Veterinary Therapeutics Market Size, Share & Industry Analysis, By Product (Veterinary Drugs {Anti-infectives, Anti-inflammatory, & Parasiticides}, Veterinary Vaccines {Inactivated, Live Attenuated, & Recombinant}, and Medicated Feed Additives {Antimicrobials, Anticoccidials, Antiparasitics}), By Animal Type (Companion {Feline, Canine, & Avian} and Livestock {Poultry, Porcine, & Bovine}) By Route of Administration (Oral, Parenteral, Topical, & Aerosol), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

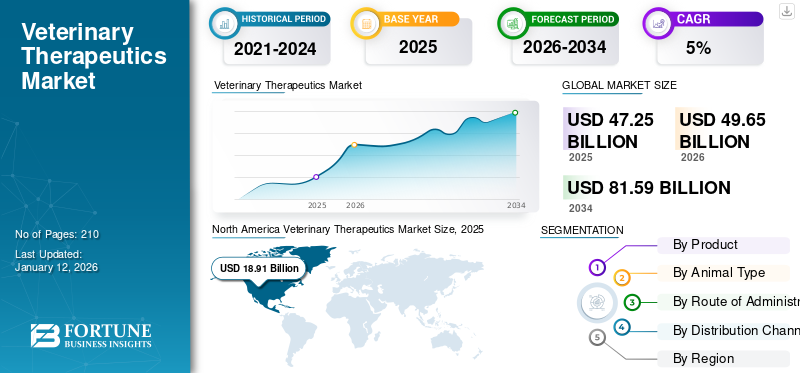

The global veterinary therapeutics market size was valued at USD 47.25 billion in 2025. The market is projected to grow from USD 49.65 billion in 2026 to USD 81.59 billion by 2034, exhibiting a CAGR of 6.40% during the forecast period. North america dominated the veterinary therapeutics market with a market share of 40.02% in 2025.

Veterinary therapeutics focuses on the development and distribution of drugs, vaccines, and feed additives for the improvement of animal health. Veterinary therapeutics address the needs of both livestock and companion animals, ensuring well-being, productivity, and public health by preventing zoonotic diseases.

The rising number of pet ownerships, increasing demand for animal protein, and rising focus on managing zoonotic diseases are expected to propel the growth of the market. Additionally, there is an increasing number of diseases in animals, including zoonotic diseases such as rabies leptospirosis, infectious diseases such as canine parvovirus, bovine mastitis, parasitic infections such as tick-borne, heartworms, and others. Thus, the rising incidence of such diseases in animals leads to increased demand for veterinary drugs and vaccines and thus propels the growth of the market.

- For instance, according to the World Organization for Animal Health, foot and mouth disease affects 77.0% of the global livestock population. Foot And Mouth Disease (FMD) is a highly contagious viral disease, caused by an Aphthovirus of the family Picornaviridae. Such contagious spread of the disease increases the demand for the earliest diagnosis and treatment measures to maintain healthy livestock production.

Additionally, the presence of key strong animal health players such as Zoetis Services LLC, Ceva, Virbac, and Merck Animal Health in the market with advanced product offerings and innovative R & D activities aimed to boost the growth of the market.

Veterinary Therapeutics Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 47.45 billion

- 2026 Market Size: USD 49.65 billion

- 2034 Forecast Market Size: USD 81.59 billion

- CAGR: 6.40% from 2026–2034

Market Share:

- North America dominated the veterinary therapeutics market with a 40.02% share in 2025, driven by high pet ownership, well-established veterinary care infrastructure, advanced livestock farming technologies, and high disposable income levels.

- By product, veterinary drugs held the largest market share in 2025, fueled by the increasing prevalence of infectious, parasitic, and chronic conditions in animals, alongside strong regulatory approvals and expansive product portfolios from major players.

Key Country Highlights:

- Japan: Demand is rising due to advanced livestock management practices and a growing trend toward companion animal ownership. Japan's focus on preventive animal care and cutting-edge veterinary research is contributing to market expansion.

- United States: With over 59.8 million dogs and 42.2 million cats owned in 2024, the U.S. is a key driver of global market demand. High spending on pet wellness, new product approvals like Zenrelia (Elanco), and increasing adoption of advanced therapies support continued growth.

- China: Veterinary therapeutics growth is supported by increasing pet adoption and expanding livestock farming to meet national protein demands. The government's initiatives to ensure livestock health and food safety are accelerating product demand.

