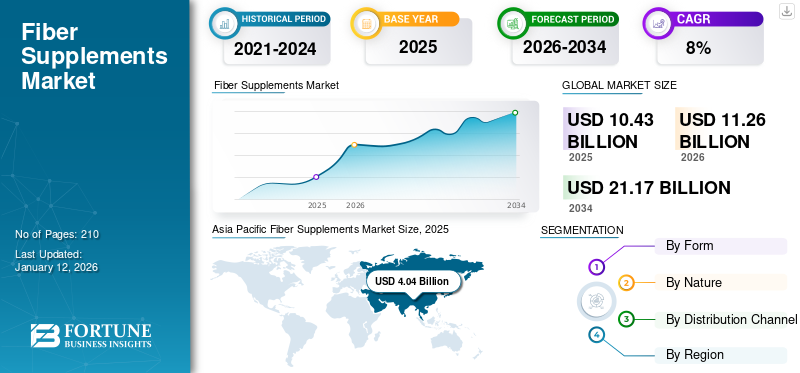

Fiber Supplements Market Size, Share, Industry Analysis, By Form (Powder, Tablets, Capsules & Chewables, and Liquid), By Nature (Conventional and Organic), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, E-commerce, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global fiber supplements market size was valued at USD 10.43 billion in 2025. The market is projected to grow from USD 11.26 billion in 2026 to USD 21.17 billion by 2034, exhibiting a CAGR of 8.21% during the forecast period. Asia Pacific dominated the fiber supplements market with a market share of 38.70% in 2025.

Fiber supplements are dietary products designed to provide additional fiber to the diet, and are often used to support digestive health, promote regular bowel movements, and address deficiencies in dietary fiber intake. They typically contain soluble or insoluble fiber, or a combination of both, and are available in various forms, such as powders, capsules, tablets, or chewables. Common ingredients include psyllium husk, methylcellulose, or inulin.

Key companies in the fiber supplements market are investing heavily in R&D and using novel ingredients to develop innovative and healthy supplements to attract more consumers. This allows them to differentiate their products and stay ahead of the competition. Archer Daniels Midland, Nestlé Health Science, Equate, Haleon, and The Procter & Gamble Company are the major players operating in the industry.

Fiber Supplements Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 10.43 billion

- 2026 Market Size: USD 11.26 billion

- 2034 Forecast Market Size: USD 18.01 billion

- CAGR: 8.21% from 2026–2034

Market Share

- Asia Pacific dominated the fiber supplements market in 2025 with a market share of 38.70%, driven by rising health awareness, changing lifestyles, and demand for digestive health products across countries like China, India, and Japan.

- By form, the tablets segment held the largest market share in 2024 due to ease of use, portability, and cost-effectiveness. However, the liquid form is projected to register the highest CAGR during the forecast period, owing to its fast absorption and multifunctional appeal.

Key Country Highlights

- China: Large consumer base and established market with rising preference for digestive wellness and weight management supplements.

- India: Strong growth driven by urbanization, middle-class expansion, and increasing dietary awareness.

- Japan: High consumption of multifunctional supplements, including those targeting gut and skin health.

- United States: The market is supported by a proactive preventive healthcare approach and popularity of plant-based, low-carb diets.

- Germany, France, UK: High awareness of gut health and rising demand for vegan, clean-label supplements drives product diversity.

- Brazil: Strong supplement demand supported by domestic agriculture and wellness trends.

- South Africa: Growing health-conscious middle class and wellness culture supporting fiber supplement consumption.

Market Dynamics

Market Drivers

Growing Awareness About Gut Health Among Consumers to Propel Market Growth

The increasing public awareness about gut health will play a significant role in driving the demand for fiber supplements. As more research highlights the crucial connection between gut health and overall well-being, consumers are becoming aware of the importance of maintaining a balanced gut microbiome. Fiber is a key component in achieving this as it acts as a prebiotic, feeding beneficial gut bacteria and promoting a healthy digestive environment.

Poor gut health is associated with issues, such as constipation, bloating, and Irritable Bowel Syndrome (IBS), as well as more systemic problems, such as weakened immunity and mental health challenges. Consequently, individuals are proactively seeking solutions to optimize their gut health, and fiber-based supplements provide a convenient and effective option. These supplements help address the common challenge of inadequate dietary fiber intake, especially in populations with busy lifestyles or limited access to fresh fruits, vegetables, and whole grains. This awareness, coupled with the convenience and variety of fiber supplements available, has led to a surge in the product’s demand across various age groups and demographics.

