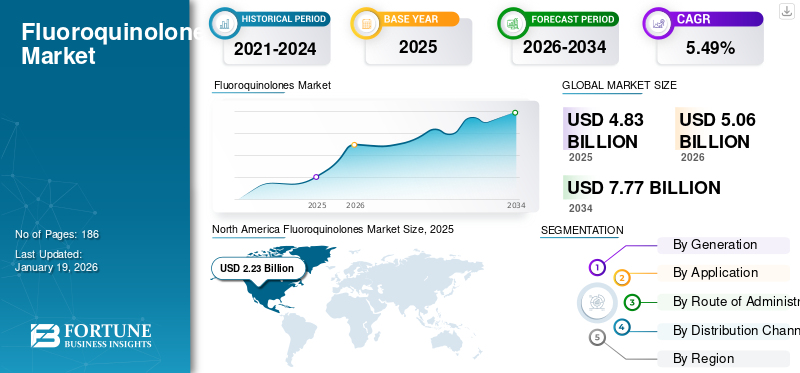

Fluoroquinolones Market Size, Share & Industry Analysis, By Generation (First Generation, Second Generation, Third Generation, and Fourth Generation), By Application (Skin Infections, Respiratory Infections, Urinary Tract Infections, and Others), By Route of Administration (Oral, Parenteral, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global fluoroquinolones market size was valued at USD 4.83 billion in 2025. The market is projected to grow from USD 5.06 billion in 2026 to USD 7.77 billion by 2034 at a CAGR of 5.49% during the forecast period. North America dominated the fluoroquinolones market with a market share of 46.22% in 2025.

Fluoroquinolones are broad-spectrum antibiotics with activity against gram-positive and gram-negative organisms, especially Pseudomonas aeruginosa. These antibiotics are well absorbed orally and have good tissue penetration, thus contributing to their widespread clinical use. Fluoroquinolones treat infections such as urinary tract infections, skin infections, and community-acquired respiratory and ENT infections.

The global market is witnessing a growth trajectory due to the rising prevalence of bacterial infections, increasing the demand for tolerable, safe, and effective antibiotics as an alternative to penicillin and cephalosporin derivatives in treating various infections.

- For instance, the report published by WHO in 2023 stated that South Africa has a particularly high burden of tuberculosis, with an incidence rate of 468 per 1,00,000 of the population.

Major players in the market include Astellas Pharma Inc., Sandoz Group AG, and Pfizer Inc., which have robust branded and generic product offerings. Also, rising focus on developing and launching novel fluoroquinolones is contributing to the strengthening of these companies’ shares.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Cases of Bacterial Infections to Propel Market Growth

The rising burden of several bacterial infections globally such as skin infections, urinary tract infections (UTI), respiratory infections, and others is one of the major factors driving the fluoroquinolones market growth. Additionally, the rising number of hospital-acquired infections also increased the demand for fluoroquinolone drugs.

- For instance, as per the data published by the American Lung Association, in 2022, 11.7 million people were reported to have a diagnosis of COPD (chronic obstructive pulmonary disease, chronic bronchitis, or emphysema). The larger number of cases associated with respiratory infections boosts the demand.

MARKET RESTRAINTS

Severe Side Effects Associated with Major Drugs Restrict Market Growth

The emergence of serious side effects associated with fluoroquinolone drugs, involving the nervous system, tendons, muscles, and joints, led to significant restrictions on their use. Stringent regulatory measures and increased awareness of these risks drive demand for safer alternatives, thus restricting their adoption.

- For instance, in January 2024, as per the data published by the U.K. Medicines & Healthcare products Regulatory Agency, these drugs have been reported to cause serious side effects involving muscles, joints, tendons, nerves, and also have some mental health effects. These side effects cause long-lasting or permanent disability in at least 1 to 10 people in every 10,000 who take fluoroquinolone. Such impacts on the patients may reduce the prescription number by practitioners.