- Europe: Growth is supported by programs like the U.K.’s Animal Health and Welfare Pathway, launched in 2023, and strong collaboration between veterinarians, farmers, and policymakers. A large pet population and advanced manufacturing base also fuel regional market expansion.

MARKET DYNAMICS

MARKET DRIVERS

Growing Pet Ownership and New Product Launches to Boost Product Demand

One of the most critical drivers of the market is a significant rise in pet ownership worldwide, driven by changing lifestyles and stronger emotional connections between humans and animals. More households welcome pets, the demand for veterinary care and therapeutics continue to grow. Additionally, pet owners are more willing to invest in the health and well-being of their animals, leading to increased adoption of advanced products for wellness and preventive care.

The market is witnessing a surge in new product launches, including innovative drugs, vaccines, and biologics tailored to address a wide range of animal health issues. Rising R&D activities and approvals by key players to meet the diverse needs of companion animals and livestock drive the growth of the market.

- For instance, in September 2024, Elanco announced the approval of Zenrelia by the U.S. Food and Drug Administration (FDA). It is a once-a-daily ilunocitinib tablet designed to control pruritus associated with allergic dermatitis in dogs aged 12 months and older. Such product launches and approvals increase demand and drive the global veterinary therapeutics market growth.

MARKET RESTRAINTS

Product Recalls Associated with Adverse Events and Safety Concerns to Hamper Market Growth

Product recalls of veterinary drugs and vaccines due to safety and efficacy concerns are a major factor hampering the growth of the market. These product recalls damage brand reputation and erode consumer trust. The recalls are often due to safety concerns, quality issues, or regulatory non-compliance.

- For instance, in June 2021, The UK's Veterinary Medicines Directorate (VMS) issued a recall for a batch of Salmovac 400 manufactured by CEVA Animal Health, a vaccine for Salmonella Enteritidis and Salmonella Typhimurium in chickens, due to safety concerns.

Additionally, in December 2023, the Australian Pesticides and Veterinary Medicines Authority (APVMA) recalled the Treidlia Auslepto Vaccine for dogs following reports of adverse reactions. One dog suffered a suspected anaphylactic reaction and died approximately within five hours, while seven other dogs experienced transient vomiting, diarrhea, and pain responses that started 5-6 hours after vaccination. Such adverse reactions and safety issues associated with the drugs and vaccines lead to damage to the customer's trust and thus restrain market growth.

MARKET OPPORTUNITIES

Research and Development and Regulatory Approvals for Launching Advanced Treatment for Animals to Offer Lucrative Growth Opportunity

Innovative research and development activities drive the advancements in veterinary medicine, leading to the development of more effective drugs, vaccines, and feed additives to address a wide range of diseases in companion and livestock animals. Additionally, increased awareness among pet owners and livestock farmers about advanced treatment options further contributes to the growth of the market.

Key market players are increasingly focused on launching new treatments for various diseases, ensuring safety and well-being, which contributes to the growth of the market.

- For instance, in April 2024, the U.S. Food and Drug Administration approved Pradalex (pradofloxacin injection) for the treatment of Bovine Respiratory Disease (BRD) associated with Pasteurella multocida, Mannheimia haemolytica, Mycoplasma bovis, Histophilus somni in cattle and Swine Respiratory Disease (SRD) associated with Bordetella bronchiseptica, Glaesserella (Haemophilus) parasuis, Mycoplasma hyopneumoniae, Streptococcus suis, and Pasteurella multocida in swine. Such approvals propel the growth of the market during the forecasted timeframe.

MARKET CHALLENGES

Antimicrobial Resistance in the Food-Producing Animals of Lower-Economic Countries to Challenge Market Growth

Lack of knowledge and economic constraints in low-middle economic countries lead to unnecessary usage of antibiotics, leading to antimicrobial resistance in animals. The use of antimicrobials in food animal production has been prevalent for decades, initially yielding significant commercial benefits in terms of enhanced growth performance in livestock. However, the prolonged and often inappropriate application of these substances such as the overuse of antimicrobials has led to serious repercussions, particularly in the form of Antimicrobial Resistance (AMR), which poses a significant threat to both human and animal health worldwide. These resistant organisms can spread through various environmental pathways, exacerbating the risks associated with AMR.

