Feline Vaccines Market Size, Share & Industry Analysis, By Technology (Inactivated, Live Attenuated, Recombinant, and Others), By Disease Type (Feline Viral Rhinotracheitis, Rabies, Feline Leukemia Virus, and Others) By Route of Administration (Parenteral, and Intranasal), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

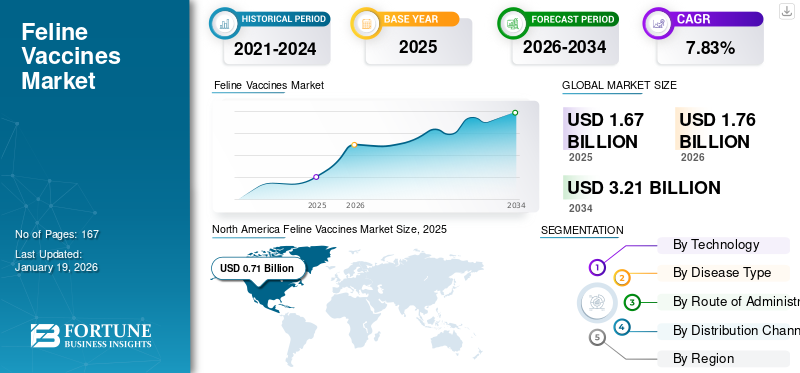

The global feline vaccines market size was valued at USD 1.67 billion in 2025 and is projected to grow from USD 1.76 billion in 2026 to USD 3.21 billion by 2034, exhibiting a CAGR of 7.83% during the forecast period. North America dominated the feline vaccines market with a market share of 42.77% in 2025.

Feline vaccines help to protect cats from illnesses such as feline panleukopenia, feline respiratory diseases, calicivirus, herpesvirus, and rabies. Furthermore, the increasing prevalence of these diseases, growing awareness among pet owners, & increasing veterinary healthcare infrastructure are boosting the market growth.

The market is expected to witness a significant growth trajectory during the forecast period. The increasing demand for prevention of cats from infectious diseases and rise in global pet ownership are increasing the product demand

- For example, in November 2022, as per the data published in NIH, a study conducted in the Campania region of southern Italy between 2019 and 2021 aimed to assess the prevalence of viral diseases in 328 domestic cats. The findings revealed that approximately 73.5% of these cats tested positive for feline panleukopenia virus. Such a large number of cats affected by the disease increased demand for active vaccination.

Additionally, the market presence of major companies, such as Zoetis Services LLC, Elanco, with strong research & development initiatives to develop innovative vaccines that offer broader protection and longer-lasting immunity, is further fueling the market growth.

MARKET DYNAMICS

MARKET DRIVERS

Rising Cat Ownership to Drive the Market Growth

Increasing pet adoption and ownership is leading to a demand for preventive care, thus driving the market growth. Moreover, increasing prevalence of feline diseases such as rabies, feline leukemia virus (FeLV), and panleukopenia is encouraging pet owners to vaccinate their cats. Thus, these factors collectively boost the global feline vaccines market growth.

- For instance, according to the American Pet Products Association, around 86.9 million U.S. households owned a pet in 2023–2024, in which 37.0% i.e., around 49.0 million households, owned a cat. Such scenarios propel the demand for vaccination and boost the market growth.

MARKET RESTRAINTS

Limited Access for Vaccination in Less Developed Countries Leads to Obstacle in Market Growth

Lack of veterinary services and veterinary healthcare infrastructure in developing countries decreases the adoption of vaccination in felines. Additionally, the limited presence of veterinary practitioners in these regions is also hampering the product adoption and market growth.

- For example, in September 2022, as per HealthforAnimals, there are only 410 veterinarians available in Kenya for animal care. Such limited availability of practitioners hampers the market growth.

MARKET OPPORTUNITIES

Increasing Government Initiatives for Feline Vaccination to Offer Market Growth Opportunities

The increasing number of feline and zoonotic diseases in humans due to animal bites is shifting the focus to offering adequate vaccination to cats. The government bodies of different countries are focusing on vaccinating cats to maintain their health and stop the spread of zoonotic diseases.

- For instance, in July 2025, the Nashik Municipal Corporation (NMC), India, launched a program to sterilize and vaccinate stray cats against rabies—such initiatives propel the adoption of feline vaccines and cater to the market growth.

MARKET CHALLENGES

Vaccine Hesitancy to Cause Challenges in Market Growth Prospects

A key challenge in the market is vaccine hesitancy among pet owners. The vaccine safety concerns, potential side effects, and a lack of awareness about the importance of feline immunizations contribute to lower vaccination rates.

