Companion Animal Vaccines Market Size, Share & Industry Analysis, By Product (Inactivated, Live Attenuated, Recombinant, and Others), By Animal Type (Feline, Canine, Avian, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Veterinary Hospitals, Veterinary Clinics, Pharmacies & Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

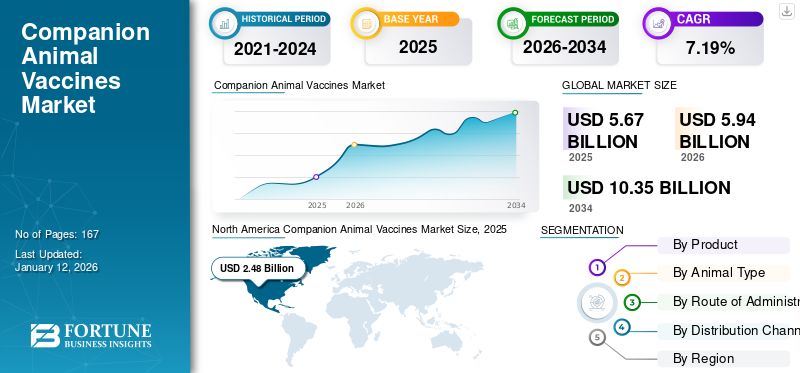

The global companion animal vaccines market size was valued at USD 5.67 billion in 2025. The market is projected to grow from USD 5.94 billion in 2026 to USD 10.35 billion by 2034, exhibiting a CAGR of 7.19% during the forecast period. North America dominated the companion animal vaccines market with a market share of 43.55% in 2025.

Companion animal vaccines are crucial for protecting pets from various animal diseases, improving their quality of life, and preventing costly treatments. They often play a crucial role in animal health protection by controlling and preventing serious epizootic diseases. The companion animal vaccines market is experiencing significant growth, driven by increasing pet ownership, heightened awareness of animal health, and advancements in vaccine production technology. Additionally, companies are continuously launching new vaccines and collaborating on research to address emerging diseases, which is expected to propel the market growth.

Furthermore, the increasing prevalence of animal disease across the globe are the factors supporting the demand for efficient immunizations. Moreover, the presence of key players in the market, such as Zoetis Services LLC, Elanco, and Virbac, with a strong focus on strategic initiatives such as new product launches, collaboration for R&D and new product development is expected to fuel the market growth during the forecast period.

Global Companion Animal Vaccines Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.67 billion

- 2026 Market Size: USD 5.94 billion

- 2034 Forecast Market Size: USD 10.35 billion

- CAGR: 7.19% from 2026–2034

Market Share:

- North America dominated the companion animal vaccines market with a 43.55% share in 2025, driven by advanced veterinary healthcare facilities, rising pet immunization programs, and the strong presence of key market players.

- By product type, the live attenuated segment is expected to retain the largest market share owing to its long-lasting immune response, frequent product launches, and increased R&D investments by key players.

Key Country Highlights:

- United States: The market is driven by a strong presence of leading vaccine manufacturers, stringent quality regulations, and rising adoption of advanced animal immunization technologies.

- Europe: Growth is supported by high pet ownership, increasing awareness of zoonotic diseases, and strategic government initiatives aimed at advancing veterinary vaccine development.

- China: Rising pet adoption rates, improving veterinary healthcare infrastructure, and growing investments in innovative vaccine technologies are fueling market demand.

- Japan: Expanding veterinary healthcare facilities and growing awareness of preventive pet healthcare are key factors supporting the adoption of companion animal vaccines.

MARKET DYNAMICS

MARKET DRIVERS

Rising Number of Pet Ownerships to Propel Market Growth

The companion animal vaccine market is poised for significant growth, driven largely by the rising number of pet ownerships worldwide. The increasing adoption of pets, particularly dogs and cats, is a key driver of the market.

- For instance, in Canada, the dog population increased from 7.6 million to 7.7 million between 2019 and 2021. Additionally, the humanization of pets and growing awareness of zoonotic diseases are further propelling market growth.

Strategic collaborations and product launches by major players such as Elanco Animal Health Incorporated and Zoetis Inc. are also contributing to the companion animal vaccines market growth. Additionally, emerging advancements in the veterinary healthcare infrastructure and rising pet insurance coverage are boosting the trend in the market. These factors are expected to fuel the segment growth over the projected years.