Rising Focus On Weight Management Through Consumption of Fiber Supplements to Drive Market Growth

The growing focus on weight management is significantly contributing to the rising sales of fiber-based supplements. Fiber plays a critical role in promoting the feeling of fullness, reducing overall calorie intake, and supporting healthy digestion—all of which are essential for weight control. As awareness of these benefits increases, consumers looking to manage or lose weight are turning to fiber supplements as a convenient and effective solution.

Soluble fiber, in particular, forms a gel-like substance in the stomach, slowing digestion and prolonging satiety. This helps reduce overeating and snack cravings, making fiber supplements a popular choice among individuals adopting calorie-restricted diets. Additionally, many of these supplements are marketed as low-calorie, natural products that fit seamlessly into various diet plans, such as low-carb, keto, or plant-based regimens. Combined with targeted marketing and endorsements from fitness influencers and healthcare professionals, the focus on weight management continues to drive fiber supplement sales upward.

Market Restraint

Limited Penetration in Emerging Markets to Pose Significant Challenge to Market Growth

In many emerging economies, awareness of the benefits of dietary fiber and fiber supplements is still relatively low. Consumers often prioritize addressing immediate health concerns over preventive measures, leading to limited demand for fiber supplements. In addition, these supplements can be perceived as luxury health products in price-sensitive markets. Many consumers in these regions focus on affordable and essential healthcare solutions, leaving less room for discretionary spending on supplements.

Moreover, limited access to retail and online platforms in rural or semi-urban areas hinders the availability of fiber supplements. Many companies face logistical challenges in establishing a widespread presence in these markets. These factors can pose a major threat to the fiber supplements market growth.

Market Opportunities

Integrating Fiber Supplements With Weight Management Solutions to Offers Significant Market Growth Opportunity

Fiber supplements are well-known for promoting satiety by slowing digestion and stabilizing blood sugar levels. This makes them an ideal addition to weight management programs as they help reduce overeating and cravings. Highlighting these benefits during promotions can attract consumers who are seeking natural appetite suppressants. Weight management often involves reduction in calorie intake, which can lead to hunger and nutrient deficiencies. Fiber supplements can provide a low-calorie solution to enhance fullness and improve dietary compliance without adding significant calories, making them appealing for dieters.

Moreover, weight loss efforts can sometimes disrupt digestion, leading to issues like constipation. Fiber supplements improve gut health, ensuring regularity and better absorption of nutrients, which can enhance the overall results of weight management programs. Popular diet plans, such as keto, low-carb, and intermittent fasting often lack sufficient dietary fiber. Companies can tailor fiber supplements to complement these diets, marketing them as essential for maintaining digestive balance and curbing hunger during fasting windows. Developing supplements that are specifically designed for weight loss, such as those infused with fat-burning ingredients (e.g., green tea extract) or combined with probiotics for gut health, can differentiate products and attract a niche audience.

Global Fiber Supplements Market Trends

Growing Trend of Multifunctional Fiber Supplements to Shape Their Demand Curve

The rising trend of multifunctional fiber supplements reflects a growing consumer preference for products that address multiple health needs in a single solution. Integration of probiotics and prebiotics is one of those trends. Many fiber supplements now include probiotics to create synbiotic products. The fiber acts as a prebiotic, feeding the probiotics, which support gut health, digestion, and immunity. By emphasizing the role of prebiotics in nurturing beneficial gut bacteria, brands highlight their supplements’ broader impact on digestion, mental health, and immunity.

Additionally, some fiber supplements are marketed for skin health by including collagen, hyaluronic acid, or antioxidants. These multifunctional products tap into the beauty-from-within trend. By addressing multiple health concerns—gut health, immunity, weight management, beauty, and more—multifunctional supplements meet the modern consumer's holistic wellness goals. This trend will continue to grow as companies innovate to meet diverse needs in the crowded supplement market.

Download Free sample to learn more about this report.

Impact of COVID-19

During the COVID-19 pandemic, consumers became more focused on improving their overall health, boosting immunity, and enhancing digestive health, which led to a higher demand for dietary supplements, including fiber supplements. Many saw fiber as an essential part of maintaining gut health, immunity, and overall well-being, especially when digestive issues became a common concern during lockdowns due to excessive stress. The pandemic caused disruptions in global supply chains, affecting the availability and cost of raw materials used in these supplements. Manufacturers faced challenges in sourcing ingredients and ensuring consistent production, which led to temporary shortages and price fluctuations.