- For instance, in January 2024, the American Veterinary Medical Association (AVMA) reported that some dog and cat owners remain hesitant or refuse vaccinations due to concerns about safety or necessity. Thus, this factor leads to lower vaccination rates and impacts market expansion.

FELINE VACCINES MARKET TRENDS

Innovations in Vaccine Platforms for Feline Diseases is an Upcoming Market Trend

With the rising demand for feline vaccines and increasing disposable income, there is a shift in the development of feline vaccination. Thus development of new vaccine platforms for feline diseases is emerging as a prominent market trend.

- For example, in September 2024, Merck & Co., Inc., announced the expansion of the NOBIVAC NXT vaccine platform for the development of NOBIVAC NXT FeLV. It is used to protect cats against one of the most common feline infectious diseases, feline leukemia virus (FeLV)—such launches and expansions are highlighted as the prominent global feline vaccines market trends.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Technology

Surge in Collaborations in Inactivated Vaccines Segment to Lead to Segment’s Dominance

In terms of technology segmentation, the global market is classified into, recombinant, live attenuated, inactivated, and others.

The inactivated vaccines segment accounts for a leading global feline vaccines market share in 2024. The rising spread of rabies from animals to humans and increasing focus of government and non-government organizations to eradicate it is expected to boost the demand for inactivated rabies vaccines, contributing to the segment’s growth in the market.

- For instance, in March 2024, Merck & Co., Inc. announced the donation of NOBIVAC rabies vaccines to the charity initiative of Mission Rabies program to eliminate rabies.

The live attenuated segment accounts for a considerable share of the global market. The rising number of cases associated with feline panleukopenia virus among unvaccinated stray cats is boosting the demand for live attenuated vaccines and augmenting the segment’s growth in the market.

The recombinant vaccines and others segment is projected to expand with a high CAGR during the forecast period. An increasing number of feline diseases, rising government programs, and advancements in technology to boost the segment’s growth in the market.

By Disease Type

Rising Prevalence of Rabies and Spread of it to Humans to Boost the Segment’s Growth

Based on the disease type, the segment is divided into feline viral rhinotracheitis, rabies, feline leukemia virus, and others.

The rabies segment held the largest market share in 2024. The increasing prevalence of rabies and its spread from cats to animals is boosting the need for adequate vaccination, thus propelling the segment’s growth in the market.

- For instance, as per the American Veterinary Medical Association, in the 2023 National Rabies Surveillance System reported around 3,760 cases of animal rabies under which 222 cats were found to be affected by it.

The feline leukemia virus segment is expected to grow substantially during the forecast period. The growth of this segment is augmented by increasing number of feline leukemia virus cases and rising focus of key players to launch advanced vaccines for prevention.

- For instance, as per the study published by the National epidemiological survey of Feline leukemia virus (FeLV) in 182 domestic cats from Chile, it was found that FeLV prevalence was around 54.9 % of the survey cat population. Thus, it increases the demand for screening and vaccination as it is causing fatal disease in domestic cats.

Feline viral rhinotracheitis and others segment are expected to grow with a moderate CAGR during the forecast period.

By Route of Administration

Higher Efficiency to Boost Parenteral Segment Growth

Based on the route of administration, the global market is divided into parenteral and intranasal.

The parenteral segment dominated the global market in 2024, due to higher efficacy and rapid onset of action. Additionally, key companies are also focusing on new product launches of new parenteral vaccines, streamlining the segment growth.

The intranasal segment is projected to expand significantly across 2025-2032. The growth of the segment is driven by rising prevalence of feline diseases, ease of administration and less stressful experience for cats compared to injections, and quick immune response, are factors that increase the demand amongst the pet parents, thus propelling the segment’s growth.

- For example, Elanco is offering the Feline UltraNasal FVRCP Vaccine, which protects cats and kittens from three major feline diseases, including feline viral rhinotracheitis, feline calicivirus, and feline panleukopenia.

By Distribution Channel

Surge in Programs for Awareness to Augment Veterinary Hospitals’ Dominance

In terms of distribution channel, the market is divided into veterinary clinics, pharmacies & drug stores, veterinary hospitals, and others.

Growing awareness and increasing collaboration to boost small animal vaccination are leading to the dominance of the veterinary hospitals segment in the market.

- For instance, in October 2022, Virbac partnered with the World Small Animal Veterinary Association to advance the health and welfare of companion animals by controlling the reproduction rate and offering adequate vaccination.

The veterinary clinics are poised for considerable growth, with an increasing number of campaigns in collaboration with veterinary clinics to bolster the segment’s growth.

- For instance, in March 2025, Petco Love aimed to distribute 1 million free vaccines to protect pets and partnered with San Antonio Animal Care Services (ACS) with an aim to vaccinate 1,000 pets at a free drive-through pet vaccination clinic.

