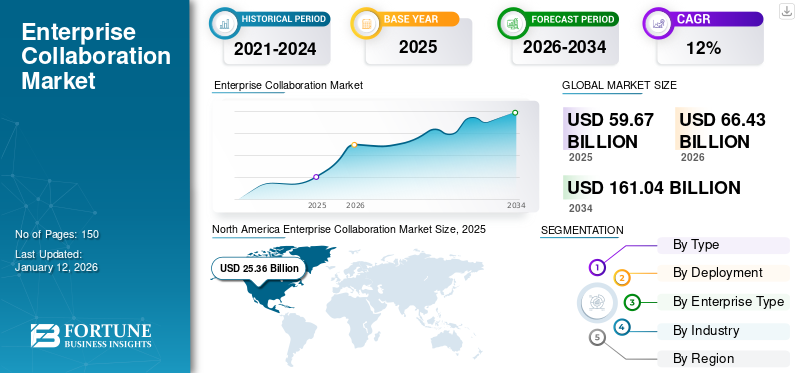

Enterprise Collaboration Market Size, Share & Industry Analysis, By Type (Unified Communication and Project Management and Workflow Automation), By Deployment (On-premises and Cloud), By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By Industry (BFSI, Manufacturing, Retail & Consumer Goods, Education, IT & Telecommunication, Energy & Utilities, Public Sector, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global enterprise collaboration market size was valued at USD 59.67 billion in 2025 and is projected to grow from USD 66.43 billion in 2026 to USD 161.04 billion by 2034, exhibiting a CAGR of 11.70% during the forecast period. North America dominated the enterprise collaboration market with a share of 42.60% in 2025.

Enterprise collaboration refers to a wide range of communication and information systems, including communications platforms, enterprise social networks, corporate intranet, and public internet tools, that employees use to collaborate and complete various tasks within an enterprise. An Enterprise Collaboration System (ECS) allow teams to collaborate more efficiently and produce better results with features, such as file sharing, project management, real-time chat, and virtual meetings. An ECS enables employees to communicate and interact both within and outside their work environment by providing them with access to technology that can improve processes and facilitate collaboration.

ECS offers a comprehensive platform that facilitates communication, project management, file storage & sharing, and team collaboration in a unified environment. Growing demand for advanced technologies, such as Artificial Intelligence (AI), cloud computing, and increasing penetration of internet technologies have led to the rising dependence on collaboration software platforms. These key factors will fuel the growth of the market during the forecast period.

Increased adoption of remote work culture by various business verticals during the COVID-19 situation has boosted the usage of different digital communication channels for seamless communication. During the pandemic, there was a 176% increase in the number of collaboration apps installed on enterprise devices to increase the productivity of the organization. According to researchers, in 2021, the demand for live chat applications, video conferencing applications, messaging apps, and e-mails increased tremendously to deliver a better communication experience to the remotely working employees. Hence, the demand for ECS increased significantly during the pandemic to boost the efficiency of the employees.

IMPACT OF GENERATIVE AI

Gen AI-Integrated ECS Can Automate Repetitive Tasks to Improve Operational Efficiency

Generative AI-driven enterprise collaboration can unlock business growth opportunities and overcome challenges by automating repetitive tasks, streamlining workflows, and improving operational efficiency.

By automating manual efforts and streamlining processes, employees can spend more time on high-value activities, resulting in higher productivity and output. Gen AI-driven collaboration tools make it easier for teams to communicate and share knowledge, allowing them to collaborate more effectively and complete tasks faster.

For example, Microsoft, Google LLC, and Slack are integrating Large Language Models (LLMs) with their software to improve the productivity of businesses and enhance collaboration and communication. Integration of generative AI can bring advancements in email management, project management, scheduling meeting, and document generation, which can significantly help enhance the overall efficiency and compliance of the organization. Hence, by considering these factors, the integration of Gen-AI capabilities with ECS anticipated to generate lucrative opportunities and fuel the market progress during the forecast period.

