Veterinary Vaccines Market Size, Share & Industry Analysis, By Product (Inactivated, Live Attenuated, Recombinant, and Others), By Animal (Companion {Feline, Canine, Avian, and Others}, and Livestock {Poultry, Porcine, Bovine, and Others}), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

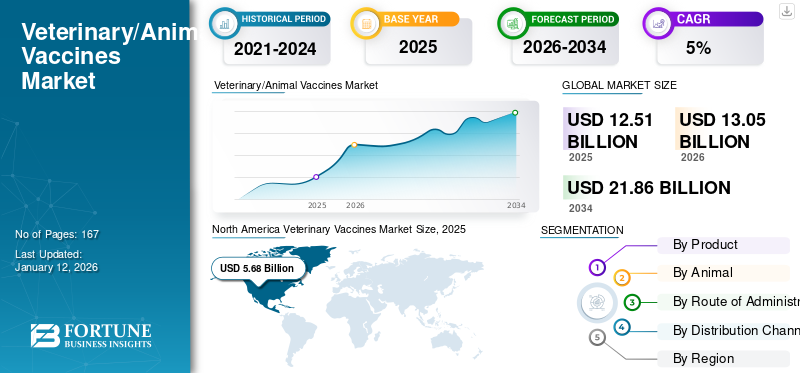

The global veterinary vaccines market size was valued at USD 12.51 billion in 2025. The market is projected to grow from USD 13.05 billion in 2026 to USD 21.86 billion by 2034, exhibiting a CAGR of 6.66% during the forecast period. North America dominated the veterinary vaccines market with a market share of 45.42% in 2025.

Veterinary vaccines are widely used to protect animals from infectious diseases. These products are designed to stimulate protective immune responses in animals and prepare their immune system to fight against infections from various disease-causing agents. These play a crucial role in animal health protection by controlling and preventing serious epizootic diseases.

Furthermore, the increasing prevalence of animal diseases, the rising number of pet ownerships, and the growing demand for animal protein across the globe are some factors supporting the demand for efficient veterinary immunizations.

- For example, in 2020, the World Organization for Animal Health reports that Foot and Mouth Disease (FMD) affects 77.0% of the global livestock population. This highly contagious viral infection, caused by an Aphthovirus from the Picornaviridae family, poses a significant threat to livestock health.

The widespread nature of these diseases heightens the need for effective preventive measures to ensure the well-being of livestock and the safety of animal products, thus bolstering the growth of the market.

Moreover, the presence of key players in the market, such as Zoetis Services LLC, Elanco, and Virbac, with strong research and development initiatives, strategic activities, and robust product offerings, also boosts the market offerings and propels the market growth.

Global Veterinary Vaccines Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 12.51 billion

- 2026 Market Size: USD 13.05 billion

- 2034 Forecast Market Size: USD 21.86 billion

- CAGR: 6.66% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.42% share in 2025. This leadership is driven by the presence of advanced healthcare facilities for animals, the rising disposable income of pet owners, a high penetration rate of animal immunization, and the introduction of novel, technologically advanced products.

- By Animal Type: The Livestock segment held the largest market share. The segment's growth is fueled by the rising global demand for animal-based protein and heightened awareness of animal health to prevent the transmission of zoonotic diseases from animals to humans.

Key Country Highlights:

- Japan: The market is driven by increasing awareness of preventive animal healthcare and rising disposable incomes. The country's regional leadership is also demonstrated through initiatives such as the World Organisation for Animal Health's pilot study on Oral Rabies Vaccination in Southeast Asia, coordinated by its representation in Japan.

- United States: Growth is supported by a massive companion animal population, with approximately 59.8 million dogs and 42.2 million cats. The market is also propelled by mandatory immunization guidelines and significant R&D initiatives, such as the development of a new vaccine for Bovine Respiratory Disease to protect the U.S. cattle industry.

- China: As part of the fastest-growing Asia Pacific region, the market in China is expanding due to rising disposable incomes, growing awareness of preventive animal healthcare, and government initiatives aimed at streamlining regulatory approvals for veterinary vaccines.

- Europe: The market is advanced by an increase in pet ownership and the rising prevalence of zoonotic diseases. Key growth factors include government-led vaccination campaigns, such as France's successful bird flu vaccination drive, and strategic investments like the establishment of a new U.K. Animal Vaccine Manufacturing and Innovation Centre.

