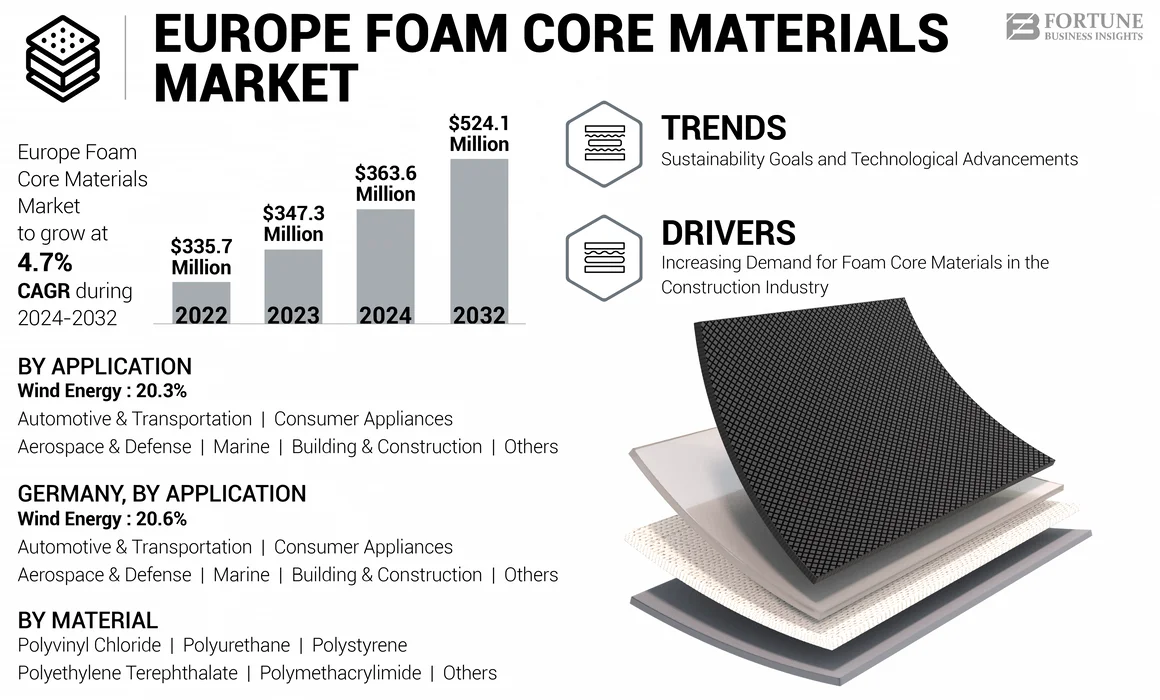

Europe Foam Core Materials Market Size, Share & Industry Analysis, By Material (Polyvinyl Chloride (PVC), Polyurethane (PU), Polyethylene Terephthalate (PET), Polystyrene (PS), Polymethacrylimide (PMI), and Others), By Application (Aerospace & Defense, Wind Energy, Building & Construction, Marine, Automotive & Transportation, Consumer Appliances and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

The Europe foam core materials market size was valued at USD 347.3 million in 2023. The market is projected to grow from USD 363.6 million in 2024 to USD 524.1 million by 2032 at a CAGR of 4.7% during the forecast period of 2024-2032.

Foam core materials are lightweight materials used to add thickness and stiffness to composite materials. They are used in many applications, including clothing, shoes, and bags, where reducing the weight and bulk is important. Their unique properties, such as exceptional impact resistance and lightweight nature, make them ideal materials for various construction applications. Owing to their versatility, flexibility, and durability, these materials are used in a wide range of application areas, including building panels, aerospace, marine, and energy.

Growing demand for core materials in the aerospace and automotive industries and rapid advancements in transportation are driving product manufacturing. Materials, such as polyvinyl chloride (PVC), polyurethane (PU), polyethylene terephthalate (PET), and polystyrene (PS) are highly utilized to produce foam core materials. Their crucial role in creating complex body structures and efficacy in reducing a vehicle’s weight by 50% is anticipated to foster market growth during the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Foam Core Materials in the Construction Industry to Drive Market Growth

The rising need for lightweight and durable materials in the construction industry will significantly drive the Europe foam core materials market growth. These materials are favored for their lightweight, high strength-to-weight ratio, and excellent insulation properties, making them ideal for various applications in building and construction. In addition to new construction projects, renovation and remodeling activities are rising, especially in developed regions. This trend will further fuel the demand for lightweight and efficient materials, such as foam cores, that improve energy efficiency in existing structures. These materials provide excellent energy absorption, stiffness, and impact resistance, making them suitable for various structural applications. Their adaptability in sandwich structures enhances their appeal across multiple sectors, including construction. They are extensively used in wall panels, roofing systems, and flooring solutions due to their thermal insulation properties and lightweight nature. The product usage contributes to energy-efficient building designs that comply with modern energy codes, enhancing the overall building performance.