MARKET OPPORTUNITIES

Increasing Usage of Fluoroquinolones as Anti-Cancer Agents Opens New Growth Avenues

Traditionally known for their antibiotic properties, these drugs are now gaining attention for their potential role as anti-cancer agents. Many researchers are investigating the possibility of repurposing these compounds and developing novel derivatives for cancer treatment because of their antiproliferative effects on cancer cells.

- For instance, in July 2024, as per the study published in MDPI, the researchers from Medical University of Silesia, Poland studied that modifications in fluoroquinolones structure and combining with metals such as Cu (me), Cu (II), Zn (II), Co (II), or Mn (II) can show increased effectiveness against cancer.

MARKET CHALLENGES

Increasing Antimicrobial Resistance with Fluoroquinolones Challenge Market Growth

Increasing resistance to fluoroquinolones are prompting healthcare systems to limit their use.

Thus, careful consideration of antibiotic prescribing practices and exploring alternative treatment strategies to decrease the resistance of drugs and reduce drug wastage are key concerns.

- For instance, in August 2024, as per the data published in the JAC-Antimicrobial Resistance report, Pseudomonas aeruginosa, a contributor to nosocomial infections, particularly at surgical sites, in the urinary tract, has a 15.0–25.0% increase in resistance to antibiotic classes such as carbapenems and fluoroquinolones.

FLUOROQUINOLONES MARKET TRENDS

Emergence of Antimicrobial Stewardship Programs Fuels New Market Trends

The rising misuse of antibiotics leads to increasing antimicrobial resistance for many drugs, thus leading to wastage of resources and increasing the burden on healthcare systems. The Antibiotic Stewardship Programs (ASPs) strive to achieve better patient outcomes, mitigate the growing threat of antimicrobial resistance, and control healthcare expenditures. These programs offer various strategies to influence prescribing patterns and overall antibiotic consumption to reduce the progressively rising resistance to the drug.

- For instance, as per the study published in the NIH journal in November 2022, a stewardship program was implemented to optimize levofloxacin use in hospitalized patients led to a significant increase in the susceptibility of Pseudomonas aeruginosa and Escherichia coli over 10 years. The study observed a 57.0% improvement in levofloxacin susceptibility for P. aeruginosa and a 15.0% increase for E. coli among inpatients. On average, P. aeruginosa demonstrated an annual increase of 2.7% in levofloxacin susceptibility during this time. Thus, such programs increase the chance for available drugs to work efficiently.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Generation

Increasing Third Generation Product Launches Boost the Segment's Growth

Based on generation, the market is segmented into first generation, second generation, third generation, and fourth generation.

The third generation segment held a leading market share in 2024, augmented by the rising generic launches associated with third-generation drugs.

- In March 2024, ANI Pharmaceuticals, Inc. launched a generic version of the Reference Listed Drug (RLD) Levaquin, a levofloxacin oral solution in the U.S.

The fourth generation segment is expected to grow with a significant CAGR during the forecast period due to its enhanced activity against gram-positive bacteria and improved anaerobic coverage than the third generation. Additionally, the launch of new fourth-generation products propels the segment’s growth.

- For instance, in February 2020, Lupin launched Moxifloxacin Ophthalmic Solution USP, 0.5%, after receiving approval from the U.S.FDA.

The first and second generation products are expected to grow with a moderate CAGR during the forecast period as they have a limited spectrum of activity and limited coverage compared to newer generations.

By Application

Surge in Case Burden of Respiratory Infections to Augment Segment’s Growth in Market

In terms of application, this market is classified as skin infections, respiratory infections, urinary tract infections, and others.

The segment of respiratory infections held a major share of the market in 2024 boosted by the increasing prevalence of respiratory infections. This led toward increased demand for adequate diagnosis and treatment.

- For instance, as per the data published by the WHO, approximately 10.8 million people were reported to have fallen ill with tuberculosis globally in 2023, showing an increase in comparison to the 10.7 million cases in 2022.

The segment of urinary tract infections (UTI) is estimated to hold a significant share as the market witnesses the rising incidence of UTIs due to hygiene issues, mostly in lower socioeconomic group females. Thus, the augmented demand for prescription drugs to treat acute UTIs has contributed to the segment’s strong share.