- For instance, in September 2024, the World Organization for Animal Health reported that antimicrobial global supply for over 2.00 billion people is projected to increase healthcare costs by USD 189.0 billion by 2025. The economic burden of antimicrobial resistance in livestock animals leads to hampering the adoption of drugs and raises concerns over usage and growth of the market.

To address this issue, regulatory bodies are implementing stricter guidelines regarding antimicrobial use in animals, which may limit the availability of these drugs for therapeutic purposes. These measures aim to address AMR challenges and ensure sustainable growth of the market within the agricultural sector.

VETERINARY THERAPEUTICS MARKET TRENDS

Emergence of New Therapies for Revolutionizing Animal Healthcare is a Prominent Trend

Revolution in animal healthcare is being driven by the development of gene and cell therapies to offer personalized treatment options for complex diseases. These advanced approaches utilize genetic engineering techniques to modify or replace defective genes, addressing hereditary conditions and enhancing overall animal health. The shift toward personalized therapy improves the quality of life for animals and tailors treatments to the specific genetic and health profiles of individual patients, minimizing the risk of adverse reactions.

As research in this field continues to advance, veterinarians are increasingly able to offer state-of-the-art solutions that were once limited to human medicine. Moreover, key players in the market are collaborating to develop and commercialize gene and cell therapies, further accelerating market growth.

- For instance, in December 2024, Protect Animal Health collaborated with Rejuvenate Bio, a company specializing in gene therapies for chronic age-related diseases. The collaboration aimed to develop and commercialize PT-401, a proprietary gene therapy for Myxomatous Mitral Valve Disease (MMVD) in dogs. These therapies deliver anti-aging genes to delay heart failure progression in dogs. Such strategic collaborations in developing new and advanced therapies for animal health will boost the veterinary therapeutics market growth during the forecast period.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a slight positive impact on the market, driven by increased awareness of zoonotic diseases and the importance of animal health. During the pandemic, the surge in demand for pet products led to higher sales of vaccines, antibiotics, and veterinary care products. Additionally, the adoption of telemedicine in veterinary practices allowed pet owners to consult veterinarians remotely, ensuring continued access to veterinary services and prescriptions, which contributed to increased sales of therapeutics.

Moreover, some prominent companies experienced revenue growth during the pandemic, supporting overall market expansion. The increasing number of zoonotic diseases and rising demand for pet and livestock maintenance products will propel the growth of the market during the forecast period.

SEGMENTATION ANALYSIS

By Product

Rising Prevalence of Diseases in Different Animal Species to Propel the Veterinary Drugs’ Segmental Dominance in 2024

Based on product, the market is divided into veterinary drugs, veterinary vaccines, and medicated feed additives.

The veterinary drugs segment held the highest global veterinary therapeutics market share of 64.87% in 2026. The segment is further divided into anti-infectives, anti-inflammatory, parasiticides, and others. The dominance of the segment is driven by the increasing number of diseases in animals and the rising number of pets and livestock animals worldwide. Moreover, the increasing regulatory approvals for generics and the presence of key players in the market with a wide range of product offerings for various animal-related diseases in different species further strengthens market growth.

- For instance, in June 2024, the U.S. Food and Drug Administration approved Phenylpropanolamine Hydrochloride chewable tablets to control urinary incontinence in dogs.

The veterinary vaccines segment held the second-largest share of the market. The veterinary vaccines segment is further sub-segmented into inactivated, live attenuated, recombinant, and others. The growth of the segment is due to the increasing number of various infectious diseases in different species of animals and the rising demand for effective vaccines to stop the spread of these diseases. Additionally, rising research and development initiatives, surge in the number of government programs, and vaccination drives propel the demand for veterinary vaccines.

- For instance, in March 2024, researchers from Louisiana State University developed a new vaccine against bovine respiratory disease (BRD) to save the U.S. cattle industry from bovine herpes virus type 1 (BHV-1).

The medicated feed additives segment is expected to grow moderately during the forecast period. The medicated feed additives segment can be further sub-segmented into antimicrobials, anticoccidials, antiparasitics, and others. The growth of the segment is due to an increase in the demand for medicated feed additives as they enhance the health and productivity of livestock by preventing diseases, promoting growth, and improving feed efficiency. These additives also contribute to better quality of meat and byproducts production. Moreover, the rising demand for animal-based protein is further driving the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Animal Type

Livestock Animal Segment Led due to Strong Demand for Advanced Veterinary Care

Based on animal type, the market is bifurcated into companion and livestock.