MARKET DYNAMICS

MARKET DRIVERS

Increased Awareness and New Product Launches to Propel Market Growth

One of the crucial drivers for the rapidly growing animal vaccines market size is the increased awareness regarding veterinary healthcare and the growth in animal ownership. The rising number of cases of infectious diseases in animals, and increasing focus on managing zoonotic diseases, and the spread of various harmful infections among animals are expected to propel the growth of the market. Furthermore, the increasing number of research and development initiatives by the key players to launch vaccines for treatment also drive the market growth.

- For instance, in February 2025, Boehringer Ingelheim International GmbH launched the VAXXITEK HVT+IBD+H5 trivalent vaccine for poultry. This trivalent vaccine is used to protect animals from diseases such as Marek’s disease, Infectious Bursal Disease, and H5 avian influenza in just one shot.

These advancements and product launches tend to drive the global veterinary vaccines market growth.

MARKET RESTRAINTS

Lack of Immunization for Livestock in Developing Countries May Hinder Growth

The lack of immunization for animals in developing countries poses a significant restraint for the market. Additionally, limited healthcare infrastructure, low public awareness, and economic constraints tend to hinder the widespread use of vaccines for livestock and companion animals in lower economic regions.

These obstacles in gaining vaccination can lead to increased disease prevalence, ultimately affecting livestock production and food security. Moreover, the spread of vaccine-preventable infectious diseases in small animals in emerging regions due to lack of immunization is also hampering the market growth.

- For instance, in 2024 according to the World Small Animal Veterinary Association Vaccination Guidelines report, canine distemper virus canine parvovirus type 2 is recognized by 88.0 to 94.0% of respondents from veterinary practices in five LATAM countries. Such an increase in the number of cases of vaccine-preventable diseases showed limited immunization adoption in the developing regions, thus restraining market growth.

Additionally, the insufficient investments in veterinary services and education further challenge the market by limiting opportunities for vaccine manufacturers to tap into the market effectively.

MARKET OPPORTUNITIES

Rising Pet Ownerships and Government Initiatives to Offer Lucrative Growth Opportunity for the Market

There has been an increase in pet ownership globally, leading to higher demand for veterinary vaccines. Pet owners are becoming increasingly aware of the importance of regular veterinary care and preventive care for their pets.

- For instance, in 2024, the American Veterinary Medical Association reported that there are approximately 59.8 million dogs and 42.2 million cats owned across U.S. households. These scenarios boost the demand for immunization for better health of the pets.

Additionally, mandatory immunization guidelines for pets boost the market growth. The increasing government’s initiatives to promote animal health through vaccination programs also offer opportunities for market growth.

- In 2023, France's bird flu vaccination campaign targeting ducks led to a 12.1% increase in poultry output in 2024, surpassing pre-crisis levels. These factors promote the adoption of vaccines for animal health and increase production, eventually bolstering the market’s growth.

MARKET CHALLENGES

High Development Cost & Regulatory Hurdles to Challenge Market Growth

The development and distribution of veterinary vaccines face several significant challenges that can impede their accessibility and effectiveness, particularly in low-income regions. High costs associated with the research, development, and manufacturing processes create financial barriers that limit its availability to veterinarians and pet owners in economically disadvantaged areas.

Furthermore, stringent regulatory hurdles can prolong the approval process for new vaccines, delaying their entry into the market and hindering the timely response to emerging animal health threats. These challenges make it difficult to have active immunization in animals in lower-middle-class countries.

VETERINARY VACCINES MARKET TRENDS

Technological Advancements in Animal Immunization is An Emerging Trend in the Market

The market has experienced significant technological advancements in recent years, notably with the introduction of immunization products based on recombinant DNA technology. This innovative approach offers improved stability and simplified administration.

Additionally, a new category of immunization technology, which lies between live and killed vaccines, utilizes nucleic acid. These vaccines are developed either through DNA cloning into a delivery plasmid or via direct injection of messenger RNA.

Also, numerous key players and research institutions are actively engaged in enhancing product development tools to create innovative and effective veterinary vaccines.

- For example, in February 2024, the University Of Pennsylvania School Of Veterinary Medicine launched its mRNA Research Initiative, aimed at expediting the development of veterinary vaccines and therapies using mRNA technology. Such initiatives contribute to the introduction of new veterinary vaccines and influence global veterinary vaccine market trends.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 outbreak resulted in a slower growth of the market. This was majorly due to the disruptions in the supply chain and a shift of focus toward human vaccine development, which temporarily disrupted animal health research. Additionally, the reduced frequency of in-person consultations and routine animal care also affected the market growth.

However, the relaxation of the COVID-19 guidelines and increasing demand for animal vaccination among pet owners and livestock farmers boosted the market growth back to the pre-pandemic levels in 2021 and 2022.