With many physical stores closed or operating under restrictions, online sales of fiber supplements surged. E-commerce platforms became a major channel for supplement sales, driving growth of the market as consumers turned to online shopping for convenience and safety.

Segmentation Analysis

By Form

Tablets Segment Dominated Market Due to Their Widespread Availability and Popularity Among Millennials

On the basis of form, the market has been divided into tablets, powder, capsules & chewables, and liquid.

The tablets segment holds the largest market share. This is mainly due to their versatility, ease of consumption, and cost-effectiveness. However, the significance of each form varies based on consumer preferences, convenience, and specific health needs. Tablets are compact, easy to carry, and convenient for individuals with busy lifestyles who might not have time to mix powders or consume liquids. Each tablet is pre-measured, allowing consumers to easily control the exact dosage they are taking.

Like tablets, capsules are easy to swallow and convenient for people who prefer not to mix powders or drink liquids. Capsules are travel-friendly and don’t require mixing or refrigeration, making them ideal for people having a busy lifestyle. The capsules & chewables segment dominated the market with share of 40.50% in 2026.

In addition, powder is also a popular form of fiber supplements among consumers. Powdered supplements are often more economical in terms of cost per dose, making them appealing to budget-conscious consumers. The powder form is absorbed more quickly by the body compared to tablets and capsules, allowing for faster benefits.

The liquid form segment is expected to register the highest CAGR during the forecast period owing to the growing interest of manufacturers in launching liquid fiber supplements to meet the growing demand from consumers. Liquids are typically absorbed faster than tablets and capsules, which can be beneficial for individuals looking for quick relief from digestive issues like constipation. Liquid supplements can also contribute to hydration, which is important for the fiber to work effectively in the digestive system. Some liquid form supplements may be combined with additional nutrients or electrolytes, further enhancing their benefits.

To know how our report can help streamline your business, Speak to Analyst

By Nature

Conventional Segment is Expected to Dominate the Market Due to Widespread Adoption and Penetration

On the basis of nature, the analysis is divided into organic and conventional types.

In the market, the conventional fiber supplements segment holds the largest share and is expected to retain its dominance with a share of 86.23% in 2026. However, organic supplements have been gaining popularity in recent years, driven by rising consumer demand for natural and sustainably sourced products.

Conventional fiber supplements tend to be less expensive than their organic counterparts, making them accessible to a broader range of consumers. This affordability is a key factor for their market dominance. Moreover, conventional supplements are widely available in most retail stores, pharmacies, and online platforms. They are often produced by large, established brands with extensive distribution networks and offer a wide range of options in terms of form (powder, tablet, capsule, liquid) and fiber sources (e.g., psyllium husk, wheat bran, inulin), making them suitable for various dietary needs and preferences.

Organic fiber supplements have been growing in popularity, though they currently hold a smaller market share compared to conventional products. This segment is expected to grow with the highest CAGR of 10.29% during the forecast period (2025-2032). The demand for organic supplements has been increasing, particularly among health-conscious and environmentally aware-consumers. These supplements are often produced using environmentally sustainable farming practices. Consumers who are concerned about the environmental impact of conventional farming are more likely to choose organic options as they are grown without synthetic pesticides and fertilizers. This promotes biodiversity and reduces pollution. The market for organic products is expected to continue expanding as these trends gain more traction in the coming years.

By Distribution Channel

Supermarkets/Hypermarkets Segment Dominates the Market by Being the Popular Choice for Buying Supplements

In terms of distribution channel, the market has been classified into hypermarkets/supermarkets, specialty stores, e-commerce, and others.

The supermarkets/hypermarkets segment is expected to capture the largest fiber supplements market share of 35.79% in 2026, retaining its dominance during the forecast period. Physical stores, such as supermarkets and convenience stores remain major channels as they provide the opportunity for consumers to browse a wide selection of supplements in one location. Many consumers prefer this option for immediate availability and the ability to check product labels and nutritional information firsthand.

E-commerce platforms, such as Amazon and specialized health food websites are becoming increasingly popular due to the convenience of shopping from home, access to a wide variety of products, and the ability to read reviews. Online shopping also allows consumers to compare prices easily and find specific dietary options, such as conventional or organic supplements. This convenience offered by the e-commerce platforms is the major reason that will push the e-commerce segment to record the highest CAGR of 9.46% over the forecast period (2025-2032).