- As per the American Academy of Family Physicians, fluoroquinolones should not be considered as first-line treatment for UTIs, but should be used for the treatment of acute UTIs for women who cannot be prescribed nitrofurantoin, trimethoprim-sulfamethoxazole, or fosfomycin.

Skin infections and other segments captured considerable market share in 2024. The rising number of skin, ear, and eye infection cases will propel the segment’s growth during the forecast period.

By Route of Administration

High Absorbency and Efficacy of Oral Drugs Supports its Major Market Share

Based on route of administration, the global market is segmented into parenteral, oral, and others.

The oral segment holds a leading share of the market. When taken orally, these drugs are well-absorbed, convenient, and easy to administer, thus making them a preferred choice for healthcare providers and patients. Additionally, increasing product launches of oral formulations boost the segment’s growth.

- For instance, in June 2018, Lannett received an Abbreviated New Drug Application (ANDA) for Levofloxacin Oral Solution USP, 25 mg/mL, used to treat bacterial infections, including pneumonia and bronchitis.

The parenteral segment is expected to grow substantially during the forecast period. Rapid absorption and enhanced bioavailability, and preference for severe infections such as pneumonia, where high concentrations of fluoroquinolones are required, are also boosting the growth of the segment.

The others segment is expected to grow with a moderate CAGR during the forecast period with the rising number of generic launches of ophthalmic and otic solutions.

- In January 2024, Caplin Steriles Limited was granted approval from the U.S.FDA for its Abbreviated New Drug Application (ANDA) of Ofloxacin Otic Solution 0.3 per cent.

By Distribution Channel

Rising Prescription Numbers to Boost Retail Pharmacy Segment

Based on distribution channel, the market is divided into retail pharmacy, hospital pharmacy, and online pharmacy.

The retail pharmacy segment held a dominant share of the market in 2024 owing to the convenience and accessibility for patients to secure the drugs, with proper guidance on the side effects and adequate usage of antibiotics. Additionally, increasing outpatient prescription rates of fluoroquinolones also boost the segment’s growth.

- For instance, as per the U.S. Outpatient Antibiotic Use: Retail Pharmacy Prescription Data, the outpatient retail pharmacy prescription rate for fluoroquinolones was 44 per 1,000 population in 2023.

The hospital pharmacy segment is expected to grow significantly during the forecast period with the increasing shift of patients toward hospitals for a wide range of infectious disease treatments.

The online pharmacy segment is expected to grow with the highest CAGR during the forecast period supported by the rising technological advancements, accessibility around the clock, and cost effectiveness.

FLUOROQUINOLONES MARKET REGIONAL OUTLOOK

In terms of regional analysis, the global market can be classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Fluoroquinolones Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.23 billion in 2025 and USD 2.34 billion in 2026. The region's growth is fueled by an increasing number of bacterial infections, the presence of advanced healthcare infrastructure, and the implementation of monitoring tools designed to combat antimicrobial resistance (AMR). Moreover, the strong presence of key market players with advanced research and development facilities propels the region's market growth.

U.S.

The rising prevalence of infectious diseases, coupled with the availability of advanced healthcare facilities, leads to the dominance of the U.S. in North America. The country has proper antibiotic prescribing guidelines to reduce resistance and maintain product usage, thus boosting adequate adoption of the products.

- For instance, in November 2024, as per the data published by the Centers for Disease Control and Prevention, around 9,633 TB cases were reported in 2023, with an incidence rate of 2.9 cases per 100,000 persons.

Europe

Europe accounted for the second dominant position, in terms of value. The presence of technologically superior healthcare infrastructure, focus toward proper usage of antibiotics, and programs to combat AMR are boosting the proper administration of antibiotics in the region.

Furthermore, the key players' increasing focus on expanding their footprint in the region will boost its growth.

- In May 2021, Sandoz Group AG announced strengthening its European antibiotics manufacturing network by expanding production capabilities in Austria and Spain.

Asia Pacific

The Asia Pacific fluoroquinolones market is expected to grow at a significant CAGR. Presence of key regional players with availability of cost-effective and efficacious generic drugs, and a high patient pool are expected to be key contributors to the region’s high growth.