MARKET RESTRAINTS

Limited Access to Veterinary Services in Developing Countries May Hinder Market Growth

Limited access to veterinary services in developing countries significantly constrains the companion animal vaccine market. The barriers such as financial limitations, geographic isolation, and limited veterinary personnel and equipment hinder the distribution and administration of vaccines. This situation is exacerbated by economic struggles and political instability, which further impede the development of veterinary infrastructure necessary for vaccine delivery.

As a result, companion animal owners in such areas often face challenges in accessing vaccinations, leading to reduced market penetration and growth opportunities for vaccine manufacturers.

- For instance, according to the research published in the journal Vaccines in January 2021, in the current scenario, only an estimated 40% of the veterinary practitioners follow the most recent policy guideline for the vaccinations of their pets. Hence, there remains a significant gap in immunization adoption due to healthcare infrastructure, low public awareness, and economic constraints.

These factors such as insufficient investment in veterinary services and education further limit the services and product penetration in these regions.

MARKET OPPORTUNITIES

Rising Adoption of Pet Insurance to Offer New Market Opportunities

The companion animal vaccine market is witnessing significant growth due to several factors, including the increasing adoption of pets globally and the rising awareness of animal health and zoonotic diseases. One of the key opportunities in this market is the growing demand for pet population insurance. As pet owners increasingly view their pets as family members, there is a growing interest in comprehensive insurance coverage for pets.

This trend is further supported by the expansion of pet insurance policies, which not only cover routine vaccinations but also provide financial protection against unexpected veterinary expenses. This helps foster a more stable and growing market for companion animal vaccines.

- For instance, Future Generali India Insurance Company Ltd sold nearly 25,000 pet insurance policies in the last quarter of 2022, highlighting significant growth potential for pet health market including vaccines

MARKET CHALLENGES

High Development Costs

The high costs associated with developing veterinary vaccines pose a significant challenge for the companion animal vaccines market. These costs include substantial investments in research, clinical trials, and regulatory approvals, which can be particularly daunting for smaller enterprises. As a result, the financial burden may limit the entry of new players into the market, potentially reducing competition and innovation in companion animal vaccines.

Regulatory Hurdles

Stringent regulatory frameworks governing veterinary vaccines also impact the companion animal vaccine market. The rigorous safety and efficacy standards for vaccines can lead to extended approval timelines and increased costs. These stringent requirements ensure the quality of vaccines but can slow down the introduction of new products to the market.

Logistical Constraints

Logistical constraints, particularly maintaining the cold chain during vaccine distribution, pose another challenge for the market. The need for strict temperature control to preserve vaccine efficacy adds complexity and expense to the distribution process. In regions with limited infrastructure, such as rural areas in developing countries, these logistical challenges can result in reduced vaccine availability and effectiveness. This situation can hinder the growth of the market by limiting access to vaccines in areas where they are most needed.

COMPANION ANIMAL VACCINES MARKET TRENDS

Technological Advancements in Animal Immunization Development is a Vital Trend

The novel technologies such as recombinant and DNA vaccines enhance vaccine efficacy and safety, leading to broader immunization coverage among companion animals. This technological progress is driving innovation in the companion animal vaccine market, enabling more effective disease prevention and contributing to the overall health and well-being of pets. Additionally, this advancement is leading to new product launches in the market.

For instance, in November 2024, Boehringer Ingelheim launched EURICAN L4 vaccine, for protection against leptospirosis in dogs.

Preventive Healthcare Focus to Boost Product Adoption

There is a growing emphasis on preventive healthcare in the market, with pet owners increasingly seeking vaccinations to avert potential diseases. This trend is driven by the desire to ensure longer and healthier lives for pets. As a result, the demand for vaccinations is rising among the companion animals

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Strong and Long-lasting Immune Response Lead to Live Attenuated Segment Dominance

On the basis of product, the market is segmented into inactivated, live attenuated, recombinant, and others.

The live attenuated segment accounted for the dominant share of the market due to an increasing number of product launches by key players, rising investments in research and development, and expanding immunization programs.

For instance, Merck Animal Health launched Nobivac Intra-Trac Oral BbPi formulation, which is an oral Bordetella bronchiseptica and canine parainfluenza virus vaccine. Such product launches are driving the growth of the segment within the market.