SEGMENTATION ANALYSIS

By Product

Higher Use of Conventional Products led to Live Attenuated Segment Dominance

On the basis of product, the global market is segmented into inactivated, live attenuated, recombinant, and other segments.

The live attenuated segment held 33.79% of the maximum share of the market in 2026. This is majorly driven by increasing product launches by the key players. Additionally, the benefits associated with the live attenuated vaccines such as the induction of strong cell-mediated immunity, which is essential for combating certain pathogens such as Salmonella is thus increasing the adoption and contributing towards the segmental growth.

- For instance, in September 2022, Merck Animal Health launched the Nobivac Intra-Trac Oral BbPi formulation, which is an oral Bordetella bronchiseptica and canine parainfluenza virus vaccine. Such launches are supporting the growth of the segment in the market.

The inactivated vaccines segment held the second-largest share of the global market in 2024. The growth of the segment is due to the ongoing launches of inactivated vaccines by government bodies and key companies, and it is expected to expand its market share in the forecast period.

- For instance, in March 2024, Merck Animal Health announced that the European Medicines Agency’s Committee for Veterinary Medicinal Products (CVMP) had given a positive opinion for the NOBILIS MULTRIVA RT+IBm+ND+Gm+REOm+EDS vaccine. This is an inactivated viral vaccine given intramuscularly to protect eight-week-old chickens against several diseases, including avian metapneumovirus, Infectious Bronchitis, Newcastle Disease, Gumboro virus, Reovirus, and Egg Drop Syndrome. Such launches and approvals boost the segment’s growth in the market.

On the other hand, recombinant vaccines are anticipated to grow at the highest CAGR during the forecast period due to their positive features, such as purity, safety, efficacy, and targeted immune response. They are widely used for the prevention of diseases such as rabies, avian influenza, and circovirus in livestock and companion animals. Moreover, the cost-effective production of higher-quality products has contributed to the high growth of the recombinant segment. Such benefits bolster the segment’s growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Animal

Livestock Segment Dominated the Market Due to Growing Demand for Animal Based Proteins

On the basis of animal, the market is segmented into companion and livestock.

The livestock segment held the largest veterinary vaccines market share in 2024. This segment is further divided into poultry, porcine, bovine, and other livestock categories. The growth of this segment is driven by the rising demand for animal-based protein and heightened awareness of animal health to prevent the transmission of zoonotic diseases from animals to humans. Thus, to avoid the spread of livestock diseases, vaccines are used as preventive measures. Also, increasing regulatory approvals and new product launches by the key players for livestock vaccination will boost the segment’s growth in the market. The livestock segment expected to hold 54.45% of the market share in 2026.

- For instance, in February 2025, Bharat Biotech received a license from the Central Drug Standards Control Organisation (CDSCO) for Biolumpivaxin. It is used to prevent lumpy skin disease in dairy cattle and buffaloes. Such launches are expected to promote the segment’s growth in the market.

The companion segment captured a substantial CAGR of 6.32% during the forecast period. This segment includes feline, canine, avian, and other companion animals. The substantial share of this segment can be attributed to the growing trend of pet ownership and the increasing demand for comprehensive treatment options from pet owners. Additionally, rising disposable incomes among pet owners and the trend of treating pets as family members have further driven spending on high-quality veterinary services and products aimed at improving the quality of life for companion animals. Moreover, increasing product launches for companion animal vaccines also propelled the segment’s growth in the market.

- For example, in September 2024, Merck Animal Health launched NOBIVAC NXT FeLV to protect cats against feline leukemia virus. Such launches boost the segment’s growth in the market.

By Route of Administration

Parenteral Segment to Lead in Terms of Revenue Generation due to Advancements in Technologies of Immunization Delivery Devices

On the basis of route of administration, the global market is sub-segmented into oral, parenteral, and others.

The parenteral segment held a dominant share of the global market in 2024. The segmented is expected to exhibit CAGR of 6% during the forecast period. This is due to their rapid onset of action and higher efficacy in inducing immunity compared to other routes. This route of administration typically involves injecting the vaccine directly into the animal's body, which can be done via subcutaneous, intramuscular, or intradermal routes. Additionally, increasing research and development activities and product launches of new parenteral vaccines also promoted the growth of the segment.

- For instance, in June 2023, Merck Animal Health launched the Circumvent CML vaccine for pigs. It is a single-dose intramuscular vaccine to control Porcine Circovirus Type 2a (PCV-2a), Porcine Circovirus Type 2d (PCV-2d), Mycoplasma hyopneumoniae and Lawsonia intracellularis in pigs.

