer devices, rely on continuous streams of signals from motion, pressure, temperature, and other physical sensors for real-time decision-making.

The image and video data segment is anticipated to grow at the highest CAGR of 19.5% during the forecast period. This is due to the expanding adoption of embedded computer vision in surveillance, ADAS, robotics, smart retail, and consumer imaging applications.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Rapid Adoption of Embedded AI Drives Consumer Electronics Segmental Growth

The end-user market is subdivided into BFSI, automotive, healthcare, consumer electronics, manufacturing, retail & e-commerce, IT & telecom, and others.

The consumer electronics segment leads the market. This has been observed as smartphones, wearables, smart home devices, and personal gadgets have rapidly integrated technology features to enhance user experience, personalize services, and facilitate on-device processing.

The automotive segment is expected to register the highest CAGR of 20.6% during the forecast period. This expansion is driven by the increasing deployment of technology in advanced driver-assistance systems, autonomous driving platforms, in-vehicle infotainment, and predictive maintenance solutions.

Embedded AI Market Regional Outlook

By geography, the market is categorized into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific

Asia Pacific Embedded AI Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest embedded AI market share due to its strong concentration of electronics and semiconductor manufacturing, particularly in China, Japan, South Korea, and Taiwan. The rapid adoption of smart consumer devices, automotive electronics, and industrial automation significantly boosts the demand for on-device intelligence in the region. Continued investments in 5G, IoT infrastructure, and national AI initiatives are expected to sustain the region’s position as the fastest-growing market over the forecast period.

Download Free sample to learn more about this report.

North America

North America accounts for the second-largest share in the adoption of embedded AI, supported by early adoption of advanced AI technologies and the presence of leading chipmakers, cloud providers, and embedded system vendors. High R&D spending and strong innovation ecosystems in sectors such as automotive, industrial, and healthcare foster the rapid integration of technology into products and platforms. In addition, the robust demand for edge analytics and autonomous systems across enterprises reinforces the region’s sizeable market position.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds a significant share of the market, largely due to its established automotive, industrial machinery, and healthcare industries. Ongoing Industry 4.0 programs and factory automation initiatives drive the deployment of AI at the edge within production lines and equipment. Furthermore, stringent data protection and safety regulations encourage on-device processing, thereby supporting the adoption of these solutions across EU member states.

Middle East & Africa

The Middle East & Africa market is expected to expand rapidly as governments and enterprises accelerate smart city, security, and infrastructure modernization projects that rely on this technology. Large-scale investments in surveillance, utilities, transportation, and oil and gas automation are creating new demand for edge intelligence. Although the current revenue base is relatively small, the increasing number of digital transformation initiatives positions the Middle East & Africa among the rapidly-growing regional markets.

South America

South America is also expected to experience strong embedded AI market growth as Brazil, Mexico, and Argentina scale up digitalization across telecom, banking, retail, and public services. The increasing adoption of smartphones, smart consumer devices, and connected industrial equipment is driving the demand for embedded AI capabilities in the region. The expanding use of AI-driven automation in agriculture, mining, and logistics further supports a robust growth outlook, given its comparatively low installed base.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasize Innovation through Product Launches to Strengthen Market Positioning

Players launch new products to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, as well as acquisitions and partnerships, to strengthen their offerings. Such strategic launches enable the technology companies to maintain and expand their market share in a rapidly evolving landscape.

LIST OF KEY EMBEDDED AI COMPANIES PROFILED

- NVIDIA Corporation (U.S.)

- Qualcomm Incorporated (U.S.)

- NXP Semiconductors N.V. (Netherlands)

- STMicroelectronics N.V. (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Renesas Electronics Corporation (Japan)

- Arm Holdings plc (U.K.)

- Intel Corporation (U.S.)

- MediaTek Inc. (Taiwan)

- Hailo Technologies Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS

- In October 2025, Qualcomm introduced its AI200 and AI250 rack-scale inference accelerator cards targeting demanding embedded and edge AI workloads. These products demonstrate the company’s continued investment in high-performance, scalable AI infrastructure solutions.

- In August 2025, Hailo detailed the Hailo-10H as the first edge-AI chip capable of running on-device large language and vision language models. This development significantly reduces reliance on cloud processing by enabling sophisticated generative AI tasks to be performed locally.

- In July 2025, Hailo Technologies Ltd. commenced commercial shipments of the Hailo-10H edge-AI accelerator, designed to support advanced on-device generative AI workloads. This release marks a major milestone in bringing high-performance inference capabilities to compact embedded systems.

- In May 2025, Qualcomm announced its intention to expand into the data-center processor market with custom CPUs designed for compatibility with NVIDIA’s AI platforms. This move underscores the company’s strategy to extend its embedded and enterprise AI footprint beyond mobile solutions.

- In April 2025, Qualcomm Incorporated completed the acquisition of Edge Impulse Inc. and introduced new developer kits specifically designed for edge AI applications. This initiative enhances its embedded AI ecosystem, particularly within IoT and low-power device environments.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.5% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, By Deployment Mode, By Data Type, By End-user, and By Region |

|

By Component |

· Hardware o CPUs o GPUs o ASICs o FPGAs o NPUs/TPUs o Neuromorphic Chips o Others · Software & Services |

|

By Deployment Mode |

· Edge · Cloud · Hybrid |

|

By Data Type |

· Sensor Data · Image and Video Data · Numeric Data · Categorical Data · Text and Audio Data · Others |

|

By End-user |

· BFSI · Automotive · Healthcare · Consumer Electronics · Manufacturing · Retail & E-commerce · IT & Telecom · Others (Government) |

|

By Geography |

· North America (By Component, By Deployment Mode, By Data Type, By End-user, and By Country) o U.S. (End-user) o Canada (End-user) o Mexico (End-user) · South America (By Component, By Deployment Mode, By Data Type, By End-user, and By Country) o Brazil (End-user) o Argentina (End-user) o Rest of South America · Europe (By Component, By Deployment Mode, By Data Type, By End-user, and By Country) o U.K. (End-user) o Germany (End-user) o France (End-user) o Italy (End-user) o Spain (End-user) o Russia (End-user) o Benelux (End-user) o Nordics (End-user) o Rest of Europe · Middle East & Africa (By Component, By Deployment Mode, By Data Type, By End-user, and By Country) o Turkey (End-user) o Israel (End-user) o GCC (End-user) o North Africa (End-user) o South Africa (End-user) o Rest of the Middle East & Africa · Asia Pacific (By Component, By Deployment Mode, By Data Type, By End-user, and By Country) o China (End-user) o India (End-user) o Japan (End-user) o South Korea (End-user) o ASEAN (End-user) o Oceania (End-user) o Rest of Asia Pacific |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 11.54 billion in 2025 and is projected to reach USD 48.90 billion by 2034.

In 2025, the market value stood at USD 4.86 billion.

The market is expected to exhibit a CAGR of 17.5% during the forecast period of 2026-2034.

In 2025, the hardware segment led the market in terms of components.

The growing demand for real-time, on-device intelligence is a key factor driving market growth.

NVIDIA Corporation, Qualcomm Incorporated, and NXP Semiconductors N.V. are some of the prominent players in the market.

Asia Pacific dominated the market in 2025 with the largest share.

Rising demand for real-time on-device intelligence, growing use of smart connected devices, increased focus on data privacy and security, and advances in power-efficient AI hardware are expected to drive product adoption.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us