The companion segment held a significant share of the market in 2024. The segment comprises feline, canine, avian, and others. The significant share of the segment is due to increasing pet ownership, the rising demand for advanced veterinary care, and greater willingness among pet owners to invest in preventive medications, treatments for chronic conditions, and specialized therapies. Moreover, the rising disposable income among pet owners and the humanization of pets, have further fueled spending on high-quality veterinary services and products, enhancing the quality of life for companion animals. This segment is estimated to capture 46.1% of the market share in 2025.

- For instance, in September 2022, according to HealthforAnimals Global Trends in the Pet Population, the population of pet cats and dogs in Europe is around 113.0 million and 92.0 million, respectively. Such rising preference for companion animals is aimed to propel the growth of the segment in the market.

The livestock segment accounted for the dominant market share in 2026. The livestock segment is further sub-segmented into poultry, porcine, bovine, and others. The growth of the segment is augmented by increasing demand for animal-based protein and increasing awareness for animal health to stop the spread of zoonotic disease from animals to humans. As livestock production intensifies to meet global consumer needs, there is a greater emphasis on preventing and treating diseases to ensure optimal productivity and food safety. Furthermore, the growing trend of sustainable farming practices and improved animal welfare standards are prompting farmers to invest more in veterinary therapeutics. This segment is likely to grow with a CAGR of 5.42% during the forecast period (2025-2032).

- For instance, according to C-DAC India, the total meat production was 9.77 million tons for the year 2022-23, with an annual growth rate of 5.13%. The rising demand for animal protein is expected to propel the expansion of veterinary treatment products in the segment.

By Route of Administration

Rising Number of Vaccination Programs Boosted the Parenteral Segment Growth

Based on route of administration, the market is sub-segmented into oral, parenteral, topical, and aerosol segments.

The parenteral segment dominated the market in 2024 due to its rapid onset of action and high bioavailability. The parenteral route is often used for vaccines, antibiotics, and for pain management in animals. Additionally, it allows for precise dosing and is particularly beneficial in emergencies or when animals are unable to take oral medications. Moreover, the rising number of government-led vaccination programs and the presence of key players offering a large number of parenteral products further contributed to the segmental dominance. The segment is estimated to grow at a considerable CAGR of 6.02% during the forecast period (2025-2032).

- For instance, in January 2025, Indonesia launched a vaccination program to stop the spread of foot and mouth disease in livestock animals.

The oral segment held the second-largest share of the market. The oral administering medications includes tablets, liquids, or powders for animals. Oral administering drugs are easy and convenient and they can be mixed with animal feed. Additionally, the presence of key players in the market with a rising focus on regulatory approvals and product launches is likely to boost the segment's growth. The segment is poised to attain 47.23% of the market share in 2026.

- For instance, in September 2024, Elanco Animal Health launched Zenrelia after the U.S. FDA approval. Zenrelia is a once-daily oral JAK inhibitor for dogs with allergic and atopic dermatitis. Such product launches promote the growth of the segment in the market.

The topical segment accounted for the third-largest share of the market. The topical route is commonly used for treating localized conditions, such as skin infections, allergies, or parasites. The rising number of skin allergies and parasite infections in animals tends to increase the demand for spot-on treatments with minimal systemic effects, making them a preferred choice for many dermatological issues.

- For instance, according to the ICAR-Agricultural Technology Application Research Institute report, lumpy skin disease affected around 2.94 million cattle in 2022. Authorities used oral and topical ethno-veterinary formulations. Such conditions boost the demand for topical formulations and boost the growth of the segment.

The aerosol segment is expected to grow with a moderate CAGR during the forecast period. The growth of the segment is augmented by increasing technological advancements and increasing adoption of aerosol formulations for the treatment of various skin diseases without touching the wound.

By Distribution Channel

Rising Launch of New Clinics Encouraged the Veterinary Clinics Segmental Growth

Based on distribution channel, the global market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary clinics segment held the dominant share of the market due to the rising number of pet ownerships and increasing demand for regular check-ups and treatment of pets. This setting offers advanced treatment facilities, making them a preferred choice among pet owners. Additionally, increasing the launch of new clinics to improve the quality of small animal care, boost the adoption of these products in the settings, and propel the segment's growth. The segment is likely to grow at a CAGR of 6.14% during the forecast period (2025-2032).