- According to the World Health Organization report in 2023, the highest number of new tuberculosis (TB) cases were reported in the Southeast Asia region, accounting for 45.0% of total cases, and amongst these, approximately 87.0% of new TB cases were concentrated in 30 high-burden countries, with over two-thirds of the global total coming from Bangladesh, China, the Democratic Republic of the Congo, India, Indonesia, Pakistan, and the Philippines.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America are estimated to grow with a moderate CAGR during 2025-2032. Emphasis on launching new healthcare facilities, and growth in awareness in terms of new infectious disease outbreaks, coupled with guidelines for proper usage of antibiotics, are expected to augment market growth. Additionally, many organizations are actively seeking to offer affordable treatment options by preventing a shortage of drugs.

- For instance, in March 2024, Latin American countries are increasingly calling for initiatives to improve access, lower costs, and prevent shortages of generic drugs. However, only Brazil has prioritized government production of generics as a key aspect of its public health strategy.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Sandoz Group AG, Merck & Co., Inc., Pfizer Inc., and Astellas Pharma Inc., Lead with Robust Product Offerings

The market comprises a fragmented competitive landscape with major companies holding the maximum fluoroquinolones market share. The key players in the market with robust product offerings and research initiatives are accounted for a substantial share in 2024. Major companies include Pfizer Inc., Astellas Pharma Inc., Sandoz Group AG, and Merck & Co., Inc. who focus on strategic activities, such as collaborations and acquisitions, to strengthen positions.

Other companies that also comprise of a steady market share are Bristol-Myers Squibb Company, Johnson & Johnson Services, Inc., Dr. Reddy’s Laboratories, Lupin, and Bayer AG focus on research and development and launches of innovative and generic products, supplemented with regulatory approvals.

LIST OF KEY FLUOROQUINOLONES COMPANIES PROFILED

- Pfizer Inc. (U.S.)

- Astellas Pharma Inc. (Japan)

- Bayer AG (Germany)

- Abbott (U.S.)

- Sandoz Group AG (Switzerland)

- AbbVie Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: ANI Pharmaceuticals, Inc. launched Levofloxacin Oral Solution, a generic version of the Reference Listed Drug (RLD) Levaquin.

- March 2024: Amneal Pharmaceuticals, Inc. received approval for an Abbreviated New Drug Application from the U.S. Food and Drug Administration for ciprofloxacin and dexamethasone otic suspension.

- January 2022: FDC Limited, India, received approval for 0.3% Ofloxacin Otic Solution from the U.S. FDA.

- August 2020: Dr. Reddy’s Laboratories Ltd. launched Ciprofloxacin 0.3% and Dexamethasone 0.1% Otic Suspension, USP, a therapeutic equivalent generic version of Ciprodex.

- October 2017: Mylan N.V. announced the U.S. launch of Moxifloxacin Hydrochloride, a generic version of Avelox. The Moxifloxacin Hydrochloride is commercialized as 0.8% Sodium Chloride Injection, in 250 mL single-dose flexible bags.

REPORT COVERAGE

The global fluoroquinolones market research report includes a comprehensive market analysis and focuses on key factors such as the prevalence of key diseases, key countries, and pipeline analysis of new drugs. Also, it covers the recent developments in the market and provides data on the recent product launches. Moreover, the report offers a detailed analysis of market drivers, opportunities, and trends and highlights key industry developments. Also, the report includes a comprehensive section on the pipeline review of upcoming drugs.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.49% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Generation

|

|

By Application

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 5.06 billion in 2026 and is projected to reach USD 7.77 billion by 2034.

In 2025, the market value in North America stood at USD 2.23 billion.

Registering a CAGR of 5.49%, the market will exhibit steady growth over the forecast period (2026-2034).

The rising incidence of bacterial infections is a major factor driving the markets growth.

Pfizer Inc., Abbott, Novartis AG, and Merck & Co., Inc. are some of the major players in the global market.

North America dominated the fluoroquinolones market with a market share of 46.22% in 2025.

The increasing use of fluoroquinolones in developing countries and the rising prescriptions around the globe are expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us