Enterprise Collaboration Market Trends

Integration of AR and VR With ECS to Provide Immersive Learning Experience to Drive Market Growth

The integration of Augmented Reality (AR) and Virtual Reality (VR) technologies will revolutionize ECS by providing immersive experiences for remotely working teams. These technologies will enable users to form interactions with data and the virtual environment to develop real-time communication among the employees and the organization.

AR and VR-powered ECS has a huge impact on employee training and onboarding processes. It is also used to streamline the workflows, boost productivity, and aims to create an innovative way for employees to work together. For instance, in the manufacturing and healthcare sectors, employees can get training in a virtual environment, allowing them to become aware of complex machineries and medical processes before interacting with them. This factor increases the engagement rate of employees, resulting in improved work efficiency.

The growing integration of Augmented Reality (AR) and VR technologies with ECS can help users deliver enhanced training in a 3-dimensional environment and work on a professional agenda to streamline the operational process.

Download Free sample to learn more about this report.

Enterprise Collaboration Market Growth Factors

Surge in Demand for Maintaining Workplace Connectivity in Large-Sized Enterprises to Fuel Market Growth

Implementation of ECS helps facilitate communication and collaboration between the organization and its employees. The increased usage of cloud phone systems, videoconferencing, document sharing, and other technologies accelerates the flow of data, making it easier to communicate with colleagues and obtain real-time feedback. The use of essential business tools by employees on multiple communication channels can help meet the evolving needs of employee network among large-sized organizations. This can be done by centralizing messages, minimizing email dependence, and developing communication.

Growth of remote and hybrid work culture, and rising demand for connectivity solutions among employees is prompting businesses to adapt to ever-changing work environments. Thus, to fulfill the needs of modern digital workspaces and create high employee engagement and satisfaction, the adoption of enterprise collaboration software increases.

Similarly, the implementation of ECS helps streamline communication, which significantly reduces the expenses associated with a variety of business inefficiencies and helps businesses take data-driven decisions to boost the workplace productivity. Hence, by considering these factors, the rising adoption of Enterprise Collaboration Platforms (ECPs) among large enterprises will help maintain the workplace connectivity and result in robust efficiency.

RESTRAINING FACTORS

Lack of Data Privacy and Rising Security Concerns to Restrict Market Growth

Data privacy and security is considered as a major challenge while using the enterprise collaboration tools. Companies use ECS to develop seamless communication between the employees and for sharing private and confidential data via multichannel digital tools and services. As the exchange of data between enterprises and employees increases, the organization faces malicious data hacking, data theft, and data breach cases due to poor data security or accidental data mishandling.

Adoption of remote work culture by companies and increased usage of Bring Your Own Device (BYOD) can increase the threat of receiving risky emails or messages from cyber criminals. Thus, by sending malicious links via workplace collaboration apps as well as email, SMS, and social media, attackers can hack the private data of the employee and the organization with unauthorized access. Hence, the lack of data security and privacy concerns can hinder the growth of the market.

Furthermore, a slow internet connection can impede the quality of video and voice calls, file downloads, message transmission, and remote office connectivity. This factor will also restrict the market growth during the forecast period.

Enterprise Collaboration Market Segmentation Analysis

By Type Analysis

Usage of Unified Communication Platforms for Managing Communication Inside and Outside Organization to Boosts the Market Growth

Based on type, the market is divided into unified communication and project management and workflow automation.

The Unified Communication (UC) segment is projected to record the maximum growth rate during the forecast period as this platform delivers communication features. These include instant messaging, audio & telephonic services, and video or web collaboration services for managing real-time communication inside and outside enterprises. Various applications, such as Zoom, Skype, and Microsoft Teams aim to deliver a seamless communication experience to the users along with enhanced productivity and security.

Meanwhile, the project management and workflow automation segment held the largest enterprise collaboration market share in 2023 as this software is mainly used among large enterprises to ensure the project’s alignment with the organization’s strategies. This software helps deliver real-time project updates to the team members to minimize the risks of miscommunication and errors.