Inactivated vaccines segment held the second-largest share of the global market in 2024. The growing population of companion animals, increasing prevalence of zoonotic diseases, and increasing investments in research and development.

The recombinant vaccines are anticipated to grow at the highest CAGR during the forecast period due to their incorporation of genes from different pathogens, enabling the creation of vaccines against multiple diseases or strains and strong immune response.

By Animal Type

High Adoption Rates lead to Dominance of the Canine Segment

On the basis of animal type, the market is divided into feline, canine, avian, and other companion animals.

In 2024, the canine segment captured a dominant market share due to their popularity as pets and increasing adoption rates. Additionally, increasing awareness of the importance of preventive healthcare for dogs, driving demand for routine vaccinations. Moreover, the introduction of combination vaccines that offer multivalent protection against multiple diseases enhances convenience and encourages vaccination compliance among dog owners.

The feline segment is expected to grow at a comparatively higher CAGR than other animal types, due to shifting trend toward cat adoption across the globe. Strong advocacy from veterinary organizations for regular vaccination protocols helps drive compliance among cat owners. Moreover, increasing product launches for companion animal vaccines will propel the segment’s growth in the market.

- For instance, in September 2024, Merck Animal Health launched a NOBIVAC NXT FeLV to protect cats against feline leukemia virus. This launch boosts the segment’s growth in the market.

The growing popularity of non-traditional pets such as rabbits and ferrets is expanding the market for specialized vaccines in the others segment.

By Route of Administration

Greater Adoption of Parenteral Vaccines to Lead to Their Market Dominance

On the basis of route of administration, the market is segmented into parenteral, oral, and others.

The parenteral segment held a dominant companion animal vaccines market share. Parenteral vaccines, administered via injection (e.g., intramuscular or subcutaneous), are a dominant route due to their proven efficacy and ability to deliver a strong immune response. Additionally, the high immunogenicity, and wide adoption of these products are growing the segment at a stable rate.

- For instance, vaccines such as Merck's Nobivac parenteral series for dogs effectively protect against multiple diseases, demonstrating the efficacy of parenteral administration.

The oral segment held the second largest share of the market and is expected to grow with a significant CAGR during the forecast period. The growth of the segment is augmented by the ease of administration and ability to target mucosal immunity. Additionally, an increasing number of programs offer vaccinations to stray animals with oral formulations to boost the growth of the segment in the market.

The others segment is projected to grow at a robust CAGR during the forecast period, driven by technological advancements in vaccine formulations and increasing demand for easier administration methods for animals. Intranasal vaccines are gaining traction, particularly for respiratory diseases in specific species, while transdermal options are being explored for their convenience and effectiveness.

By Distribution Channel

Rising Number of Veterinary Clinics to Result in Segmental Dominance

On the basis of distribution channel, the market is segmented into veterinary hospitals, veterinary clinics, pharmacies & drug stores, and others.

The veterinary clinics segment is estimated to have the dominant share during the forecast period due to the rising number of veterinary clinics. Additionally, increased investments by governments and organizations to address the shortage of veterinary professionals is expected to drive segment growth.

- For instance, in September 2022, VCA Animal Hospitals launched Urgent Care clinic in Los Angeles and plans to expand in Arizona, Southern California, Colorado, and Texas.

Increasing visits by pet owners to veterinary hospitals for administering vaccines and post-vaccination care are significant growth drivers. These hospitals offer advanced care infrastructure, reducing complications and attracting more pet owners. This trend is expected to bolster the segment's growth during the forecast period.

On the other hand, the pharmacies and drug stores segment is also expected to witness significant growth opportunities during the forecast period. These facilities cater to a large volume of vaccinations, contributing to their steady growth during the forecast period.

COMPANION ANIMAL VACCINES MARKET REGIONAL OUTLOOK

North America

North America Companion Animal Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America's companion animal vaccines market size was valued at USD 2.36 billion in 2024 and is expected to grow significantly during the forecast period. The growth of the market in North America is driven by the availability of advanced animal healthcare facilities and increasing disposable income among pet owners. Additionally, the rising adoption of immunization programs for pets and the introduction of innovative, technologically advanced vaccines have significantly supported the regional market expansion.

U.S.

In terms of country, the U.S., accounted for the largest share of North America, which is due to the strong and established presence of major players in the U.S., and stringent regulatory standards to ensure the quality and efficacy of these vaccines, and facilitating widespread adoption.