Other channels include health food stores, small retailers, discount stores, fitness centers, and gyms. These channels are preferred by health-conscious shoppers seeking specialized supplements, including organic and conventional options. Health food stores often carry niche brands that cater to specific dietary needs, making them a go-to for dedicated consumers. Moreover, many consumers purchase supplements directly from gyms or fitness centers, where they can access products tailored to their active lifestyles. This channel appeals to those looking for convenience after workouts.

Fiber Supplements Market Regional Outlook

With respect to region, the market covers North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Fiber Supplements Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region dominated the global fiber supplements market with a valuation of USD 4.04 billion in 2025 and USD 4.39 billion in 2026. The outlook for the market in Asia Pacific is positive, driven by increasing health awareness, changing lifestyles, and a rising demand for digestive health products. Consumers in the region are becoming more conscious of the importance of gut health and turning to dietary supplements that contain fiber to address issues, such as constipation, bloating, and Irritable Bowel Syndrome (IBS). A growing middle-class population, increased urbanization, and greater access to modern healthcare & wellness trends will fuel this shift in consumer behavior.

India, China, and Japan are the major consumers of fiber supplements in the region. China and Japan have large, established markets, with consumers increasingly seeking products that offer digestive health benefits and help manage diet-related diseases. India, with its large population and growing focus on health and wellness, is seeing a surge in the demand for both conventional and organic fiber supplements, driven by an increasing middle-class demographic. India is anticipated to reach a valuation of USD 0.42 billionin 2026, while Japan is set to be valued at USD 0.9 billion in the same year.

Europe

Europe is the second leading region, anticipated to reach a market value of USD 3.5 billion in 2026, exhibiting a CAGR of 31.27% during the forecast period (2026-2034). The growing recognition of the importance of gut health, fueled by research linking fiber intake to improved digestion, immune function, and disease prevention, has been a key growth driver for the market. The U.K. market is increasing, projected to capture share of USD 0.57 billion in 2026. Additionally, increasing concerns about lifestyle-related diseases, including obesity, diabetes, and cardiovascular diseases, are prompting consumers to make fiber supplements a part of their healthy diet to regulate cholesterol levels, aid weight management, and improve overall well-being. The rise of plant-based and organic products, particularly in response to the growing demand for vegan and clean-label products, is another important driver, with consumers becoming more selective about the ingredients in their supplements. Germany, France, and the U.K. are the major consumers of fiber supplements in Europe. Germany, with its strong focus on health and wellness, is a leading market where consumers are highly aware of the benefits of fiber and natural products.

Opportunities for growth in the European market include expanding product innovation, particularly in the areas of prebiotics and gut health combinations, and targeting emerging markets, such as Italy, Spain, and Scandinavia, where the demand for health supplements is rising. Germany is expected to reach a valuation of USD 0.77 billion in 2026, while France is set to be valued at USD 0.40 billion in the same year.

North America

North America is the third largest market, expected to hold a share of USD 2.59 billion in 2026. The North American market is primarily dominated by the U.S., which accounts for the largest share of fiber supplement consumption in the region. Factors, such as a rising focus on preventive healthcare, growing aging population, and shift toward healthy lifestyles have contributed to a surge in the demand for dietary fibers.

The U.S. market is characterized by a wide range of products, including fiber tablets, powders, and functional foods, with consumers increasingly seeking organic options. Canada also plays a key role in the North American market, with a growing interest in wellness and digestive health solutions. Additionally, the popularity of plant-based and vegan diets has further boosted demand, as fiber-rich plant foods are seen as a natural alternative to synthetic supplements. As a result, companies are focusing on product innovation and incorporating ingredients, such as psyllium husk, inulin, and chia seeds to cater to the diverse needs of health-conscious consumers in these countries. The U.S. market is set to be valued at USD 2.04 billion in 2026.

South America

South America is the fourth largest region and is expected to reach a market value of USD 0.52 billion in 2026. The fiber supplements industry in South America is rapidly evolving, fueled by a growing health-conscious consumer base and an increasing demand for convenient and nutritious food options. Countries, such as Brazil, Chile, Colombia, Peru, and Argentina are leading the way, showcasing significant market growth driven by rising disposable incomes and changing dietary preferences.

Brazil stands out as a major player with a robust market for supplements, benefiting from the country's rich agricultural resources that support fiber sourcing. In Argentina, the trend toward wellness has spurred interest in dietary supplements, leading to the emergence of local brands that emphasize natural ingredients and high nutritional value. Overall, the South American market will continue to expand, driven by innovation, health trends, and increased awareness of the benefits of including fibers in diets.