By Deployment Analysis

Installation of Cloud-based ECS to Fulfill Cloud-Computing Needs of Organizations to Drive Market Growth

On the basis of deployment, the market is divided into on-premises and cloud.

The cloud segment is expected to record the highest CAGR during the forecast period. The Cloud segment is expected to lead the market, contributing 56.89% globally in 2026. The growing installation of cloud-based enterprise collaboration software helps reduce the time and cost required to upgrade and update applications, making the file sharing, storage, and collaboration process easy to deliver a better customer experience. As per industry experts, in 2020, 82% of the companies surveyed said that they were using either private or public cloud solutions to develop efficient and seamless communication between employees present inside and outside the organizations.

The cloud-based collaboration software helps leverage the capabilities of multiple messaging channels and fulfill the cloud computing needs of any business. This factor will help boost the demand for cloud-based ECPs among various enterprises during the forecast period.

Furthermore, the high installation and implementation costs of on-premises collaboration platforms, along with high-risk security issues, will reduce the demand for on-premises platforms among users.

By Enterprise Type Analysis

SMEs to Prosper in the Market Due to Increased Demand for Collaboration Tools to Bring Advancement in Communication

By enterprise type, the market is segregated into small & medium enterprises and large enterprises.

The small & medium enterprises segment accounting for 50.88% market share in 2026 & will record the highest CAGR during the forecast period due to the increasing demand for ECPs among these organizations. The growing need for the development of cost-efficient and scalable collaboration tools to bring advancements in collaboration and communication systems among SMEs will fuel the growth of the market. In addition, the rising demand for remote and flexible work environments further increased the need for agile collaboration tools during the pandemic across all enterprises. This factor will result in SMEs being more likely to invest in the market and drive future growth.

By Industry Analysis

Optimizing Workflow Efficiency by Securing Data to Boost Demand for ECS in BFSI

By industry, the market is divided into BFSI, manufacturing, retail & consumer goods, education, it & telecommunication, energy & utilities, public sector, healthcare, and others.

The BFSI sector is projected to record the maximum CAGR during the forecast period & it will account for 22.28% market share in 2026. The enterprise collaboration platforms are used by financial institutions for real-time communications, secure data sharing, and compliance. It also offers transparency, efficiency, and accountability in business processes to handle sensitive financial data. Thus, to optimize the workflow efficiency and improve customer experience, the adoption of ECS in BFSI sector is increasing rapidly.

The IT & telecommunication segment held the largest market share in 2023. This is due to the increasing investment by companies to develop a new digital workplace to align with the business processes for improving the overall operational productivity. The usage of process management, workflow management, project management, and messaging tools by employees can help them manage their work and collaborate more effectively.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America Enterprise Collaboration Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America is estimated to be a dominant contributor to the enterprise collaboration market growth and held the maximum market share in 2023. Growing technological advancements and the presence of a large number of enterprise collaboration software providers, such as Adobe Inc., IBM Corporation, Microsoft Corporation, and Slack Technologies, LLC. in countries, such as the U.S., Canada, and Mexico will drive the demand for this technology among end-users during the forecast period. The U.S. market is projected to reach USD 17.06 billion by 2026.

Asia Pacific

Asia Pacific is projected to record the highest CAGR during the forecast period. This is due to the continuous digital transformation and increasing initiatives taken by key developers for developing new cloud-based software across the region. This factor is expected to drive the growth of the Asia Pacific market revenue. Similarly, growing investments in SMEs in India, China, and Japan to enhance productivity and streamline employee communication with the help of multichannel communication platforms will drive the market growth in the region during the forecast period. The Japan market is projected to reach USD 1.77 billion by 2026, the China market is projected to reach USD 4.41 billion by 2026, and the India market is projected to reach USD 2.38 billion by 2026.