The oral segment is projected to hold 69.39% of the share in 2026 and is expected to grow with a significant CAGR during the forecast period. The growth of the segment is augmented by the preference for these routes in situations where mass vaccination is needed, and administration can be easily done to large groups. The oral vaccines are administered through the animal's mouth, often in the form of liquids, gels, or coated pellets.

Furthermore, an increasing number of programs offering vaccinations to stray animals with oral formulations boost the growth of the segment in the market.

- For instance, in March 2024, the World Organisation for Animal Health Regional Representation in Japan (WOAH RRAP) collaborated with the General Directorate for Animal Health and Production (GDAHP) of the Cambodian government to initiate a pilot study on Oral Rabies Vaccination (ORV) in various villages within the Krang Thnong Commune in Takeo Province. Such activities promote segment growth.

On the other hand, the other segment is expected to grow moderately during the forecast period. The growth of the segment is due to increasing technological advancements in formulations and rising demand for easier administration of vaccines to animals. Additionally, intranasal vaccines are gaining popularity, particularly in species with respiratory diseases, while transdermal options are being explored for their potential ease of use and effectiveness. Such benefits propel the segment’s growth during the forecast period.

By Distribution Channel

Veterinary Clinics Segment to Hold the Largest Share Owing to Conduction of Short-duration Procedures in Small Institutions

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary clinics segment is anticipated to have the dominant share during the forecast period as vaccinations are often a short-duration procedure that is conducted at smaller institutions. Additionally, the activities performed by veterinary professionals to boost vaccination among pets propel the segment’s growth in the market. This segment is also expected to show a CAGR of 6.16% during the forecast period.

- For instance, in December 2024, The Veterinary Medical Association, Texas, in collaboration with Flint Veterinary Clinic, asked pet owners to get their animals vaccinated against leptospirosis to protect against the spread of bacterial infection. Such activities are expected to boost the segment’s growth in the market.

The veterinary hospitals segment is projected to maintain a strong position during the forecast period. This is largely due to their capability to offer advanced care and specialized treatment options for pets experiencing complications. These facilities are equipped with state-of-the-art technology and a team of trained professionals, enabling them to address a wide range of medical issues effectively. This segment is likely to capture 31.15% of the market share in 2026.

The pharmacies and drug stores segment is also expected to witness significant growth opportunities during the forecast period. The rising popularity of online pharmacy services provides convenience to pet owners by streamlining the process of obtaining medications and health products for pets benefiting the segment’s growth. Additionally, as more consumers turn to digital solutions for their pharmaceutical needs, the collaboration between veterinary hospitals and online pharmacies is likely to foster further expansion in this segment, enhancing accessibility and overall care for pets.

VETERINARY VACCINES MARKET REGIONAL OUTLOOK

North America

North America Veterinary Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's veterinary vaccines market size was valued at USD 5.93 billion in 2026 and dominated the global market. In 2025, this region also dominated the market with a value of USD 5.68 billion. The growth of the region is augmented by the presence of advanced healthcare facilities for animals and the rising disposable income of pet owners.

Additionally, the growing penetration of immunization among the animal population and the introduction of novel technologically advanced products across North America support regional growth.

U.S.

The U.S. is set to dominate the North American market across the study period. The U.S. market size is estimated to hit USD 5.25 billion in 2026. Growing pet ownership, along with mandatory immunization guidelines for animals, is anticipated to support the country's market growth. Additionally, the presence of key players and the increasing number of research and development activities in the country for vaccine development boosts the country’s growth.

- For instance, in March 2024, researchers from Louisiana State University developed a new vaccine against Bovine Respiratory Disease (BRD) to save the U.S. cattle industry from Bovine Herpes Virus Type 1 (BHV-1).

Europe

Europe is projected to be the second-largest market with a whopping USD 3.39 billion in 2026, exhibiting a CAGR of 5.68% during the forecast period. The growth of the region is driven by an increase in pet ownership and the rising prevalence of zoonotic diseases, which has resulted in an increase in the number of veterinary practices and improved healthcare services in European countries. The market in U.K. is estimated to be USD 0.35 billion in 2026.

The Germany’s market size is foreseen to be valued at USD 0.48 billion in 2026 and France’s likely to be USD 0.51 billion in 2025.

Additionally, the presence of key players in the market with broad product offerings and favorable regulatory guidelines for animal health also propelled the region’s growth in the market.

- In March 2023, the UKRI Biotechnology and Biological Sciences Research Council (BBSRC) and the Foreign, Commonwealth and Development Office (FCDO) partnered with the Bill & Melinda Gates Foundation to establish a new center at The Pirbright Institute. This initiative aims to expedite the development of animal vaccines to address emerging and urgent infectious diseases.