Foam core is increasingly being used in the aerospace industry to make composite structures for spacecraft and aircraft. It is used in spoilers, aircraft flaps, tail structures, and gear doors. Pursuing fuel efficiency and emission reduction propels the adoption of lightweight materials in vehicle and aircraft manufacturing, thereby boosting the market.

Furthermore, the wind energy sector will significantly contribute to the product demand, particularly in constructing wind turbine blades, where lightweight and durable materials are crucial.

MARKET RESTRAINTS

Fluctuations in Raw Material Prices and Potential Health Risks May Restrain Market Growth

The primary raw materials for producing foam core products include petrochemical derivatives, such as benzene, toluene, polyol, and phosgene. These materials are essential for creating various types of foam, including polyurethane and polystyrene foams.

The prices of these raw materials are subject to significant volatility due to factors, such as geopolitical tensions, fluctuations in crude oil prices, and changes in global demand. For instance, oil price fluctuations in recent years have increased costs for key feedstocks, such as propylene and propylene oxide, which are critical for manufacturing polyols used in foam production. Events, such as conflicts in oil-producing regions, can increase these fluctuations, causing instability in supply chains and impacting production costs across the foam industry.

Potential health risks associated with certain foam materials, especially those that release Volatile Organic Compounds (VOCs), may deter their use in specific applications. In addition, foam core materials are subject to stringent regulations on their Fire, Smoke, and Toxicity (FST) performance. For instance, the European standard EN 45545-2 has strict requirements for FST performance in core materials used in railway applications. Environmental regulations regarding the production and disposal of foam materials may affect market dynamics.

MARKET OPPORTUNITIES

Rising Demand for Electric Vehicles to Present New Market Opportunities

The automotive industry's evolution over the past few years has impacted the electric vehicle (EV) sector. EVs are designed to replace conventional traveling methods owing to use of advanced technologies, low carbon emission, low maintenance, and smoother drive. According to some statistics, EVs emit 40% less CO2 than combustion cars over a car's lifetime. The rise in demand for high-performance, low-emission, and fuel-efficient vehicles and strict government emissions regulations propel the market’s growth. Surging demand for EVs will also fuel the need for lightweight materials to improve fuel economy, safety, and performance. Using lightweight materials improves an EV’s fuel economy and allows it to carry more advanced systems without increasing its overall weight. Foam core materials offer lightweight solutions without compromising the strength of key materials. Also, these materials are used in EVs for various purposes, including absorbing shock and insulation. Therefore, the rising demand for lightweight materials in EVs to maximize battery efficiency will present new opportunities in the market.

EUROPE FOAM CORE MATERIALS MARKET TRENDS

Sustainability Goals and Technological Advancements to Shape Market Dynamics

The shift toward eco-friendly materials and sustainable manufacturing processes will present significant growth opportunities for the market. There is a growing emphasis on sustainability across various industries, including construction, automotive, and aerospace. Governments and regulatory bodies across the globe are implementing stringent regulations to reduce carbon emissions and promote the use of eco-friendly materials. This regulatory environment encourages manufacturers to adopt sustainable practices and materials in their production processes.

The increasing focus on corporate sustainability initiatives will also drive the demand for lightweight, recyclable core materials contributing to lower carbon footprints. Companies increasingly seek eco-friendly materials that reduce environmental impact while maintaining performance standards. Innovations in manufacturing processes enhance the properties of foam core materials, making them more efficient and cost-effective. As industries continue to reduce their environmental impact while enhancing performance, the demand for these materials is expected to expand across multiple sectors.

Download Free sample to learn more about this report.

IMPACT of COVID-19

Lockdown measures, economic uncertainty, and reduced consumer spending decreased the sales of vehicles and building materials. The aviation industry was also severely affected during the pandemic. Industries, such as aerospace & defense, building & construction, and automotive & transportation are the prominent consumers of foam core materials and as these markets were hit hard, the overall sales revenue of foam core products declined in the European market in 2020. However, as restrictions eased, there was a gradual recovery in construction and manufacturing activities, leading to a resurgence in product demand. Businesses began to resume projects that were put on hold, which positively impacted the market.