- For instance, in August 2021, DCC Animal Hospital launched its first veterinary hospital in India for small animal medical care.

Veterinary hospitals held the second-largest share of the market. Veterinary hospitals are equipped with advanced treatment methodologies and facilities for animals. Thus, pet and livestock owners shift toward these settings to treat their pets and livestock. Additionally, increasing collaborations between the hospitals and the diagnostics companies will propel the segment's growth. This segment is set to gain 40.99% of the market share in 2026.

- For instance, in December 2024, VCA Animal Hospitals and Antech, a leader in veterinary diagnostics, collaborated with One Health reporting organizations to publish the six-step framework. This collaboration emphasized the importance of collaboration between veterinary professionals, public health officials, and diagnostic experts to create a seamless and effective response system. Such collaboration boosts the growth of the segment in the market.

The pharmacies & drug stores and the others segment are expected to grow during the forecast period. The presence of a wide variety of drugs, vaccines, and feed additives in these settings also makes these channels more convenient and easily accessible for the caregivers. Moreover, the increasing initiatives by these settings to offer better client and pharmacy services boost the segment's growth.

- For instance, in February 2024, Vets Pets, a network of veterinary hospitals in North Carolina, appointed a new director of clinical pharmacy services. The internal pharmacy initiative at Vets Pets aimed to offer resources to support more than 100 veterinarians to enhance pharmacy-related services for veterinary patients and clients, thus boosting the growth of the segment.

VETERINARY THERAPEUTICS MARKET REGIONAL OUTLOOK

Geographically, the global veterinary therapeutics market is studied across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Veterinary Therapeutics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, generating USD 18.91 billion in 2025 and USD 20.10 billion in revenue in 2026. The growth of the region is due to the increase in the number of pet ownerships, well-established veterinary healthcare infrastructure and rising disposable income of pet owners.

Additionally, high dependency on animal protein and the presence of advanced livestock farming technologies have significantly boosted the production quality and quantity of livestock production. This, in turn, has led to increased demand for veterinary therapeutic products, further propelling market growth.

Within North America, the U.S. dominates the key share. The country’s dominance can be attributed to increasing pet ownership rates, presence of advanced veterinary care facilities, and high disposable income amongst pet owners. These factors are likely to maintain the strong position of the country throughout the forecast period. The U.S. market is estimated to reach a valuation of USD 18.93 billion in 2026.

- For instance, in 2024, according to the American Veterinary Medical Association, the U.S. pet ownership owned approximately 59.8 million dogs and 42.2 million cats. The report also highlighted that annual spending per household averaged USD 580 for dogs and USD 433, a strong market demand for veterinary therapeutics.

Europe

Europe held the second-highest position in the global market in 2024 and is expected to gain USD 12.01 billion, exhibiting a CAGR of 5.36% during the forecast period (2025-2032). The region's growth is augmented by the presence of a large pet population, along with the rising demand for livestock. Additionally, rising government initiatives and the presence of a large number of key manufacturing companies with advanced product offerings propel the region's growth in the market. The U.K. market continues to grow and is projected to be valued at USD 3.27 billion in 2026.

- For instance, in 2023, The U.K. government launched the Animal Health and Welfare Pathway, collaborating with farmers, vets, and the industry stakeholders to boost farm productivity, food security, and public health by improving animal health and welfare.

The U.K.’s 2023 launch of the Animal Health and Welfare Pathway aimed to improve animal health and farm productivity in collaboration with industry stakeholders.

Germany is poised to reach USD 1.76 billion in 2026, while France is estimated to hit USD 1.93 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market set to be valued at USD 8.80 billion in 2026. The region is expected to grow with the highest CAGR from 2025 to 2032, fueled by the rising importance of the livestock sector in economic growth. The demand for these products is rising as better animal health ensures high-quality livestock products. China is expected to hold USD 1.53 billion in 2026.

- For example, a report from the Department of Animal Husbandry and Dairying indicates that the contribution of livestock to the Gross Value Added (GVA) of the total agriculture and allied sectors has risen from 24.38% in 2014-15 to 30.23% in 2022-23. India holds the top position in global milk production, contributing 24.76% of the world's total, underscoring the importance for better veterinary healthcare to support sustainable livestock growth.

India is poised to attain USD 1.57 billion in 2026, while Japan is projected to be valued at USD 3.30 billion in the same year.