Asia Pacific

Asia Pacific region is to be anticipated the third-largest market with USD 1.89 billion in 2026.

This market is expected to grow with a significant CAGR during the forecast period. With rising disposable income in the region, there is a growing awareness of preventive animal healthcare. Pet and livestock owners in India, China, Japan, and other parts of Asia Pacific are increasingly interested in regular and timely vaccinations for their animals. Additionally, government initiatives aimed at streamlining regulatory approvals for veterinary vaccines are responding to the heightened demand. This trend is expected to drive market growth throughout the region.

- For example, in June 2023, India's Ministry of Fisheries, Animal Husbandry and Dairying launched the Nandi portal to improve the application process and facilitate the issuance of non-objection certificates (NOCs) for veterinary drugs and vaccines. This initiative aims to enhance the accessibility of veterinary products and promote timely vaccinations for livestock. Such initiatives are expected to propel the region’s growth during the forecast period.

The market in China is projected to be USD 0.76 billion in 2026.

The Japanese market is anticipated to be valued at USD 0.51 billion and India’s likely to be USD 0.17 billion in 2026.

Latin America and the Middle East & Africa

Latin America region is to be anticipated the fourth-largest market with USD 1.25 billion in 2026. The Middle East & Africa and Latin America markets are expected to witness stable growth rates during the forecast period. The increasing number of diseases in companion and livestock animals and the rising demand for effective immunization to protect from deadly and contagious diseases is propelling the demand for veterinary vaccines in the regions.

Additionally, increasing government initiatives to fight against the spread of zoonotic diseases will bolster the region’s growth during the forecast period. GCC market size is expected to hit USD 0.28 billion in 2025.

- For instance, in November 2022, Mexico's agriculture ministry announced the vaccination drive against avian influenza to prevent the spread of a highly contagious H5N1 strain. Such scenarios are expected to boost the region’s growth during the forecast period.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Strive to Have a Strong Global Presence and Provide Robust Product Offerings to Strengthen their Positions

In terms of the competitive landscape, a few companies have conquered the market due to their strong product portfolio and key strategic decisions. Zoetis Services LLC, Merck Animal Health, and Elanco are some of the prominent players in the market. The continued R&D for new product approvals and extensive geographical presence are expected to propel the company’s share in the market.

- For instance, in September 2022, Zoetis acquired Jurox, an animal health company that provides veterinary medicines for treating livestock and companion animals in Australia.

LIST OF KEY VETERINARY VACCINE COMPANIES PROFILED

- Elanco (U.S.)

- HIPRA (Spain)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck Animal Health (U.S.)

- Zoetis Services LLC (U.S)

- Ceva (France)

- NEOGEN CORPORATION (U.S.)

- Hester Biosciences Limited (India)

KEY INDUSTRY DEVELOPMENTS

- June 2024: Merck Animal Health launched the NOBIVAC NXT Rabies portfolio, including NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies in Canada.

- January 2024: Boehringer Ingelheim launched Vaxxilive Cocci 3, a poultry coccidiosis vaccine formerly called Hatchpak Cocci III. The vaccine is used to prevent coccidiosis in birds.

- April 2022: Ceva launched Cevac IBird for poultry in India to protect them from Infectious Bronchitis (IB) disease.

- April 2021: Boehringer Ingelheim International GmbH launched PREVEXXION RN and PREVEXXION RN+HVT+IBD, vaccines against Marek’s disease in the European Union countries and the U.K.

- February 2021: Virbac and Algenex SL entered an international commercial licensing agreement to develop and commercialize CrisBio.

REPORT COVERAGE

The global veterinary vaccines market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, animals, route of administration, and distribution channels. Besides this, it offers insights into the market trends, the impact of COVID-19, and the prevalence of zoonotic diseases, among other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.66% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Animal

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 12.51 billion in 2025 and is projected to reach USD 21.86 billion by 2034.

In 2025, the market stood at USD 12.51 billion.

By registering a CAGR of 6.66%, the market will exhibit steady growth during the forecast period (2026-2034).

Based on the product segment, the live attenuated segment is expected to lead the market during the forecast period.

Increased awareness about animal health, the rising transmission of zoonotic diseases, surging animal ownership, and new product launches would drive the adoption of veterinary vaccines.

Elanco, Inc. and Merck Animal Health are the top players in the market.

North America is expected to hold the largest market share, accounting for 45.42% in 2025.

The current market trends are the adoption of advanced vaccines, novel modes of vaccine delivery, stringent regulatory norms with respect to livestock animals, and increased awareness amongst owners.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us