SEGMENTATION ANALYSIS

By Material

Polyvinyl Chloride (PVC) Segment Held Dominant Market Share Due to Its Superior Properties

On the basis of material, the market is categorized into polyvinyl chloride (PVC), polyurethane (PU), polyethylene terephthalate (PET), polystyrene (PS), polymethacrylimide (PMI), and others.

The polyvinyl chloride (PVC) segment held the largest market share in 2023 and is anticipated to dominate the market during the forecast period. This is due to its superior durability, chemical resistance, and affordability. PVC foams are extensively used in marine, transportation, and wind energy applications, where their high strength-to-weight ratio feature is critical. The growing investment in offshore wind energy projects across Europe is a major driver of the segment’s growth, as PVC foam cores are integral to turbine blade construction.

The demand for PU foam cores is boosted by their excellent mechanical properties, such as high strength-to-weight ratio, thermal insulation, and energy absorption. The automotive sector is using these foam cores extensively, with increasing adoption of lightweight materials to improve fuel efficiency and reduce emissions. PU foam cores are also widely used in building insulation due to stringent energy efficiency rules in Europe.

The polyethylene terephthalate (PET) segment will grow significantly during the forecast period. The lightweight, high mechanical strength, and recyclability of this material drive the growth. Its alignment with Europe’s circular economy objectives makes it particularly attractive. PET foams are being increasingly adopted in automotive and wind energy applications, where sustainability and performance are critical. This will drive the segment’s growth significantly during the forecast period.

By Application

Aerospace & Defense Segment Holds Major Market Share Owing to Growing Demand for Lightweight Materials

On the basis of application, the market is segmented aerospace & defense, wind energy, building & construction, marine, automotive & transportation, consumer appliances, and others.

The aerospace & defense segment is a leading consumer of foam core materials due to advancements in aviation technology and the demand for lightweight, high-strength components. The region’s robust aerospace sector, led by key players such as Airbus and Dassault Aviation, is increasingly adopting foam cores for structural and interior applications to improve fuel efficiency and reduce emissions. These materials, particularly those made from polyurethane and polymethacrylimide, are widely used in aircraft components, such as wing structures, floor panels, and cabin interiors, due to their superior thermal insulation and impact resistance.

To know how our report can help streamline your business, Speak to Analyst

The wind energy segment in Europe’s foam core materials market is driven by the region’s ambitious renewable energy goals and extensive wind power capacity. Countries, such as Germany, Denmark, and Spain lead the way, focusing on reducing carbon emissions and transitioning to sustainable energy. Foam core materials are essential for manufacturing lightweight yet durable wind turbine blades that withstand high stress and environmental challenges. Recycling and sustainability trends also influence the market, pushing manufacturers to innovate with eco-friendly and bio-based materials.

The building & construction segment is witnessing significant growth opportunities due to the rising emphasis on energy-efficient and sustainable construction practices. Foam cores are widely utilized in insulation panels, roofing systems, and sandwich structures for residential, commercial, and industrial buildings. Urbanization and infrastructure development across Eastern Europe and renovation activities in Western Europe contribute to the product’s steady demand.

Other applications, such as marine, automotive & transportation, and consumer appliances, are projected to create additional demand for materials during the forecast period.

EUROPE FOAM CORE MATERIALS MARKET COUNTRY OUTLOOK

Germany

Germany accounted for the largest Europe foam core materials market share in 2023 and is expected to dominate the market during the forecast period due to its robust industrial base in the automotive, aerospace, and construction sectors. The country’s strong emphasis on sustainability and lightweight engineering will drive the adoption of these materials, particularly polyurethane and polystyrene, in key industries. Automotive giants, such as BMW, Volkswagen, and Mercedes-Benz are increasingly using foam cores to enhance energy efficiency and reduce vehicle weight. The country’s strict environmental regulations further compel manufacturers to innovate with recyclable and bio-based foam cores, strengthening its global market position.

To know how our report can help streamline your business, Speak to Analyst

U.K.