Europe

Europe holds the second-largest share of the market due to the high population of pet dogs and cats across the U.K., Germany, and France. Rising awareness about pet health and welfare, coupled with government initiatives to prevent zoonotic diseases, supports market growth. Additionally, increased adoption of advanced vaccine technologies contributes to the expansion of this regional market

- In March 2023, the UKRI Biotechnology and Biological Sciences Research Council (BBSRC) and the Foreign, Commonwealth and Development Office (FCDO) partnered with the Bill & Melinda Gates Foundation to establish a new center at The Pirbright Institute. This initiative aims to expedite the development of animal vaccines to address emerging and urgent infectious diseases. Such an initiative boosts the region’s growth in the market.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR in the market, fueled by increasing disposable income, and rising pet ownership. Additionally, the region's growth aids in increasing awareness about pet health, and expanding veterinary healthcare infrastructure. For instance, In March 2024, DCC Animal Hospitals announced the grand opening of its new DCC Animal Hospital in Japan, expanding its footprint in the Asia Pacific region. Furthermore, the emerging markets such as China and India within Asia Pacific, are also witnessing investments in innovative vaccine technologies to cater to the evolving needs of pet owners.

Latin America and Middle East & Africa

The Middle East & Africa and Latin America are expected to witness stable growth rates during the forecast period. The increasing number of diseases in companion animals and the rising demand for effective immunization to protect from deadly and contagious diseases is propelling the demand for companion animal vaccines in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Global Presence and Robust Product Offerings by Elanco, Inc., and Other Players to Strengthen their Positions

In the competitive landscape of the companion animal market, companies such as Zoetis, Merck Animal Health, and Elanco have emerged as dominant players, leveraging their robust product portfolios and strategic initiatives to secure significant market shares. These industry leaders have consistently invested in research and development to introduce innovative pharmaceuticals, vaccines, and diagnostic tools tailored to the evolving needs of pet health.

Their extensive geographical reach and ability to navigate regulatory complexities further strengthen their positions. The market's growth is fuelled by increasing pet ownership, the humanization of pets, and heightened awareness of animal health, driving demand for advanced healthcare solutions.

LIST OF KEY COMPANION ANIMAL VACCINES COMPANIES PROFILED

- Elanco (U.S.)

- HIPRA (Spain)

- Boehringer Ingelheim International GmbH (Germany)

- Virbac (France)

- Merck Animal Health (U.S.)

- Zoetis Services LLC (U.S)

- Ceva (France)

- NEOGEN CORPORATION (U.S.)

- Hester Biosciences Limited (India)

KEY INDUSTRY DEVELOPMENTS

- June 2024: Merck Animal Health launched the NOBIVAC NXT Rabies portfolio of vaccines, including NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies in Canada.

- February 2024: BMC launches comprehensive stray dog vaccination drive under 'Mumbai Rabies Elimination Project.

- September 2022: Merck Animal Health (Merck & Co., Inc.) signed an agreement to acquire Vence in order to advance technologies in animal health.

- October 2022: Chile government introduced a vaccine called Egalitte, which temporarily sterilizes dogs for one year.

- February 2021: Virbac and Algenex SL entered an international commercial licensing agreement to develop and commercialize CrisBio.

REPORT COVERAGE

The global companion animal vaccines market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, animals, route of administration, and distribution channels. Besides this, it offers insights into the market trends, the impact of COVID-19, and the increasing prevalence of zoonotic diseases, among other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.19% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Animal Type

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 5.67 billion in 2025 and is projected to reach USD 10.35 billion by 2034.

By registering a CAGR of 7.19%, the market will exhibit steady growth during the forecast period (2026-2034).

The live attenuated segment is expected to lead the market during the forecast period.

Increased animal healthcare awareness and the efficient launch of immunization products will drive the growth of the market.

Elanco, Inc. and Merck Animal Health are the top players in the market.

North America is expected to hold the largest share of the market.

Increased awareness about animal health, the rising transmission of zoonotic diseases, surging animal ownership, and new product launches would drive the adoption of companion animal vaccines.

The current market trends are the adoption of advanced vaccines, novel modes of vaccine delivery, stringent regulatory norms with respect to livestock animals, and increased awareness amongst owners.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us