Latin America and Middle East & Africa

Latin America is the fourth largest market estimated to be worth USD 5.02 billion in 2025. The markets in Latin America and the Middle East & Africa regions are anticipated to grow during the forecast period due to the rising number of diseases in animals and the presence of government programs to improve animal health. The GCC market is foreseen to hit USD 1.50 billion in 2025.

- In February 2024, Mexico's Ministry of Agriculture and Rural Development introduced a new Veterinary Pharmacovigilance System designed to improve the safety, quality, and effectiveness of animal medications. This system, created by the National Service for Health, Safety, and Agri-Food Quality (SENASICA), is intended to identify, evaluate, and reduce risks linked to veterinary drugs available in Mexico. Such scenarios are likely to boost the quality and efficacy of products for veterinary use and thus boost the adoption and growth of the market.

KEY INDUSTRY PLAYERS

COMPETITIVE LANDSCAPE

Prominent Players with Robust Product Offerings and Strong Strategic Activities to Maintain Dominance

Zoetis Services LLC, Merck Animal Health, and Elanco are some of the prominent players in the veterinary therapeutics industry. In 2024, several companies played a pivotal role in shaping the global market landscape. Their robust product portfolios, bolstered by regulatory approvals and timely product launches, have been crucial in maintaining their competitive edge. Moreover, the strategic initiatives such as collaborations, joint ventures, and product approvals have strengthened their market position.

Other prominent players are Ceva, Vetoquinol, and Virbac, each employing diverse strategies to expand their market presence. These strategies include introducing innovative products, forging strategic partnerships, and expanding into emerging markets. Additionally, increasing focus on sustainability and the growing consumer demand for eco-friendly products are driving research initiatives to enhance product effectiveness and meet evolving customer needs.

LIST OF KEY VETERINARY THERAPEUTICS MARKET PLAYERS PROFILED

- Zoetis Services LLC (U.S.)

- Merck Animal Health (U.S.)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH. (Germany)

- Ceva (France)

- Vetoquinol (France)

- Virbac (France)

- Phibro Animal Health Corporation (U.S.)

- Panav Bio Tech. (India)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Panav Bio Tech. launched Maropitant Injection. It is designed to treat and prevent nausea and vomiting in dogs and cats.

- October 2024: Ceva established its brand-new logistics center in Montpon-Ménestérol, France. This logistic center is capable of serving more than 100 countries.

- April 2024: Phibro Animal Health Corporation acquired Zoetis Services LLC's medicated feed additives product portfolio.

- September 2022: Vetoquinol launched Simplera (florfenicol, terbinafine, mometasone furoate) otic solution for dogs. This treatment is the most cost-effective, single-dose option available for addressing canine otitis externa linked to susceptible strains of yeast (Malassezia pachydermatis) and bacteria (Staphylococcus pseudintermedius).

- December 2020: Spectrum Antimicrobials, Inc. launched vetricept skin and wound care cleanser. It is an innovative formula designed for advanced wound care, combat, and managing infections.

REPORT COVERAGE

The global veterinary therapeutics market research report centers on providing an industry overview and examining the market dynamics of the veterinary therapeutics sector. This includes the market analysis, analyzing the drivers, restraints, opportunities, and trends influencing the market. The report highlights key developments within the industry, conducts pipeline analysis and regulatory guidelines, and discusses the launch of new products by major players. Furthermore, the report delves into the impact of the COVID-19 pandemic on the industry and provides an overview of the market situation during this period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.40% from 2026-2034 |

|

Segmentation |

By Product

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global veterinary therapeutics market size was valued at USD 47.25 billion in 2025 and is projected to reach USD 81.59 billion by 2034, growing at a CAGR of 6.40% during the forecast period.

The livestock segment holds the largest share of the veterinary therapeutics market, fueled by the global demand for high-quality animal protein and the need for disease prevention in farm animals.

The veterinary therapeutics market is growing at a compound annual growth rate (CAGR) of 6.40% from 2026 to 2034, driven by rising pet ownership, livestock demand, and advances in animal health products.

The veterinary drugs segment dominated the market in 2025.

North America region dominated the market in 2025.

Major drivers include increasing pet adoption, rising demand for animal protein, growing awareness of zoonotic diseases, and continuous innovation in veterinary drugs, vaccines, and feed additives.

The emergence of new cell and gene therapy for animals is the key trend in the market.

Zoetis Services LLC, Merck Animal Health Inc., and Elanco are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us