The growth of the market in the U.K. is attributed to the growing product demand in the aerospace industry and a rising focus on sustainable construction. The presence of aerospace hubs, such as Rolls-Royce and BAE Systems, fosters high demand for these materials in lightweight and high-performance aircraft parts. Additionally, the U.K.’s ambitious housing and infrastructure projects under government programs, such as the Housing Infrastructure Fund, will create significant opportunities for foam cores in building applications.

France

France’s automotive industry, led by brands, such as Renault and Peugeot, emphasizes lightweight materials for improving fuel efficiency and meeting EU emission standards. The construction sector is another major driver, with foam cores widely used in energy-efficient buildings to comply with France’s ambitious energy transition policies. Additionally, the marine industry, particularly in regions including Brittany, generates demand for foam cores in shipbuilding. Government support for green technologies and sustainable development will further accelerate the adoption of innovative materials.

Other Countries

Other countries, such as Denmark and Ireland, had the highest share of wind in their electricity mix, with 56% and 36%, respectively. Wind met at least 20% of the electricity demand in another eight countries: Germany (31%), the U.K. (29%), the Netherlands (27%), Spain (27%), Sweden (26%), Portugal (26%), Lithuania (21%), and Greece (20%). Such high growth in the wind energy sector and plans to expand this sector will act as catalysts for growth for the rest of the European region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Adopting Product Innovation Strategies to Attract New Customers

3A Composites, Achilles Corporation, Armacell International S.A., CoreLite, and Diab Group are identified as key manufacturers in the Europe foam core materials market study. Players operating in the market have adopted both organic and inorganic expansion strategies to capitalize on the growing market potential. Major companies are driving the market’s growth by launching new foam cores with enhanced properties to meet the evolving demands of various industries. They also focus on developing efficient recycling methods to address environmental concerns associated with these materials. Such initiatives taken by them are set to shape the market.

LIST OF EUROPE FOAM CORE MATERIAL COMPANIES PROFILED

- 3A Composites (Switzerland)

- Achilles Corporation (Japan)

- Armacell International S.A. (Luxembourg)

- CoreLite (U.S.)

- Diab Group (Sweden)

- Euro-Composites S.A. (Luxembourg)

- Evonik Industries AG (Germany)

- Gurit Holding AG (Switzerland)

- Hexcel Corporation (U.S.)

- NMG Europe (Italy)

KEY INDUSTRY DEVELOPMENTS

- September 2024 - Armacell announced a new technology named aerogel technology, which will complement its revolutionary aerogel-based product range. With the product launch, the company has enhanced its existing ArmaGel offering and will meet the increasing demand for battery cells for applications such as electric vehicles.

- September 2024 - Evonik enhanced the high-performance foam ROHACELL manufacturing process at its main site in Darmstadt, Germany, by using renewable energy sources. As a result, the company's High-Performance Polymers business division will reduce its yearly CO2 emissions by 3,400 metric tons.

- January 2024 - SP International GmbH & Co KG, a consolidated subsidiary of JSP Corporation, acquired a 30% ownership stake in General-Industries Deutschland GmbH's foam recycling (EPP/EPE) operations. Through this investment in GID, JSP ensured sustained market access to premium granulates and recyclates.

- May 2022 - 3A Composites Core Materials successfully acquired Solvay’s TegraCore polyphenylsulfone (PPSU) resin-based foam to add in its portfolio under the name Airex TegraCore. With this portfolio expansion, 3A Composites will expand its offering, allowing it to target markets, such as aerospace, marine, and rail.

- March 2022 - Hexcel Corporation expanded its engineered core operations by adding a manufacturing facility in Morocco. The new expansion was advantageous for meeting the demands of aerospace customers for lightweight advanced composites.

REPORT COVERAGE

The report provides a detailed market analysis, focusing on crucial aspects, such as leading companies, materials, and applications. In addition, it provides quantitative data regarding market size, analysis, research methodology, and insights into market trends. It also highlights vital industry developments and the competitive landscape. In addition to the above-mentioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 4.7% during 2024-2032 |

|

Segmentation |

By Material

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the European market size was valued at USD 347.3 million in 2023 and is projected to reach USD 524.1 million by 2032.

Recording a CAGR of 4.7%, the market is expected to exhibit rapid growth during the forecast period.

By application, the aerospace & defense segment dominated the market in 2023.

Increasing demand for foam core materials in the construction industry will drive the markets growth.

3A Composites, Achilles Corporation, Armacell International S.A., and Diab Group are the top players in the market.

An inclination toward electric vehicles will create remunerative opportunities for market players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us