The pharmacies and drug stores, and other segments in the feline vaccine market are expected to grow substantially during the forecast period. Increasing research and development, and convenience in procuring vaccines via drug stores to contribute toward the segment’s growth.

FELINE VACCINES MARKET REGIONAL OUTLOOK

In terms of region, the market is divided into North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

North America

North America Feline Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's feline vaccines market size stood at USD 0.71 billion in 2025 and the region accounting for the largest share in the global market. The surge in cat ownership and increasing disposable income amongst the people drives the regional market growth. Also presence of key players with advanced product offerings and adequate veterinary healthcare infrastructure to propel the market growth in the region.

- For instance, as per the Government of Canada report, in 2024, around 17.2 million pets were owned in Canada amongst which, 8.9 million being cats.

U.S.

The U.S. accounted for the largest share in the North America region across 2025-2032. The presence of active guidelines for small animal health, a large number of cats as pets, and the presence of advanced veterinary facilities to boost the country’s growth in the market.

Europe

Europe is projected to witness strong growth across the forecast period. The growth of the market in the region is driven by the surge in incidence/cases of feline diseases, increasing pet population, and active government support for vaccination across major countries.

- As per the People's Dispensary for Sick Animals (PDSA) Animal Wellbeing Report 2024, there are 10.8 million pet cats in the U.K. Such a high number of cats increases the demand for vaccines and drives the market growth.

Asia Pacific

The Asia Pacific market is anticipated to register the fastest CAGR during the forecast period. The substantial increase in cases of feline diseases due to improved awareness and increasing number of pet cats are some of the critical parameters influencing the feline vaccines market growth.

- For instance, in November 2024, as per the Invasive Species Council Australia, there are 4.9 million pet cats. Such presence of a cat increases the demand for vaccination and thus boosts the market growth.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America markets are projected to register comparatively lower but steady growth during the forecasted timeframe. An increase in the number of government run initiatives for stray cat vaccination in the region are expected to drive market growth.

- For instance, in February 2025, Animal Welfare Abu Dhabi (AWAD) received government support to improve the care of animals and offer quality care to stray cats.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Diversified Product Portfolio Dedicated to Feline Vaccines and Innovative R&D Culture to Maintain Market Presence of Major Players

In terms of competition scenario, it is semi-consolidated with a small number of strong players. The key players operating in the market include Zoetis Services LLC, Merck & Co., Inc., and Elanco.

These companies’ strong product offerings and portfolio, geographic presence, and new product launches are enhancing its position in the market.

Other major companies include Virbac, Ceva, Boehringer Ingelheim International GmbH, and others. Improved product offerings and development activities are expected to expand their competitive share, in terms of sales, in the market.

LIST OF KEY FELINE VACCINES COMPANIES PROFILED

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck & Co., Inc. (U.S.)

- Zoetis Services LLC (U.S.)

- Ceva (France)

- Bioveta, a.s. (Czech Republic)s

KEY INDUSTRY DEVELOPMENTS

- August 2025- Bioveta, a.s. launched new lines of vaccines for dogs (Biocan) and cats (Biofel) in Venezuela.

- February 2025- Ceva opened a new genomics research laboratory, “Biogenovac” in Beaucouzé, France. This facility aimed to advance vaccine development and combat emerging animal diseases.

- November 2024- Ceva announced the establishment of a new vaccine manufacturing facility in Hungary.

- September 2024- Merck Co. & Inc., launched NOBIVAC NXT FeLV to protect cats against feline leukemia virus (FeLV).

- June 2024- Merck Co. & Inc. launched the NOBIVAC NXT Rabies portfolio in Canada. This portfolio includes NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies vaccines.

REPORT COVERAGE

The global feline vaccines market report provides a comprehensive analysis of the market. The report covers and emphasizes analysis of major segments such as technology, diseases, route of administration, and channels of distribution. Additionally, global market analysis offers insights into the market dynamics impacting the global market. Besides this, the global feline vaccines industry report covers the scenario in terms of regulations, overview of vaccination guidelines for cats, recent developments pertaining to the industry, and launches of innovative products. Moreover, the report includes analysis of several parameters that have determined the growth trajectory in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.83% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By Disease Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 1.67 billion in 2025.

In 2025, the North America market stood at USD 0.71 billion.

By registering a CAGR of 7.83%, the market will exhibit steady growth during the forecast period (2026-2034).

Based on the products, the inactivated segment is expected to lead the market during the forecast period.

The rising prevalence of feline diseases and increased pet ownerships, would drive the adoption of feline vaccines.

Zoetis Services LLC, Merck & Co., Inc., and Elanco are the top players in the market.

North America is expected to hold the largest share of the market.

The current market trends are the adoption of advanced vaccines and increased government awareness programs.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us