In February 2024, Tata Communication, in collaboration with Microsoft Corporation, aimed to deliver flexibility in voice calling on Microsoft Teams among Indian enterprises. The integration of Tata Communications' GlobalRapide platform with Microsoft is expected to enhance the workforce efficiency and productivity of enterprises by following legal rules and regulations across the globe.

Europe

Europe is anticipated to showcase moderate growth during the forecast period. This is due to the rising number of data centers across countries, such as the U.K., Germany, Italy, and France. This will generate demand for the adoption of enterprise communication and collaboration platforms to deliver a seamless communication experience to employees. Similarly, the increasing penetration of the internet and smartphones will enhance the usage of ECS among companies to develop advanced IT infrastructure in various European countries. The UK market is projected to reach USD 2.68 billion by 2026, while the Germany market is projected to reach USD 3.54 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa markets are expected to experience significant growth during the forecast period. This is due to rising investments by key players in delivering enterprise collaboration services to SMEs. The growing usage of ECPs helps improve operational productivity by enhancing communication among employees using various communication tools and platforms.

Key Industry Players

Technological Developments by Leading Companies to Aid Market Proliferation

Companies providing enterprise collaboration solutions mainly include Wrike, Inc., Cisco Systems, Inc., Zebra Technologies Corp., Adobe Inc., IBM Corporation, Microsoft Corporation, and Slack Technologies, LLC. are focusing on enhancing communication of employees' among the enterprise. To expand their operations throughout the world, the market participants use various methods, such as acquisitions, partnerships, mergers, and collaborations. Besides, the report offers insights into the market trends and highlights key industry developments.

List of Top Enterprise Collaboration Companies:

- Huawei Technologies Co., Ltd (China)

- Wrike, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Zebra Technologies Corp. (U.S.)

- Adobe Inc. (U.S.)

- IBM Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Slack Technologies, LLC. (U.S.)

- Staffbase (Germany)

- Citrix Systems, Inc. (U.S.)

- Open Text Corporation. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Dialpad, Inc., an AI-powered customer intelligence platform provider, entered a partnership with T-Mobile and launched AI Recaps to improve video calling experiences for T-Mobile customers.

- March 2024: Zoom Video Communications collaborated with Avaya to provide a seamless management experience for communication environments and workflows through a Zoom Workplace solution.

- February 2024: Oracle Corporation launched an Enterprise Communications Platform (ECP) to bring real-time communication among cloud applications in different industry verticals. The seamless integration of Oracle industry applications with Internet of Things (IoT) devices and networks can help organizations empower associations to reconsider how to carry on with work.

- May 2023: Mural, a visual collaboration software provider, launched new AI-powered capabilities to improve enterprise team collaboration. The AI-powered feature powered by Microsoft Azure OpenAI helps team members work together, irrespective of time and location.

- December 2021: Alcatel-Lucent Enterprise, a communication and cloud networking solution provider, developed ALE Connect, a hybrid CCaaS solution. The solution helps optimize Omni channel interactions through voice and digital channels by delivering improved customer experience.

REPORT COVERAGE

The study on the market includes prominent areas to gain enhanced knowledge of the industry verticals. Moreover, the research offers insights into the most recent endeavors and industry developments and an analysis of high-tech solutions being promptly adopted worldwide. It also highlights some of the growth-stimulating factors and limitations, allowing the reader to obtain a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 161.04 billion by 2034.

In 2026, the market value stood at USD 66.43 billion.

The market is projected to record a CAGR of 11.70% during the forecast period.

In 2024, the unified communication segment held the largest market share.

Surge in demand for e-commerce platforms is expected to drive the market growth.

Huawei Technologies Co., Ltd, Wrike, Inc., Cisco Systems, Inc., SAP SE, Adobe Inc., IBM Corporation, Microsoft Corporation, and Slack Technologies, LLC. are the key players in the market.

North America dominated the enterprise collaboration market with a share of 42.60% in 2025.

Asia Pacific is expected to record the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us