Middle East and Africa

The market in the Middle East and Africa is poised for growth, driven by increasing consumer awareness about the importance of digestive health and rising prevalence of lifestyle diseases, such as obesity, diabetes, and cardiovascular disorders. Other key drivers include a growing middle-class population, particularly in countries, such as Saudi Arabia, the United Arab Emirates (UAE), and South Africa, where there is a shift toward health-conscious living and preventive healthcare.

The demand for fibrous supplements is further fueled by the increasing consumption of processed foods and a shift away from traditional diets, leading to higher fiber deficiencies in daily nutrition. However, challenges, such as limited education on the health benefits of fiber and relatively high cost of dietary supplements, especially in emerging markets, may slow the market’s expansion. Additionally, diverse cultural dietary preferences across the region can make it challenging for manufacturers to create universally appealing products. Despite these hurdles, there are significant opportunities in the MEA region. Growing awareness campaigns and collaborations with local influencers and healthcare professionals are expected to drive the market, with South Africa emerging as a key consumer base due to its well-established health and wellness culture. The UAE market is estimated to capture a share of USD 0.03 billion in 2025.

Competitive Landscape

Key Industry Players

The competitive landscape of the global fiber supplements market offers insights into various competitors. This includes an overview of each company, their financial performance, revenue generation, market potential, investments in research & development, new initiatives, strengths & weaknesses, product & brand portfolios, product launches, mergers & acquisitions, and product applications.

List of Key Companies Profiled In The Report

- Archer Daniels Midland (U.S.)

- Nestlé Health Science (Switzerland)

- Equate (U.S.)

- Haleon (U.S.)

- The Procter & Gamble Company (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- NOW Foods (U.S.)

- Bayer Consumer Health (U.S.)

- Sanofi US (U.S.)

- Atlantis Consumer Healthcare Inc. (U.S.)

Key Industry Developments

- September 2024 – ZBiotics announced the launch of “Sugar-to-Fiber” Probiotic Drink Mix, the first product of its kind for the consumer market. Sugar-to-Fiber is a genetically engineered probiotic specifically designed to address deficiencies in the diet by converting dietary sugar (sucrose) into a special type of prebiotic fiber (levan) continuously throughout the day.

- July 2024: Manitoba Harvest, one of the popular names in hemp foods, launched the second series of its revolutionary “Organic Bioactive Fiber” in partnership with Brightseed, a bioactives company. The company launched two new flavors - Coffee and Chocolate.

- May 2024 – GenoPalate, one of the popular U.S.-based nutrigenomic platforms, launched “GenoBlend,” an innovative plant-based fiber powder customized to meet the unique genetic nutritional needs of each individual. “GenoBlend” offers a tailored approach to dietary supplements with the addition of premium ingredients, including organic pea protein, organic brown rice protein, organic citrus fiber, and oat fiber.

- August 2022 – SoWell launched the only three-part supplement system designed specifically for GLP-1 users. Dr. Alexandra Sowa developed this product from a decade of GLP-1 research and patient care to specifically meet the unique needs of individuals on a GLP-1 weight loss journey.

- May 2020 – OptiBiotix Health U.K. launched SnackSmart Fruit & Fiber Gummies as part of its new range of healthy and functional snack products that support digestive health and weight management. The gummies come in apple and strawberry flavors, contain no added sugar, and provide 40% (12 grams) of adults’ recommended daily intake of fiber.

Investment Analysis and Opportunities

Increasing Brand Investment and Collaboration With Different Stakeholders to Provide Market Opportunity

The fiber supplements industry is witnessing significant investments that are focused on innovation and diversification. Companies are launching a variety of new products, such as tailored supplements made from organic sources. Major brands, such as ADM and Nestle are investing in new R&D facilities to launch new products in their portfolios.

Report Coverage

The report analyzes the market in depth and highlights crucial aspects, such as prominent companies, competitive landscape, form, nature, and distribution channels. Besides this, it provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth over the years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.21% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Form

By Nature

By Distribution Channel

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 11.26 billion in 2026 and is anticipated to reach USD 21.17 billion by 2034.

Fortune Business Insights says that the global market value stood at USD 10.43 billion in 2025.

The global market will exhibit a CAGR of 8.21% over the forecast period.

By form, the tablets segment dominates the market.

Increasing awareness about gut health is likely to drive the product’s demand in the market.

Archer Daniels Midland Company, Nestle Health Science, and Now Foods are some of the leading players.

Asia Pacific dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us